Deep Dive: 3 Key Modular Blockchain Trends For 2024

Bear markets are always the ideal place for developers to focus on creating new apps and innovations. This is why every bull market always has new trends emerging. In the previous bull market, we saw new L1 projects like Solana explode and the metaverse trend became everyone’s talk. Modular blockchain has the potential to be one of the popular trends in the next bull market. Although it’s being talked about a lot, many people don’t know what modular blockchain is and what are the modular blockchain trends. This article will discuss it in detail.

Article Summary

- 🟪 Modular Blockchain Concept: A modular blockchain is a blockchain design that separates functions into specific segments. Ethereum started this modular design concept with the rollup and has now evolved with widespread adoption as seen in Cosmos.

- 📈 Major Trends in Modular Blockchains: The three main trends in modular blockchains are the modularity of the Data Availability (DA) layer, sovereign rollup, and the development of rollup-as-a-service (RAAS).

- 🔐 Problems in Modular Blockchains: Some of the challenges in modular blockchains include composability issues, security issues, increasing technological complexity, and liquidity fragmentation.

- 💸 Investment Opportunities in the Modular Blockchain Sector: The sector attracts many investors with the potential for speculation on airdrops and new projects. There are opportunities for long-term investors to pick winners in each subsector, although we do not yet know who will be the leader in the long run.

What is Modular Blockchain?

A modular blockchain is a blockchain design that separates the functions of each blockchain layer into segments. Each segment performs a specific function and can be modified by swapping.

Read more: What is Modular Blockchain?

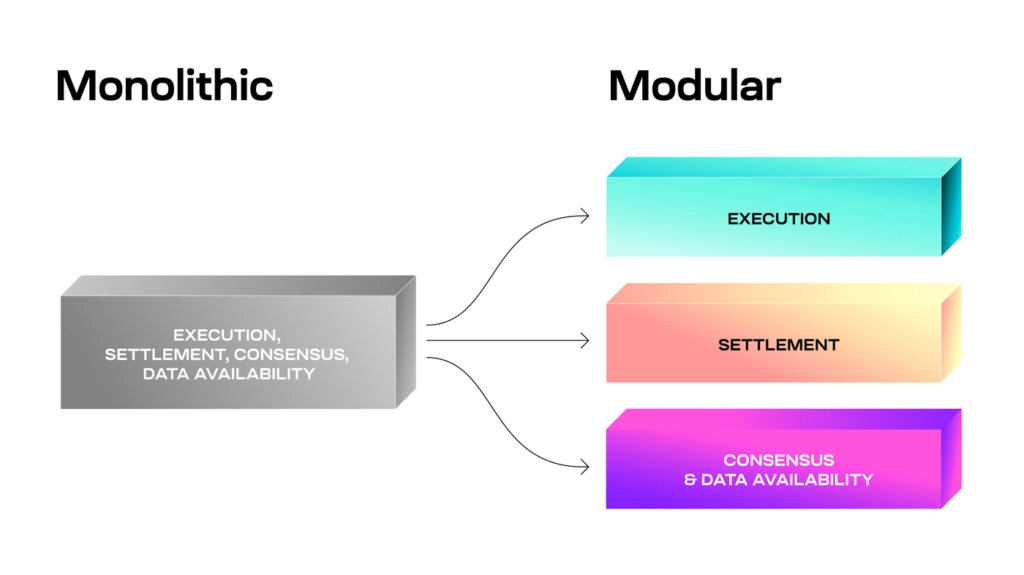

The opposite of a modular design is monolithic. In a monolithic blockchain design, the network cannot be broken down into segments and interconnected. The modular vs monolithic blockchain debate is still very hot today as both offer different advantages and disadvantages.

The concept of Rollup was introduced by an Ethereum contributor named Barry Whitehat in 2018.

The concept of modular design was started by Ethereum which introduced the concept of rollups. Vitalik himself has a vision that Ethereum will have a rollup-centric future. Then, The Merge process made Ethereum fully modular.

While modularity in blockchain is not new, widespread implementation of modular blockchains has only happened in the last two years. Cosmos is one of the pioneers of modular blockchain implementation.

The modular blockchain trend is making a comeback in 2023 and 2024 due to innovations that allow the Data Availability (DA) layer to be abstracted. Celestia, Near, Avail, and Eigenlayer are some of the projects that provide DA services.

However, the world of modular blockchains is much more complex than just DA services. Every layer of the blockchain can now be outsourced from the execution layer, DA, consensus, and even validity proofing services.

Modular Blockchain Layers

Modular blockchains are a very broad category. As investors, we should categorize various modular projects according to the functions they perform. We can separate modular blockchains based on the functions they perform, namely consensus, DA, execution, and settlement.

- Consensus: The layer where all validators/nodes agree on the order of transactions and finalize them.

- Settlement: The layer for resolving transaction conflicts and proof checking. This layer is highly required by L2s like Ethereum.

- Data Availability: A crucial layer that ensures data are available so all validators can know the latest status of the network and new data can be entered. DA stores historical data and is essential for L2 to store transaction data. In addition, the DA layer is also the biggest bottleneck in scalability.

- Execution: The layer closest to the user as it serves as the first stage of processing transactions, where smart contracts are stored, and user commands are executed. It is also the place for sequencing and proving of L2.

3 Key Trends of Modular Blockchain

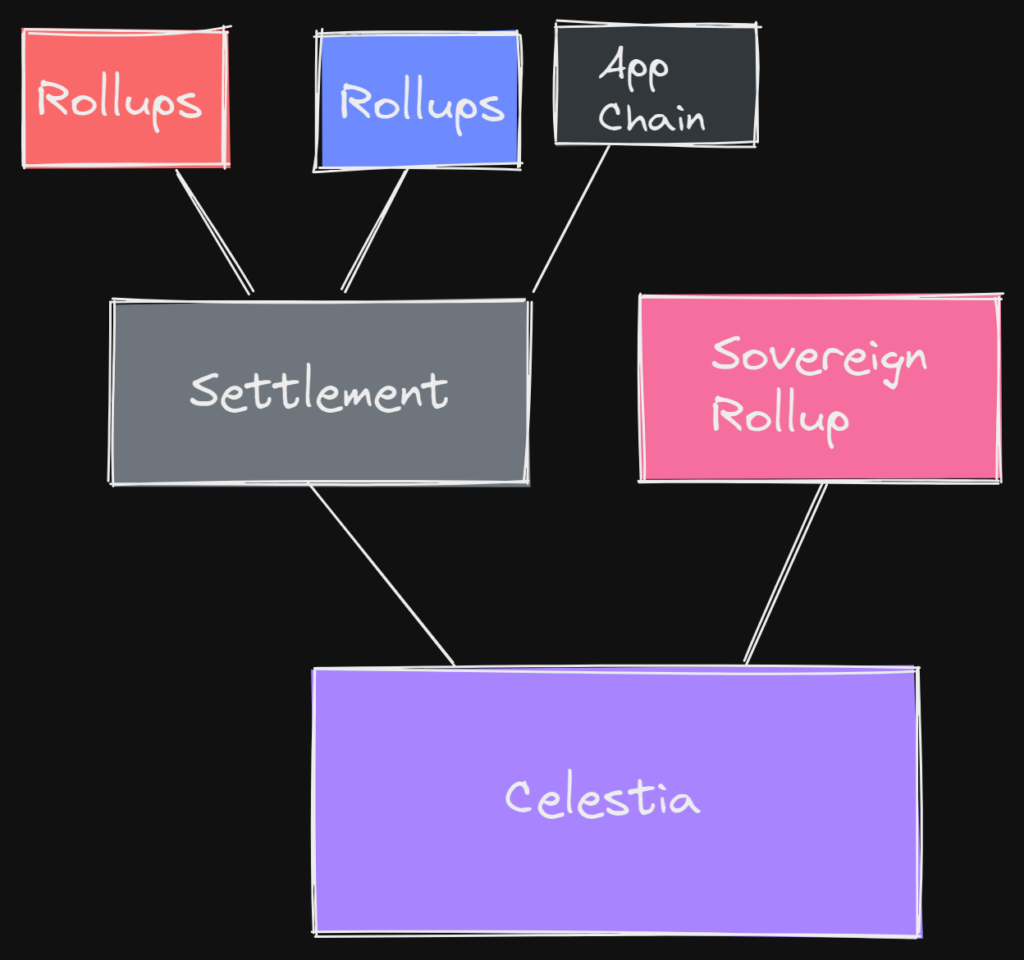

1. Celestia, EigenLayer, and Alternative Data Availability Layers

Nowadays, many development teams realize that the biggest bottleneck in improving blockchain scalability is DA, not execution. No matter how advanced Ethereum’s L2 technology is, its speed will always be hampered by Ethereum’s limited DA speed and cost.

Calldata is a code instruction that L2 uses to request the latest data on Ethereum and sends L2 transaction data to be included in the latest block.

Imagine a future where there are 50 rollups on Ethereum competing for calldata at the same time. With the DA layer being so crucial, transaction fees will likely continue to increase with more L2s. However, updates to a more effective DA for Ethereum are underway (but will take some time).

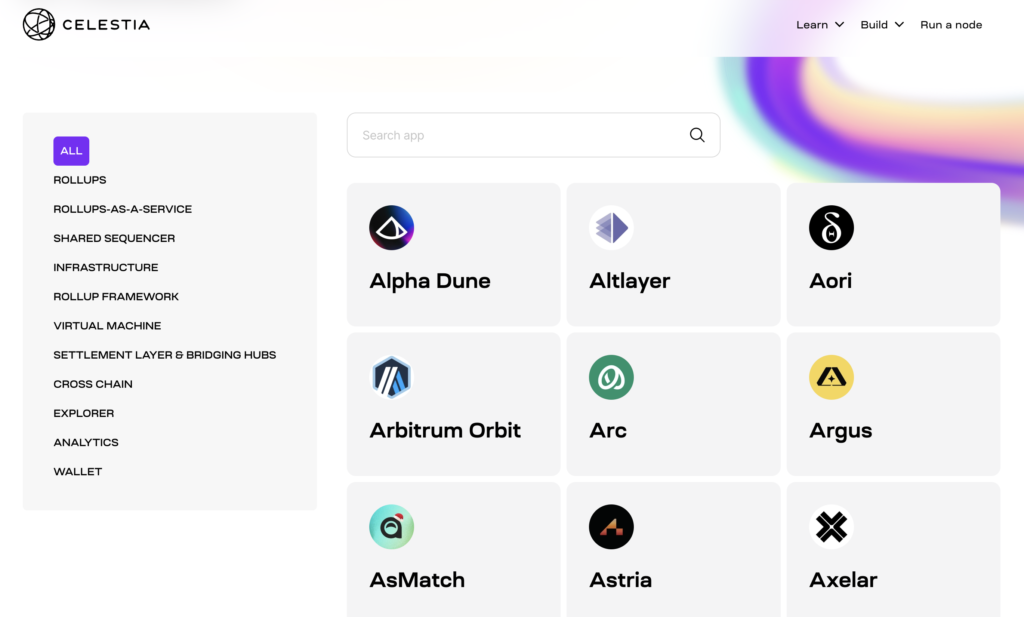

Celestia, Avail, EigenDA, and Near are some of the projects that provide modular DA functions. Celestia and EigenDA are two DA layer projects that utilize two different technologies. Furthermore, Celestia is a project that offers DA and consensus services at the same time while Eigen only provides DA.

Read more about Celestia: What is Celestia? and Celestia Ecosystem Development.

Consensus and Data Availability layers are generally not modularly separated to maintain security, speed, cost, and composability.

Eigenlayer and Near focus on improving DA performance while maintaining the most optimal compatibility with Ethereum. EigenDA continues to utilize the Ethereum consensus layer. So, Eigenlayer primarily wants to be Ethereum-aligned.

Meanwhile, Avail and Celestia enhance the performance functions of DA without focusing on a single blockchain ecosystem (chain agnostic). Both seek to be compatible with as many ecosystems as possible. Moreover, with such low fees when compared to Ethereum, many new projects outsource the DA and consensus layers to Celestia.

Avail and Celestia both use Data Availability Sampling (DAS) technology to improve DA performance. DAS allows data to be retrieved and transmitted by nodes by performing sampling techniques. DAS ensures that data is always available and the size that nodes need to download remains small.

Avail and Celestia’s chain agnostic approach is one of the drivers why so many sovereign rollups (rollups that use external DA and consensus) are emerging.

Projects in this subsector: Celestia, Avail, Eigenlayer, and Near.

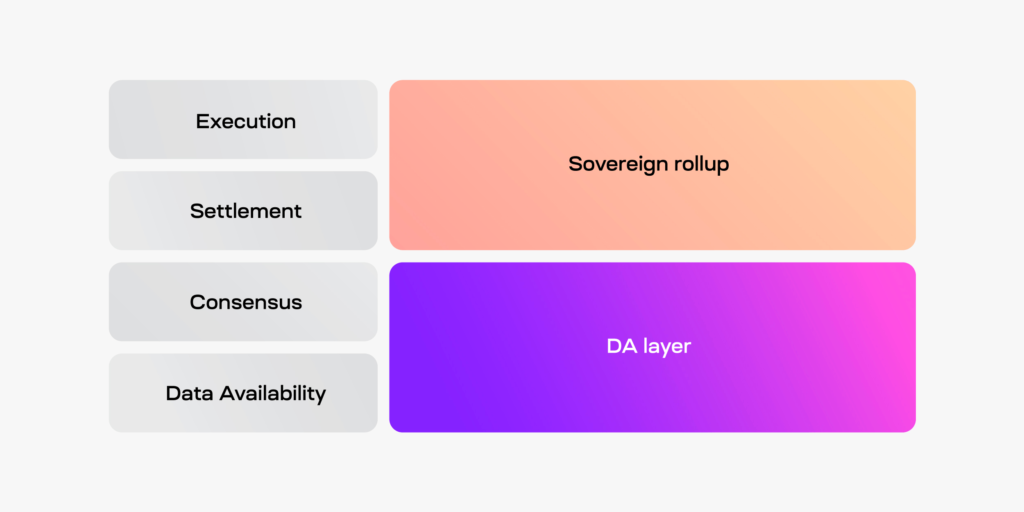

2. Sovereign Rollup

With the advent of external DA and consensus solutions such as Avail and Celestia, the concept of a sovereign rollup emerged. Sovereign rollup is a rollup that relies on external DA and consensus layers. Therefore, a sovereign rollup relies on a third party to sort transactions and blocks in a decentralized manner.

Such independent rollup ecosystems offer flexibility and convenience to crypto app developers. Most sovereign rollup ecosystems such as Dymension, Initia, and Saga utilize Celestia’s DA or Avail.

While sovereign rollup ecosystems have great advantages in transaction speed and fees, their security is untested. Separating a crucial layer like DA has a security trade-off and we don’t yet know how secure Celestia and other external DAs are.

Nonetheless, the sovereign rollup ecosystem and Celestia have been in the limelight of crypto investors in recent months. TIA, considered a modular blockchain sector leader, is up 700% since October 2023. In addition, Dymension will be the first sovereign rollup project to launch tokens (DYM) by the end of January 2024.

Projects in this subsector: Dymension, Initia, and Saga.

3. Rollup-as-a-Service and the Appchains Ecosystem

One of the emerging trends in 2023 due to modular blockchain design is rollup-as-a-service (RAAS). Rollup-as-a-service is a project that provides infrastructure and various software to facilitate the creation of layer-2 blockchains. Arbitrum and Optimism are the two largest RAAS projects that offer developers an easy way to create L2s.

Arbitrum offers RAAS through Arbitrum Orbit and Stylus while Optimism offers OP Stack and Superchain ecosystem. Both have attracted many new L2 projects such as Zora, Base, XAI Games, and Aevo. Some other RAAS projects in the Ethereum ecosystem that are compatible with Orbit and OP Stack are AltLayer, Caldera, and =nil;.

Further read: What is Layer 3 Crypto?

The RAAS and L3 concepts have the same goal of creating applications in the form of blockchains or Appchains. The vision is that each application will become their own blockchains to reach optimal speed.

In addition, RAAS opens up a new, more economical option for many new projects. Conduit is one of the pioneering projects that helps rollup launches without the need for extensive coding. Zora and Aevo are two projects successfully launched by Conduit.

Apart from Ethereum, RAAS is also thriving in the Cosmos ecosystem. Dymension and Saga are two major RAAS projects in Cosmos that also bring two new concepts, RollApps and Chainlet. RollApps is an L2 that does not need its own validator network while Chainlet is a rollup that has only one smart contract.

Chainlet’s main advantages are speed and transaction costs that can be designed to be as efficient as possible and compatible with any execution layer (currently supporting EVM, Evmos, and CosmWasm). Meanwhile, Dymension’s RollApps is more similar to appchains in Cosmos.

The RAAS and appchains trend is likely to grow rapidly in 2024 as so many projects are still in development. However, we still need to see what the user adoption rate of these projects will be.

Projects in this subsector: Saga, AltLayer, Caldera, Dymension, and Gelato.

Modular Blockchain Issues

Composability

Composability is a problem where applications cannot interact with external ecosystems such as how Ethereum’s L2s cannot interact with each other. As the layers of a blockchain become more modular, composability becomes a bigger problem. However, interoperability solutions like LayerZero and Axelar help solve this problem. A unified ecosystem like Cosmos does not suffer from this problem either.

Security Issues

Celestia is one of the modular blockchains that provides security services to other projects. However, the use of external security like Celestia raises questions about security, especially if Celestia for example has to secure 100 other projects. In this case, can Celestia provide a security equivalent to Ethereum?

Technological Complexity

Modular blockchains add additional complexity to an already complicated technology. In addition to complexity in implementation, does a modular blockchain also add a level of difficulty for new users? This is an important consideration for the adoption of modular architecture.

Liquidity Fragmentation

Modular blockchains add to the liquidity fragmentation problem that Ethereum also suffers from. When there are dozens of modular blockchains separated from each other, this can cause problems with ease of asset movement and user experience. Again, the solution to this fragmentation is interoperability protocols that can be used by multiple blockchains and modular blockchains offering high composability.

Investing in the Modular Blockchain Sector

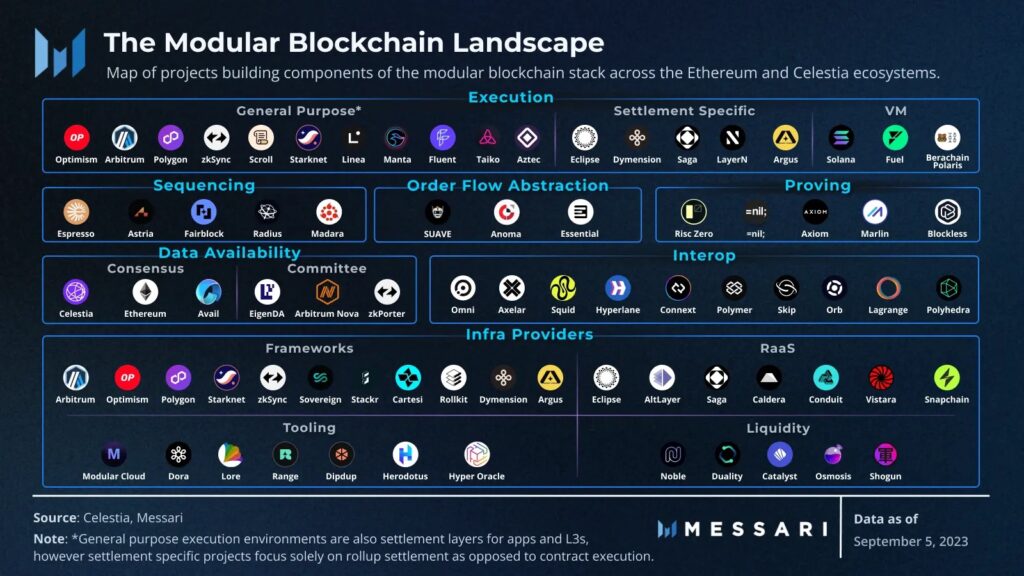

The modular blockchain landscape. Source: Messari.

The modular blockchain sector managed to attract many new investors and users. Speculation about airdrops has also greatly helped bring many new users to the modular projects mentioned above (especially Celestia). However, as in the three trends above, understanding the modular sector is not something easy.

If you are a long-term investor, picking the winners of each sector will likely be the easiest way. We could argue that Celestia (TIA) is the interim winner of the modular sector.

However, almost all of the projects mentioned above such as Saga have yet to launch tokens. Dymension, Saga, Caldera, and AltLayer are some of the big projects that don’t have tokens yet. You can wait to see which project gets the most adoption.

Modular blockchains are predicted to be a popular trend in 2024. Read the article: **Crypto Trends 2024: 9 Potential Narratives to Watch Out For.**

If you are an investor who likes to look for high-risk-high-return projects, there are many modular blockchain subsectors that you can explore. In addition to the three modular blockchain trends above, decentralized sequencers and ZKP prover services are another small trend on the rise.

Decentralized sequencers and proving services address the crucial issues of Optimistic Rollup and zkRollup. Some of the projects that fall into this category are Espresso and Astria which offer decentralized or shared sequencer services while Risc Zero and =nil; offer ZKP proving services.

Ultimately, the modular blockchain sector provides a great opportunity for investors and traders willing to enter a new sector. Although we cannot yet measure its adoption rate, the trend is that new sectors historically have great potential in bull markets.

Conclusion

Modular blockchains are emerging as an important concept in the crypto world, providing more flexible and specific designs compared to monolithic approaches. 3 key modular blockchain trends include the development of modular Data Availability layers, sovereign rollup, and rollup-as-a-service. While this concept offers many advantages, it also brings challenges such as composability, security, technological complexity, and liquidity fragmentation issues.

From an investment perspective, the modular blockchain sector offers exciting opportunities, but it also requires a deep understanding of the technology and the risks involved. Investors should consider these factors when exploring this emerging sector, especially with the potential for popular trends in modular blockchain to emerge in 2024.

How to Buy Cryptocurrencies on Pintu

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Stephanie Dunbar, “The Modular Blockchain Landscape“, Messari, accessed on 17 January 2024.

- Ikuma Mutobe, “Modular Blockchain Thesis“, Tane Labs, accessed on 17 January 2024.

- Maven11, “The Modular World“, Substack, accessed on 18 January 2024.

- Alec Chen, “Modular Blockchains: A Deep Dive“, Volt Capital, accessed on 18 January 2024.

- “Celestia – An introduction to sovereign rollups“, Celestia, accessed on 18 January 2024.

- Shivam Sharma, “The Rollups-as-a-Service Primer“, Binance Research, accessed on 19 January 2024.

Share

Table of contents