Memecoin Strategies: How to Choose and When to Buy

Memecoin is the most lucrative gold mine for crypto investors. Every crypto investor dreams of being a DOGE, PEPE, or WIF owner with 10,000% gains. The years 2023 and 2024 rekindled the fervor for memecoin. Many investors are diligently searching for the next WIF or PEPE. However, finding the right memecoin is not easy. Investing and trading memecoins requires a special strategy. We will discuss tips and strategies for buying memecoins.

Article Summary

- 🐸 Memecoin is a crypto asset based on iconic jokes used by the crypto community (such as PEPE). Memecoins have no monetary value and no usability.

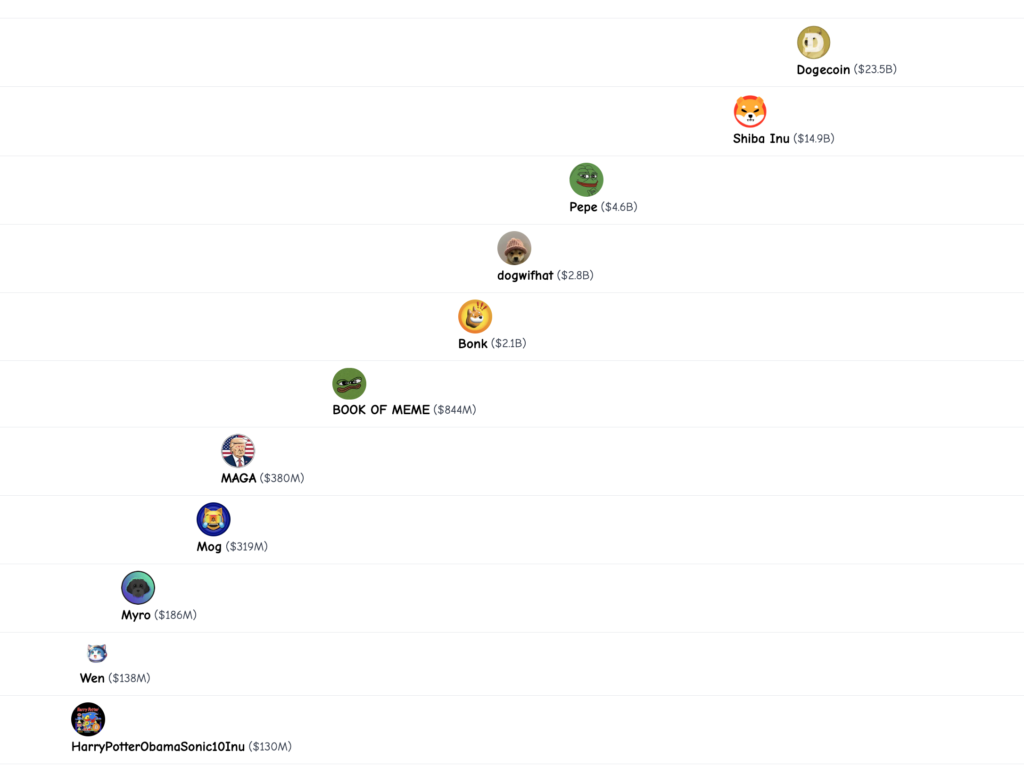

- 🐕 The value of a memecoin is seen in its strong community and the meme symbols that make it popular. DOGE, WIF, PEPE, and SHIB all have market capitalizations above $1 billion.

- 🧠 99% of memecoins will return to zero and only 1% will make it to the mainstream. Buy memecoins on CEX to avoid scams.

- ⚖️ The best memecoin trading strategy is to wait for a major correction to occur. Some crucial points are -40%, -60%, and -80-90% corrections. Buy memecoins with strong communities, cute meme icons, and consistent volume.

Potential and Risks of Buying Memecoin

Memecoins are a term for crypto assets that are based on jokes, memes, or popular culture icons. Memecoins have no monetary value and no usability. Meme tokens are usually tokenizations of iconic jokes commonly used by the crypto community (such as PEPE).

Investing and trading memecoins is not easy. 99% of memecoins will go to zero. Memecoins like WIF, BONK, PEPE, and DOGE are exceptions, part of the 1% that make it to the mainstream.

On the other hand, getting 10,000% of the right memecoins is also very difficult. You need to be mentally strong not to sell when the meme drops 60% multiple times. This is why people such as The DOGE millionaire or WIF whale are so respected.

Before reaching the $1 billion mark, WIF experienced declines of -80%, -60%, and -40%. Not everyone can survive 3 extreme corrections. Most investors and traders will definitely TP (take profit) and be satisfied with their profits. However, after the 40% correction, WIF rose 1,000% within 19 days.

In addition, the allocation of memecoin in your portfolio is very important because the correction is very extreme. Memecoins are the highest risk asset and traders will sell them first for safer assets like BTC, ETH, or SOL. However, when the market turns bullish, memecoin will be the fastest to move compared to other altcoins.

Reasons to Buy and Not to Buy Memecoin

Buy because:

- Highest profit potential.

- You like the community.

- Simple and cute.

- You can withstand a big correction (50-80%).

Don’t buy because:

- High risk.

- Extreme volatility.

- Rug pulls and scams.

How to Choose Memecoin for Investment

Investing into memecoins is very different from choosing the usual altcoin. Selecting memecoins require specific criteria as they have no fundamental value. Also, make sure that the allocation of memecoins in your investment portfolio is not too high.

Investing in memecoins means choosing the blue chips to reduce risk. You can also apply the DCA or buy the dip strategy to buy memecoins. Here are 2 indicators to judge the potential of memecoins.

Investing in memecoins mean you are willing to hold on through large corrections. For example, PEPE went through -85% and almost 6 months of not moving. However, it rose 1400% from February to May 2024.

1. Popularity and Community

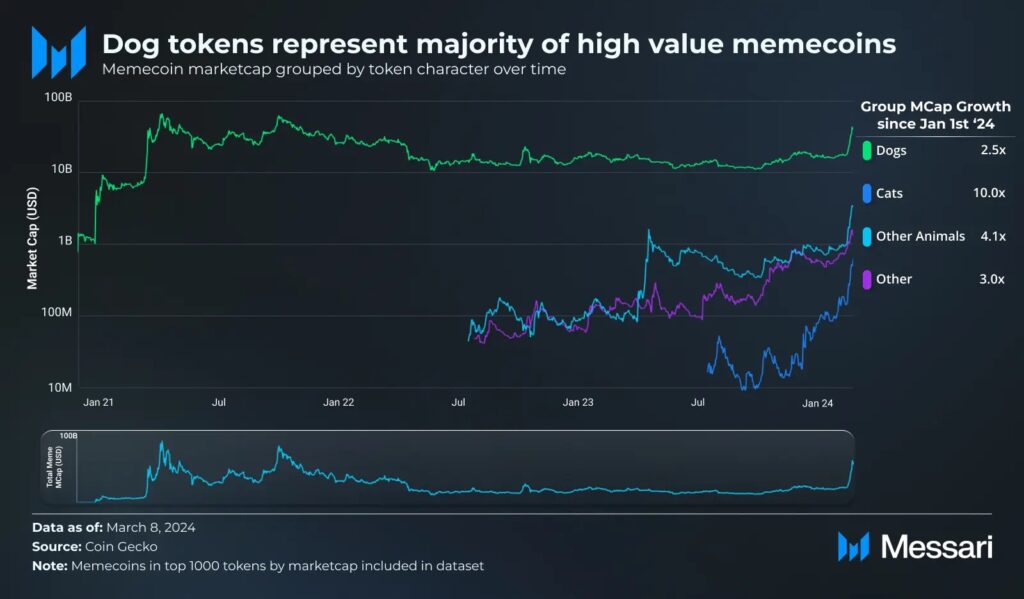

The difference between a memecoin with a market capitalization of $1 billion and $50 million is the popularity of the meme. One of the reasons DOGE, PEPE, and SHIB can reach high numbers is because many people recognize them. The more popular a meme is, the higher the probability of it reaching a high market capitalization.

In addition, new memecoin communities like POPCAT and WIF have catchy phrases like “The hat stays on!” and “The cat pops!” when promoting their memes. With catchy phrases, these communities are all about WIF and POPCAT in many ways. Even the official account of investment firm Franklin Templeton tweeted “Ben Wif Hat.”

The easiest thing you can do to gauge community activity is to search for asset symbols like $WIF and $PEPE on Twitter (X). X is the most popular platform for the crypto community or CT (Crypto Twitter).

2. Market Cap Comparison

As with investing in altcoins within a sector, we should compare market capitalizations to gauge potential returns. At its peak, DOGE almost reached a market capitalization of $100 billion and is still the largest memecoin today. DOGE and SHIB are also proof that memecoins can make it through bear markets.

You can compare memes by looking at various aspects such as popularity, volume, and community activity. For example, PEPE is a meme popular in the crypto community, has consistent volume, and is considered the premier memecoins on Ethereum. When ETH goes up, PEPE will follow. You can use SHIBA’s market capitalization as a benchmark for PEPE targets.

Memecoin Trading Strategy

Trading memecoins is more difficult than large-cap altcoins. Also, as mentioned, the possibility of rug pulls and fraud is higher. In addition to the risk of smart contract honeypots, memecoin developers can also pull liquidity and do pump and dump.

Therefore, you should utilize sites like Dexscreener, Bubblemaps, and Birdeye. Memecoining on Solana is generally safer because there won’t be any tokens with honeypot risk. You can also more easily find out the owner of the largest token and other suspicious things.

1. Buying Memecoin Corrections

This strategy is a variation of buying the dip combined with the Fibonacci Retracement indicator. Fibonacci is a suitable indicator for determining support and resistance when there is a potential trend reversal from up or down.

Learn about Fibonacci in this Pintu Academy article: How to Use Fibonacci when Trading Crypto.

The strategy of using Fibonacci in memecoin is also quite different as it is subject to extreme price fluctuations. The Twitter account @CoinGurruu gives 3 important levels during correction to buy the dip which are 40%, 60%, and 80-90%. Of course, you are better off doing this strategy for memecoins with strong communities such as WIF, PEPE, and SHIB.

Here are 3 levels to bu the dip in memecoin:

- 40% correction: A -40% correction usually coincides with the Fibonacci 0.382 as the first support level. Also, assets with high volume and hype won’t correct more than 40%. As the correction gets smaller, the asset will reach a blow-off top and experience a deep correction.

- 60% correction: The most common pattern in coins. This coincides with the Fibonacci golden pocket support of 0.618-0.65. Reversals within this range have to be followed by high volume. Also, you should buy at the first -60% correction as it has less risk.

- 80-90% correction: The riskiest correction level that usually sits at the first ATH price. This correction is the last area of support and any coin that fails to defend it can be considered dead. If you buy at this level, ensure the volume remains consistent and does not decrease, the number of token holders continues to increase, and the distribution of ownership spreads further.

2. Trading Memecoin Based on Narratives

Trading memecoins following a trending narrative has very high risk and profit potential. You can be a first-wave buyer of a new trend and thus earn the biggest profits. On the other hand, you should be careful to avoid rug pulls and memecoin with teams that control supply.

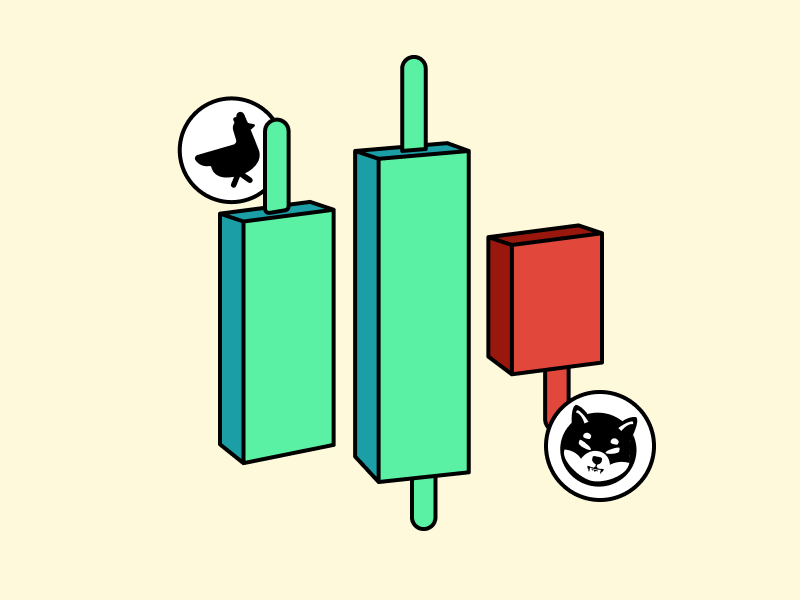

So, what are the narratives or trends in memecoins? At Solana some time ago there were narratives like cat memecoins, US president memecoins, and even country memecoins. Cat memecoins have survived until now with winners like POPCAT, MEW, and MICHI.

If you want to trade memecoins based on a popular narrative, you can consider the following strategies:

- Based on the First Popular Memecoin: Buying first movers has been proven several times to bring huge profits. POPCAT, MYRO, and WIF were some of the first memecoins to spark new trends in Solana. The key is to buy the first memecoins in a potentially lasting trend. If a trend is short-lived, take your profits immediately.

- Based on Volume: Sometimes the memecoin with the largest volume is the same as the first mover. However, like in the case of WIF, WIF took the largest volume on Solana despite not being the first dog coin.

Conclusion

Memecoins are a perpetually confusing asset category in the crypto world. Memecoins have no clear monetary use and value. The value of a memecoin comes from its loyal community and the value of the memes on which it is based. That said, many memes already exceed $1 billion.

Investing and trading memecoins is not easy. You need to deal with the scams and rug pulls that are rife in memecoins. Buying memecoins already listed on big CEX like Pintu also helps to avoid scams.

A buy-the-dip strategy is also useful to trade memecoins. Compared to FOMO buying when a memecoin goes up, buying during a correction has less risk and doesn’t make you someone else’s exit liquidity. With the right strategy, memecoins can bring you considerable profits.

How to Buy Memecoins on Pintu

You can start investing in memecoins by buying them on the Pintu app. Here is how to buy crypto on the Pintu app:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for PEPE, WIF, DOGE, etc.

- Click buy and fill in the amount you want.

- Now you have memecoins!

In addition to memecoins, you can purchase a variety of cryptocurrencies such as ETH, SOL, and others. Pintu diligently evaluates all its crypto assets, making sure investors aren’t exposed to scams and rug pulls.

Pintu is also compatible with popular wallets such as Metamask. Download Pintu app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. All Pintu Academy articles are for knowledge and educational purposes, not as financial advice.

References

- Dustin Teander, “Systematic Memecoin Investing”, Messari, accessed on 21 May 2024.

- Ally Zach, “Navigating Memecoin Mania”, Messari, accessed on 21 May 2024.

- Ally Zach, “Memecoin Escape Velocity”, Messari, accessed on 22 May 2024.

- @Web3Quant, “those looking for meme plays. lots of good data to mine from the replies. heres what i would typically look for”, X, accessed on 27 May 2024.

- @cryptohoem, “How to trade memecoins. A memecoin masterclass: 🧵👇”, X, accessed on 27 May 2024.

- @coingurruu, “The Ultimate Memecoin Trading Guide Put together a massive thread that covers all the tricks/tips I’ve learned to become profitable trading low caps”, X, accessed on 28 May 2024.

Share