A Guide to Use Limit Orders on Pintu

To provide a seamless trading experience, Pintu has introduced the Limit Order feature. With this feature, the user’s transaction process can be entirely automated and by the predetermined price. In addition to making it easier, Limit Order can optimize each user’s trading strategy. Want to know how to use Limit Order on Pintu? Check out the full article below.

About Limit Orders

Limit Order is a feature that allows users to buy or sell an asset at a specific price. With a Limit Order, the transaction execution will be done automatically through the system when the asset price matches the predetermined price.

In addition to making it more effortless, Limit Order can optimize each user’s trading strategy. You can use it to minimize risk, simplify cost management, and maximize profits.

Pintu Academy has prepared an in-depth article on limit orders here.

Limit Order ala Pintu

As a commitment to improve users’ trading experience, Pintu has launched the Limit Order feature. There are two types of limit orders on Pintu: Buy Limit Orders and Sell Limit Orders.

In a Buy Limit Order, the asset will be bought automatically when its price drops to or below the set price target. You can use this type of limit order to enter the market at the best price. The trick is to set the buy price target at the support area of the asset.

Meanwhile, with a Sell Limit Order, the asset will be sold automatically when the price rises to or above the specified price target. You can use this type of limit order to make the most profit. You do this by setting the selling price target at the asset’s resistance area.

Find out more important tips on using Limit Orders in the following article.

All tokens on the Pintu app market page can be bought or sold using the Limir Order feature. So, you no longer need to worry about missing out on buying or selling assets according to your target price. What are you waiting for? Let’s use Limit Order on Pintu!

A Guide to Use Limit Orders on Pintu

Perhaps you have never used a Limit Order and don’t know how to use it. Don’t worry. Here’s a guide to using Limit Order on Pintu.

Example of Using a Sell Limit Order on Pintu

In the past week, the crypto market has been on a positive trend when this article was written. Using the Sell Limit Order feature, this could be the perfect moment to take a profit.

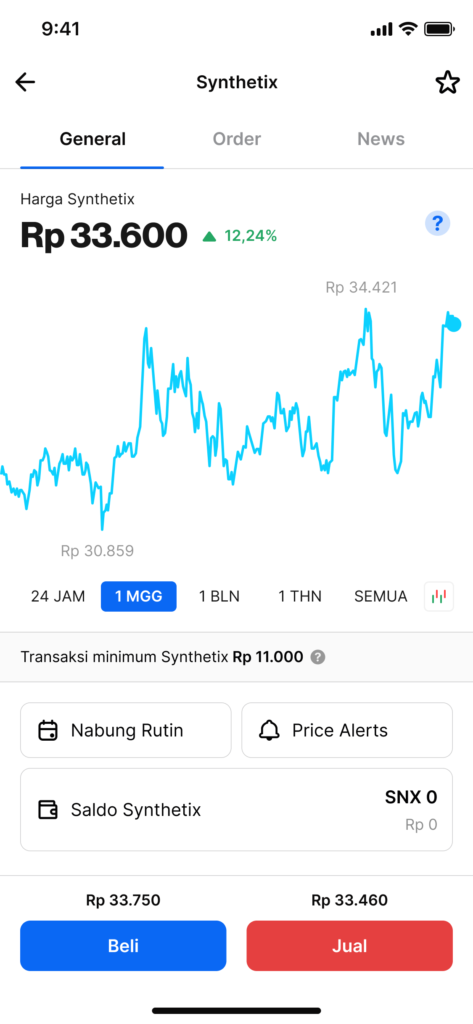

For example, Risvi has IDR 500,000 worth of Crypto SNX assets. At that time, he bought it when the price was at IDR 31,750. Now, the SNX price is Rp 33,600, and Risvi wants to use a Sell Limit Order to sell his asset at the price he wants.

The following are the steps Risvi needs to take:

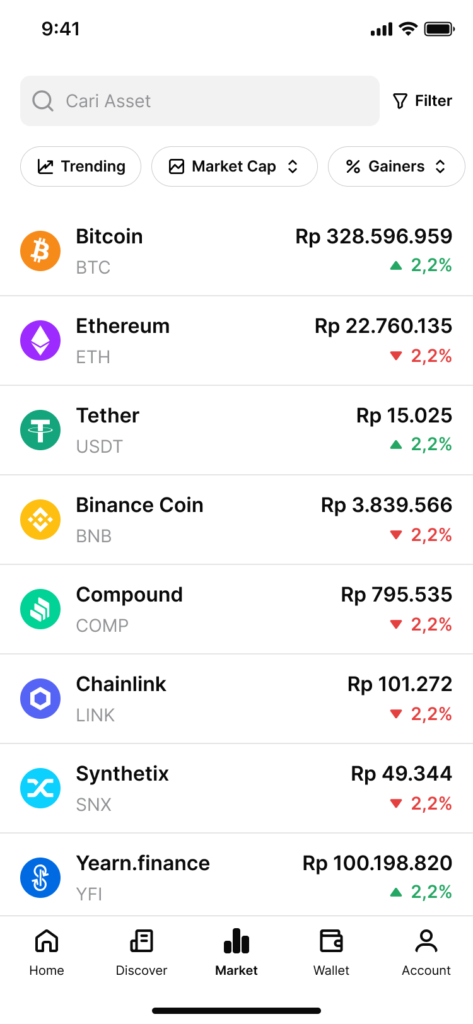

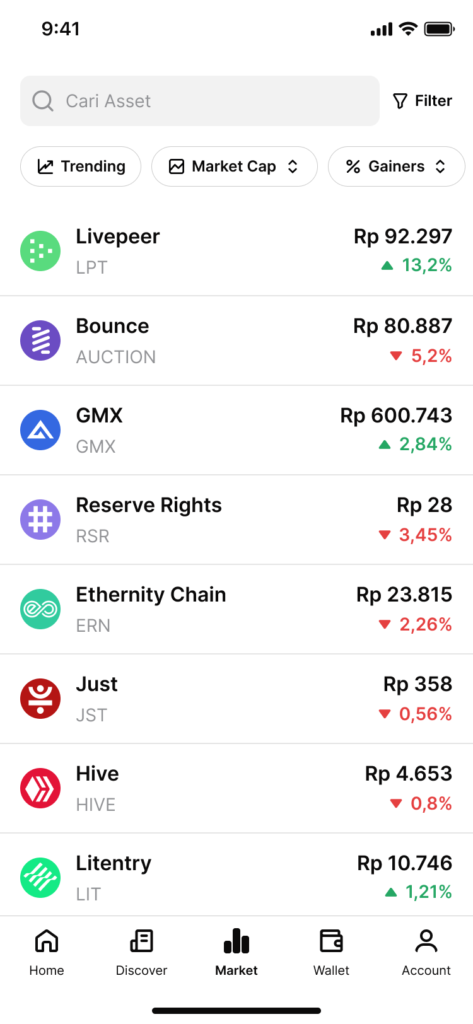

- Open the Pintu app and choose the “Market” menu to select the crypto asset he wants to sell using a Limit Order.

2. After selecting the SNX crypto asset, Risvi presses the “Sell” button.

3. He needs to select the order type by tapping the button on the top right of the screen. Then select the “Limit” option.

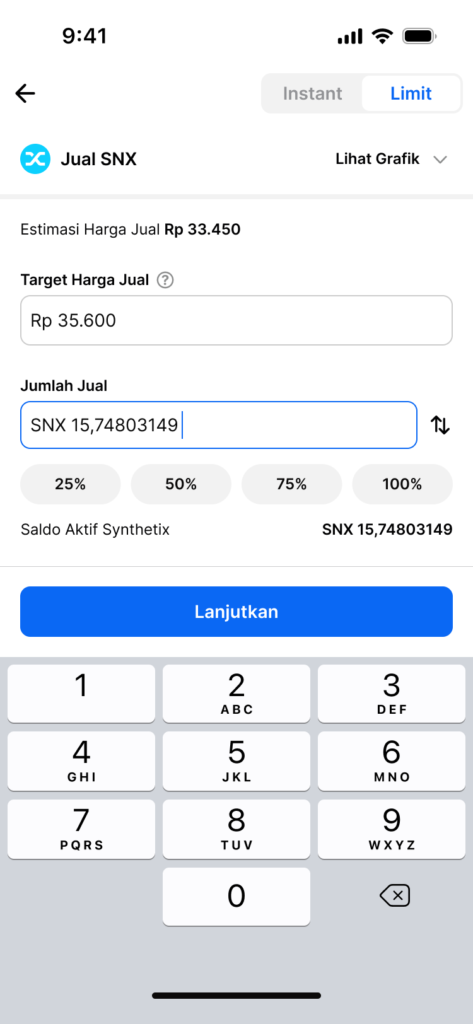

Based on Risvi's analysis using the Fibonacci extension, he sees the US$ 2.30 (IDR 35,665) area as SNX's resistance area. Then, he decided that the target price for the SNX Limit Order is IDR 35,600.

4. Risvi filled in the target selling price of IDR 35,600, and the amount of assets sold is 100% of what he has.

5. After checking and ensuring that the amount filled is appropriate, Risvi presses “Place Order”.

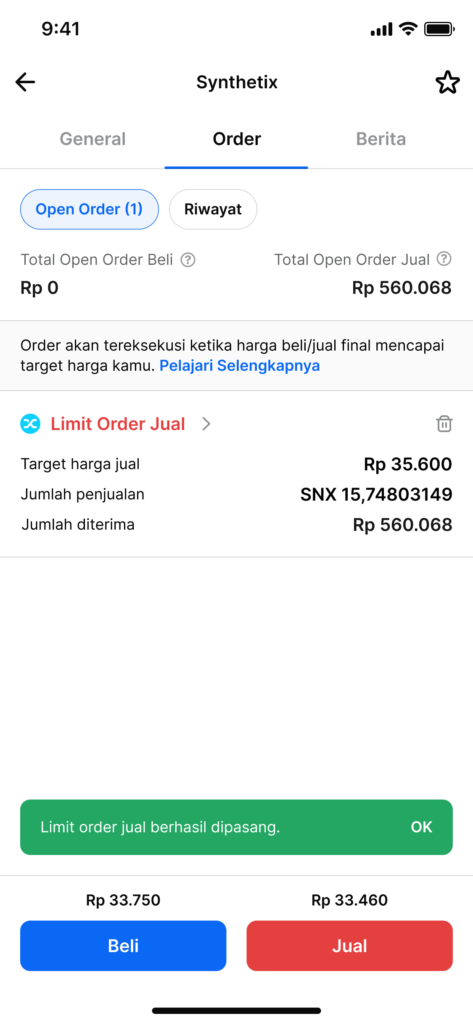

6. Done! Risvi’s Limit Order is in place and will be executed automatically if the price exceeds the target selling price of IDR 35,600. If the price is exceeded, Risvi will get a profit of IDR 60,600 (12.13%).

Disclaimer: The above examples are for illustrative purposes only and are not financial advice or recommendations. Make sure always to do your own research when making crypto asset transactions.

Example of Using a Buy Limit Order on Pintu

Amidst the general positive crypto market trend, some crypto assets will be in a correction trend. When the price of an asset is falling, it makes it attractive to buy. You can use a Limit Buy Order to get the entry point at the best price.

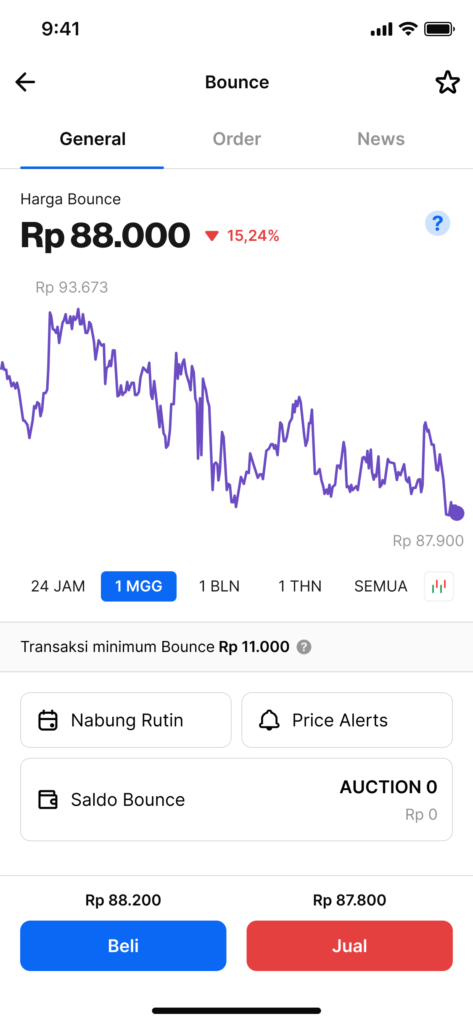

For example, Risvi sees that the crypto asset Bounce is in a correction trend. He believes AUCTION has exciting prospects and wants to buy it when it is "discounted". However, he thinks the price of IDR 88,000 is not too attractive, so he wants to use a Limit Buy Order to get a lower price.

The following are the steps Risvi needs to take:

1.Open the Pintu app and choose the “Market” menu to select the crypto asset he wants to buy using a Limit Order.

2. After selecting the AUCTION crypto asset, Risvi presses the “Buy” button.

3. He needs to select the order type by tapping the button on the top right of the screen. Then select the “Limit” option.

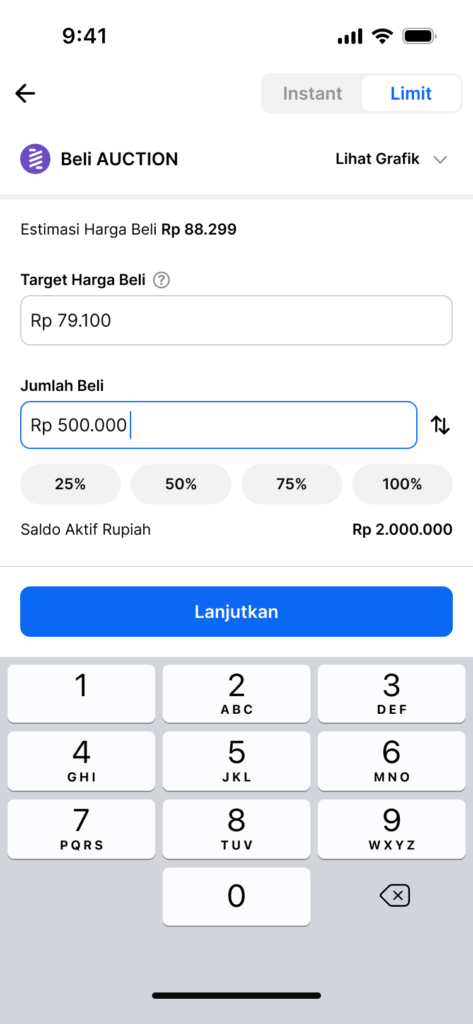

Based on Risvi's analysis using the Fibonacci extension, he sees the US$ 4.96 (IDR 79,083) area as the AUCTION support area. So he decided the AUCTION Limit Order's target price was IDR 79,100.

4. Risvi also filled in a target purchase price of IDR 79,100 with the amount of assets purchased of IDR 500,000.

5. After checking and ensuring that the amount filled is appropriate, Risvi presses “Place Order”.

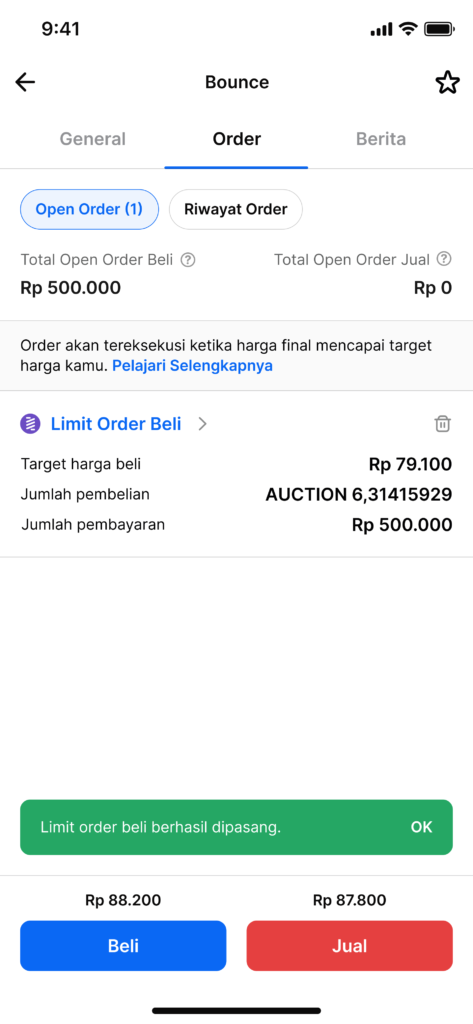

6. Done! Risvi’s Limit Order is in place and will be executed automatically if the price exceeds the target buying price of IDR 79,100

Disclaimer: The above examples are for illustrative purposes only and are not financial advice or recommendations. Make sure always to do your own research when making crypto asset transactions.

Conclusion

Isn’t it easy to use Limit Order on Pintu? Well, what are you waiting for? Hurry up and enjoy this feature for a more pleasant trading journey. With Limit Order, you no longer need to monitor the market price whenever you want to make a transaction. Now, you can optimize your trading strategy more efficiently and quickly thanks to Limit Order on the Pintu app.

You don’t need to worry about any fraud or scams on Pintu. This is because all crypto assets on Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Share

Related Article

See Assets in This Article

AUCTION Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-