Solana Ecosystem Updates 2024: Jupiter, Drift, and Sanctum

Solana is on its way to living up to its name as the “Ethereum killer”. Since the collapse of FTX, Solana’s ecosystem underwent a total resurgence. Projects such as Jupiter and Jito take center stage in Solana’s current era. Additionally, new ones such as Sanctum and Grass bring their innovation to the ecosystem. This article will provide Solana ecosystem updates, specifically on Jupiter, Drift, and Sanctum.

Article Summary

- Solana’s Resurgence and Key Projects: After FTX’s collapse, Solana’s ecosystem revived, living up to the name of an “Ethereum killer.” Projects like Jupiter, Drift, and Sanctum now drive its growth, each introducing innovations and expanding Solana’s use cases.

- Solana Breakpoint Highlights: Solana Breakpoint showcased various things, including the Frankendancer upgrade, Blackrock’s BUIDL fund, and the Solana Seeker phone.

- Project-Specific Developments: Jupiter introduced Jupiter Mobile and new mobile-focused features, Drift announced a $25M Series B funding round, and Sanctum introduced its innovative Creator Coins.

- Solana vs. Ethereum Ecosystem: Solana is rapidly gaining on Ethereum in DEX volume and user engagement. However, there is a significant disparity in market cap valuations for Solana projects compared to their Ethereum counterparts, despite similar or superior performance metrics.

Breakpoint and Solana Ecosystem Updates

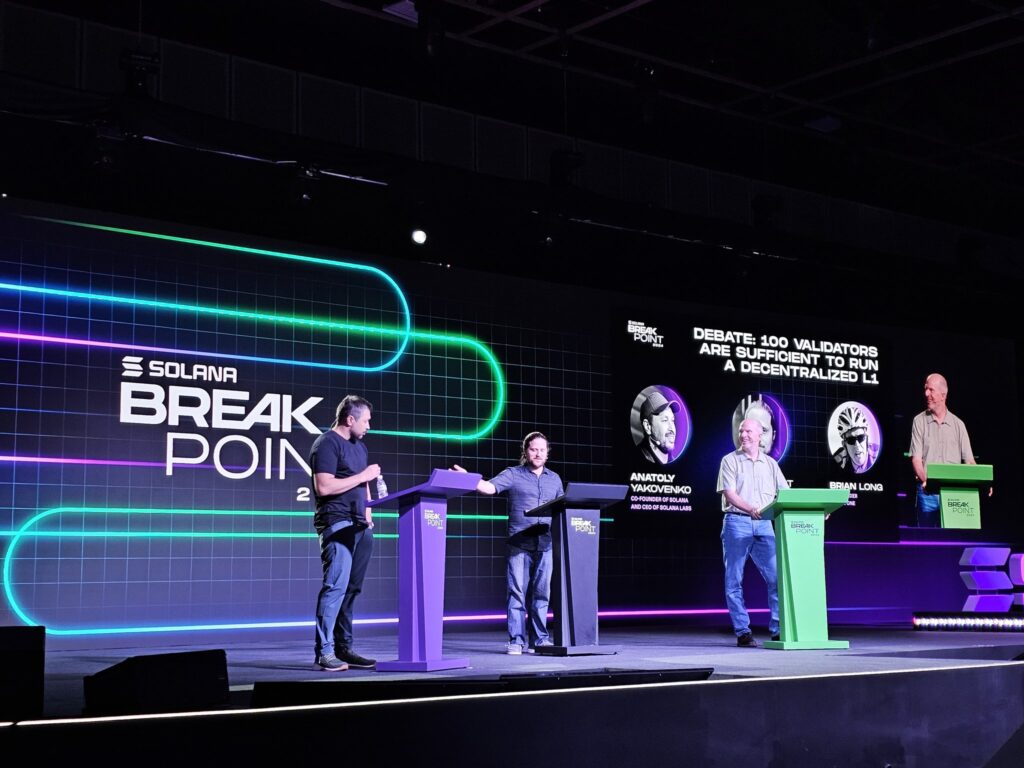

Solana Breakpoint is the largest Solana conference organized by the Solana Foundation. Breakpoint has always been the place for Solana and ecosystem projects to announce important upgrades or catalysts. For example, Solana Firedancer was first announced at last year’s Breakpoint.

This year’s Breakpoint highlight was the Frankendancer upgrade, Blackrock’s BUIDL fund coming to Solana, and Solana Seeker. Frankendancer is the early prototype for Firedancer, which is still in testnet. Blackrocks’ BUIDL news is one of the few institutions coming to Solana—Franklin Templeton and Citi are in the process of doing the same.

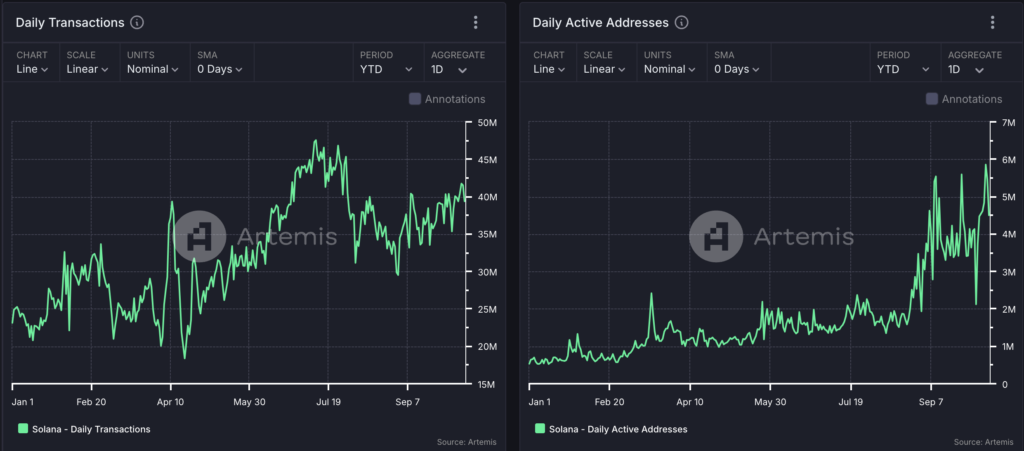

Breakpoint also comes at an important juncture for Solana. The chain has been in an ‘up only’ since late 2023. Various metrics such as TVL, DEX volume, daily transactions, and daily active addresses point to Solana as the go-to chain for most users. In fact, Solana’s TVL has been constantly making new yearly highs since the start of the year.

At the time of Breakpoint, Solana’s mindshare in crypto is at an all-time high. So, projects such as Jupiter, Drift, and Kamino used Breakpoint to announce their most exciting updates.

Analyzing Solana’s Top 3 Projects

1. Jupiter

Currently, Jupiter is the largest protocol in DEX aggregator categories across multiple blockchains. Jupiter now accounts for 55% of the market share, with a volume of $3,37 billion in the last 7 days. This is even more impressive when we consider that Jupiter only operates on one chain, Solana.

On Solana, Jupiter’s been the go-to platform for most traders, especially on memecoins. It is even more so now that the platform has DCA, limit orders, perps trading, launchpad, and ape (for memecoin trading).

On Solana Breakpoint, Jupiter makes several big announcements:

- The launch of Jupiter Mobile

- Jupiter RFQ

- Jupiter Perps V2

- Ape Pro

The main theme of Jupiter’s announcement is the new mobile-first focus of Jupiter. With the launch of Jupiter Mobile, Jupiter is overhauling its UI to cater more to mobile users. This is even more apparent with Ape Pro, the newest version of Jupiter’s specialized memecoin trading platform.

Additionally, it has a strong and dedicated community through its DAO. Jupiter’s launchpad has also been the place for many exciting projects to launch in Solana (notably Sanctum). Without meaningful competition, Jupiter already holds the title—and is poised to maintain its place—as the premier trading platform in Solana.

2. Drift

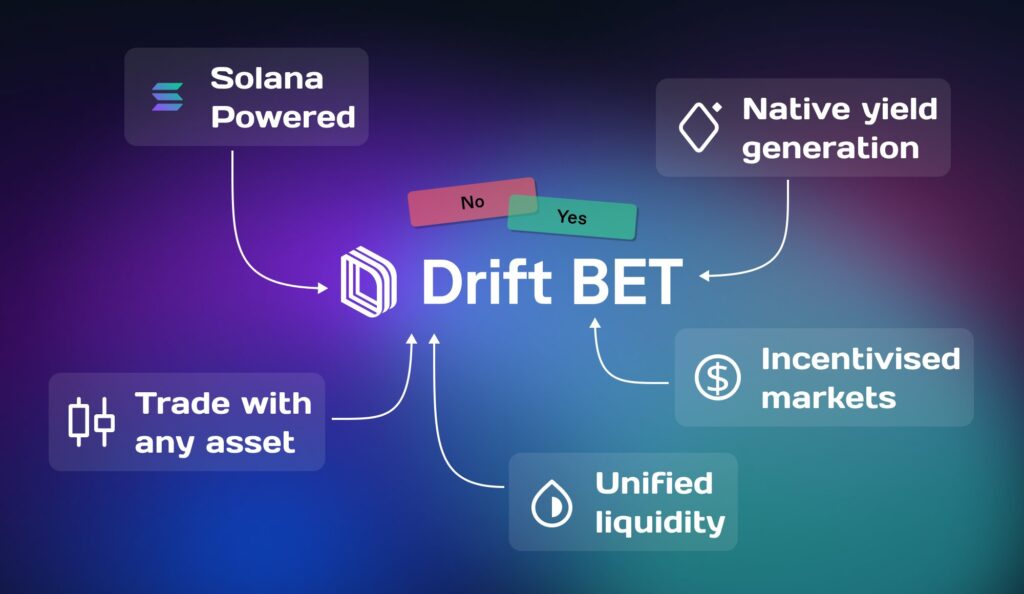

Drift is an all-in-one DeFi protocol on Solana specializing in perpetual trading. By weekly volume, Drift is the second largest perps trading on Solana after Jupiter and the 10th largest across all chains. Drift also offers swaps, spot trading, lending/borrowing, and liquid staking.

However, what eventually becomes the game-changer for Drift is the release of its prediction market, BET. On BET, users can bet on various real-life situations such as the winners of F1 or the US Presidential election. Users can also trade on BET using various assets, even memecoins like POPCAT and MOTHER. Even though the volumes on BET aren’t that high, it is still the first prediction market on Solana.

On Solana Breakpoint, Drift announced that it had raised a $25M Series B round. Drift is looking to introduce new liquidity mechanisms, new collateral, and new ways for users to earn. Furthermore, the team is planning to launch new experimental products such as BET and support teams looking to build on Drift.

Lastly, Drift’s TVL has been constantly increasing since early 2024. It is currently (24 October) sitting at a new all-time high of $485 million. Although Jupiter Perps has the highest volume, Drift offers more tokens and accepts various assets for collateral.

3. Sanctum

Sanctum is a unique liquid staking protocol on Solana that acts both as the infrastructure and application layer. It is the 2nd largest liquid staking protocol in Solana after Jito with $1.27 billion. On Sanctum, users and applications can apply to create their own liquid staking tokens (LSTs). Sanctum is the first platform to enable an easy and decentralized way of launching LST.

On Solana Breakpoint, Sanctum announced two important visions for their roadmap: Creator Coins and Cloud Card. Creator Coins represent the steps to proliferating LST use as an alternative for NFT mints. Using LST Creator Coins, users can participate in a community without fear of being rugged. Meanwhile, Cloud Cards add additional utilities for LSTs as it is fully integrated into SOL as a medium of exchange.

In addition, Sanctum’s approach to creating CEXes LSTs has proven to be successful. BybitSOL (bbSOL) reached $150 million TVL in just under two months. Binance stake SOL (bnSOL) seems to be following the trend, reaching more than $70 million.

In the end, what makes Sanctum and its token CLOUD attractive is its wide approach to adding utilities. Sanctum utilizes both centralized and decentralized approaches to growing its ecosystem. Additionally, its infrastructure layer means it has significant room for growth when compared to its competitor, Jito.

Read our article on what is Sanctum and how it works.

Solana Ecosystem Potential

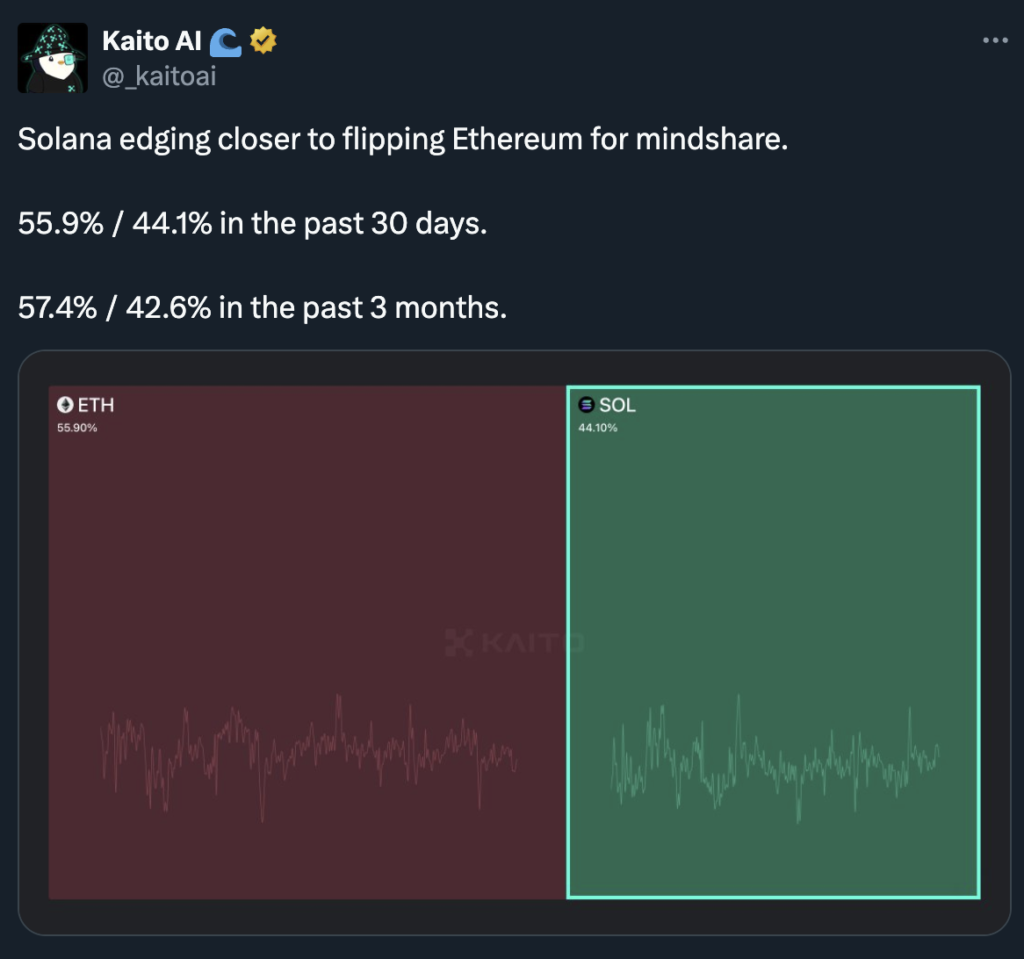

Solana is starting to overtake Ethereum in several metrics. Solana’s DEX volume now consistently beats Ethereum on a weekly and daily basis. As can be seen above from Kaito AI, SOL’s mindshare is also edging closer to Ethereum’s. Additionally, from a price standpoint, the SOL/ETH chart is making new all-time highs for the first time since 2022.

With so much attention going into Solana, its ecosystem has been flourishing since the start of 2024. This is why projects such as Sanctum can garner so much TVL and attention within a short period. People are switching to Solana in hopes of finding undervalued projects or trading various memecoins.

| Jupiter | UniSwap | Drift | dYdX | Sanctum | Lido | |

|---|---|---|---|---|---|---|

| TVL | $1.5B | $3.8B | $490M | X | $1.27B | $24B |

| Volume 7D | $6.6B | $10B | $927M | $2.2B | X | X |

| Market Cap | $1.34B | $5.9B | $162M | $485M | $67M | $963M |

| FDV | $9.96B | $7.8B | $572M | $485M | $375M | $1.08B |

If we compare some of the projects in the Solana and Ethereum ecosystem, we can spot some disparity between fundamental values and market value. However, the listed projects on Ethereum are more than 3 years old while most on Solana have only existed for one to three years.

Jupiter has more than half the volume and almost half the TVL of UniSwap but is only 1/5 the market cap. Drift does roughly half of dYdX’s volume but has 1/4 the market cap. Finally, Lido’s metrics blow Sanctum out of the water but Sanctum offers more than just a simple liquid staking so a 15x gap in market cap seems too big.

Conclusion

The Solana ecosystem has shown remarkable growth and innovation, with Breakpoint underscoring both community-driven advancements and increasing institutional interest. Projects like Jupiter, Drift, and Sanctum illustrate Solana’s versatility and appeal to various market segments. As Solana continues to attract new users, it positions itself as a serious competitor to Ethereum.

References

- Lila, “Solana Breakpoint Review: Highlights of Popular Trends in the Ecosystem,” Chaincatcher, accessed on 23 October 2024.

- Mensholong Lepcha, “Bullish on Solana: Top 5 Takeaways From Solana Breakpoint,” Technopedia, accessed on 24 October 2024.

- Tom Wan, “15 Key Takeaways from Solana Breakpoint that you can’t miss,” X, accessed on 24 October 2024.

- Jae Sik Choi, “BREAKING INTO SANCTUM (An Overview),” X, accessed on 24 October 2024.

Rate this article

Share