Market Analysis Oct 2nd 2023: A Promising Start to October for Bitcoin

As October unfolds, Bitcoin finds itself in a historically favorable position. This month has traditionally favored BTC with an upward trajectory. Adding to the optimism is the news of the Securities and Exchange Commission (SEC) considering approval for a Bitcoin spot ETF, a development that could significantly boost BTC sentiment this October. Read the full analysis below.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 🪜 The S&P Manufacturing PMI has climbed to 48.9, though the Services and Composite PMIs have declined. These shifts reflect stagnation and concerns within the U.S. economy due to mounting interest rates and persistent inflation.

- 🏡 U.S. new home sales have dropped by 8.7%, with 30-year mortgage rates jumping above 7%, influencing buyer decisions and marking the highest level since July 2001.

- 📦 U.S. durable goods orders have slightly increased by 0.2%, with the machinery category as the main contributor, indicating growth amidst interest rate discrepancies with the Fed.

- ❇️The month of October holds promising prospects for BTC, with the potential approval of a Bitcoin spot ETF by the SEC. Currently, BTC hovers around the 20-month moving average (MA) line.

Macroeconomic Analysis

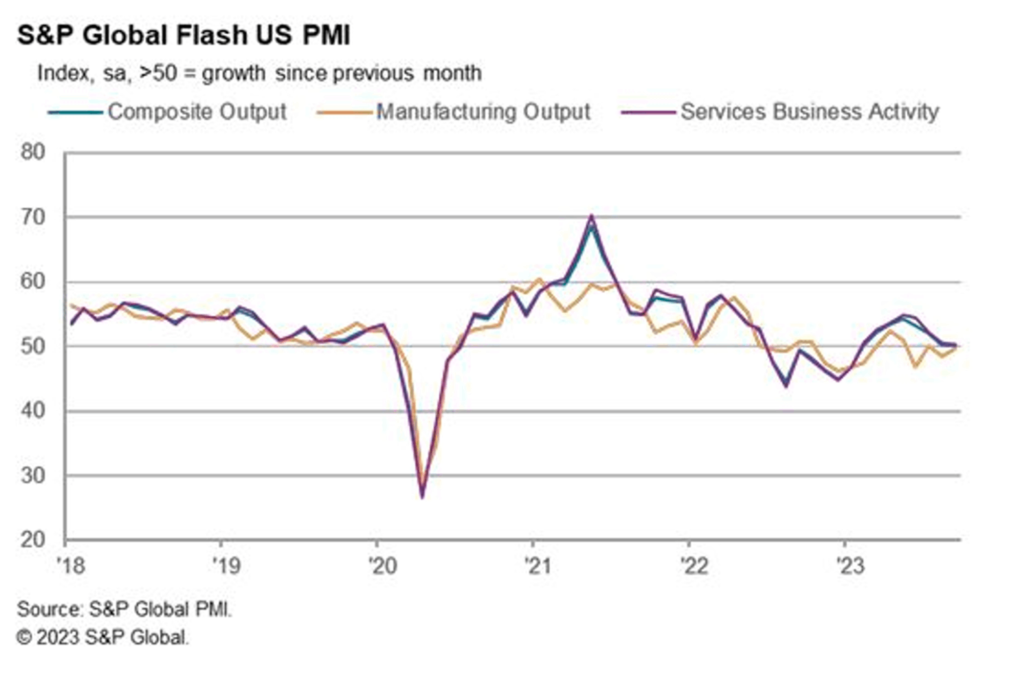

The beginning of September this year, there were several updates on the Purchasing Managers’ Index (PMI) Manufacturing and Standard & Poor’s (S&P) Global data, including the following

- In August, the S&P Global Manufacturing PMI rose to 48.9 from 47.9.

- The services PMI fell from 50.5 in August to 50.2 in the same period.

- The composite PMI fell to 50.1 from 50.2 in August.

There are concerns about the direction of demand conditions in the U.S. economy caused by rising interest rates and persistently high inflation. Meanwhile, the overall production index remains above 50.0, indicating stagnation in overall activity for two consecutive months. It is important to note that the service sector is losing momentum, with new orders declining at an increasingly rapid pace.

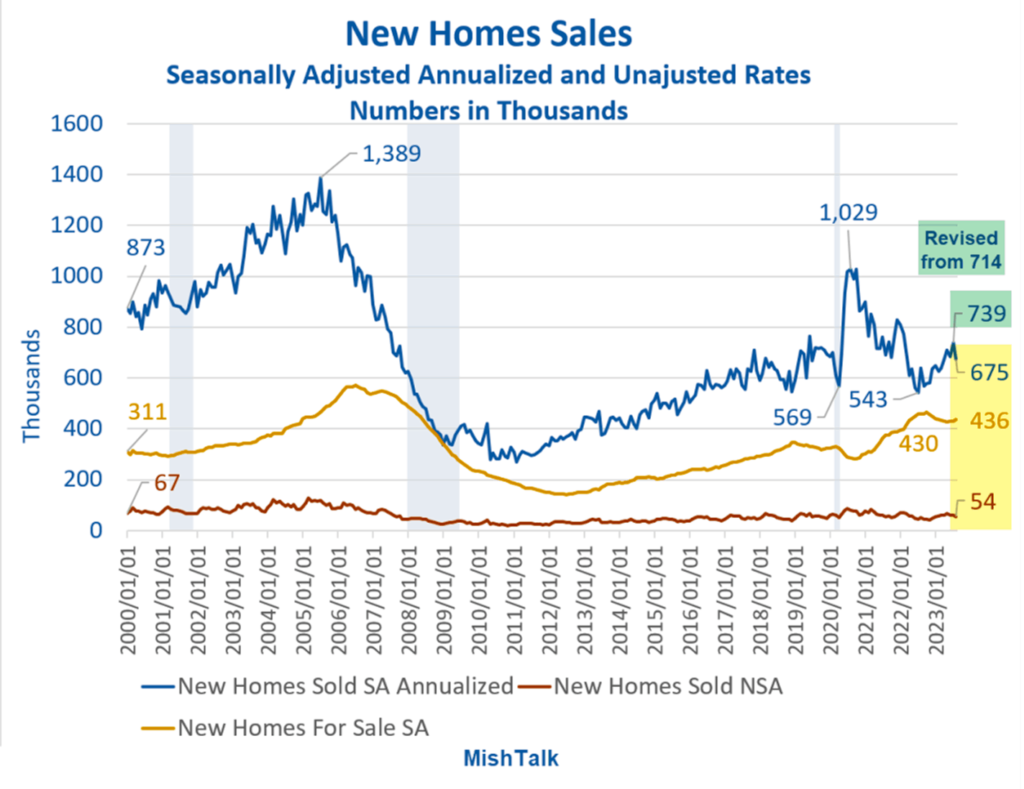

Another activity that is experiencing a decline is new home sales. According to a report from the U.S. Department of Commerce on Tuesday, new home sales have experienced a significant decline of 8.7%, resulting in a seasonally adjusted annual rate of 675,000 units for last month. Notably, July’s sales figure was revised up to 739,000 units from the previously reported figure of 714,000 units.

Moreover, new single-family home sales in the U.S. also declined in August, influenced by the 30-year fixed mortgage rate rising above 7%. This decline has made prospective buyers reluctant to enter the market.

According to Freddie Mac, the interest rate on the widely used 30-year fixed mortgage rose above 7% last week to an average of 7.19%, the highest level since July 2001. The increase in mortgage rates coincides with a rise in U.S. Treasury yields, driven by concerns that a sharp rise in oil prices could pose a challenge to the Fed’s efforts to combat inflation.

Last week, the Fed decided to keep its benchmark interest rate in a range of 5.25% to 5.50%. However, the central bank adopted a more hawkish stance, signaling expectations for a rate hike at the end of 2023 and a commitment to maintain much tighter monetary policy through 2024.

Durable Goods

Amid the differences related to interest rates between the Fed and the central bank, on the side of durable goods orders in the US, there have been some updates according to a report from the US Census Bureau as follows:

- Durable goods orders rose slightly by 0.2%, equivalent to $0.5 billion, reaching a total of $284.7 billion in August. This number marks an increase compared to the previous month which experienced a decrease of 5.6% (revised from 5.2%). This figure also surpassed market expectations, which predicted a decline of 0.5%.

- Excluding transportation, new orders increased by 0.4%.

- Excluding defense, new orders fell by 0.7%.

The main contributor to the increase in new orders was the machinery category, which increased by $0.2 billion or 0.5%, reaching a total of $37.8 billion, and achieving growth in four of the last five months.

Initial Unemployment Claims

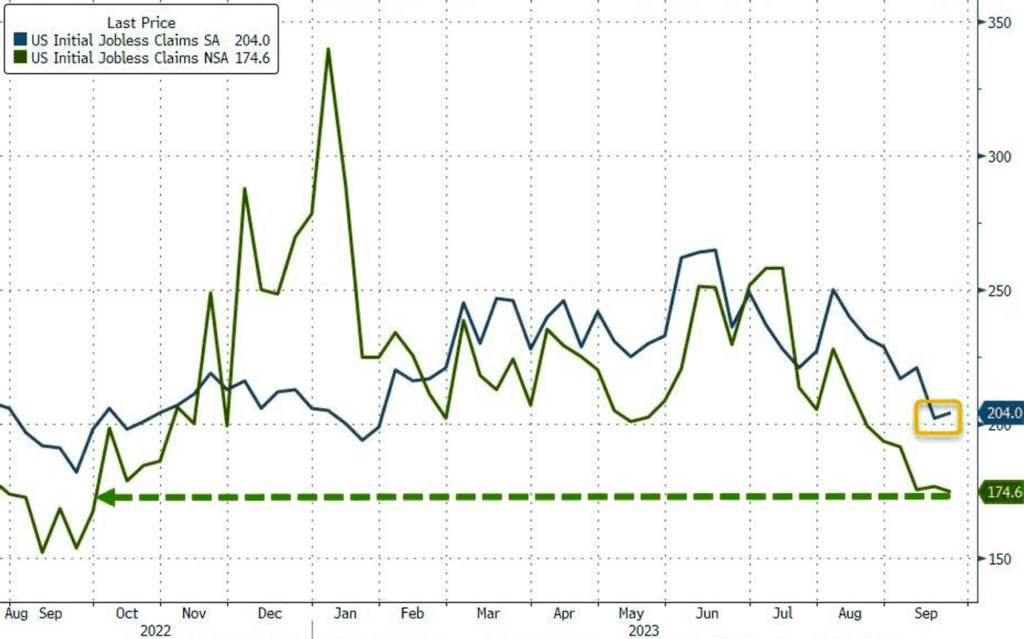

In contrast to durable goods orders, which showed some increases, initial jobless claims for the 3rd week of September were 204,000, the second lowest level since the end of January. This number follows the previous week’s reading of 202,000 and is below the market’s expectation of 215,000.

The U.S. Department of Labor also reported that the 4-week moving average was 211,000, a decrease of 6,250 from the previous week’s revised average.

In addition, Continuing Claims for the week ending September 16 fell by 12,000 to a total of 1.67 million, below the market’s expectation of 1.675 million.

The above data continue to confirm that the labor market is operating at historically low levels of slack, suggesting increased resilience to the Fed’s rigorous tightening measures and leaving room for a possible rate hike in November.

BTC Price Analysis

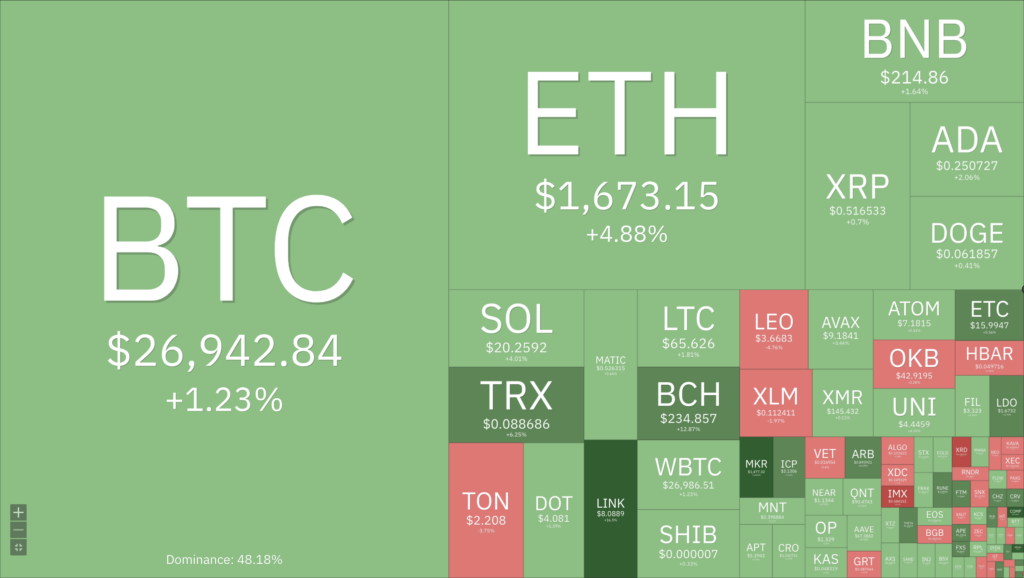

Over the course of the week, BTC experienced a significant rise of 2.52%, resulting in the formation of a substantial green candle. The rise in BTC is attributed to U.S. lawmakers urging the SEC to approve the Bitcoin Spot ETF, arguing that there are no valid reasons for the continued denial. Due to bitcoin’s sudden and significant move overnight, the altcoin market also experienced a reversal, driven by the existing positive sentiment.

BTC is currently trading around its 20-month moving average (MA) line. If it manages to close above this resistance line at the end of the month, it can be seen as an indicator of a bullish outlook for October.

In addition, there is a high probability that the SEC will approve the Bitcoin Spot ETF in October. As a result, there is a possibility of a sentiment-driven or speculative rally in bitcoin prices in the days leading up to the official decision.

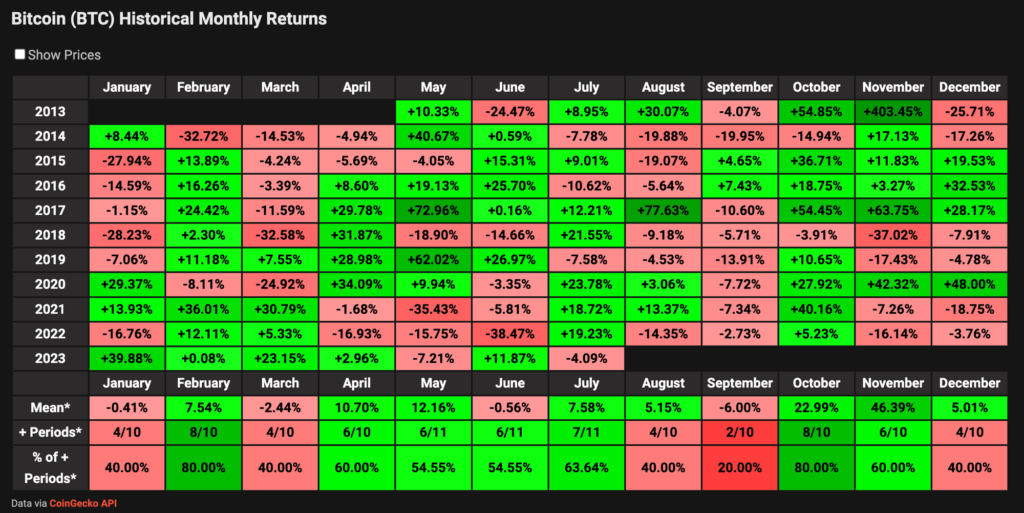

Historically, October has been one of the most profitable months for BTC price movements. Over the past 10 years, BTC has experienced positive performance in 8 Octobers.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7days was lower than the average. They have a motive to hold their coins. Investors are in an anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic It indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- The Arbitrum Foundation is collaborating with the protocol studio Fracton Ventures to launch Arbitrum Japan. This initiative aims to amplify Arbitrum’s presence in Japan by promoting ecosystem development and community education programs. Although the amount of funding and its allocation were not disclosed, this collaboration will focus on business development between web2 and web3 companies and on technical education through AMA sessions and hackathons to boost consumer adoption of Arbitrum in Japan, a jurisdiction that is crypto-friendly. Additionally, Arbitrum also plans to expand its presence in Korea and other regions in Southeast Asia.

News from the Crypto World in the Past Week

- Su Zhu, one of the co-founders of the hedge fund Three Arrows Capital, was arrested at Changi Airport in Singapore. The hedge fund went bankrupt in 2022, which had a significant impact on the crypto industry. Zhu and another founder, Kyle Davies, were banned by the Monetary Authority of Singapore from owning or operating a registered capital markets firm for nine years. They were also reprimanded by the crypto regulator in Dubai for operating an unregulated exchange, OPNX.

- Senior ETF Analyst at Bloomberg, Eric Balchunas, reported via his account that the Securities and Exchange Commission (SEC) is reportedly looking to expedite the launch of Ether Futures ETFs. The SEC has asked applicants to update the necessary documents by Friday evening (9/29). According to Eric’s tweet, this filing must be completed within 48 hours, especially for independent issuers, in order for the ETFs to be effective by Monday (2/10) and begin trading by Tuesday (3/10).

- Walmart, the world’s largest retailer, will sell the Pudgy Penguins toy collection, a collection of NFTs, in 2,000 of its stores across the United States. Each Pudgy toy will include access to Pudgy World – a multiplayer digital social platform where users can create “Forever Pudgy” characters, play mini-games and interact with other users. Pudgy World is built on zkSync Era, an Ethereum Layer 2 blockchain network.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Compound +20.52%

- Maker +16.08%

- Chainlink (LINK) +14.95%

- Bitcoin Cash (BCH) +13.21%

Cryptocurrencies With the Worst Performance

- Immutable (IMX) -5.33%

- Render (RNDR) -4.03%

- Synthetix -3.72%

- Hedera -2.55%

References

- Jack Schickler, Bankrupt Crypto Hedge Fund 3AC’s Su Zhu Apprehended in Singapore, Liquidator Says, accessed on 30 September 2023.

- James Hunt, Arbitrum Foundation partnership seeks to boost Arbitrum’s presence in Japan, Theblockco, accessed on 30 September 2023.

- Eric Balchunas, UPDATE: Hearing the SEC wants to accelerate the launch of Ether futures ETFs, X, accessed on 30 September 2023.

- Yogita Khatri, Walmart to sell Pudgy Penguins toyline in 2,000 stores, Theblockco, accessed on 30 September 2023.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-