The US Election and Its Effects on the Crypto Market

All market participants’ attention is currently directed towards the US presidential election. The four-year event is expected to significantly affect the economy and investment environment. Furthermore, the election’s outcome is anticipated to influence the crypto market’s fate. Are you curious how US presidential election dynamics can impact the economy and the crypto market? Explore the detailed analysis in the article below.

Article Summary

- Historically, BTC and altcoins have performed better after the US presidential election.

- In this election, each presidential candidate’s policies regarding the crypto industry now play a crucial role in shaping its future.

- If elected, Donald Trump, a candidate known for his favorable stance towards the crypto industry, is seen as potentially initiating a bull run in BTC and altcoin.

About 2024 US Election

The United States (US) presidential election for 2024-2028 is the main focus of market participants worldwide. In this election, former 45th US President Donald Trump, nominated by the Republican Party, will be challenging incumbent President Joe Biden, nominated by the Democratic Party.

The US election results are believed to have a major impact in the midst of uncertain global economic conditions. Moreover, each candidate has a different vision, mission, and approach to economic policy. In addition, market attention is also drawn to the presidential candidates’ policies toward the crypto industry.

There are at least three policies that impact global investor behavior. The first is geopolitical policies. Geopolitical issues are one factor that causes the global economy to be sluggish due to uncertainty. If the elected president can improve the situation, the global economy will undoubtedly begin to improve.

Second is the interest rate policy. The Fed has implemented high interest rates so far in an effort to lower inflation. Although inflation has slowed, the Fed has yet to lower its interest rates. High interest rates make companies hesitate to expand their business. On the other hand, the flow of investment funds has also stalled due to these conditions. A more accommodative interest rate policy is considered to be a stimulus for economic growth and money circulation.

Crypto Agenda in the 2024 US Elections

Third is the crypto regulation policy. So far, the US has been quite harsh towards the crypto industry. Apart from strict regulations, big crypto figures have also been arrested recently. It will be interesting to see what policies the president-elect will take towards the crypto industry.

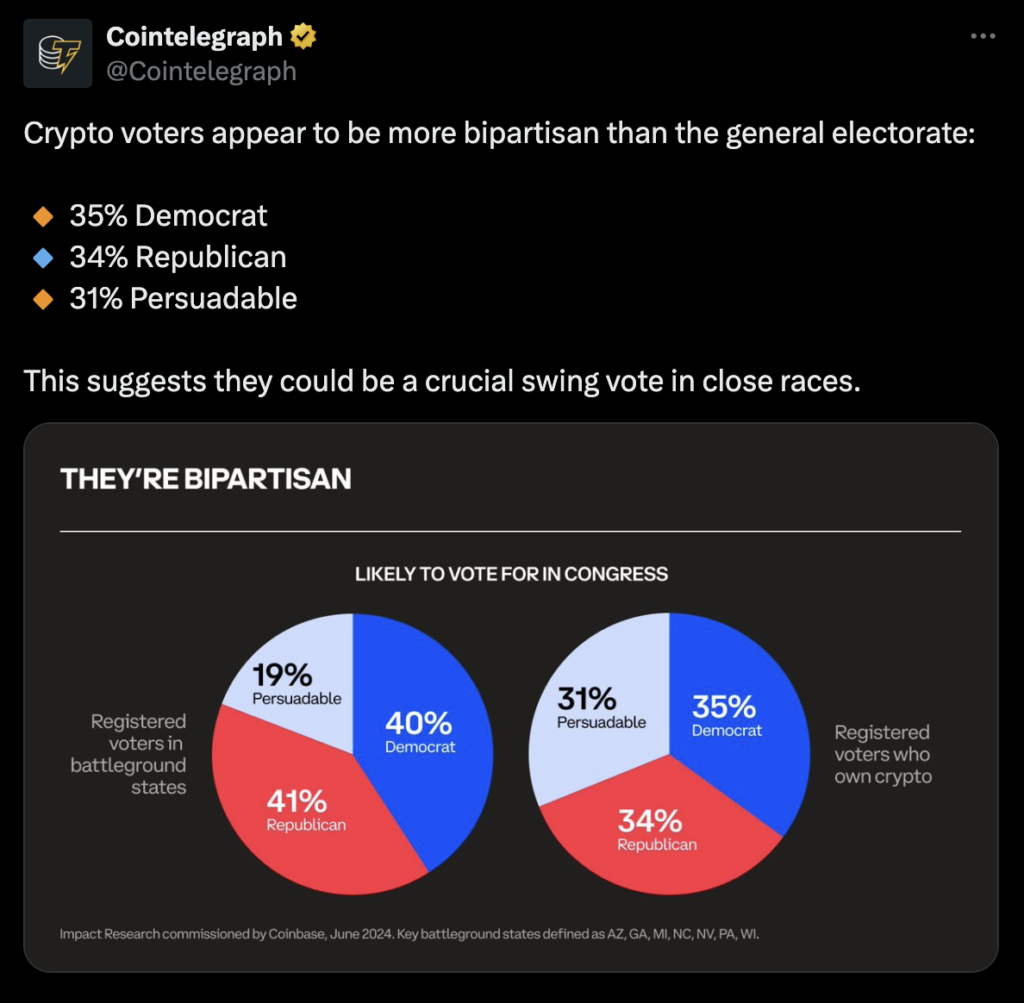

On the one hand, the crypto community has a considerable influence on the US election competition. One interesting finding came from Coinbase’s Impact Research. It is known that the voter composition of crypto owners is divided into three equal groups.

As many as 35% of correspondents stated that they would likely vote for the Democratic Party, and as many as 34% would vote for the Republican Party. The remaining 31%, known as the swing voters, have not made a choice.

Thus, each candidate can pursue a large crypto community. If the election goes close, the swing voters will be crucial. It is important for presidential candidates to be able to attract sympathy from these swing voters in order to become the number one person in the US.

US Presidential Candidates’ Policy Stance

Based on their campaigns, here are the positions and policy directions of the candidates running for the US presidency:

GOP’s Political Stance

- 💥 Geopolitics. Trump has shown his disapproval of some of the current geopolitical conditions. During his campaign, Trump promised to reduce geopolitical tensions. He demanded a ceasefire between Russia and Ukraine and Israel and Palestine.

- 💐 Interest Rates. As a businessman, Trump is at odds with the Fed’s policy direction. When he took office, Trump criticized the Fed’s policies on several occasions.

- 🪙 Crypto. Trump is very clear about his position on supporting the crypto industry. Starting from criticizing Biden for having repressive policies against crypto, promises to ensure regulations supporting the crypto sector, and his involvement in crypto events (BTC 2024 Conference).

Following his shooting, Trump appointed J.D Vance as his vice presidential candidate. Vance has publicly admitted to owning BTC and opposing SEC Chairman Gary Gensler's approach.

Democratic Party’s Political Stance

- 💥 Geopolitics. Biden strongly condemned Russia’s actions and offered substantial aid to Ukraine, as evidenced by increased funding and weapons support. The geopolitical conflict will likely continue if Biden is re-elected as US president.

- 💐 Interest Rates: Biden never intervened with the Fed’s policy during his presidency.

Please note that the US President (executive) does not have the authority to intervene in the Fed's (independent) monetary policy.

- 🪙 Crypto: At the beginning of his presidency, Biden showed an anti-crypto attitude. He had presidential policies, prosecuting big names in the crypto industry, and raised crypto taxes to 20% and 30% for miners. However, by the end of his term, Biden began to soften with the approval of spot BTC ETFs and ETH ETFs.

Disclaimer: Democratic Party policy positions are based on Joe Biden's policies and campaigns. Along with Biden's resignation, there may be changes in the policy positions Kamala Harris took.

The US Election and Its Effects on the Crypto Market

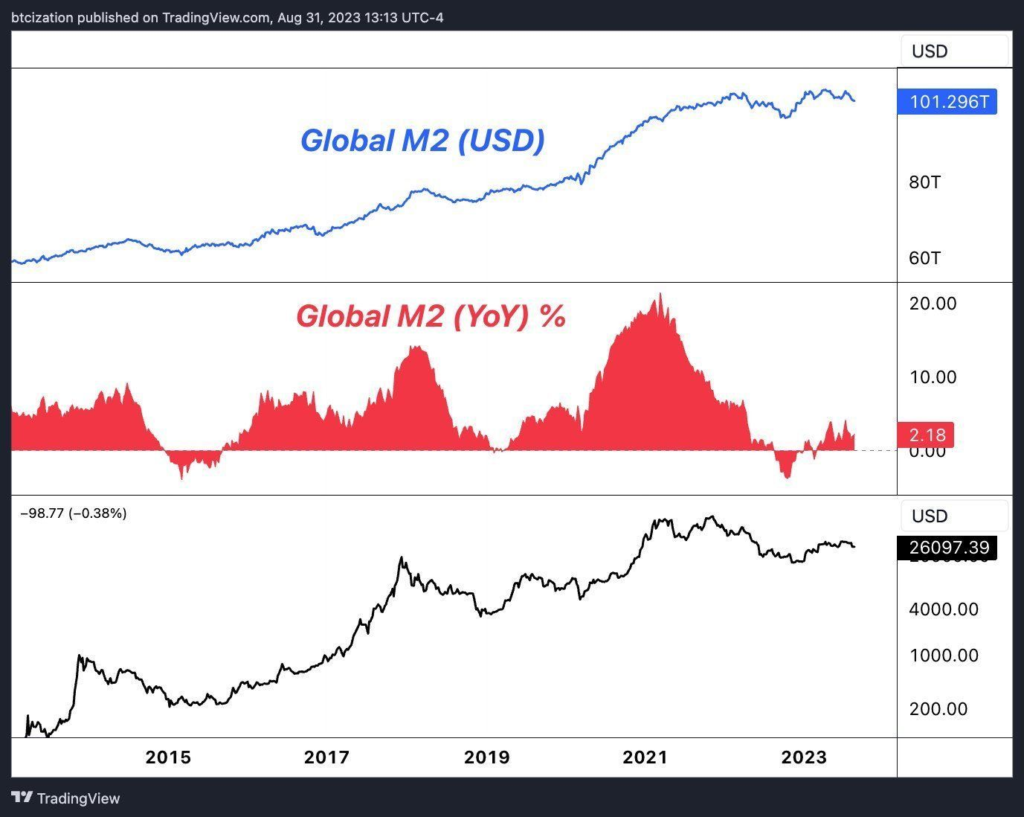

Beyond directly impacting economic policies, historically, US elections have tended to lift the prices of risk assets, including crypto. Elections often incentivize dynamic market changes as well as growth incentives. This is due to an increase in the money supply circulation.

When there is more money in circulation, it fuels monetary inflation. Historically, risky assets such as stocks and BTC tend to increase in price when there is monetary inflation. This is likely to happen again this post-election. Therefore, many believe this agenda is a positive sentiment for the crypto market.

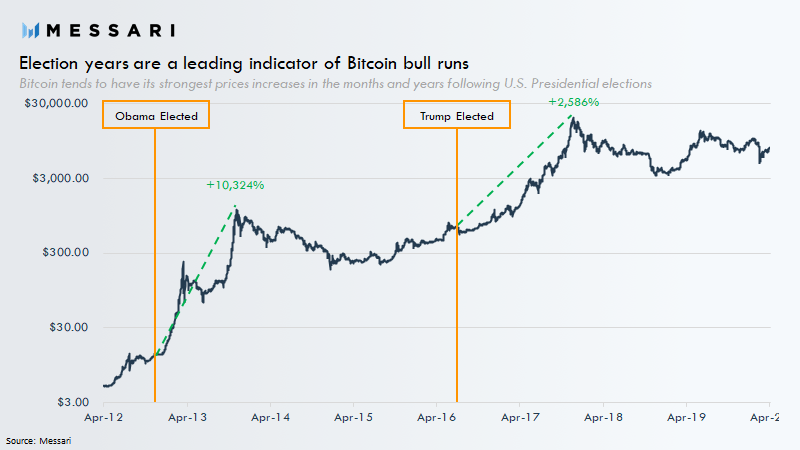

BTC’s price movements historically also correlate with this assumption. Obama’s victory in 2012 pushed the price of BTC up from $8 to $820. Then, Trump’s victory in 2016 also made the price of BTC jump from $670 to $17,350. Most recently, Biden’s victory in 2020 brought the price of BTC up from $15,000 to $30,000 and the market capitalization of other cryptos reached $1 trillion for the first time.

What are the conditions for this election? It’s hard to guess exactly what the rise will look like. However, it is believed that the rise in BTC and other cryptos will be more significant when Trump becomes president. As explained earlier, Trump has been the most vocal in showing his support for crypto so far.

One indication is the shooting incident that happened to Trump on July 13, 2024. Polymarket, a blockchain-based prediction platform, showed that the prediction of Trump’s victory immediately rose from 60% to 71% after the shooting. The crypto market also reacted positively to the news.

Bitcoin, which was previously stuck below the $58,000 for eight days, swiftly surged past $65,000. The increase is inseparable from the sentiment of the increasing chances that Trump will be elected as US president. Following this development, BTC managed to turn the $62,762 which was previously a pivotal resistance into a support.

Apart from BTC, Trump-themed memecoins also experienced an increase after the incident. For example, TREMP, which rose by 80% to $0.72, or MAGA Trump, which rose by more than 40% past $10. In addition, other Trump memecoins such as MAGA Hat, Super Trump, and others also experienced an increase. However, the increase did not last long, and the price gradually fell.

The Latest US Election Updates

Biden shockingly announced that he was withdrawing from the contestation of the U.S. presidential election on July 21, 2024. He then appointed US Vice President Kamala Harris as his replacement for the presidential candidate.

With Biden’s withdrawal, Trump’s chances of being elected are increasing. Many believe that Trump can win easily against Harris. The crypto market then reacted positively to the development. After the announcement, BTC immediately skyrocketed from $63,400 to US$ 68,169 when this article was written.

The rise in BTC prices further confirms the assumption that Trump’s election as president is a positive catalyst for the crypto industry.

Crypto Policy After the US Election

The crypto industry must thrive through regulatory clarity regardless of the next US president. If the president-elect imposes strict policies that limit the industry’s development, it will have a negative impact. It will trigger volatility and reduce the number of retail or institutional investors.

However, if the president-elect accommodates the crypto industry with supportive policies, it will have a positive impact. Sentiment and confidence in crypto will increase. This could boost the growth of retail and institutional investors and encourage more fund flows into the crypto market.

The positive catalyst will be further enhanced if the president-elect is interested in tokenization sectors such as Real World Asset (RWA). The RWA sector is currently the main link between institutional investors and blockchain technology.

To summarize, here are three scenarios for the crypto industry after the US election:

📈 Bullish Scenario:

- Accommodative policies and regulations for the crypto industry.

- Low interest rates and high inflation

- Institutional investors’ interest in blockchain and tokenization is growing

📉 Bearish Scenario:

- Policies and regulations that restrict the crypto industry.

- Interest rates remain high

- Recession and economic crisis continue.

↔️ Neutral Scenario:

- Balanced policies and regulations

- Moderate economic conditions and interest rates

- Institutional investor adoption and interest in blockchain and tokenization grows gradually.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Ngomongin Uang, Trump atau Biden? Pemilu Amerika Tentukan Ekonomi Dunia, Youtube, accessed on 19 July 2024.

- Coin Telegraph, a new voting bloc is emerging that could shake up the outcome of the race: crypto owners, X, accessed on 19 July 2024.

- Distilled Crypto, US Elections: The Next Crypto Catalyst? X, diakses pada 18 Juli 2024.

- Cprinze, Is the 2024 U.S. Election a Potential Catalyst for the Bull Market? X, accessed on 19 July 2024.

- S4mmy, Political Turmoil Drives Crypto Boom: Trump Incident Sparks Market Rally, Substack, accessed on 19 July 2024.

- Cole Petersen, History shows presidential elections often mark a turning point for bitcoin, CryptoSlate, accessed on 19 July 2024.

Share