Market Signals May 21th, 2024: ETH Price Soars Amid Speculation of ETF Spot Approval

After moving sideways in the last three weeks, the crypto market began to show renewed excitement in the past week. The recent news of the SEC’s potential approval of Ethereum ETF Spot is fueling the rise in various crypto prices.

BTC, which had been hovering between $60,000 and $63,000, surged past US$71,000. In response to the positive news, ETH surpassed the $3,600 mark. Additionally, other altcoins have experienced double-digit gains.

With this increase, the total crypto market caps increased by about $150 billion to $2.36 trillion at the time of writing. The next resistance is at the 0.5 Fibonacci retracement line, which is 2.38 trillion.

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions!

Ethereum (ETH) ➡️ Bullish 🚀

Ethereum faced bearish pressure earlier this week. Many analysts anticipated the SEC would reject the upcoming Ethereum Spot ETF filings from VanEck and 21Shares on May 23rd and 24th, respectively. This pessimism stemmed from factors like the lack of communication between VanEck and the SEC. Additionally, VanEck CEO Jan van Eck was also pessimistic that the SEC would approve their Ethereum Spot ETF filing.

However, a dramatic shift occurred overnight on Tuesday, May 21st. Prominent analysts Eric Balchunas and James Seyffrat increased their Ethereum ETF approval predictions, jumping from 25% to 75%. This change was reportedly fueled by rumors suggesting the SEC might be reevaluating its stance on approving Ethereum Spot ETFs.

https://x.com/EricBalchunas/status/1792636523050906102

This positive news served as a significant catalyst for ETH. In the past 24 hours, the world’s second-largest cryptocurrency by market cap surged by 18.72%, reaching a price of IDR 58,305,720.

Fantom (FTM) ➡️ Bullish 🚀

Fantom is one of the tokens that could be in a bullish trend this week. The main factor that could boost its price is the Sonic upgrade that is set to launch soon. Although there is no specific date for the update, the Fantom team has indicated that it will be implemented in Spring 2024, which ends on May 31.

Based on this information, it is anticipated that the Sonic update will take place in late May or early June 2024 at the latest. Additionally, Fantom has recently released a proposal to migrate FRM tokens to S tokens in a 1:1 ratio. Reaffirming the assumption that the Sonic upgrade is imminent.

Sonic is a new L1 blockchain network that will use native S tokens for its ecosystem. The Sonic network will also be connected with a Layer-2 Ethereum bridge. This update will also increase the performance of Fantom Opera from 200 TPS to 2,000 TPS.

Not surprisingly, as the upgrade approaches, FTM is gaining momentum and generating positive hype. Over the past week, FTM has experienced a 28.59% increase, reaching IDR 14,151 at the time of writing.

Chainlink (LINK) ➡️ Bullish 🚀

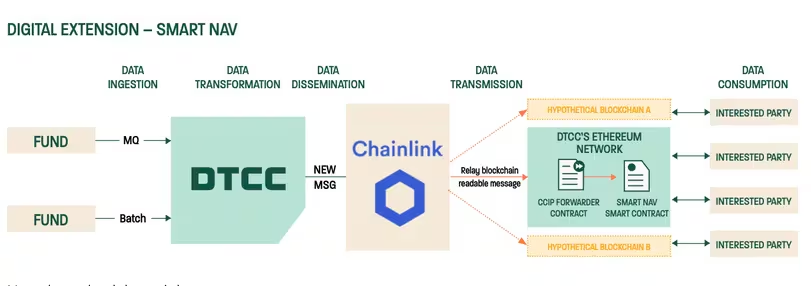

The next token that was on a bullish trend this week is Chainlink (LINK). The positive catalyst came from the publication of the Depository Trust & Clearing Corporation’s (DTCC) test results regarding the Smart NAV trial. The trial aims to explore its Mutual Fund Profile Service to leverage distributed ledger technology for data dissemination and consumption.

The Smart NAV aimed to utilize DTCC’s digital asset capabilities and Chainlink’s cross-chain interoperability and blockchain abstraction technology. DTCC was satisfied with the test and stated that on-chain price and rate data can serve as a key enabler for exploring new initiatives.

The announcement gives another example of implementing blockchain in the existing financial industry. Inevitably, the positive announcement lifted LINK’s price. Given the size of the DTCC institution, this catalyst has the potential to have a positive impact on LINK prices this week.

At the time this article was written, the price of LINK was at the level of IDR 267,425 or had risen 23.17% in a week.

Ondo Finance (ONDO) ➡️ Bullish 🚀

Ondo Finance is expected to experience a bullish trend this week due to its success in achieving growth metrics. The total value locked (TVL) for ONDO has recently reached $420 million, making it the largest US bond tokenization protocol. This marks a 40% increase from the previous month, when the TVL was $303 million.

The TVL represents the overall value of assets locked in a DeFi protocol. A growing TVL is a positive indicator of increasing interest and participation in the protocol.

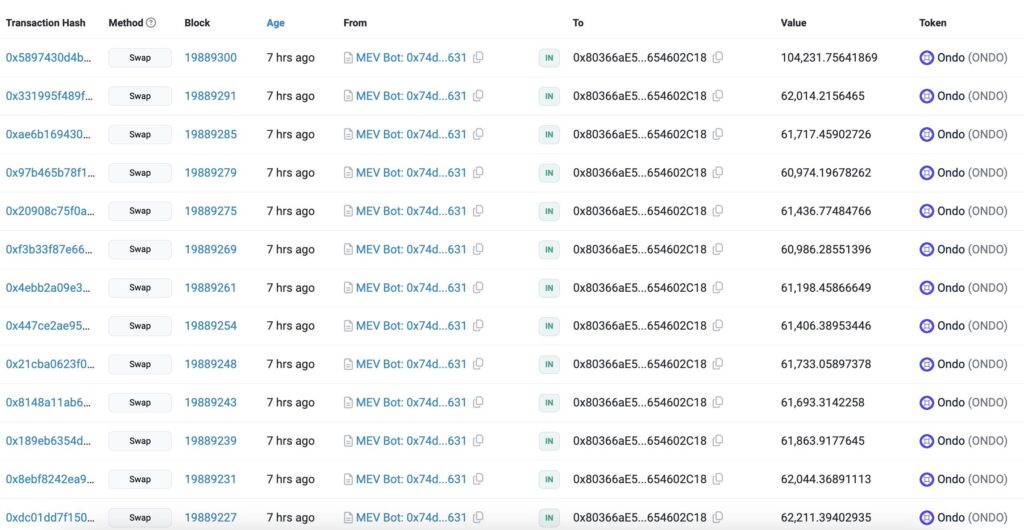

In addition to the rising TVL, on-chain data recently showed that a whale bought $5.7 million worth of ONDO at an average price of IDR 15,621.

The combination of the two momentum could be the fuel that lifts ONDO prices this week. As for the ONDO price, it is currently at the level of IDR 14,923, up 19.94% in the last seven days.

Pyth Network (PYTH) ➡️ Bearish 📉

Pyth Network (PYTH) is under bearish pressure this week due to the scheduled token unlock on May 20, 2024. Pyth Network plans to release 2.13 billion PYTH, or approximately 141.67% of the total outstanding supply.

The unlock tokens are allocated to early private sale investors and the PYTH development team. Using the current PYTH price of $0.44, the unlock value is equivalent to $937 million.

An unlock token with such a large amount of value could potentially be a negative catalyst as the supply of AEVO grows. Moreover, if there is no demand to absorb the token. However, some PYTH owners have already staked their tokens, which will help reduce selling pressure during the token unlock.

Crypto Performance Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- Apeiron (APRS): 🔼43,03% (Rp 9.117)

- Unifi Protocol DAO : 🔼41,62% (Rp 81.323)

- Reserve Rights : 🔼40,48% (Rp 136)

Cryptocurrencies With the Worst Performance

- Entangle (NGL): 🔽27,83% (Rp 7.836)

- Aevo (AEVO): 🔽27,21% (Rp 13.084)

- GT Protocol : 🔽26,72% (Rp 23.722)

Last Week’s Crypto News

Here are some important cryptocurrency news from last week:

References

- Aleks Gilbert, Fantom DeFi jumps 20% as Sonic upgrade rolls out, DL News, diakses pada 20 Mei 2024

- Liam Wright, Chainlink surges 30% as DTCC explores blockchain for mutual fund data delivery, Crypto Slate, diakses pada 20 Mei 2024

- Caden Pok, Bloomberg Analyst Raises Spot Ethereum ETF Approval Odds to 75%: Will Approvals Happen This Week? Yahoo FInance, diakses pada 20 Mei 2024.

Share

Related Article

See Assets in This Article

FTM Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-