USDC Depeg: A Timeline of The Event and Its Impact

Stablecoins are one of the pillars of the crypto industry for many activities ranging from DeFi to being an asset to hedge against market volatility. In fact, three stablecoins made it into the top 10 largest assets in the crypto market. This shows the importance of stablecoins in the crypto industry. However, concerns about stablecoins have started to emerge in recent years. From investigations into Tether and Binance to the risk of centralization in stablecoins like USDC. On March 11, this risk materialized and USDC depegged. So, what is crypto depeg and how did USDC depeg? What is the impact of the USDC depeg? This article will explain the March 11-13 depeg event.

Article Summary

- ⚠️ A crypto depeg is a situation where a stablecoin loses value against its pegged asset. In this situation, USDC depegged against the value of the US dollar, where $1 USDC is not equivalent to 1 US dollar.

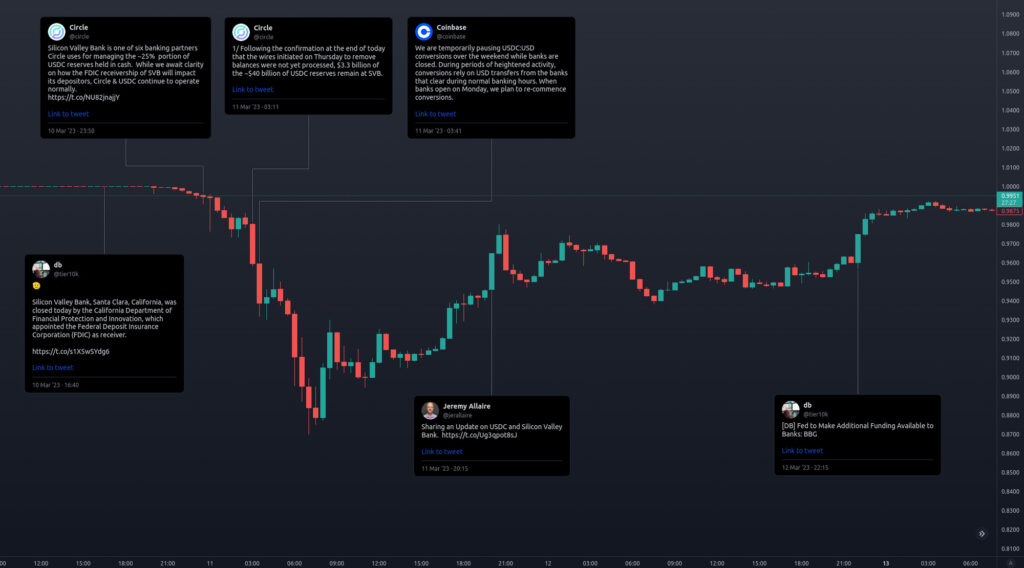

- 📉 USDC hit a low of $0.87 on March 11 and managed to return to $0.99 on March 13, 2023. The recovery happens when the US government anounce a bailout for the banks so Circle assets are safe.

- 🏦 The USDC crash was triggered by Sillicon Valey Bank (SVB) experiencing liquidity issues due to a bank run. The bank run was triggered by the news that SVB kept its assets in long-term US bond. SVB’s long-term bonds lost more than $1 billion dollars and this cause panic in SVB’s customers.

- 🧠 The USDC incident impacts the DeFi market, causing some USDC liquidity pools to drain as users trade their USDC for other stablecoin such as USDT.

- 💭 USDC price has now returned to normal but the incident has reignited many concerns about stablecoins. Discussions about stablecoins pegged to other currencies and the need for decentralized stablecoins has resurfaced.

What Happened to USDC?

A depeg is a situation where the value of a stablecoin is not equivalent to its pegged asset. A stablecoin pegged to the US dollar depegs when the price of $1 offered is not equivalent to 1 US dollar. In this case, on March 11-13, the price of $1 USDC was not equivalent to $1 US dollar. USDC even fell to $0.87 on March 11.

Circle is the issuer of the USDC stablecoin and explains that the assets that collateralize USDC are USD treasury bills and assets held in banks.

Why USDC depeg started with news of a bank in the US called Silvergate experiencing a bank run where it could not fulfill its customers’ asset withdrawal requests. Silvergate had liquidity issues as a number of its assets were locked up in long-term assets and so it is unable to meet the short-term needs of its customers.

However, a big problem suddenly arose when Silicon Valley Bank (SVB), a bank with $209 billion in assets, was shut down by the government on Friday, March 10 due to the same thing as Silvergate. Unfortunately, Circle was one of SVB’s clients. Circle explained that it kept about $3.3 billion or 8% of its reserves in SVB (out of USDC’s total $40 billion market cap). Hearing the news about Circle and SVB, many crypto investors rushed to sell their USDC for other stablecoins like USDT or fiat.

Why did SVB go bankrupt? Basically, SVB's collapse was caused by a miscalculation of future economic conditions. SVB held a number of assets in long-duration bonds with the expectation that inflation would fall. As we know, Inflation increases and the Fed raises interest rates. So, the value of these long-term bonds decline as the Fed's interest rates increased. SVB lost more than $1 billion in its bond assets and this eventually triggered SVB's bankruptcy.

The Impacts of USDC Depeg

It should be noted that the SVB incident is the largest bank failure in the US since the global financial crisis in 2008. It spread quickly on social media and caused panic in the traditional financial market as well as crypto. In crypto, USDC has considerable dominance in major DeFi protocols including Frax Finance and Curve. The incident caused a significant fall in the liquidity of some protocols. In addition, the stablecoin landscape has also shifted.

DeFi Experience Record Transaction Volume

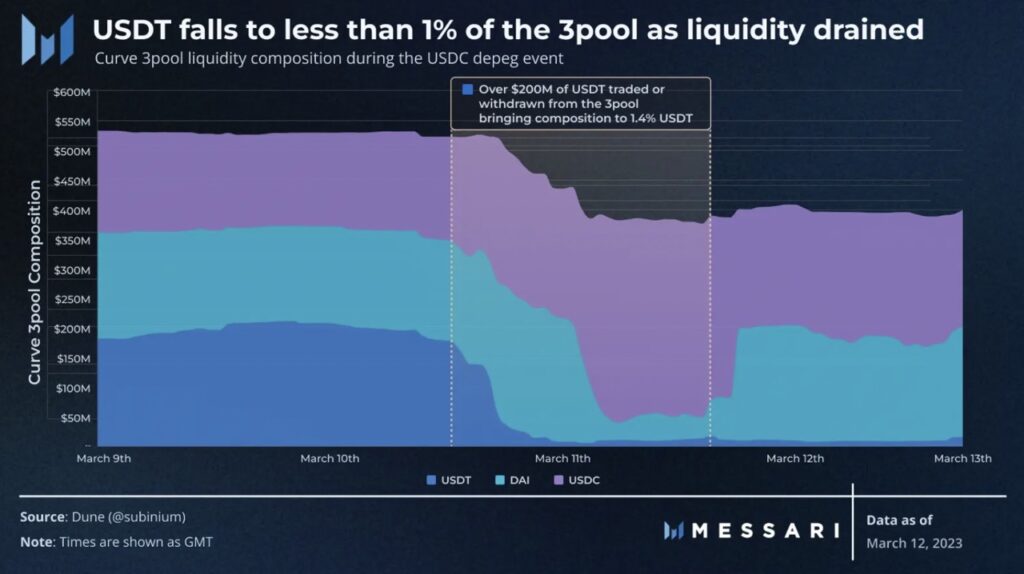

Curve had an eventful day as it score its highest transaction volume in history, $6.03 billion on March 11. Furthermore, the majority of this transaction volume occurred in just one liquidity pool, the 3pool. The 3pool liquidity pool contains USDC, USDT, and MakerDAO’s DAI. USDT in 3pool was depleted to less than 1% as everyone converted their USDC to USDT. Users who were liquidity providers (LPs) on this pool managed to earn $4.9 million dollars in transaction fees on the week of the USDC event.

On UniSwap, the same thing happened. The USDC-USDT and DAI-USDC liquidity pools saw $6 billion and $1.4 billion dollars in volume. Like Curve, USDT assets were also depleted as everyone wanted to exchange their USDC for other stablecoins. LPs on Uniswap also earned sizable transaction fees of $2.4 million on the USDC-USDT pool and $4.7 million on the WETH-USDC pool.

Fun Fact: Justin Sun earned $3.3 million dollars in profits from a series of trades he made while USDC depegs. Justin Sun bought USDC using USDT at a price below $1, and he profits when the price returned to normal.

USDT and Other Stablecoins

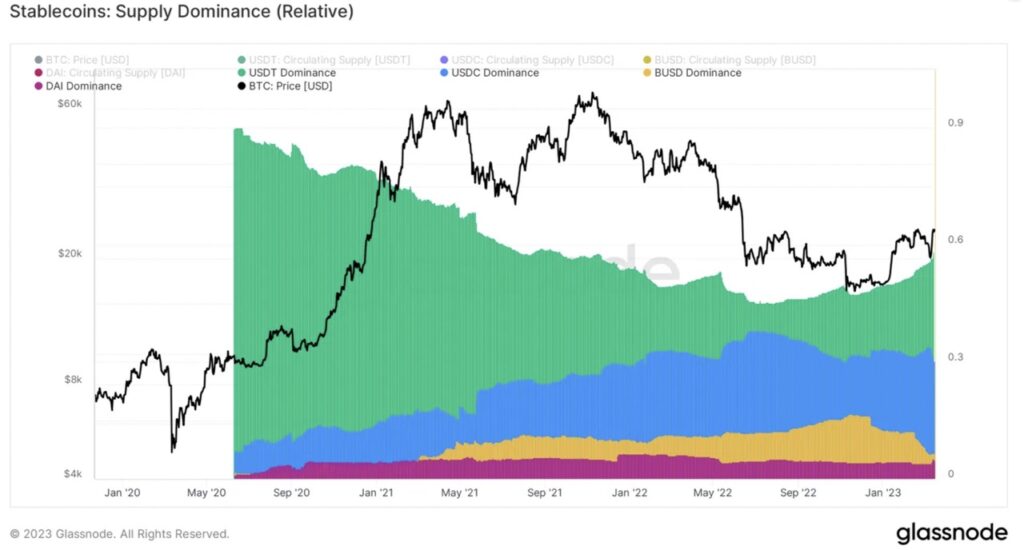

The USDC depeg also affected the stablecoin market. The market capitalization of USDT (Tether) increased by about $5 billion on 11-19 March 2023. The dominance of USDT also increased to 58.1% while USDC dropped to 30%. This depeg brought USDC dominance back to the pre-UST crash in May 2022.

In addition, DeFi which relies on USDC collateral is also affected. According to DeFiLlama, DAI and FRAX also experienced a dip to $0.96-0.97 during the incident. The majority of DAI and FRAX was printed using USDC collateral. On the other hand, some stablecoins benefit from the USDC depeg. TrueUSD (TUSD) and Liquity USD (LUSD) saw their supply expand by 22.9% and 10.3% respectively in the last seven days.

Will the USDC depeg mark a shift in the stablecoin landscape? Or will this only have a short-term impact? We will have an answer in the next few months by gauging crypto users' confidence in USDC.

What’s Next?

In the end, Coinbase temporarily suspended the conversion of USDC to US dollars as the USDC price deviated from the $1.00 value. Circle hands out a statement that all USDC withdrawal requests would be fulfilled on Monday, March 13. Then, on March 12, the US government explained that it would compensate SVB customers. The US government allocates $250 billion dollars to troubled banks such as SVB, Signature, and Silvergate. This intervention was done to prevent a bank run on other banks. Finally, this announcement calmed investors and on March 13 USDC made it to the $0.99-$1 price range.

A bank run is a situation where customers of a bank panic and withdraw their money simultaneously, causing the bank to lose liquidity. Historically, this situation has always required government intervention to compensate customers who were unable to withdraw their money.

Circle, the USDC issuer, went on to say that it has a new partnership with Cross River Bank, which also has Visa as a client. In addition, Circle will increase the intensity of its cooperation with the Bank of New York Mellon. This is Circle’s attempt to rebuild trust with crypto investors.

Concern Over Stablecoins

The crypto industry is not immune to the impact of the traditional financial world but US dollar stablecoins represent a significant attachment to US market conditions. Some in the crypto industry are already voicing the need for stablecoins pegged to other currencies. This is an attempt to create diversification within the crypto ecosystem. However, this has yet to happen due to the overwhelming dominance of the US dollar.

Circle CEO, Jeremy Allaire, feels the irony in the USDC incident: "It’s somewhat ironic that there has been a lot of talk of protecting the banking system from crypto, here we are in a situation where we are trying to protect a digital dollar (USDC) from the banking system", Allaire told CNBC.

In addition, the USDC incident has once again raised the need for decentralized stablecoins. Post Terra’s UST, the crypto industry has yet to see a decentralized stablecoin that takes up a large portion of the market share. The majority of DAI and FRAX collateral are also still dominated by USDC. There are several protocols that are about to launch their own stablecoins such as AAVE with GHO, fUSD from Fantom, Curve with crvUSD, and DJED from Cardano. These protocols may be able to take a large chunk of the crypto stablecoin market.

How to Buy Cryptocurrencies in Pintu

You can start investing in crypto by buying them in the Pintu App. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite token.

- Click buy and fill in the amount you want.

- Now you have crypto as an asset!

You can also invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily through Pintu.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions in the Pintu Apps, you can also learn crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for educational purposes, not financial advice.

References

- Dustin Teander, DeFi Implications Following USDC Depeg, Messari, accessed on 15 March 2023.

- Zhiyuan Sun, Crypto whales suffer huge losses due to USDC depeg, SVB collapse, Coin Telegraph, accessed on 15 March 2023.

- Samuel Haig, USDC Finds Stability Near $0.97 After Crashing on SVB Concerns, The Defiant, accessed on 16 March 2023.

- Nivesh Rustgi, Curve Finance, Uniswap Trade Volumes Soared Amid USDC Depeg, Decrypt, accessed on 16 March 2023.

- Andrew Asmakov, SVB Collapse Meant Protecting ‘a Digital Dollar From the Banking System’: Circle CEO, Decrypt, accessed on 17 March 2023.

Share