Understanding DeFi in Bitcoin and How it Works

Who doesn’t know DeFi, or decentralized finance? Decentralized Finance or DeFi is a financial application ecosystem based on blockchain that can operate without a central authority such as a bank or other financial institution. DeFi is generally run on the Ethereum blockchain using smart contracts. And this is what makes the Ethereum network gain popularity. But recently Bitcoin developers can also create DeFi on the Bitcoin network. Want to know more? Let’s explore DeFi in Bitcoin.

Article Summary

- 🔗 Unlike Ethereum which was the first blockchain to allow DeFi to be built, Bitcoin was not previously meant to be a platform for developing decentralized applications. The best way to do this is to launch a BTC version of DeFi wrapped in some other project network and access DeFi from there.

- 💰 DeFi in Bitcoin exposes Bitcoin users to the same options and ability to generate investment rewards that Ethereum users have enjoyed over the past few years.

How is DeFi in Bitcoin?

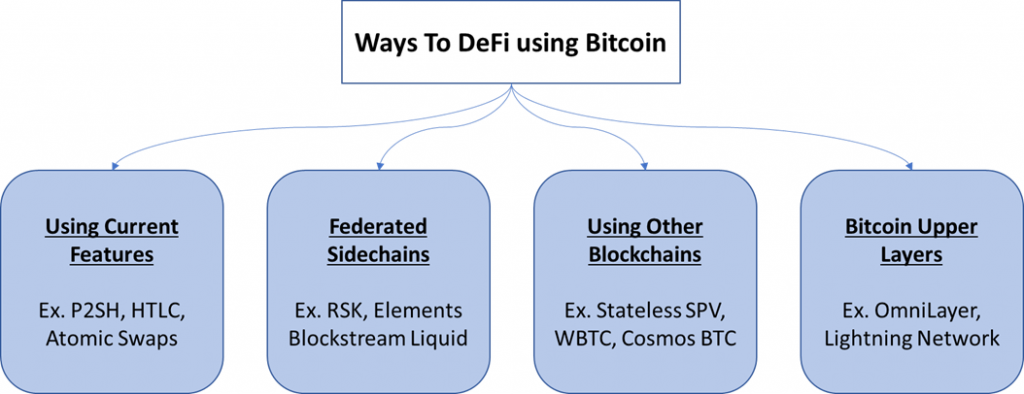

There are four ways one can use Bitcoin in a DeFi product.

Using Current Features

The first method is to use features already available in Bitcoin such as P2SH, HTLC, or Atomic Swaps. P2SH (Pay to Script Hash) allows you to lock bitcoins into a hash script, it allows you to create your own scripts in the bitcoin blockchain and share them securely.

Federated Sidechains

The second method is to use a sidechain with its own token like L-BTC or RSK. L-BTC or Liquid Bitcoin is a separate token from the main Bitcoin chain and runs on a separate network, the Liquid Network. While RSK is also a sidechain of Bitcoin that can be used for DeFi

Using Other Blockchains

The third method is to use a version of Bitcoin wrapped in a other blockchain such as WBTC i.e. ERC-20 token which is 1:1 compared to that run on the Ethereum network. By using WBTC, this token uses Ethereum gas fees.

Bitcoin Upper Layers

The fourth method is a method that is being built, namely DeFi Bitcoin which is built on a Bitcoin network, such as Discreet Log Contracts, Lightning Network etc.

What is a Discreet Log Contract?

Discreet Log Contract is a method for minimizing trust in obtaining data from external sources to the blockchain — popularly referred to as an oracle. Discreet Log Contract does not use a turing-complete smart contract on bitcoin. Instead, they rely on the use of Schnorr’s signature to mask the details of agreed contracts from the oracle, effectively creating a situation where payments on publicly known data (i.e., numbers) are possible between three parties in the process.

Example: For example, and in the context of DeFi, Alice and Bob could open a futures contract between each other speculating on the future price of bitcoin on a specific date. Using the power of multi-sig output, contract details containing Alice and Bob’s committed funds can be hidden from blockchain. Next, the third-party oracle publishes a message that is signed and entered into the contract details as important data that determines how the funds in the contract should be allocated. In the case of the Alice and Bob futures contract, the funds tied to the contract will be delivered based on the price of bitcoin provided at the expiration of the futures contract. Thus the oracle is unaware of this whole process both the fact that Alice and Bob are using the price data and about the actual contract details.

This prevents Oracle from executing or manipulating contracts e.g. by displaying incorrect price data. In addition, the DLC avoids the oracle being the deciding party in the agreement between Alice and Bob (i.e., 2-of-3 multisg), and instead allows Alice or Bob to withdraw funds based on a signed message published by the oracle.

Thus, the trust attached to the oracle which is the current problem can be avoided and smart contracts can be more easily executed. So the Discreet Log Contract can be an alternative to the Defi application.

Examples of DeFi in Bitcoin Using Sidechain

The most popular Bitcoin definitions are run through the Sidechain using a 1 to 1 stake, examples include:

Rootstock (RSK)

Referred to as Bitcoin-powered smart contracts, Rootstock (RSK) is a platform that facilitates the execution of smart contracts but uses Bitcoin as its asset. This platform combines the advantages of Bitcoin as the number one cryptocurrency in the world with the advantages of decentralized applications or DApps. RSK is a Bitcoin sidechain, so it has its own network and *blockchain. RSK essentially provides added value for Bitcoin users, such as faster transactions and better scalability.

To allow Bitcoin to enter and exit the RSK, the RSK has a two-way-peg to Bitcoin. When Bitcoin is transferred to the blockchain RSK, it becomes “Smart Bitcoin”. This Smart Bitcoin is the equivalent of Bitcoin living on the RSK blockchain, and it can be transferred back to the Bitcoin network at any time without additional fees, except for the transaction fees of RSK and standard Bitcoin. RBTC is the native currency used on the RSK network and is pegged 1:1 to bitcoin. RBTC is used as a gas fee paid to miners to execute smart contracts just like ETH as a gas fee on blockchain Ethereum

RSK has several dApps such as stablecoin & leverage, lending and borrowing (Sovryn) and savings (Tropykus).

Stacks

Stacks is a layer-1 blockchain, which uses a new and unique mining protocol called proof-of-transfer (PoX). The PoX blockchain runs in parallel with another blockchain (in this case Bitcoin). STX is the native cryptocurrency of the Stacks network. STX is used to run smart contracts for Bitcoin, rewards miners on the Stacks network, and allows its holders to earn bitcoins via Stacking. Stacks provides a native connection to the state of the Bitcoin blockchain and at the same time enable smart contract functionality for Bitcoin.

What are the advantages of using DeFi in Bitcoin?

Currently, DeFi development is happening within the Bitcoin program. As we know that Bitcoin still dominates the crypto market and it is undeniable that many users are trying to get more profit through the lending and borrowing programs offered by DeFi. The journey to building DeFi in Bitcoin is not as easy as building it in Ethereum for example. This is because the Bitcoin program has quite strict limits compared to Ethereum, with the aim of maintaining the security of Bitcoin.

Through the bitcoin DeFi platform, users can lend and borrow cryptocurrencies in a custodial manner: the borrower deposits bitcoins as collateral, which is repaid after the loan money is repaid in full.

References

- Stacks 101, Stacks.co, accessed on 25 May 2022

- Jude Nelson, What Kind of Blockchain is Stacks?, Stacks.org, accessed on 25 May 2022

- Sergio Demian Lerner, Rootstock Whitepaper Overview, Rootstock, accessed on 25 May 2022

- Mohamed Fouda, Pathways for DeFi in Bitcoin, Token Daily, accessed on 25 May 2022

- Andrew Zapotochnyi, Defi On Bitcoin: Decentralized Exchanges & Stablecoins on top of Bitcoin´s Network, Blockgeeks, accessed on 25 May 2022

- Alex Zha, Bitcoin Has No Real Use for DeFi in its Current Form, Bitcoin Magazine, accessed on 25 May 2022

Share