Market Insights Feb 14-20: BTC Price Movement, First Bank in Metaverse, & US Crypto Oversight Policy

Bitcoin (BTC) Price Movement

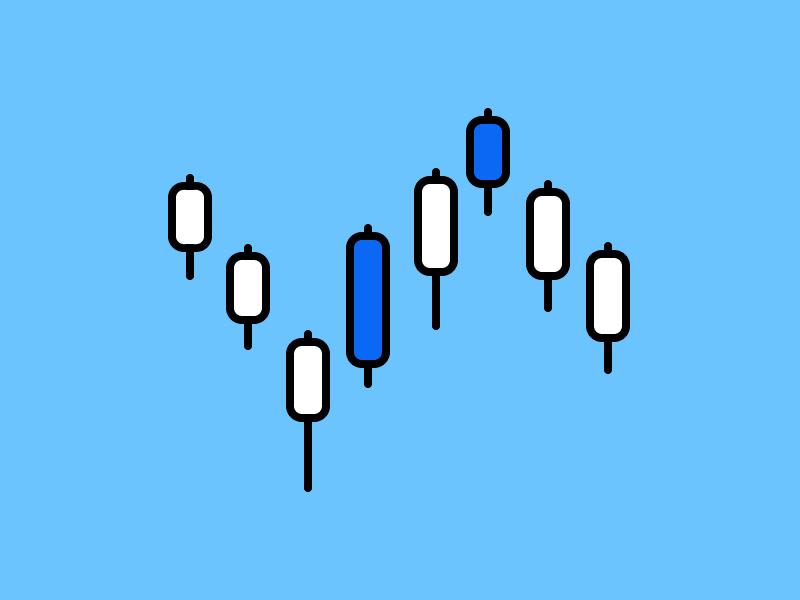

Over the past week, BTC price action has been in a sideways mode in the range of $39-45k dollars. This week is the 6th week where BTC is below the 55 week EMA. Bitcoin is still trying to break through above the 55 week EMA. During last year’s rally (May 2021), BTC price was in the range of the 21 and 55 EMAs for 11 weeks before finally breaking through the 21 weeks EMA and continuing its bull run.

Currently, Bitcoin has gone 4 weeks between the 21 and 55 weeks EMAs before breaking below 55 weeks and now is moving between the 55 and 100 weeks EMAs for the 6th week.

From a structural point of view, we can see if BTC can hold the $40K dollar price point. If BTC breaks down, we could see a retest to the $30-33K price. In addition, the price of BTC will have to past $47K before we can confirm that the market stabilizes again. There is a confluence of several bullish indicators at this price point.

Also read: How to choose the right trading strategy?

Therefore, according to technical analysis, we do not face the same situation compared to the middle of last year. The market looks more bearish, spot transaction volume is weak, and the sentiment is bearish from a macroeconomic point of view.

💡 Bearish = Negative sentiment towards the market and conditions in which the market is in a downward trend.

Bullish = Positive sentiment towards the market and conditions in which the market is in an uptrend.

According to the meeting notes of the January 25-26 FOMC meeting, the Fed agreed that current economic and financial conditions would justify an accelerated runoff rather faster than the easing period from 2017 to 2019. However, this news did not significantly affect prices as investors were already aware of it and there was no explicit mention of the timeline for the runoff. Therefore, after the minutes of the meeting came out, BTC rose to the level of $44.5K.

Rising geopolitical tensions between Russia and Ukraine subsequently reversed those gains and it impacted both equity and crypto markets. Then, investors took a further risk-off (sell of assets) when the Biden administration announced it would issue a crypto oversight executive order next week. Currently, the market situation is very volatile because most investors do not have confidence in seeing the highly uncertain macro-economic and geopolitical conditions.

Also read: How to start trading in crypto?

What’s behind Bitcoin price movement?

- 🗒️ FOMC meeting notes: The FOMC meeting minutes were released on February 16 and explained various things, especially about accelerating interest rate hikes to fight inflation. Most investors have known this for a long time so crypto prices are not affected by this. On the contrary, the crypto market even experienced a (rather short) rally that launched the BTC price to $44.5K.

- 🔫 Tension and uncertainties of the Russian-Ukrainian conflict: The Russia-Ukraine conflict has heated up again with news of an alleged shootout between Ukrainian troops and pro-Moscow rebels in eastern Ukraine. Although this event has yet to be confirmed, many investors are frightened and sell risky assets such as Bitcoin and choose to risk-off.

- ⚠ Crypto surveillance executive order: The Joe Biden administration will announce an executive order regarding Crypto next week. This encourages further selling of BTC as most investors will wait for the executive order before making a decision.

block-heading joli-heading" id="what-else-should-we-pay-attention-to-from-last-weeks-market-movements">What else should we pay attention to from last week’s market movements?

- 💻 One of the most important statistics for Bitcoin is Bitcoin’s Hashrate which reached an all-time high. This means that the number of Bitcoin miners has again reached high numbers after the crypto mining ban by China. This number indicates that the Bitcoin network is becoming increasingly more secure.

- 📉 One of the on-chain data that deserve your attention this week is Bitcoin’s funding Rates which reached negative numbers. Funding rates are derivative trading numbers from futures trading on CEX such as Binance. This negative number indicates most Bitcoin derivative assets are dominated by short traders that show the overall bearish sentiment of the market.

News from the crypto industry

- 💸 Warren Buffett invests $1 billion dollars in crypto-friendly Fintech: Warren Buffett, one of the most iconic investors, recently invested $1 billion dollars in NuBank, a crypto-friendly fintech in Brazil. In their report, Buffett’s company, Berkshire Hathaway, also sold some of its Visa and Mastercard shares. Although Buffett says he doesn’t believe in the value of Bitcoin, the purchase is part of his company’s efforts to enter the crypto world without direct exposure to assets like BTC.

- 🆘 Canada blocked a number of crypto wallets related to protests Freedom Convoy: The Canadian government and police agencies recently issued a policy to block and freeze a number of crypto wallets associated with the funding of the freedom convoy protest. Through FINTRAC, Canada freezes crypto wallets that intends to donate to the protesters. This policy is criticized by many people as being undemocratic and an excessive financial censorship.

- 🏦 JPMorgan opens the first Bank in the Metaverse: JPMorgan, one of the largest Banks in the US, has just opened a lounge in the metaverse game Decentraland. JPMorgan also released a paper on how businesses can take advantage of the opportunities that exist in the metaverse.

- ☠️ OpenSea experienced another phishing: OpenSea, one of the most popular NFT marketplaces in the crypto world, recently experienced phishing targeting large numbers of users and stealing their NFTs. This exploitation occurred in the middle of OpenSea’s announcement that it would renew its smart contract. Hackers do phishing by sending emails containing instructions for users to migrate their NFT. This email is made as if it is an official message from the OpenSea team and the link gives hackers access to steal the user’s NFT.

References:

- Ian Allison, JPMorgan Is the First Bank Into the Metaverse, Looks at Business Opportunities, Coin Desk, accessed on 20 February 2022.

- Arijit Sarkar, OpenSea planned upgrade stalls as phishing attack targets NFT migration, Coin Telegraph, accessed on 20 February 2022.

- Aoyon Ashraf dan Danny Nelson, Canada Sanctions 34 Crypto Wallets Tied to Trucker ‘Freedom Convoy’, Coin Desk, accessed on 20 February 2022.

- Yashu Gola, Warren Buffett invests $1B in Bitcoin-friendly Nubank, dumps Visa and Mastercard stocks, Coin Telegraph, accessed on 21 February 2022.

- Turner Wright, Biden expected to issue an executive order on crypto and CBDCs next week: Report, Coin Telegraph, accessed on 21 February 2022.

- Omkar Godbole, Bitcoin Wilts as Russia-Ukraine Tensions Push Gold to 8-Month High, Coin Desk, accessed on 21 February 2022.

- Helene Braun, Minutes Show Fed Ready to Take Action, Mentions Crypto and Stablecoin Risks, Coin Desk, accessed on 21 February 2022.

Share