Alternative Layer 1 Blockchain Comparison

The alternative layer-1 network sector was a big winner in the 2021 bull market. Crypto assets from L1 projects such as Solana, Fantom, Avalanche, and Terra experienced thousands of percent price appreciation within a few months. However, the 2022 bear market saw many Layer 1 projects lose more than 50% of their users. The majority of L1s are struggling to attract attention both from the developers and users. So, what is the situation in the L1 sector now? Do many still have users? This article will dive into layer 1 blockchain comparison.

Article Summary

- ⚖️ The L1 network sector is losing many users and attention after the 2021 bull market. The bear market of the past year shows that Ethereum is still the leader in this sector.

- 📱 Solana showed adaptation and growth, implementing various technical updates and collaborating with companies like Shopify and Visa.

- 👻 Fantom faced major difficulties in 2023, with a drop in TVL and the Multichain hack that led to the bankruptcy of several important DeFi applications in its ecosystem.

- 🗻 Avalanche looks to increasingly collaborate with financial institutions and become the first blockchain partner for Amazon Web Services (AWS), showing growth potential across multiple sectors.

- 🧠 Cardano, which was popular in the 2021 bull market, is now trying to build its own DeFi ecosystem but is still far behind its competitors.

Overview of the Current Alternative L1 Sector

The L1 network sector is no longer the favorite of the crypto industry. With the emergence of many DeFi applications and Ethereum L2 networks, the attention of the crypto community has automatically begun to shift. This is evident both on social media and on-chain.

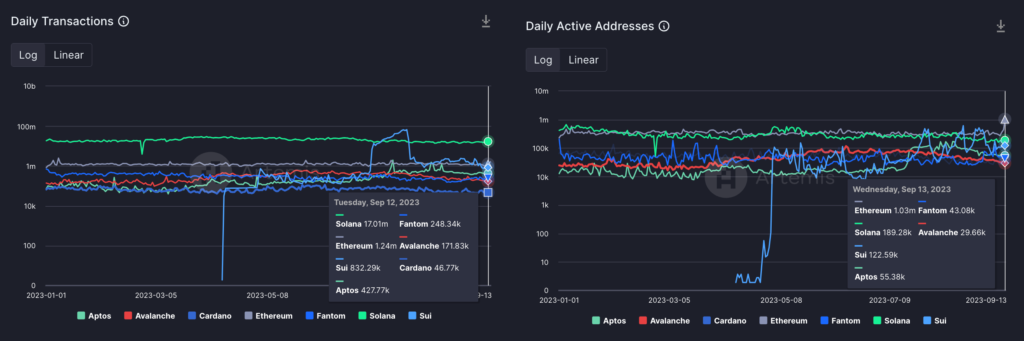

As can be seen from the chart above, Solana and Ethereum far outperform other L1s such as Fantom, Cardano, and Avalanche. Ethereum and Solana have over 1 million daily transactions while Cardano doesn’t even reach 100K transactions per day. In fact, the daily transactions of Ethereum’s L2 networks Polygon, Optimism, and Arbitrum are still far ahead of Avalanche, Fantom, and Cardano.

However, the Total Value Locked (TVL) numbers tell a different story. The TVL figures show Avalanche is able to compete with Ethereum and Solana. Other L1 TVL figures are well below those three networks, Cardano being the closest at $146 million dollars, half that of Solana. Ethereum also remains king in TVL figures due to the sheer value of its DeFi sector.

The biggest contributor to Ethereum’s TVL is the liquid staking app Lido at $14 billion dollars. Meanwhile, AAVE and Benqi apps have dominance on the Avalanche network. Interestingly, the biggest TVL contributors on Solana are also liquid staking applications like on Ethereum, namely Marinade Finance and Lido.

1. Solana

Since late 2022, Solana has focused on holding hackathons to develop its ecosystem and technical updates to prevent frequent incidents of network blackouts in 2021 and 2022. The implementation of fd_quic and Stake-Weighted Quality of Service (QoS) updates has made Solana more stable than ever.

Read more: Solana Firedancer, upcoming massive update for Solana?

The effectiveness of these updates can be seen as the last Solana network downtime was in February 2023. Now, Solana can handle a large number of transactions without experiencing system failure.

2023 is also an important year for Solana to recover from the FTX catastrophe because Solana received a huge investment from FTX ($1.6 billion dollars’ worth of SOL). Solana’s DeFi ecosystem is showing signs of life with new applications such as MarginFi, Drift Protocol, and Hxro starting to gain attention from the community. In addition, Solana also recently established important partnerships with Shopify and Visa for the use of Solana as a payment infrastructure.

Recommended reading: Solana’s DeFi 2.0 ecosystem.

2. Fantom

Fantom, previously known for having a very vibrant DeFi ecosystem, stumbled into 2023. Fantom started 2023 with positive news of the planned launch of the Fantom virtual machine (FVM). However, the still-negative market conditions and the abundance of other new protocols saw Fantom’s TVL numbers continue to decline. In January 2023, Fantom had a TVL of $355 million dollars. Then, 6 months later this figure dropped dramatically to $220 million.

Then, Multichain announced that it would close its operations on July 14, 2023, due to the arrest of its CEO in May. Multichain was an important part of the Fantom ecosystem as many of Fantom’s funds were held on Multichain. Apparently, the CEO of Multichain had sole access to the funds, and $125 million worth of Multichain assets were suddenly withdrawn to various digital wallets.

In the aftermath of the incident, Fantom’s TVL plunged even further, until only $50 million dollars remained as of September 2023. In addition, the DeFi apps Geist Finance and SpiritSwap also announced the cessation of operations due to the Multichain hack. Both apps lost all their assets, including those for employee payroll and daily operations.

However, Fantom Foundation has not given up. At the Token2049 event, Fantom announced the Fantom 2.0 update, with various performance improvements such as FVM and 1-second transaction time. Even so, the likelihood of Fantom returning to the 2021 bull market numbers is still small. With so many innovations and new projects in the crypto asset industry, Fantom’s chances are getting smaller and smaller.

3. Avalanche

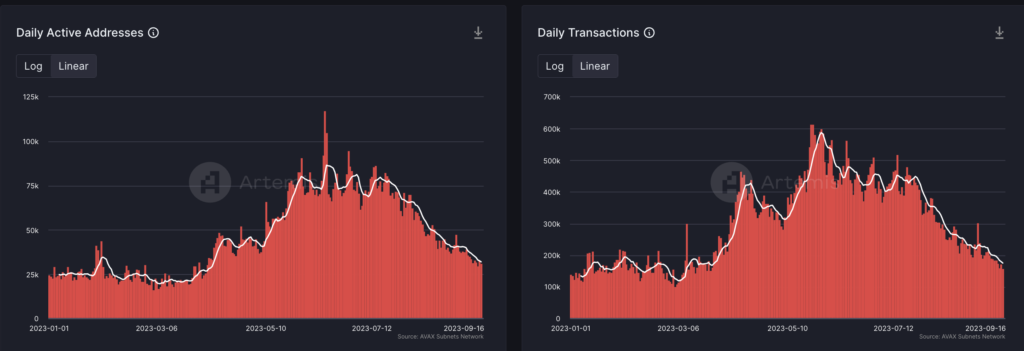

Avalanche’s on-chain statistics in 2023 show quite interesting numbers. Avalanche’s peak active address and daily transaction activity occurs around May 2023. May was the peak of the Avalanche Summit in Barcelona. However, as seen from the graph above, Avalanche activity continued to decline post Avalanche Summit.

Apart from on-chain activity, Avalanche managed to pull off many major partnerships throughout 2023. In early 2023, Avalanche partnered with Shopify to create and facilitate the buying and selling of Avalanche NFTs. Avalanche also became the first blockchain partner for Amazon Web Services (AWS). AWS will support Avalanche’s validator infrastructure and make it easier for the development team.

In addition, Avalanche also seems to be getting closer to traditional financial institutions. This can be seen from the launch of several “Evergreen” subnets targeted at institutional investors who want to get into blockchain. One of the Evergreen subnets is Spruce which is being tested by several investment institutions such as T. Rowe Price, WisdomTree, Wellington Management, and Cumberland. These institutions will use Spruce for various on-chain trading activities.

With the competition getting stronger, Avalanche seems to be looking for new sectors where it can take a chunk of the market share. This can be seen with the Avalanche Foundation committing $50 million dollars to bring tokenized assets to Avalanche. With TVL already outperforming Solana, Avalanche could very well become a competing blockchain to Ethereum and its L2 ecosystem.

4. Cardano

Cardano is one of the most popular blockchains in the 2021 bull market. Despite having no DeFi ecosystem and no smart contract capabilities, the bull market situation made ADA attractive to millions of investors in the world. However, the reality of the bear market sets in, and Cardano eventually falls to the side due to various new trends in the crypto world.

Since the end of 2022 and the beginning of 2023, the Cardano team has been focusing on DeFi sector activities. This effort proved to be successful as Cardano’s TVL finally crossed the $100 million dollar mark and is currently at $149 million dollars. For the first time, Cardano users can perform DeFi activities in DEX applications such as Minswap and Indigo.

Currently, Cardano is focusing on making many updates to its network. One protocol that is getting a lot of attention is Mithril, a security protocol that also speeds up Cardano node operations. Input-Output HK explains that Mithril is crucial to improving Cardano’s security going forward.

What About the L1 Newcomers?

Aptos, Sui, and Injective are L1 projects launched in the 2022-2023 timeframe. All three are new L1 generations with various innovations such as new virtual machines (Move for Sui and Aptos) or DeFi functions that are natively built into the network (Injective).

As in the chart above, Aptos has the advantage of first movers as it has been launched since the middle of last year while Sui is the newest among the three. Aptos has the highest TVL figure at $50 million while Sui and Injective have slightly different TVL at around $20 million.

Recommended reading:

Aptos and Sui are direct competitors as they share the same programming language and virtual machine. Meanwhile, Injective is one of the few L1 projects focused on creating a DeFi ecosystem and applications that require high speed such as GameFi.

In terms of high-profile cooperation, Aptos announced a partnership with Microsoft Azure OpenAI Service to explore the potential of blockchain and AI. In June 2023, Sui actually cooperated with Formula 1 team Red Bull Racing. This multi-year cooperation will make Sui the blockchain of choice for Red Bull for various digital products for Red Bull team fans. Injective Protocol chose to expand its network, focusing on interoperability partnerships such as with Celer, Klayton, and Polygon Labs.

These three new L1 projects have quite interesting potential for the next bull market. Aptos and Sui have experienced teams (ex-Meta/Facebook) while Injective has technology suitable for advanced DeFi applications. If these three L1s can attract liquidity and produce interesting applications, it is not impossible that they can rival many of the previous generation L1 networks such as Cardano and Fantom.

Conclusion

The layer 1 (L1) network sector that once dominated the crypto market in 2021 has experienced various ups and downs, especially after the 2022 bear market. Ethereum and Solana are still the leaders in this sector, while networks such as Fantom and Cardano are facing challenges from both a technical and economic perspective. Even so, Solana and Avalanche are showing adaptation and growth, with a focus on ecosystem development and collaboration with large enterprises. On the other hand, Fantom and Cardano are struggling to maintain their relevance in the ever-changing crypto world.

In general, the trend is now starting to shift towards L2 networks and other applications, making competition in the L1 sector even tougher. However, several new L1 projects have emerged in the past year. Sui, Aptos, and Injective are three L1 projects that have caught the attention of the crypto community. They have clear technological advantages and only need to attract new users to their networks.

How to Buy Cryptocurrencies on Pintu

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice

References

- DeFiLlama, accessed on 15 September 2023.

- Artemis Dashboard, accessed on 15 September 2023.

- Amber Group, “Can any Layer-1 blockchain overtake Ethereum?”, Global Coin Research, accessed on 15 September 2023.

Share