Bitcoin Network Development: What is BRC-20, STAMPS, and Ordinals?

Since its inception, the crypto industry has experienced rapid development in various sectors. Many layer-1 networks have emerged with increasingly sophisticated technology, the development of the DeFi protocol is difficult to follow because there are so many innovations, and Ethereum has just made a massive update to Proof-of-Stake (PoS). So, what about the OG, Bitcoin? Are there any developments on the network? In early 2023, there was some excitement within the Bitcoin community. Bitcoin Ordinals created a heated debate about Bitcoin’s development principles. On top of that, Bitcoin Stamps and the BRC-20 format also became another hot topic. Ordinals even created a new NFT trend in the crypto community. So, what are the developments happening on the Bitcoin network? What are BRC-20 and Ordinals? We will explain everything in this article.

Article Summary

- 🖥️ Two notable developments in the Bitcoin network in recent years have been the improvement of privacy through Taproot and the adoption of the Lightning Network as a layer-2 solution to improve scalability.

- 🖼️ Ordinals is a platform that enables the creation of NFTs on the Bitcoin network using Taproot and SegWit. Ordinals enables the BRC-20 experiment, creating a standardized token format similar to ERC-20 on Ethereum.

- 🎴 Another NFT protocol in Bitcoin is Bitcoin STAMPS. STAMPS utilizes Counterparty to insert images in Bitcoin transactions as NFTs. STAMPS NFT content cannot be pruned by Bitcoin nodes, unlike Ordinals. Bitcoin STAMPS also has an SRC-20 token standard similar to Ordinals.

- 😡 These developments created controversies in the BTC community. Many people oppose Ordinals and STAMPS NFTs because they don’t fit into Bitcoin’s functionality. In addition, non-financial transactions in Bitcoin also disrupt the performance of BTC as a network that facilitates payments.

- 🧠 Although controversial, these developments bring new uses and exciting economic potential to the Bitcoin network, including the opportunity to try NFTs, invest in layer-2 tokens, or become a Bitcoin miner.

Bitcoin Network Development

Since its invention, Bitcoin has remained true to Satoshi Nakamoto’s original design, with debates among its developers usually spawning new hard forks such as BCH and BSV. In the absence of a central authority, updates to the Bitcoin network need to go through a systematic process referred to as Bitcoin Improvement Proposal (BIP). The process of discussing, introducing, and approving BIPs takes place on the Bitcoin developer Github forum. The most recent BIP in the proposal list is BIP-0327 which deals with Musig2, an attempt to upgrade multi-signature transactions on the Bitcoin network.

Another important aspect of the development of Bitcoin is Bitcoin Core. Bitcoin Core is a client application for accessing the Bitcoin network. The platform is officially managed by developers of the Bitcoin Foundation. Many BIP updates are directly applied to the Bitcoin Core platform. Additionally, Bitcoin Core also acts as a digital wallet like MetaMask for storing, sending, and receiving BTC.

Recent developments in the Bitcoin network include two main aspects: privacy and scalability. First, the introduction of Taproot increases privacy in the network. Taproot is an upgrade that separates complex transactions from simple transactions. Furthermore, this strengthens Bitcoin’s fungibility, as it is difficult to trace and associate individual transactions with specific users. Taproot transactions will have different codes on the blockchain and this update is one of the foundations for the creation of NFTs in Bitcoin. So, BIP-0341 Taproot was implemented as a soft fork on block 709,632, on November 14, 2021.

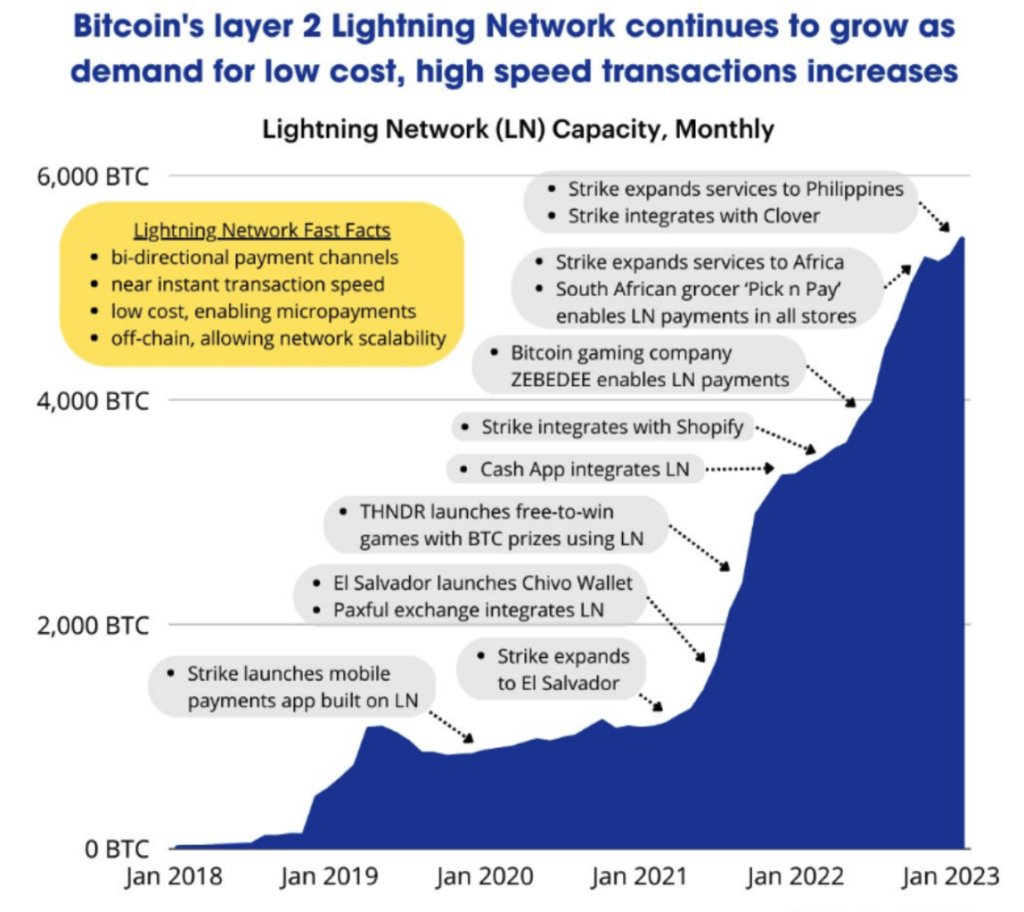

Second, a very important development of the Bitcoin network is layer-2 solutions such as the Lightning Network (LN). Lightning Network is a protocol that enables Bitcoin off-chain transactions. By using the Lightning Network, users can make transactions quickly with lower gas costs. So, Lightning Network increases Bitcoin’s scalability by reducing transaction congestion on the main network.

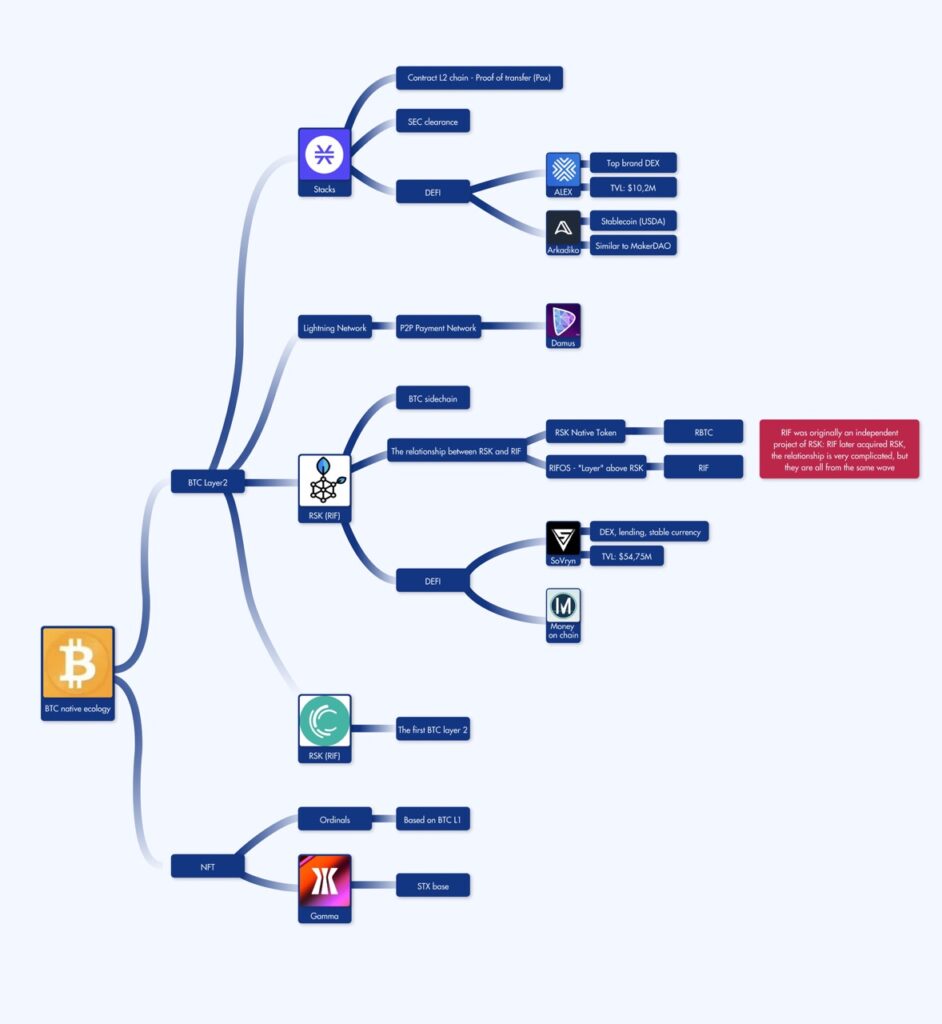

One company that is expanding the use of LN to several countries is Strike. Strike is already operating in the Philippines, El Salvador, Kenya, Ghana, and Nigeria. Beyond the Lightning Network, Stacks and Rootstock are layer 2 blockchains built on Bitcoin. Both facilitate the development of smart contracts and DeFi on top of the Bitcoin network.

Recent Protocol Developments in Bitcoin

In addition to the two privacy and scalability updates described above, there are several new trends developing in Bitcoin. These trends bring a variety of new use cases to the Bitcoin network. In addition, these developments have also sparked debate in the Bitcoin community. Many feel that these new protocols are not in line with Satoshi Nakamoto’s vision. However, many also support these protocols because they bring new use cases to the Bitcoin network.

1. Bitcoin Ordinals

Ordinals is a platform that enables NFT on the Bitcoin network. The Ordinals protocol enables NFT Inscription by utilizing some of the existing technologies in Bitcoin such as Taproot (2021), SegWit (2017), and ordinal theory (2022). In Ordinals, you create an NFT by minting or inscribing NFT content such as images, videos, text, or other documents into Bitcoin’s smallest unit, Satoshi. After inscribing an NFT into one Satoshi, you can track it using the Ordinals platform through the unique ordinal number that each Satoshi has. Ordinals sparked the trend of creating NFT collections on the Bitcoin network.

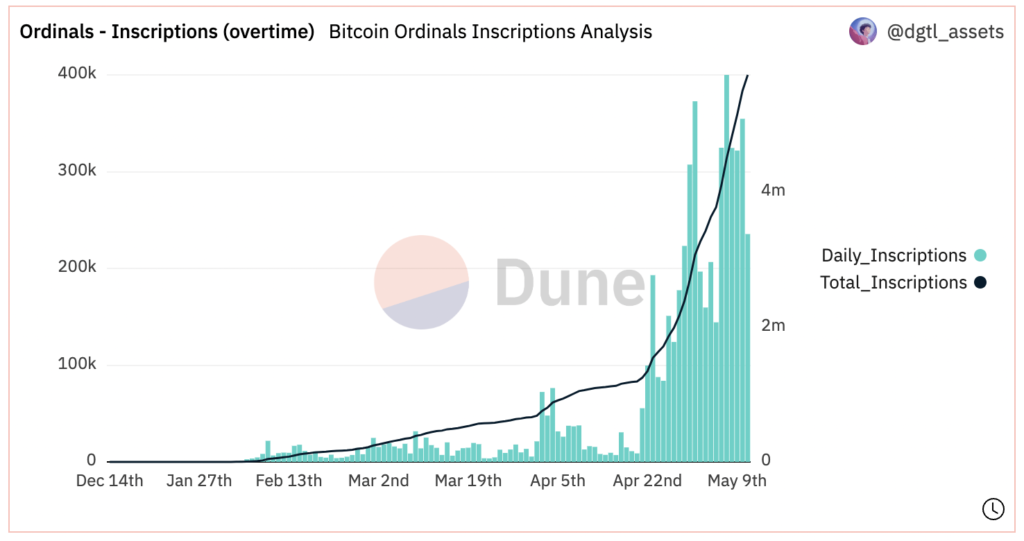

The Ordinals platform itself was launched in early January 2023. To date (May 12, 2023), there have been 5.7 million Inscriptions created on the Bitcoin network. Data in Dune Analytics shows that the total transaction fees required to create Ordinals have reached $32 million dollars. Furthermore, the highest number of Inscription creations just happened on May 7, with a total of 400,000 Inscriptions in a day.

You can read more about how Ordinals works at Pintu Academy.

Ordinals are the start of Bitcoin catching the attention of developers and the crypto community on Twitter again. In fact, Ordinals became the foundation for the creation of BRC-20, Bitcoin’s first token standard.

2. BRC-20 Experiment

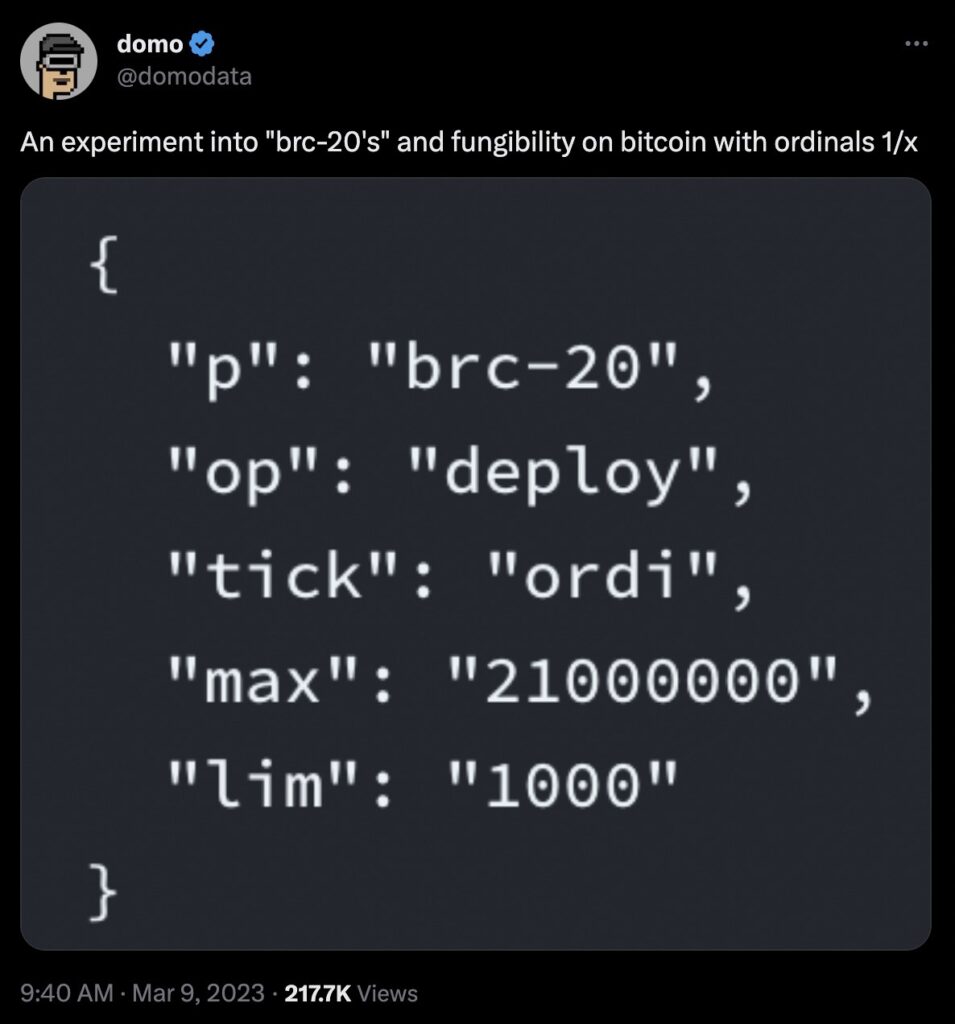

BRC-20 is an experiment to create a standardized format for tokens on top of the Bitcoin network. As the name suggests, BRC-20 tokens take inspiration from the ERC-20 standard on Ethereum and have the same functionality: allowing developers to create tokens that are fungible. So, BRC-20 tokens are created by utilizing the Ordinals protocol. The experiment was started by the Twitter account @domodata who tweeted on March 9, 2023, about trying to create BRC-20. Now, he has a GitHub page with a full explanation of BRC-20, including how it operates.

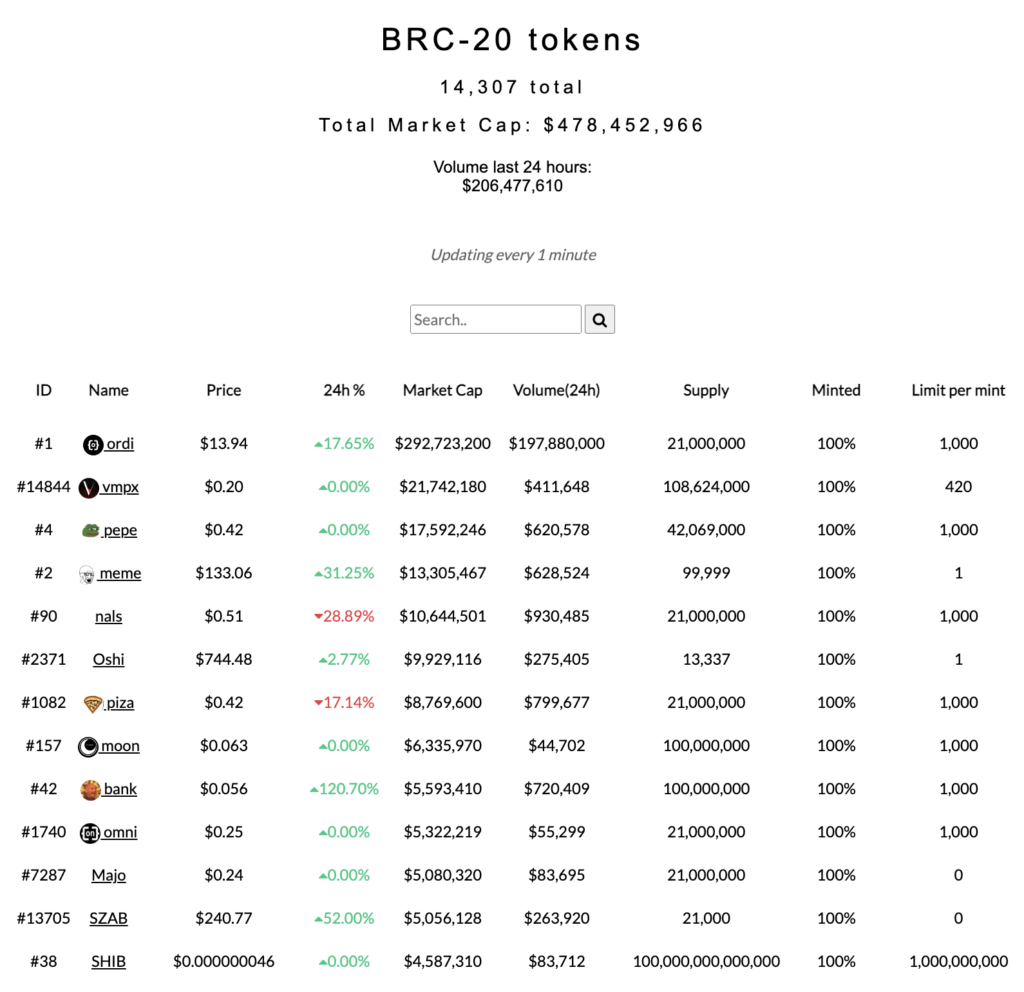

BRC-20 tokens are created using the Ordinals protocol by inserting a JSON document containing various instructions for creating, printing new tokens, and sending BRC-20 to other accounts. So, the image above is an example of how to create a new BRC-20 token. Currently (16 May 2023), the market capitalization of BRC-20 tokens has reached $493 million dollars. ORDI is the BRC-20 token with the largest market capitalization and the first BRC-20 token on Bitcoin. Currently, BRC-20 tokens are still dominated by meme coins that function only as speculation for traders.

If you want to try buying, selling, or minting BRC-20 tokens, you need to download Unisat’s digital wallet. You can create a new wallet in Unisat (choose Taproot address type) and start minting BRC-20 or buying (you must first earn 20 Unisat points by making 20 transactions). You must have enough Sats in your wallet before making BRC-20 transactions to compensate for gas fees. The creation, sale, and purchase of BRC-20 is still very complicated and you need to understand how on-chain Bitcoin transaction works.

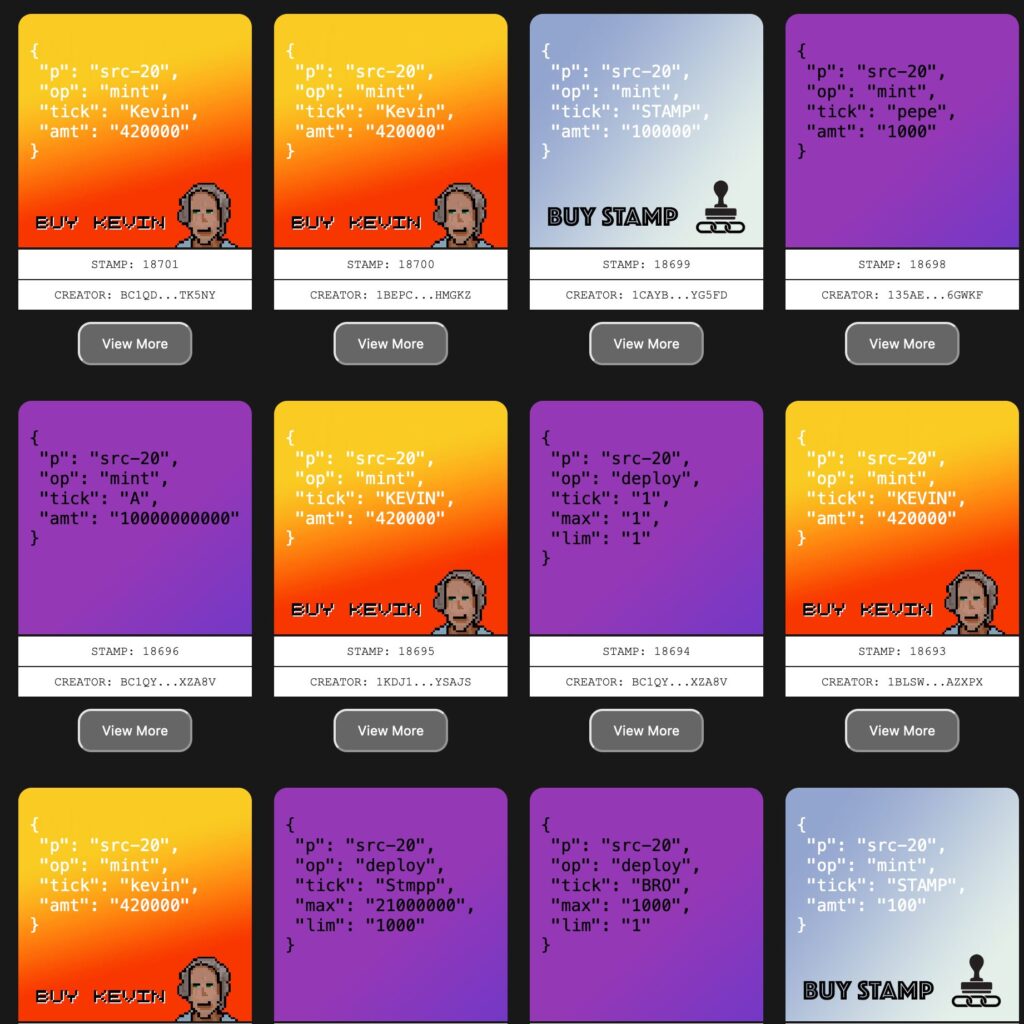

3. Bitcoin Stamps

Bitcoin STAMPS (Secure Tradeable Art Maintained Securely) is an NFT protocol that utilizes the Counterparty platform and inserts images in the unspent transaction outputs (UTXOs). STAMPS inserts STAMP:base64 code in the description key. Counterparty platforms can read this code and execute it as a bare multi-sig transaction to the Bitcoin network.

As a result of being treated as multi-sig output with the code STAMP:, NFTs in STAMPS have an image size limit of 24×24 pixels in PNG or GIF form. This means that the average size of STAMPS is 5-7 KB, a far cry from the 2 MB limit of Ordinals. With this size, STAMPS is ideal for pixelated art.

Although the size of STAMPS is smaller than Ordinals, STAMPS NFT requires heavier computing power and costs more gas. STAMPS does not utilize SegWit discounts like Ordinals as it inserts images on UTXO and uses STAMP code.The reason STAMPS imposes this restriction is so that STAMPS NFTs cannot be censored by nodes because they are stored in the UTXO set. This is the opposite of Ordinals which can be censored (prunable) because they are in the witness section. That way, STAMPS are guaranteed to be stored on the Bitcoin blockchain permanently. You can try to learn how to create STAMPS in this document.

Currently, there are already around 30,000 STAMPS created. Just like BRC-20, STAMPS also has an SRC-20 token standard. SRC-20 utilizes a feature of STAMPS where users can instantly mint a number of tokens from the same collection. Just like BRC-20, users use SRC-20 to create meme coins and it has no real use case (at the moment).

4. Bitcoin Layer-2: Lightning Network, Stacks, and RSK

Bitcoin’s layer 2 network becomes popular due to the Lightning Network. LN proves that layer 2 networks can increase Bitcoin’s scalability without compromising security. The network transactions become cheaper and faster, making it ideal for payment. The adoption of LN is proof that more and more parties still want to utilize BTC.

Outside of Lightning Network, two layer 2 projects on BTC that are garnering attention are RIF and Stacks. Stacks is a Bitcoin layer 2 project that enables smart contract-based decentralized applications (DApps) features. Stacks wants to create a DeFi ecosystem on top of Bitcoin. Currently, some of the applications that have launched on Stacks are Alex (DEX), Arkadiko (stablecoin protocol), and the NFT marketplace Gamma. Stacks has a TVL of $36 million dollars, of which $34 million is from Alex.

RIF or Rootstock Infrastructure Framework is an ecosystem built on top of the Rootstock (RSK) sidechain. Rootstock is an EVM-compatible Bitcoin sidechain. Like Stacks, the RIF platform also supports smart contract-based applications in Bitcoin. RIF has an ecosystem of applications such as ZK technology-based rollups, RIF Wallet, and RIF Name Service (RNS).

Are these Developments Positive or Negative? Debate in the Bitcoin Community

Unconventional developments on the Bitcoin network such as Ordinals and Bitcoin STAMPS are creating controversy within the BTC community. Basically, these developments create two different sides, the first wants Bitcoin to follow the usability trend and the second wants BTC to stay true to Satoshi’s vision and thus considers these developments useless and unnecessary.

Dhea Rezkitha, the founder of Kelas Bitcoin, thinks transactions like Ordinals and BRC-20 are still valid and that Bitcoin is designed to prioritize who can pay for block space, regardless of what type of transaction comes in. Michael Saylor, co-founder of Microstrategy, said that developments like Ordinals are a catalyst for Bitcoin adoption.

The opposition argues that Ordinals transactions congest the Bitcoin network and make transaction fees skyrocket. In fact, some blocks were difficult to process on May 8, 2023. Some in the Bitcoin community consider Ordinals to be “damaging” to the network and disrupting Bitcoin’s primary function as a payment network. The high transaction volume on May 8 meant that users who wanted to send transactions had to pay about $20 dollars in transaction fees. In fact, Luke Dashjr, a popular Bitcoin developer, made a proposal to block Ordinals and BRC-20 transactions. Most of the BTC community rejects Luke’s proposal.

On the other hand, BTC miners benefit greatly from the popularity of Ordinals, STAMPS, and BRC-20. One miner earned 6.7 BTC from a single block on May 8, more than the 6.25 BTC block subsidy. These activities provide a new source of income for Bitcoin miners. With the halving scheme continuing to cut miners’ rewards, this is a very positive development for the Bitcoin mining community.

What Can You Do as a BTC Investor?

- Try NFTs in Bitcoin: You can try buying or minting NFTs on the Bitcoin network using Ordinals or STAMPS. Ordinals transaction fees are cheaper and it is more popular while STAMPS provides a guarantee that your NFTs will never be lost.

- Invest in Bitcoin’s L2 token: If you have a positive view toward L2 developments on the Bitcoin network, investing in L2 tokens could be an option for you. STX, RIF, and ALEX are some of the L2 assets in Bitcoin. Don’t forget to do your research before buying.

- Try BRC-20 tokens on Bitcoin: If you’re more of a risk taker, BRC-20 meme tokens are on the rise. Although currently limited to meme coins, it’s possible that BRC-20 tokens will have a clearer utility in the future.

- Become a Bitcoin Miner: Of all the technological developments in Bitcoin, the ones who benefit the most are BTC miners. All activities that can attract more Bitcoin users will be a net positive for BTC miners. With increased activity, miners will continue to reap the benefits of transaction fees. You can try to become a miner (full node) to take advantage of this momentum.

Conclusion

The development of the Bitcoin network has seen significant innovations in recent years. Two of them are privacy enhancements through Taproot and Lightning Network as a layer-2 solution to improve Bitcoin’s scalability. Additionally, Ordinals and Bitcoin STAMPS NFT protocols have created controversy in the Bitcoin community. Moreover, the new BRC-20 and SRC-20 token standards are also creating new trends in the crypto community. Some consider developments like Ordinals to be out of place in the Bitcoin network. While there are different opinions about these developments, we cannot deny that they bring new uses and exciting economic potential to the Bitcoin network. For investors, there is an opportunity to try out NFTs, invest in layer-2 tokens, or even become a Bitcoin miner.

References

- A beginner’s guide to the Bitcoin Taproot upgrade, Coin Telegraph, accessed on 11 May 2023.

- ‘Bitcoin Stamps’ NFTs Are Gaining On Ordinals, Decrypt, accessed on 11 May 2023.

- Crypto Koryo, “Memecoin madness just got a new playground! Late to the $PEPE party? No worries, Bitcoin’s BRC-20 tokens are where the degens are flocking now.”, Twitter, accessed on 11 May 2023.

- The Smart Ape, “📖 BRC-20 Ultimate Guide 📖 I spent hours studying #BRC20 tokens on #Bitcoin”, Twitter, accessed on 11 May 2023.

- Fabian D., “well looks like the cat’s out of the bag. more people are starting to take notice now that the #BTC blockchain”, Twitter, accessed on 11 May 2023.

- Alex Wacy, “Memecoins making people millionaires and you missed it. But don’t worry, you’re not late yet. The new wave of 100x is BRC-20 tokens”, Twitter, accessed on 12 May 2023.

- brc-20 – brc-20 experiment, Gitbook.io, accessed on 12 May 2023.

- Mikeinspace, stamps/BitcoinStamps.md, GitHub, accessed on 12 May 2023.

- Alex Wacy, “$PEPE made some people millionaires and you missed it. $Ordi BRC20 yielded a 350x return, but you missed that too. Last chance! SRC-20 or STAMPS on Bitcoin”, Twitter, accessed on 15 May 2023.

- Nivesh Rustgi, Bitcoin Developer Calls to Block Ordinals, BRC-20 Tokens From Network, Decrypt, accessed on 15 May 2023.

- Bitcoin Developers Debate Over Whether to Censor Ordinals BRC-20s, Coin Desk, accessed on 15 May 2023.

Share

Related Article

See Assets in This Article

STX Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-