How to Use DeFi Applications

how to use defi

The number of decentralized finance projects significantly increased in the mid of 2020, a period that is also known as the DeFi summer. A lot of DeFi applications emerged around that time, offering new financial services as an alternative to the traditional financial (TradFi) system.

In the previous article, we discussed what DeFi is. Now, we will guide you on how to use DeFi applications with a straightforward step-by-step tutorial. You don’t need to be a seasoned cryptocurrency trader to use DeFi services. You just need to understand the basics of DeFi financial services, which we will also explain in this post.

Article Summary

- 🔗 DeFi is a blockchain-based decentralized financial platform that does not depend on centralized financial middlemen like banks.

- 🤑 DeFi offers its users big opportunities to make financial assets work more productive in generating profits.

- 🔐 Using DeFi applications is relatively easy. Users just need to connect the decentralised applications (DApps) they wish to use with a cryptocurrency wallet like Metamask.

- 🏦 There are numerous DeFi platforms available, including decentralized exchanges (DEX), lending and borrowing, staking, farming and crypto asset insurance.

About DeFi

DeFi stands for decentralized finance, a blockchain-based decentralized financial platform that does not depend on financial institutions or banks.

DeFi uses cryptocurrency, blockchain, and smart contracts in its operating system. Smart contracts play essential roles in managing all activities in DeFi, such as controlling the token prices, interest rates, service fees, approving transactions, and other activities.

Data from DeFiLlama on November 15, 2022, the funds in the entire DeFi ecosystem of various blockchains reach 43.78 billion US dollars. As you can see, in December 2021, the TVL (Total Value Locked) once hit an all-time high of 181.32 billion US dollars!

Why Do We Use DeFi?

DeFi basically provides financial services that most people are already familiar with. The distinction is that DeFi offers transparency and higher return opportunity to its users. Furthermore, no institution has control over financial services in DeFi.

The advantage of DeFi compared to TradFi systems is that anyone can access DeFi financial services online anytime, 24/7. In addition, users can execute payment transactions within minutes and manage their crypto or self-custody.

DeFi eases its users to access financial services. Anyone can use DeFi through decentralized applications (DApps) or DeFi applications. Users do not need to do a KYC (Know Your Customer) to access DApss. It is different from the TradFi system. TradFi requires personal data of prospective customers to open savings accounts or borrow funds, such as e-mail, id card, photo, and other data.

block-preformatted">Decentralized applications (Dapps) are similar to regular applications on your smarphone or PC. The difference is that DApps are built with blockchain technology.

How to Use DeFi Applications?

Select Blockchain Network

Ethereum is a blockchain that pioneers smart contracts; most DeFi applications run on the Ethereum blockchain. However, currently there are a lot of new challengers to Ethereum, namely Binance Smart Chain, Solana, Avalanche and other blockchains.

Some blockchains have advantages such as fast transaction processing, low gas fees, and a mature DeFi ecosystem. So, you need to consider the network you want to use before choosing the DeFi application. In this article, we will guide you on how to use DeFi applications on the Ethereum network.

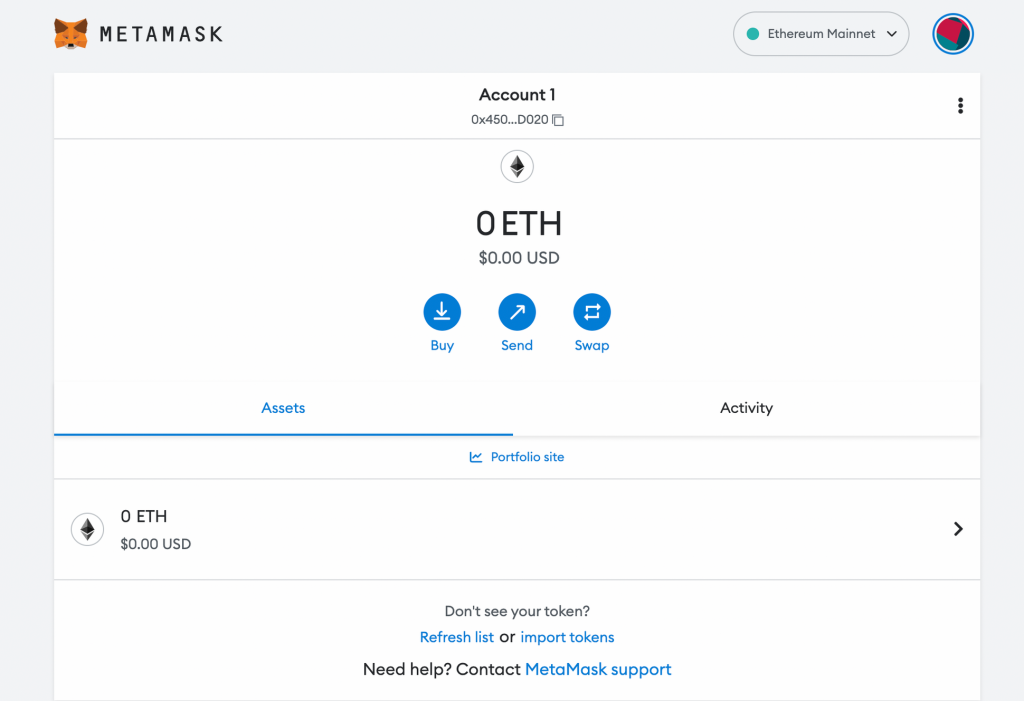

Create Crypto Wallets

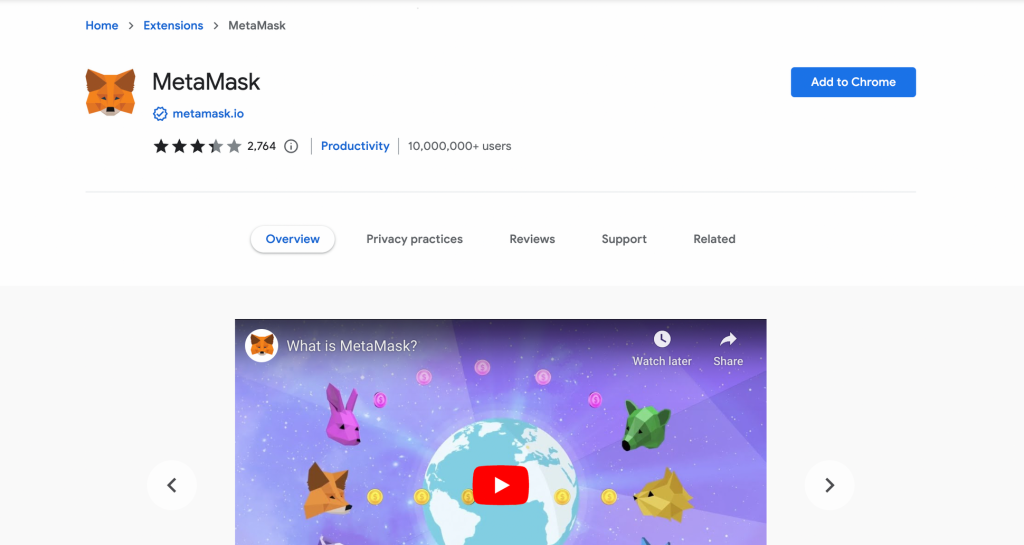

First, you need to connect crypto wallets to access DeFi applications. Several wallets you can choose are Metamask, Trustwallet, Phantom, and other wallets. Metamask is an Ethereum wallet that supports multiple blockchain networks and can be installed as a wallet extension in your browser. Metamask also provides safe and efficient access to DeFi applications.

The wallet extension enables users to jump right into DeFi applications and manage money in the browser. Here’s how to create a Metamask account.

Step 1

- Visit Chrome Extension.

- Type “Metamask”in the column Search Extensions.

- Click Add to Chrome.

Step 2

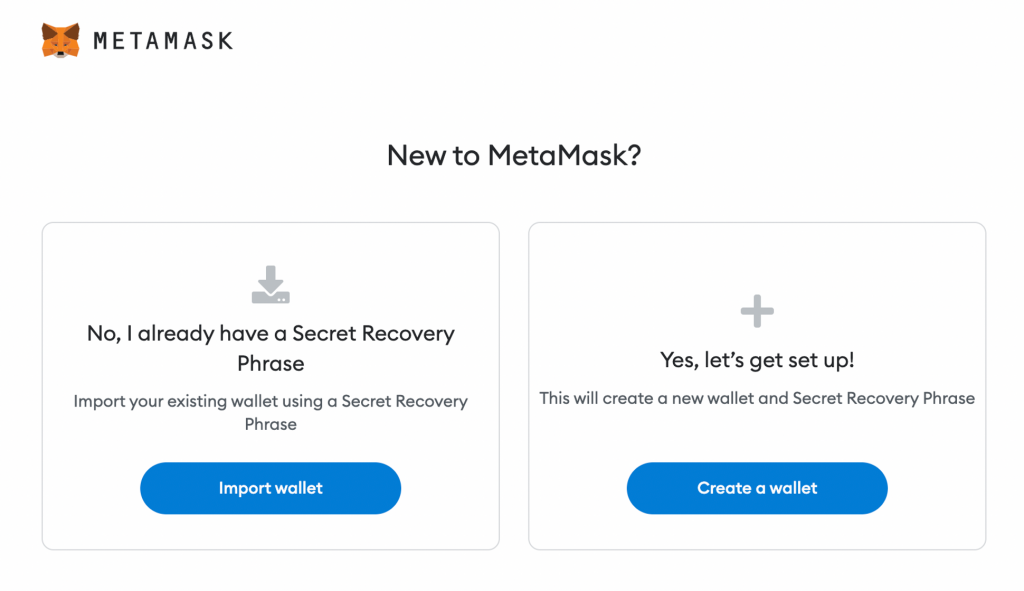

- Click Create a Wallet.

Note: If you already have a Metamask wallet, you can click Import wallet and enter a secret recovery phrase.

Step 3

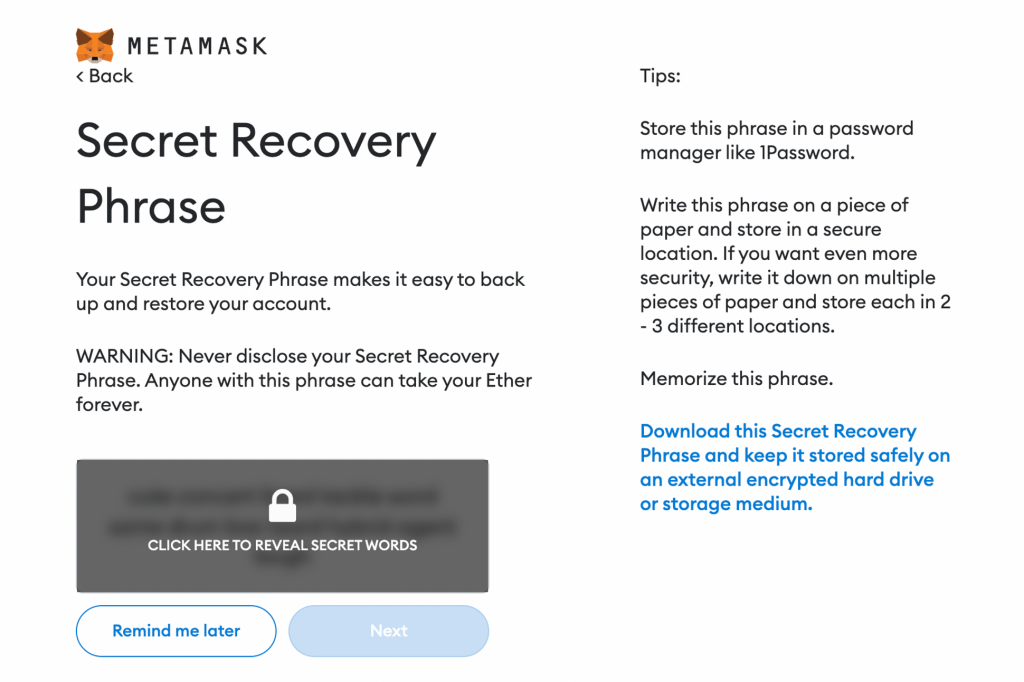

- Click the padlock icon to find out your secret recovery phrase.

Note: this secret recovery phrase consists of 12 random words. Write these words down in a notebook so they don’t get lost. Remember, never give anyone your secret recovery phrase! Someone can access your wallet if he/she has it.

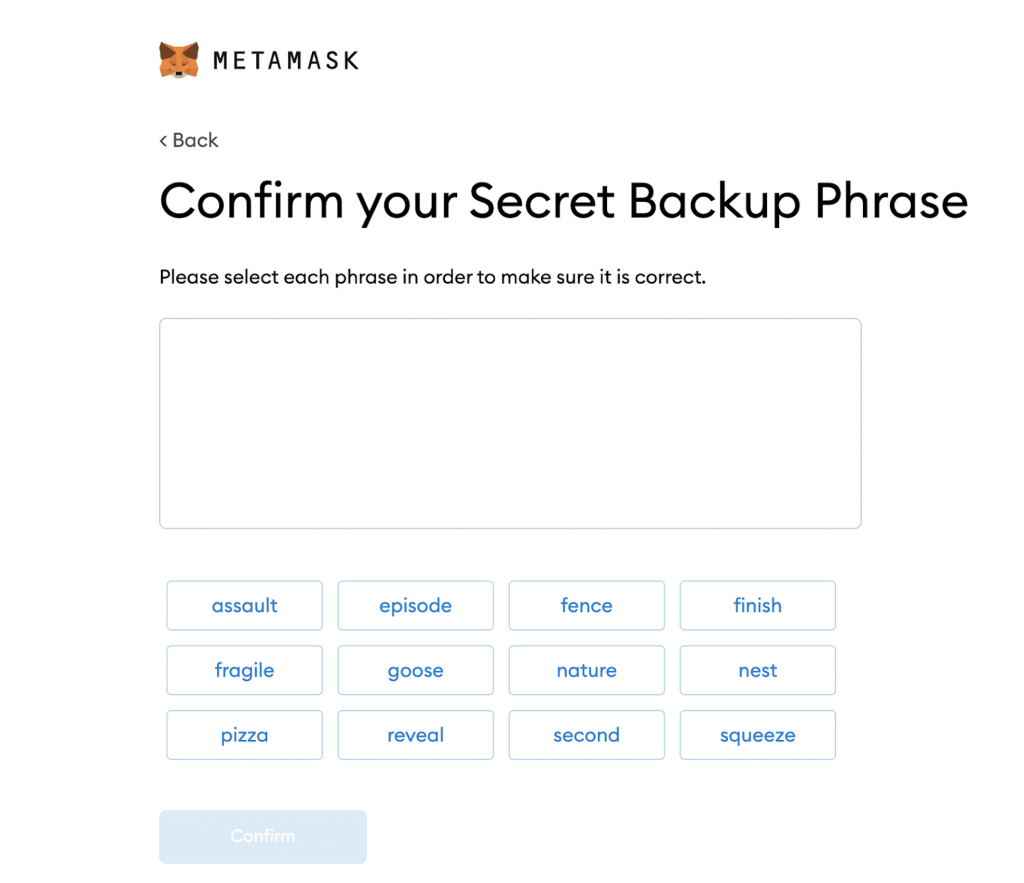

Step 4

- Sort the words you have written by clicking on them.

- Success! You have a Metamask wallet. You can access DeFi applications in the Ethereum ecosystem. Metamask wallet is available on smartphone version, so you can also download it. Since you already have a secret recovery phrase, you can enter these words in your smartphone version of Metamask.

Buy Cryptocurrencies

Before using a decentralized application, you must have a certain number of blockchain native coins (e.g., ETH) or blockchain standard tokens (e.g., ERC-20 tokens) in your wallet.

Why you need to provide cryptocurrency in your wallet? Because you have to pay gas fee in cryptocurrency. Gas fee in Ethereum refers to the additional fee required to execute a smart contract or transaction on the blockchain network.

You can buy cryptocurrency on centralized exchange like Pintu. After that, you can send it to your wallet. Here’s how to send crypto assets from Pintu.

Step 1

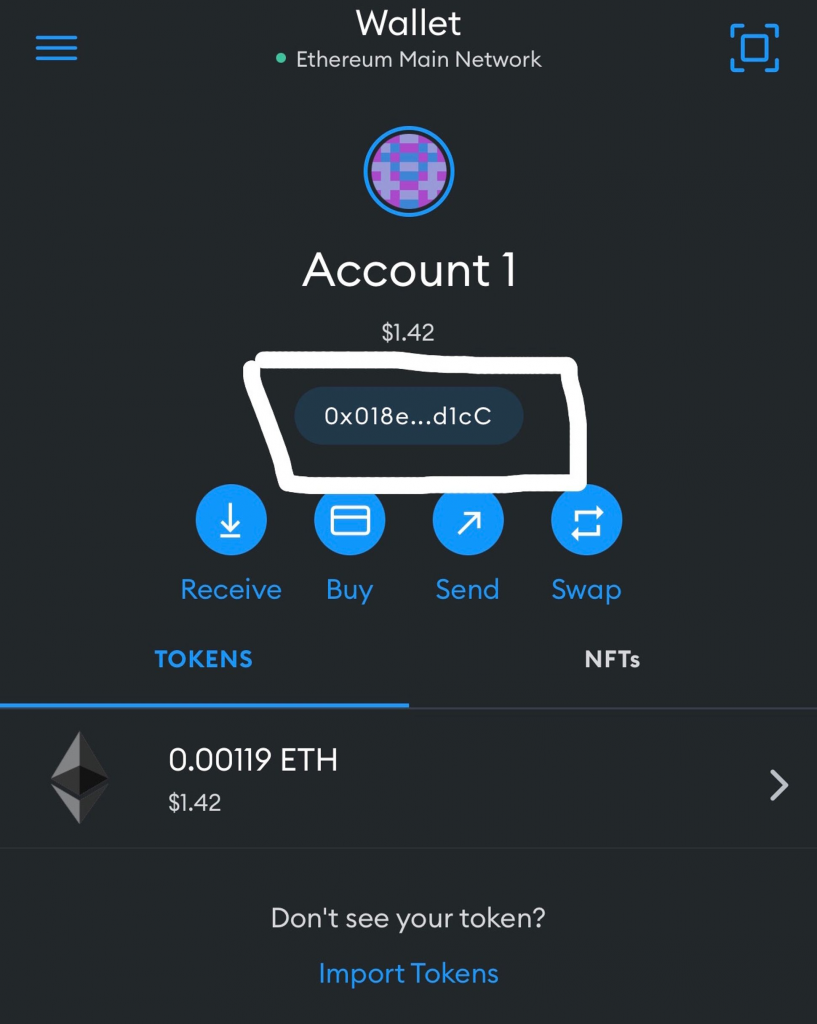

- Copy the Metamask wallet address.

Note: Make sure your wallet address is correct, and there are no letter or number errors.

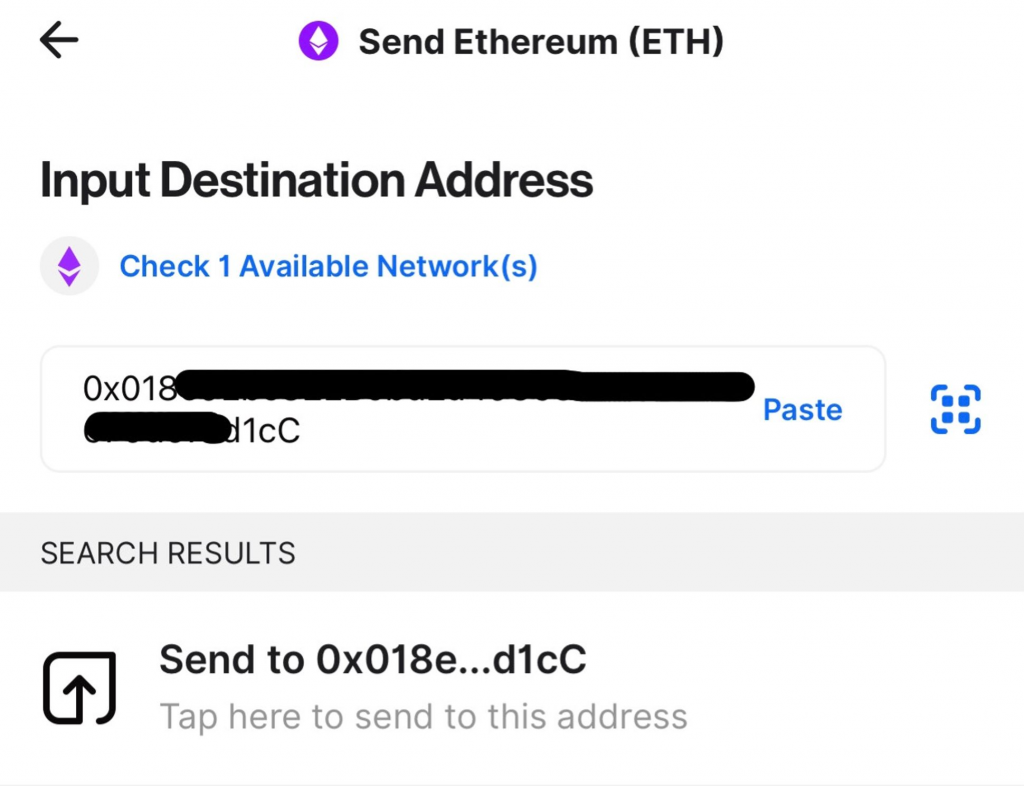

Step 2

- Enter Pintu application, then click Wallet.

- Select Ethereum, then click Send.

- Paste the Metamask address in the Wallet Address field, then click Send to.

Note: If you send ETH, then the automatically available network is the Ethereum network. Consider what network to use if you send other crypto assets.

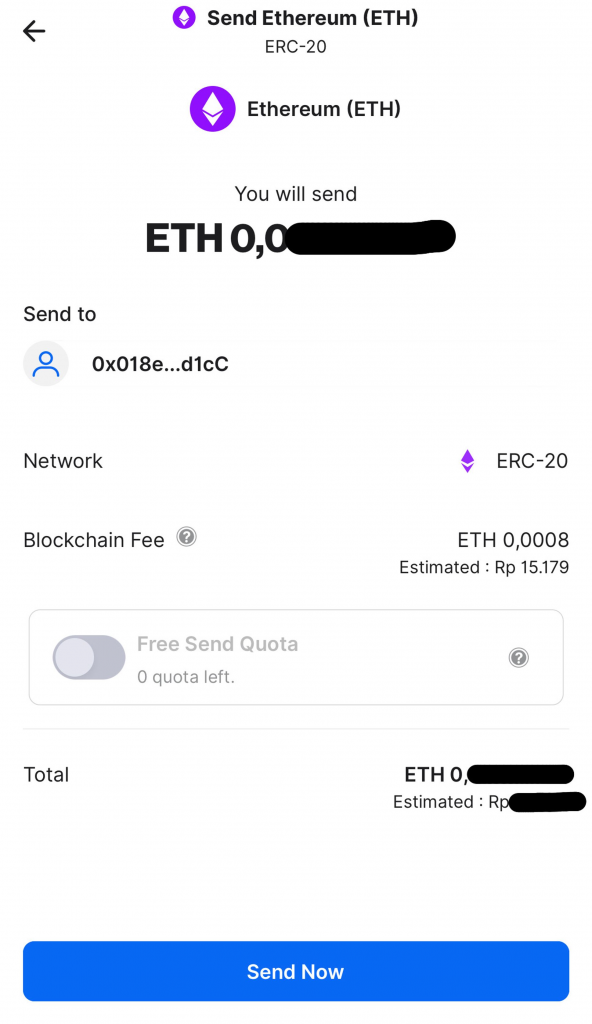

Step 3

- Enter the amount of ETH you want to send.

- Click Next.

- Click Send Now.

- Enter password.

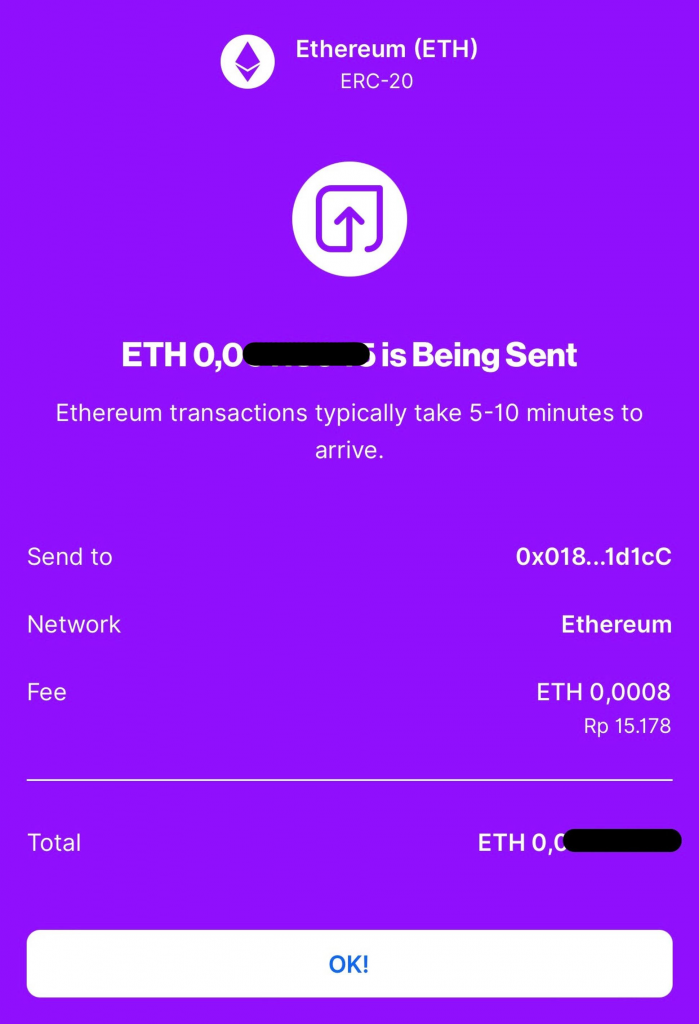

Step 4

- Success. You can wait a few minutes to receive ETH on your Metamask.

- Click OK.

Note: To send crypto ETH on the Ethereum network (ERC-20), you will be charged a blockchain transfer gas fee.

Choose DeFi Applications (Decentralized Applications or DApps)

DeFi users usually aim to maximize profits or interests by utilizing several DeFi applications. You only need to connect your wallet with the DApps you want to use to access all DeFi applications.

Here are some of the DeFi financial services and DApps that are currently available. You can use them to earn rewards as passive income.

exchange-dex">1. Decentralized exchange (DEX)

On DEX, there are several financial services such as cryptocurrrency swapping, yield farming, staking, etc.

If you want to earn rewards in Farming, you can be a liquidity provider (lp). You can deposit two crypto assets into the liquidity pool to get liquidity pool tokens. And then, you can deposit them into the Farming pool to earn the native DEX tokens such as UNI, SUSHI, CRV, and others.

Another feature you can use on DEX to get passive income is staking. In the staking feature, you can lock several tokens to get rewards in the form of other tokens.

In this section, we will give you a tutorial how stake SUSHI token on Sushiswap. Sushiswap allows you to stake SUSHI tokens to get xSUSHI tokens. Here’s how to do staking on Sushiswap.

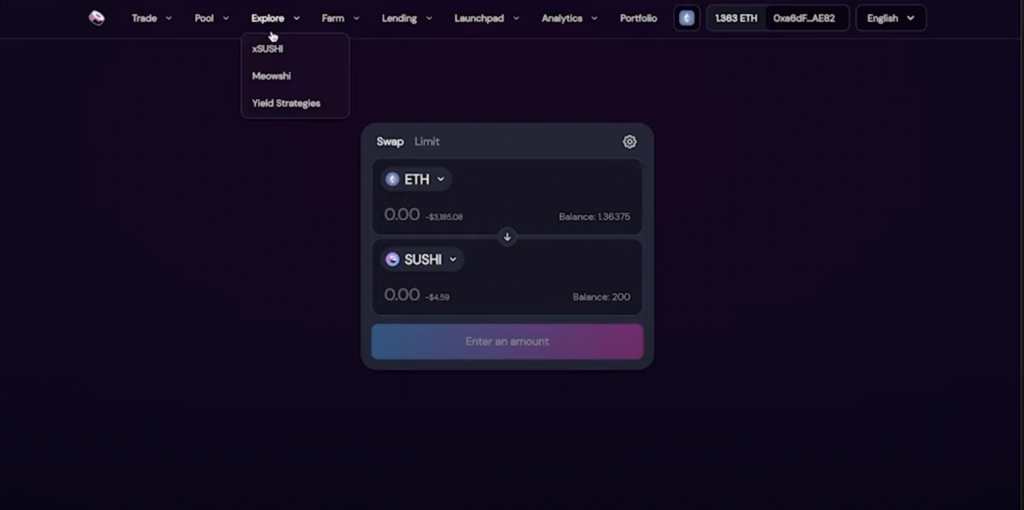

Step 1

- Visit Sushi.com, then connect wallet.

- Choose Explore, then xSUSHI.

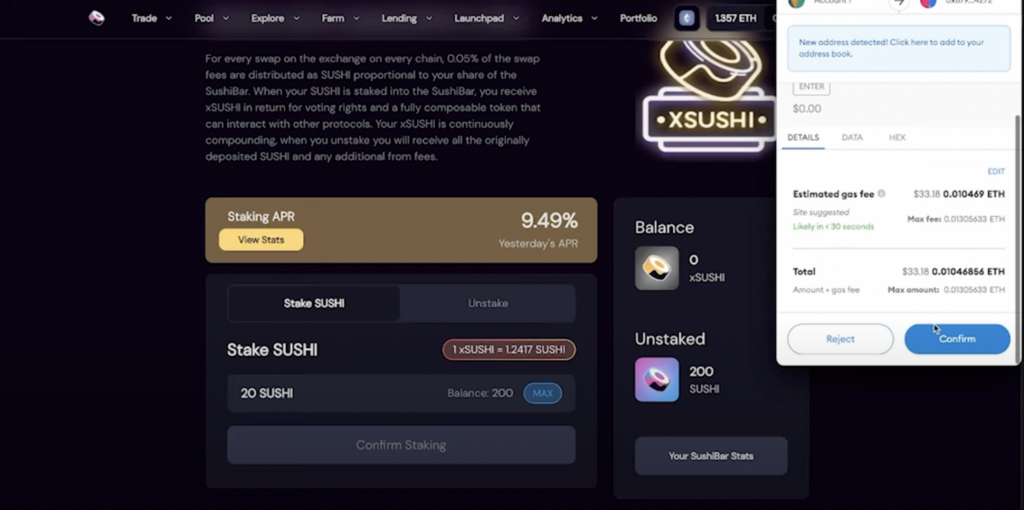

Step 2

- Enter the number of SUSHI tokens you want to stake to get xSUSHI tokens.

- In this tutorial, you enter 20 SUSHI.

- Click Confirm Staking.

- Metamask wallet will appear to confirm the transaction.

- Click Confirm.

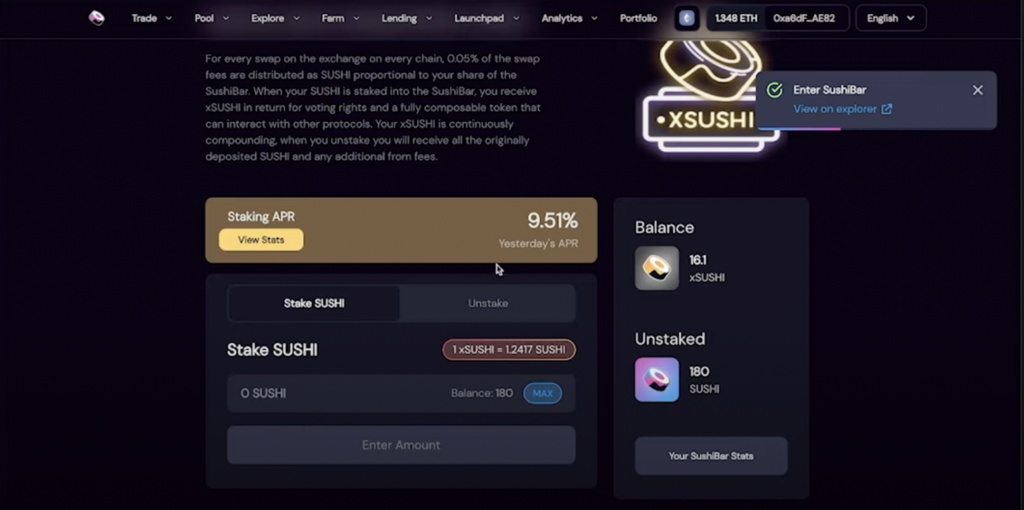

Step 3

- Staking successful!

- You can see the number of xSUSHI has increased to 16.1.

- The number of xSUSHI will increase daily, so you can get passive income through staking SUSHI.

2. Lending and Borrowing

Like deposit money and loan service in the bank, DeFi also has lending and borrowing financial services in crypto assets. Users can lock crypto assets in a liquidity pool and earn rewards as a lender.

Users can also borrow crypto assets to leverage trading (trading with borrowed capital). To borrow a crypto asset, users must deposit a crypto asset as collateral to secure the loan from the lender. Each crypto asset has a different LTV (Loan to Value) percentage.

LTV (Loan to Value) defines the maximum amount of assets that can be borrowed with specific collateral. For example, the LTV of the crypto asset ETH is 80%. At LTV=80%, for every 1 ETH worth of collateral, borrowers can borrow 0.8 ETH worth of the corresponding currency.

One of the DApps that provides lending and borrowing services on Ethereum is Aave. Here’s how to borrow crypto assets on Aave.

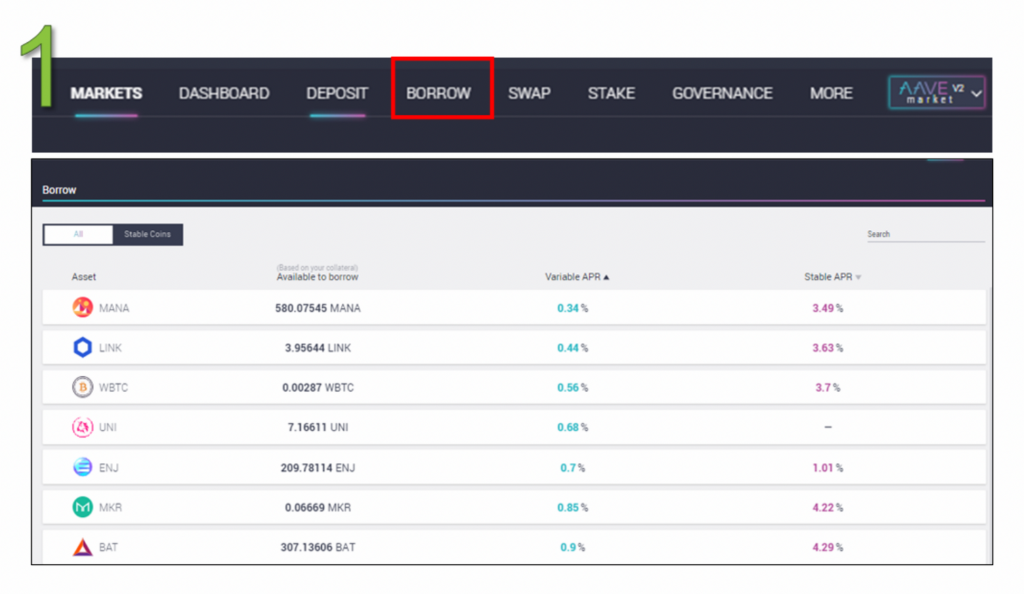

Step 1

- Visit Aave website, then connect the wallet.

- Deposit a crypto asset (e.g., 100 DAI) by clicking Deposit, then complete the crypto asset deposit processes.

- After depositing 100 DAI, click Borrow.

- With 100 DAI, you can see some of the crypto assets you can borrow and the amount of interest.

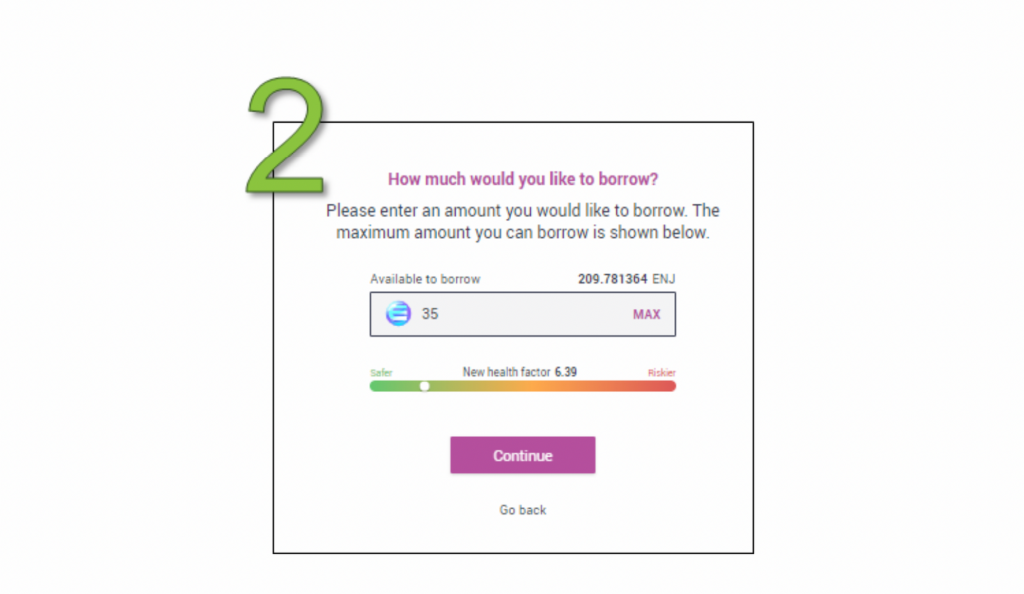

Step 2

- For example, you choose the crypto asset Enjin (ENJ). With 100 DAI, you can borrow 209 ENJ. But, you decide to borrow only 35 ENJ.

- Click Continue.

Step 3

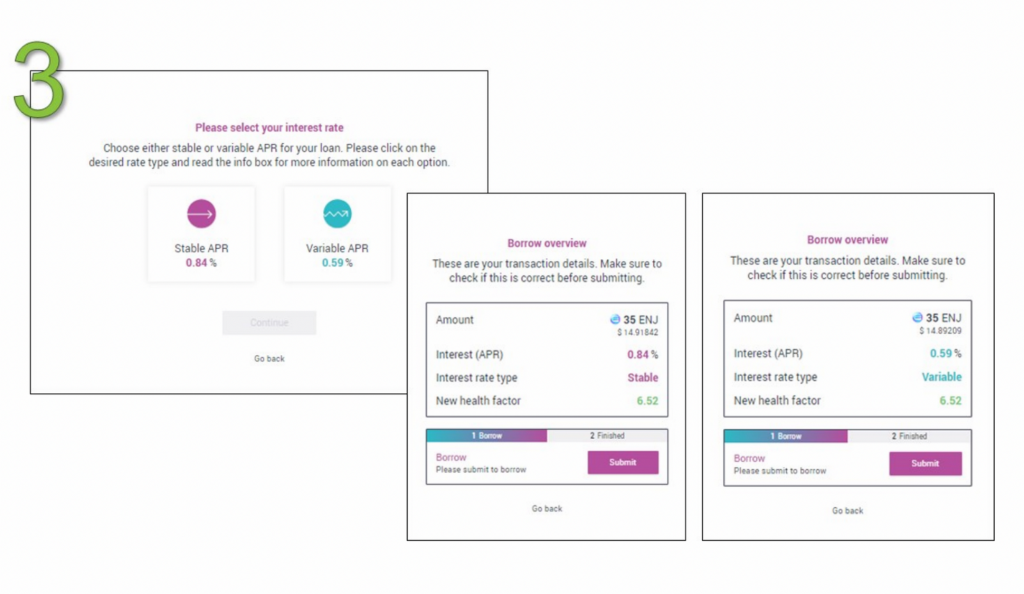

- Select the type of interest.

- There are two types of interest: stable APR and variable APR. At stable APR, you will be charged a fixed APR 0.84% per year on your loan. But, in the variable APR, the interest percentage can change up or down daily.

Read also APY dan APR in Crypto.

Step 4

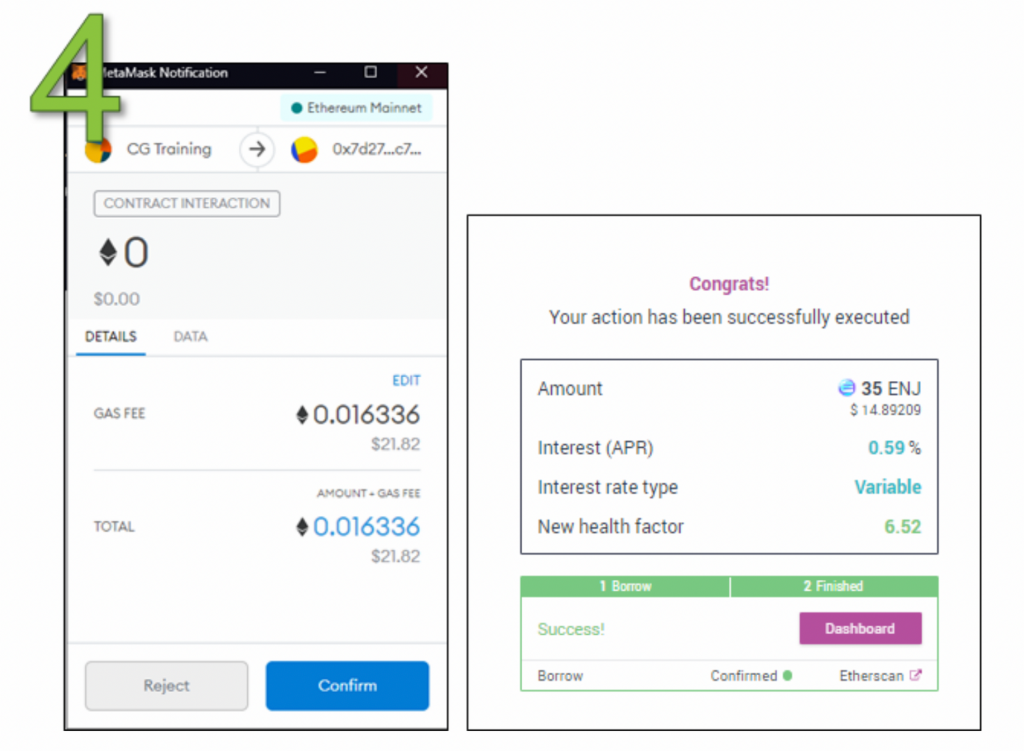

- Click Confirm.

- Success! You managed to borrow 35 ENJ.

After borrowing ENJ with DAI as collateral, you now have 35 ENJ in your Metamask wallet. You can trade ENJ tokens or deposit them in other DApps to generate interest. You can also use an aggregator application to see the highest percentage of interest on various DApps.

3. Aggregator

A DeFi aggregator is a platform that collects price comparisons from different DEXs. It helps users maximize profits, save users time, as well as mitigate high slippage.

To minimize the slippage, users may split their crypto assets into smaller parts and route them onto several DEXs. With DeFi agregator, users can automatically split their large crypto assets into smaller parts. Then, the DeFi agregator routes them to the relevant DEXs for the best exceution price. DeFi aggregators on Ethereum are 1Inch, Matcha, Zapper, etc.

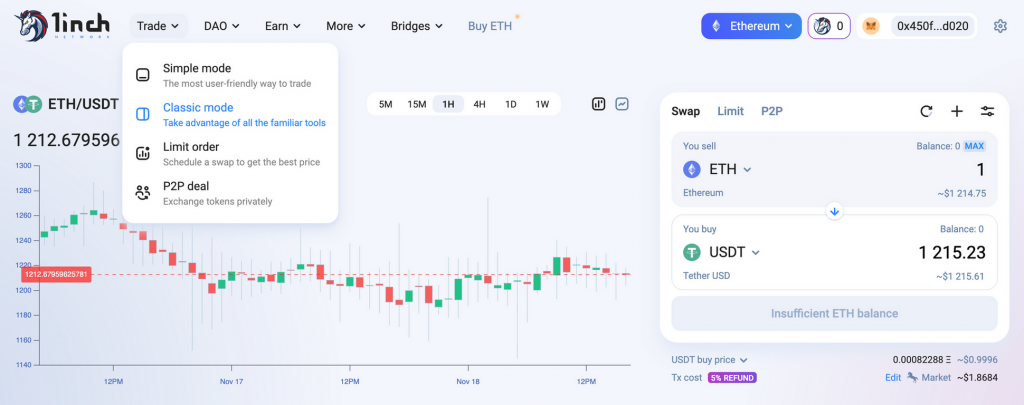

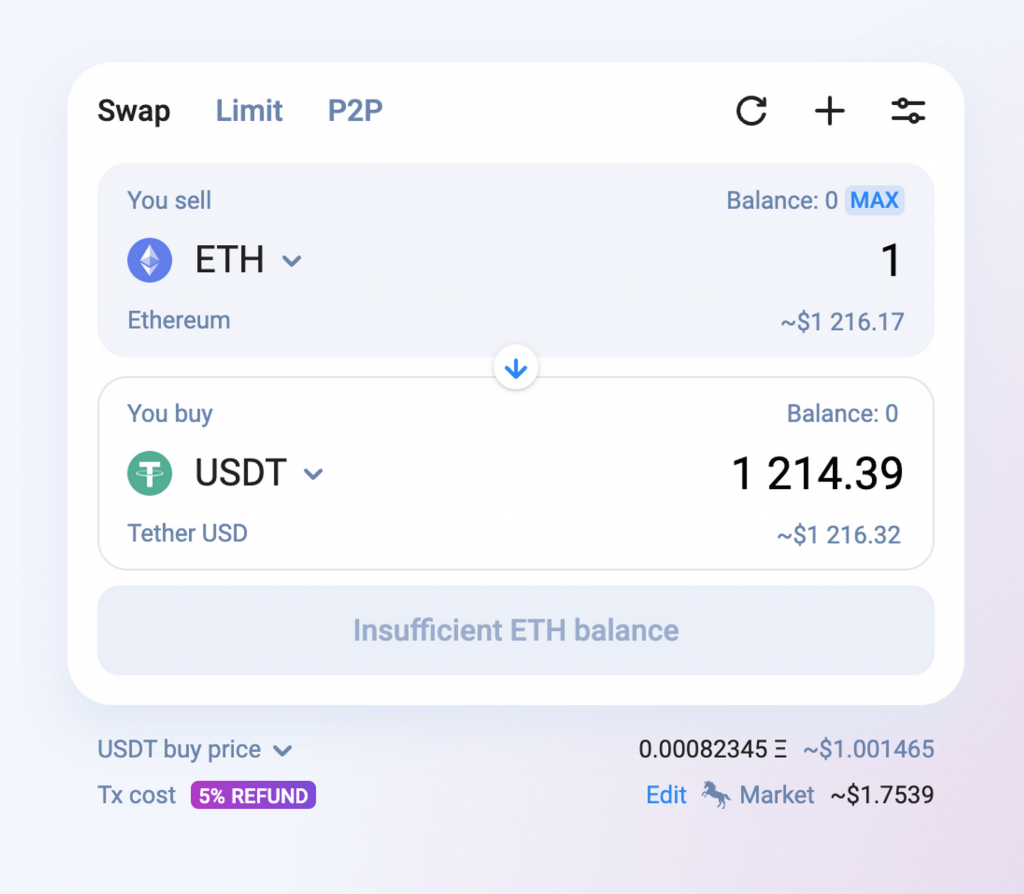

Here is an example of swapping crypto assets using a DeFi aggregator on 1Inch to get the best price.

Step 1

- Visit 1Inch website, then connect wallet.

- Select the Trade menu, then click Classic Mode.

- For this tutorial, you exchange ETH for USDT.

Step 2

- Several DEXs display the price of USDT that you will get by exchanging 1 ETH.

- 1Inch and Uniswap have the same price. You can choose to swap ETH on 1Inch or Uniswap.

- You can swap ETH on 1Inch directly.

Step 3

- Enter the amount of ETH you want to exchange.

- Then click Swap.

After a successful swap, you will have USDT in your wallet.

How to Identify a Good DeFi Project?

After knowing what services you can use in DeFi and how to use DeFi applications, you can determine which DApps that are right for you. Here are some steps you can take before choosing a DeFi app.

- Choose the blockchain. Some blockchains have robust DeFi ecosystems, such as Ethereum, Binance Coin, Solana, Avalanche and others. Each blockchain also implements different amount of fee to confirm transactions. So, before deciding to use services on DeFi, it’s important to choose a network.

- Check the TVL (Total Value Locked) or the number of funds available on the DApps to see asset liquidity. You can also check the number of assets owned by DApss through the wallet address in the block explorer.

- In the staking feature, you can choose the amount of APR that suits you. The higher the APR number, the more profit you will get. However, the risks are also higher.

- Active community is essential. You can check a DeFi project’s Telegram, Twitter, and Discord to assess the community sentiment towards the project.

- You can find out who the developers are and how a DApp project will sustain in the future through the available whitepapers and roadmaps.

Popular DeFi Applications

- Uniswap

Uniswap is one of the most popular decentralized exchanges (DEX) on the Ethereum network. This platform works using Automated Market Maker (AMM) to run its protocol.

On Uniswap, you can exchange crypto assets. Furthermore, you can also become a liquidity provider by locking crypto assets in liquidity pools.

Learn more about What is Uniswap?

- Compound

Compound is one of the most popular lending and borrowing DApps in Ethereum. On Compound, you can lend crypto assets by depositing crypto assets to earn rewards COMP tokens. You can also borrow ERC-20 tokens by depositing crypto assets as collateral.

To find out more about Compound, you can read the article What is Compound?

- Aave

Aave is an Ethereum-based decentralized money market application. This platform is the native token for the Aave protocol. Aave allows users to deposit and borrow crypto assets. Besides, users can also stake AAVE tokens to secure the network and earn rewards.

Read also What is Aave?

- Synthetix

Synthetix is a DEX that provides synthetic assets. It creates synthetic assets known as Synths in tokens that resemble the original assets. A primary goal of Synthetix is to give crypto investors exposure to reach an asset that is not on the blockchain, for example, gold and silver. In short, Synths are a combination of cryptocurrencies with derivative assets.

Assets on Synthetix are cryptocurrencies, commodities (gold, silver, petroleum), fiat currencies, Indexes (NIKKEI, CEX, FTSE), and stocks (TSLA). These synthetic assets (Synths) will become sTokens, such as sBTC, sXAU, sUSD, sJPY and so on.

On this platform users can buy, stake, and borrow synthetic assets.

The Future of DeFi

DeFi is touted as the future of the banking. DeFi thrives to overhaul traditional financial systems. But right now, DeFi is still considered as a high-risk financial service.

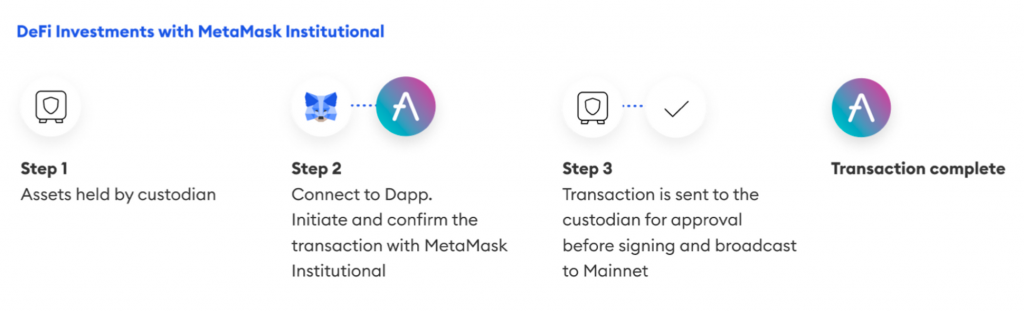

Nonetheless, several major institutions have direct exposure to crypto assets and already experimenting with DeFi. Goldman Sachs, Barclays, Banco Santander, and Itau Unibanco are among the organisations that have entered the DeFi ecosystem in the past two years. On November 2, 2022, JP Morgan made transactions using the DeFi application, Aave, on the public blockchain for the first time.

However, it is important to remember that DeFi projects are still in their early stages and are fraught with hazards such as smart contract errors, rug pull, and blockchain network difficulties.

In the future, DeFi will be developed more by various blockchains and cooperate with centralized financial institutions. Some US economists have also stated that regulation is critical to DeFi’s sustainability.

How to Buy DeFi Cryptocurrency at Pintu?

You can start investing in DeFi cryptocurrency such as AAVE, COMP, SUSHI, YFI, and others by buying them on Pintu. Here’s how to buy DeFi cryptocurrency on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for one of the DeFi cryptocurrency.

- Click buy and fill in the amount you want.

- Now you have one of the DeFi cryptocurrency !

In addition, Pintu is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Come and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Cointelegraph writer, How to get started in DeFi: A guide on the first steps in decentralized finance, Cointelegraph, accessed 14 November 2022

- Robert Stevens, DeFi: The Ultimate Beginner’s Guide to Decentralized Finance, accessed 14 November 2022

- Liz Mathew, Why DeFi is the Future of Finance, Consensys, accessed 15 November 2022

- Onomy Protocol, What Is Institutional DeFi — Overview, Potential, Challenges, and Solutions, Medium, accessed 15 November 2022

- Rahul Mantri, Which Earn Protocol Should I Choose, Coinstats, accessed 15 November 2022

Share

Table of contents

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-