What is Bitcoin Halving?

Experienced investors and traders pay attention to market-affecting events in the crypto space. These range from economic conditions, macro events, to announcements related to crypto projects. One important event that has proven to have an influence is the Bitcoin halving. So, what is a Bitcoin halving? Why does it happen, and what impact does it have? This article will explain.

Article Summary

- ✂️ Bitcoin halving is an event where the block reward earned by Bitcoin miners is cut in half.

- 🪙 Satoshi Sakamoto, the creator of Bitcoin, implemented halving because he wanted to create a limited supply of Bitcoin to preserve its value.

- 📈 Halving is an important event to watch for Bitcoin investors. Halving makes BTC more scarce and drives the value of Bitcoin up. In general, the price of BTC always goes up after a halving occurs.

What is Bitcoin Halving?

Bitcoin halving is an event where the block reward earned by Bitcoin miners is cut in half. Halving events occur every 210,000 blocks or approximately four years. The idea behind the halving policy is to limit supply and slow down the speed at which new Bitcoins enter the market (inhibiting the inflation of BTC).

Based on its history, after the BTC halving event, the price tends to increase. This proves that the reduction in Bitcoin’s supply can trigger a price surge. So far, Bitcoin halving has occurred three times since it was first launched in 2009. The most recent halving took place on May 11.

Referring to the latest estimates, the fourth Bitcoin halving is expected to occur in April 2024. Leading up to the 2024 halving, BTC has reached a new all-time high of $73,750 on March 14, 2024. Some experts predict that the price of BTC could reach anywhere from $100,000 to $200,000 this year.

Where does Bitcoin come from?

While gold is mined from the earth and fiat money is printed by the government, Bitcoin is “mined” by processing and validating transactions that have occurred in the bitcoin network. Bitcoin miners will be rewarded with Bitcoin once they verify one block of transactions. This is the only way to release new Bitcoin into circulation.

To get the reward, Bitcoin miners have to update the blockchain from time to time by verifying transactions made in the network into a ‘block’. The miners then compete against each other to solve a resource-intensive computational puzzle, called ‘proof of work’. The miner that manages to find the answer to the puzzle will be able to add/chain that latest ‘block’ into past transaction blocks and receive a certain amount of newly minted Bitcoin as a reward by the Bitcoin protocol.

Why Halving?

Satoshi Nakamoto wants to create a limited supply of Bitcoin, in order to do that the supply of Bitcoin needs to be restricted from time to time. This is where halving plays an important role.

The Bitcoin reward obtained by the miners for verifying one block of the transaction will be cut in half every 210,000 blocks mined, or roughly equal to 4 years. This reduction of Bitcoin reward is called ‘halving’. The table below shows the timeline of Bitcoin halving up until the time of writing this article.

| Halving event | Date of The Halving | Block Number | Reward to Miner |

| 0 | 3 January 2009 | 0 | 50 BTC/block |

| #1 | 28 November 2012 | 210,000 | 25 BTC/block |

| #2 | 9 July 2016 | 420,000 | 12.5 BTC/block |

| #3 | 11 May 2020 | 630,000 | 6.25 BTC/block |

| #4 | Unknown, 2024 | 840,000 | 3.125 BTC/block |

This halving event plays an important role in Bitcoin’s valuable deflationary characteristics. The reward of Bitcoin miners will decrease over time. As a result, Bitcoin becomes more scarce over time, and it will rise in value as long as demand stays at least constant. Based on the halving model, the last Bitcoin will be mined in 2140 after the 64th halving event.

The Effect of Halving

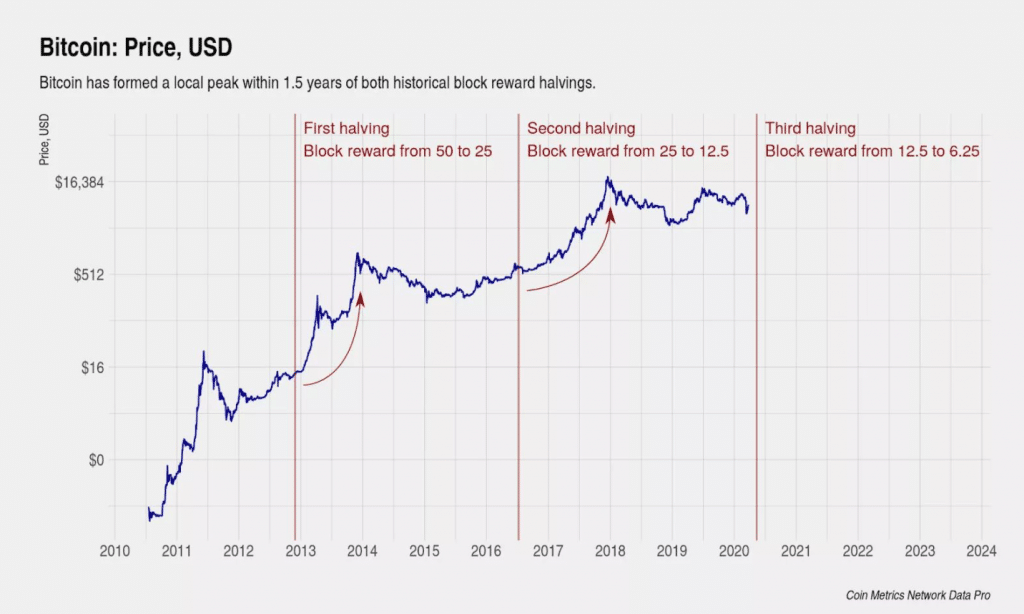

When the first halving was introduced in 2012, Bitcoin price soared to $1,000. After the second halving in 2016, Bitcoin price soared from $700 to almost $20,000.

Halving is inevitably an important event to watch out for Bitcoin investors. The supply of new Bitcoin released will be cut in half, making it more scarce, and driving Bitcoin’s value up. As you can see in this chart above, Bitcoin’s price always went up after halving occurred.

However, the price increase is not happening instantly after the halving event, but it will occur slowly and will eventually reach its peak. After reaching its peak, the price will go down, forming a new support level that is usually higher than the support level before halving.

Effect on the market

Since Bitcoin’s halving and inflation are scheduled, the market is anticipating the halving and buy more Bitcoin before the halving or just after the halving. People believe that because bitcoin’s supply is getting more constricted, and if the demand remains the same or more, it will push the price up. Even though the effect on the price is not immediate but we can say from the data that after 6-18 months there is a significant price increase after the halving.

Conclusion

Bitcoin halving plays an important role to ensure that Bitcoin’s supply is limited. By scheduling the rewards of Bitcoin, we can see that there will be only 21 million Bitcoin ever created in the world. When a halving happened, miners then have less Bitcoin to sell, thus making Bitcoin become more scarce and valuable.

Share

Related Article

See Assets in This Article

ATH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-