Fantom Sonic Upgrade: Potential and Impact

Crypto industry veterans will be familiar with the name Fantom. Fantom is one of the 2021 batch of blockchain projects. Along with Solana and Avalanche, Fantom is an Ethereum killer touted to rival Ethereum. However, Fantom has fallen behind because of the bear market. Fantom is now struggling to attract new users to its network. Sonic is a Fantom upgrade similar on a scale to the Merge for Ethereum.

Article Summary

- 🤖 Fantom is an L1 blockchain that was the destination of many small investors in the 2021 bull market. At its peak, the TVL of the Fantom ecosystem reached $8 billion.

- 💎 Sonic was a major upgrade to Fantom that would rename the Fantom network and introduce new technologies. Sonic introduces the Fantom Virtual Machine (FVM), reduces storage size for validators, and makes Fantom more efficient.

- 👀 Fantom will be renamed Sonic Chain and maintain a native L2 with full compatibility with Ethereum. The FTM coin will also change its name to S.

- 🧠 Through Sonic Chain, Fantom will have technology on par with Solana and newer generations of L1s. Sonic will be the biggest catalyst for Fantom to attract new users.

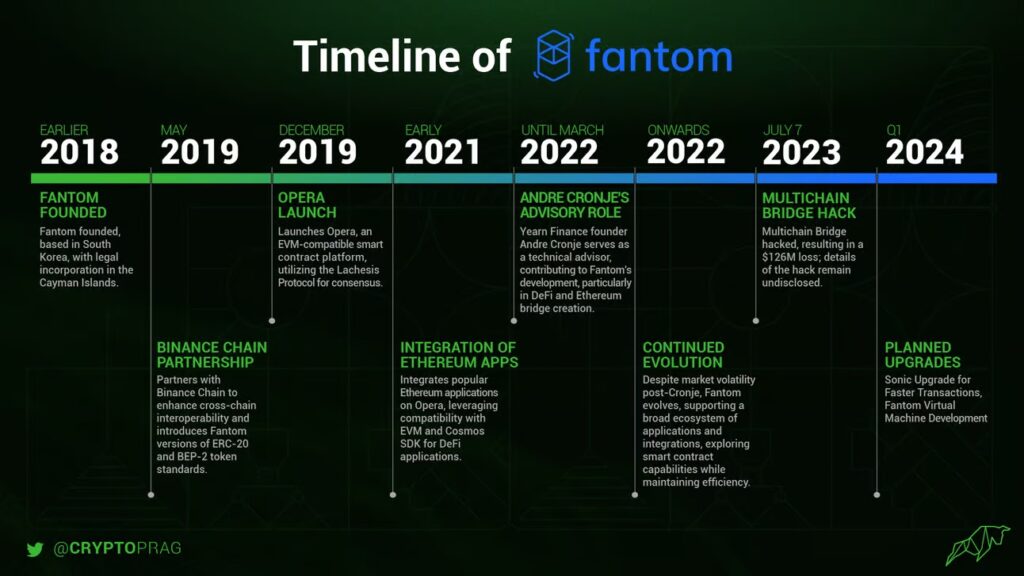

A Short History of Fantom

Fantom is one of the most popular layer 1 projects in the 2021 bull market. Fantom’s TVL even reached $8 billion at the peak of the 2021 bull market. At the time, Fantom was one of the biggest DeFi blockchains in crypto.

One of the major influences that attracted users to Fantom was Andre Cronje, Fantom’s DeFi icon. Andre created Yearn Finance and pioneered the DEX Ve(3,3) model that protocols like Aerodrome still use today. Andre is a DeFi and Fantom icon.

However, the 2022 bear market had a very significant impact on Fantom. Fantom’s TVL dropped 90% due to Andre Cronje stepping down from Fantom and the Multichain bridge hack. In addition, the price of FTM also fell 95% from its peak. Fantom, for all intents and purposes, was a “dead chain”.

However, when everyone was very pessimistic about Fantom, Andre Cronje returned to Fantom in late 2022. The Fantom team also announced big plans such as the development of the Fantom Virtual Machine (FVM) and a major update called Fantom Sonic in late 2023.

What is Fantom Sonic?

Sonic is the name for a series of major upgrades to the Fantom blockchain network. Sonic is also the name for the Fantom blockchain after those updates took place. With competition from new generations of L1s like Sui and Aptos, Fantom needed a catalyst to become relevant again. Sonic is Fantom’s attempt to be on par with the new generation of L1s.

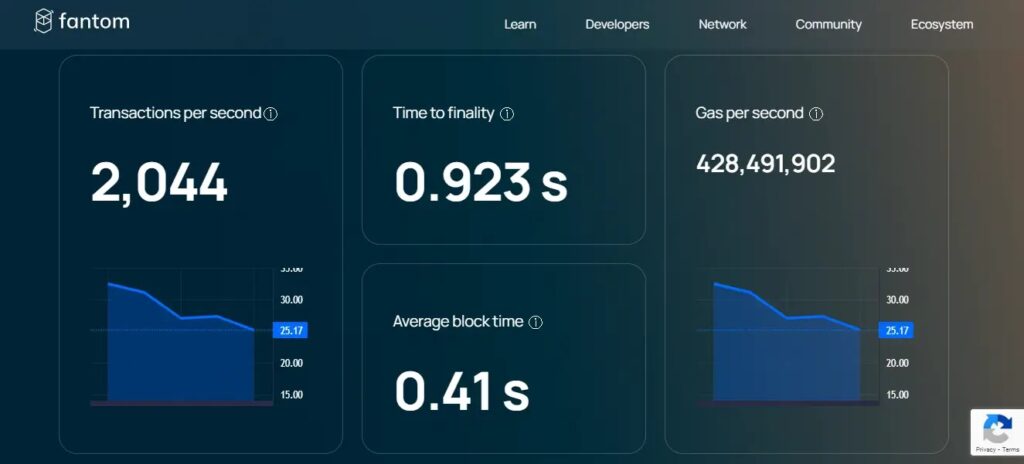

With Sonic, Fantom could achieve 2,000 TPS or transactions per second (equivalent to Solana). Sonic testing yielded 2,000 TPS for realistic scenarios, 4,000 for swaps, and 10,000 for asset transfers. Sonic provides a strong technological foundation for welcoming flows of new assets, users, and applications on Fantom.

The Sonic update itself consists of 3 important elements: FVM, Carmen, and Lachesis.

- Fantom Virtual Machine: FVM is basically EVM with a brand-new engine. FVM is 100% compatible with the old EVM code but can execute transactions faster, has better features for developers, and is more efficient.

- Carmen DB: Carmen is the name of Fantom Sonic’s data storage mechanism. Carmen separates operational nodes into validator and archive nodes. Carmen’s data structure allows the deletion of unnecessary data and reduces data storage costs by 95%.

- Lachesis Update: Lachesis is Fantom’s consensus mechanism. Sonic improved the performance of Lachesis to be able to handle larger transactions than before. Sonic also improved the security of Lachesis by increasing the minimum number of validator quorums.

Comparison of Fantom Opera and Sonic

The graph above is a performance comparison of the Sonic version of Fantom and Opera (the current network version of Fantom). Some of the significant changes from Opera to Sonic are an increase in daily transaction capacity (number of gas and peak transactions) and a reduction in data storage size (from around 10k to 1k and 2,106 to 180).

The cost of operating a validator also experienced smaller start-up and operational costs due to Sonic’s reduced data growth. In addition, the upgrade reduces the cost of becoming a validator. Validators who used to take around 4 weeks to download the entire network data now only need 2 days.

Potential and Impact of Sonic Update

The Fantom community’s enthusiasm for Sonic can be seen in Fantom’s on-chain activity. Despite stagnant user activity and transaction numbers, Fantom’s DEX volume and TVL numbers have increased since early January.

Solana shows that a strong community of users and developers can revive the network. Therefore, Fantom is trying to attract users to Fantom before Sonic’s release. Some of these include the Meme season program, integration of USDC into Fantom, and introduction of incentive systems such as gas monetization and potential airdrops.

Fantom Foundation launched the Memecoin Season program in June. The program wants to create a safe memecoin ecosystem and prevent the community from being exposed to scams. There are a total of $10 million FTM incentives to memecoin teams and token holders. At the moment, there are already 9 memecoins on Fantom’s meme season list.

Lastly, Fantom integrated USDC.e in partnership with Wormhole. USDC.e is a temporary solution for the Fantom ecosystem that lacks stablecoins. Post Sonic, USDC.e can then be updated to native USDC without needing Wormhole.

Sonic is a New Era for Fantom

Along with the Sonic upgrade, Fantom will change its name to Sonic Chain. Fantom Foundation and Labs will be renamed Sonic. Of course, this change includes the Fantom coin which will change to Sonic . The Fantom Foundation has already submitted a proposal regarding this change.

Sonic Chain will consist of an L1 Sonic network with a native L2 fully connected to Ethereum. From Ethereum’s perspective, Fantom is like an L2 with the speed and security of an L1. Sonic will be a hybrid L1 and L2 EVM network as it is fully integrated into Ethereum.

The Fantom Foundation has already proposed an FTM migration as well as a Sonic ecosystem incentive program and airdrop. Although welcomed, many people are concerned about the added supply of S beyond the current FTM supply. The addition of S supply will impact FTM owners by adding selling pressure and diluting the value of FTM.

Supply dilution of assets is an important aspect that is often overlooked. Adding supply reduces the value of the asset unless followed by a significant increase in market demand.

Fantom also announced a $10 million fundraising from UOB Ventures, Signum Capital, and the Aave Foundation. Several DeFi founders such as Michael Egorov (Curve), Fernando Martinelli (Balancer), and Sam Kazemian (Frax Finance) are also Sonic investors.

Fantom/Sonic Chain Roadmap

- Layer 2 Bridge to Ethereum: Sonic Chain will be the first L1 to have a native L2 Bridge to Ethereum.

- Sonic Airdrop Program: The Fantom team proposes incentivizing the Sonic ecosystem in the form of grants to the dev team and airdrops for the community.

- Parallel FVM: The Sonic team will explore potential FVM parallelization in the next upgrade.

- Use of Zero-Knowledge Technology: Andre Cronje’s DeFi team is developing potential uses of ZK for the Sonic ecosystem. However, Fantom’s CEO, Michael Kong, mentioned the implementation is still very far away.

Conclusion

Fantom was one of the popular L1 projects in the 2021 bull market. During the bear market, Fantom suffered a hack that cost it tens of millions of dollars and thousands of users. Sonic is Fantom’s attempt to become relevant again and compete with the new generation of L1s.

Sonic will also be a new era for Fantom. Fantom will be renamed Sonic Chain, which has the capability of 2,000 transactions per second. In addition, Sonic has a native L2 that connects to Ethereum and an FVM that executes Ethereum transactions more efficiently. All this puts Sonic as one of the L1s with great potential.

References

- Bernhard Scholz, “Fantom Foundation Launches Testnet for Fantom Sonic“, Fantom Blog, accessed on 3 June 2024.

- Gaz, “Is The Fun Moving to Fantom? All You Need To Know About The Sonic Upgrade“, Blocmates, accessed on 4 June 2024.

- @ModestusOkoye, “At its core, Fantom Sonic is comprised of 3 main features”, X, accessed on 4 June 2024.

- Michael Kong, “Michael Kong Unveils Sonic’s Launch and Beyond (Part 1)“, Fantom Blog, accessed on 5 June 2024.

- Michael Kong, “Sonic and Beyond: A New Era of Blockchain Innovation“, Fantom Blog, accessed on 5 June 2024.

Share

Related Article

See Assets in This Article

FTM Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-