Understanding Crypto Tax and How to Calculate Them

The subject of crypto taxation can be perplexing to investors, who may have questions about how to pay, how much to pay, and how to report their taxes. In the following article, you will find the answers to these questions.

Article Summary

- ⚖️ Indonesia has imposed crypto tax under Finance Minister Regulation (PMK) No. 68/PMK.03/2022 since May 2022.

- 💸 Since cryptocurrencies are not intended for payments and are considered an investment commodity in Indonesia, crypto investors will be required to pay final Value Added Tax (VAT) and Income Tax (PPh) on each transaction.

- 🏦 Investors do not need to calculate and pay the tax themselves. The exchange was the designated third party by the government to handle it.

- 📄 Investors, however, are still required to report their crypto assets in the list of assets or debts in the Annual Tax Return (SPT).

What is Crypto Tax?

As the crypto industry develops and more people buy crypto assets, governments have started taxing crypto assets. For instance, in the United States, taxes are applied to each transaction involving the purchase and sale of crypto assets as well as the use of crypto for payment.

Investors who purchase cryptocurrencies and keep them as investments are not subject to taxes in the US. However, the tax is paid later on when the investor sells their assets, and their gains are “realized.” Taxes will also apply to asset exchanges, such as spending ETH to purchase BTC. Both are taxed as capital gains.

If someone were paid in crypto by an employer, it would be subject to income tax. Likewise, income earned from crypto mining or staking rewards would also be taxed as income.

Is Crypto Taxed in Indonesia?

Then how about in Indonesia? Does the government also impose tax on crypto assets? The answer is yes.

Regarding crypto asset tax, the government, through the Ministry of Finance, has imposed Finance Minister Regulation (PMK) No.68 / PMK.03 / 2022 in May 2022. The PMK regulates Value Added Tax (VAT) and Income Tax (PPh) on crypto asset transactions.

In PMK 68/2022, taxable crypto transactions include buying and selling a crypto asset, asset swaps, and exchanging crypto assets into fiat currencies.

As quoted from Bisnis Indonesia, Head of the Sub Directorate of VAT, Trade, Services, and Other Indirect Taxes, Directorate General of Taxes of the Ministry of Finance Bonarsius Sipayung explained that there are several reasons that make crypto an intangible taxable item.

The reason is that crypto is not an official payment method, but an intangible commodity in the form of digital assets, so it is included in taxable goods. Also, crypto is not a securities and is recognized as a commodity, so its trade is related to the obligation to VAT.

In collecting and depositing the crypto tax, the government has appointed a third party to do so. The third party is a crypto exchange, such as Pintu.

Crypto Tax Percentage in Indonesia

In PMK 68/2022, the tax amount for each crypto transaction has been regulated. Buyers or recipients of crypto assets will be subject to VAT tax with two provisions. If the transaction is carried out on an exchange platform that is registered on Bappebti, such as Pintu, the tax fee is 0.11% of the transaction value. If the transaction is carried out on an exchange platform that is not registered on Bappebti, the tax fee is 0.22%.

Meanwhile, sellers or senders of crypto assets will also be subject to PPh final tax with two provisions. If the deal is made on an exchange platform that is registered on Bappebti, the tax amount is 0.1% of the transaction value. However, if the deal is made on an exchange platform that is not registered on Bappebti, the tax amount is 0.2% of the transaction value.

In addition to buying and selling transactions, there are VAT and income taxes for crypto miners and a mining pool. The VAT rate is 1.1% of the conversion value of crypto assets and mining services that have verified asset transactions. The tax rate on crypto asset mining revenue is 0.1% of the income earned by crypto asset miners, excluding VAT.

How to Calculate Crypto Tax

The following is a simulation of crypto tax calculation based on PMK 68/2022:

Aldo intends to sell his 1 ETH via a registered exchange platform. At the same time, Laura plans to buy 1 ETH as an investment. At that time, the price of 1 ETH was equivalent to IDR 25 million.

Aldo as the seller in this transaction is subject to an income tax of 0.1%. So, the tax value is 0.1% x (1 coin x IDR 25 million) = IDR 25,000. Meanwhile, Laura as the buyer is subject to a VAT tax of 0.11%. Thus, the tax value is 0.11% x (1 coin x IDR 25 million) = IDR 27,500.

Fortunately, Aldo and Laura do not need to calculate and pay taxes themselves. Instead, the exchange platform handles the tax collection and deposits it to the government on their behalf. The tax fee will be deducted directly from the transaction fee.

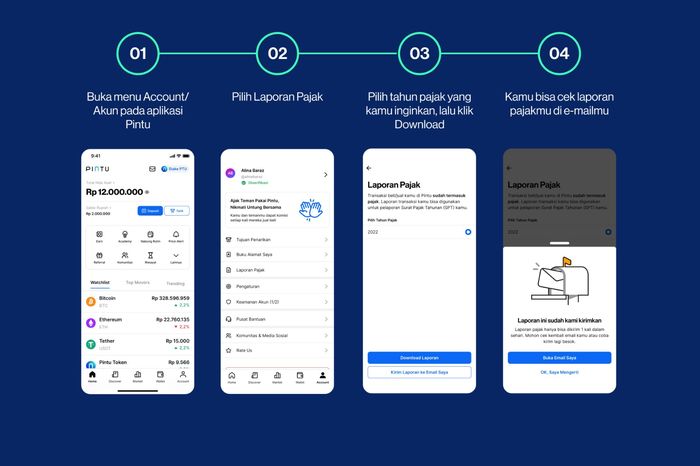

How to Download Crypto Tax Report in Pintu

Although the exchange has deposited taxes from crypto asset investments, crypto investors are still required to declare any crypto assets they possess in their list of assets or liabilities on their Annual Income Tax Return (SPT). However, the income earned from crypto trading will not be counted with other income in SPT reporting because it uses the final Income Tax scheme.

To simplify the tax reporting process for crypto investors, Pintu has introduced the Lapor Pajak feature. Through this feature, Pintu users can download tax reporting data in PDF format or send it to email. The crypto tax report file contains the complete data such as transaction date, transaction type, tax type, tax rate, tax value, status, and transaction ID number at Pintu.

To use Lapor Pajak via Pintu application, users can open the app and then click the account menu. After that, select the Tax Report option. Then, users can choose the desired tax year. Finally, choose between “download report” or “send a report to my email.”

Once the entire process is complete, the user will get a tax report file that can be used to help fill out the SPT.

Buying Cryptocurrencies in Pintu

Pintu gives you a safe and easy platform to invest. You can invest in various crypto assets such as BTC, ETH, SOL, and others safely and easily. Furthermore, Pintu has subjected all its crypto assets to a thorough evaluation process, emphasizing the importance of prudence.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles updated weekly! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

Indonesia, Peraturan Menteri Keuangan Republik Indonesia Nomor 68/PMK.03/2022 tentang Pajak Pertambahan Nilai dan Pajak Penghasilan Atas Transaksi Perdagangan Aset Kripto. Menteri Keuangan, accessed on 8 March 2022

Wibi Pangestu, Pemerintah Ungkap Alasan Transaksi Kripto Kena Pajak, Simak Penjelasannya, Bisnis Indonesia, accessed on 8 March 2022.

Fitriya, Sah! Ini Tarif Pajak Kripto Indonesia, Pemungut PPh dan PPN Kripto, Klik Pajak, accessed on 8 March 2022.

Coinbase, Understanding crypto taxes, accessed on 8 March 2022.

Share