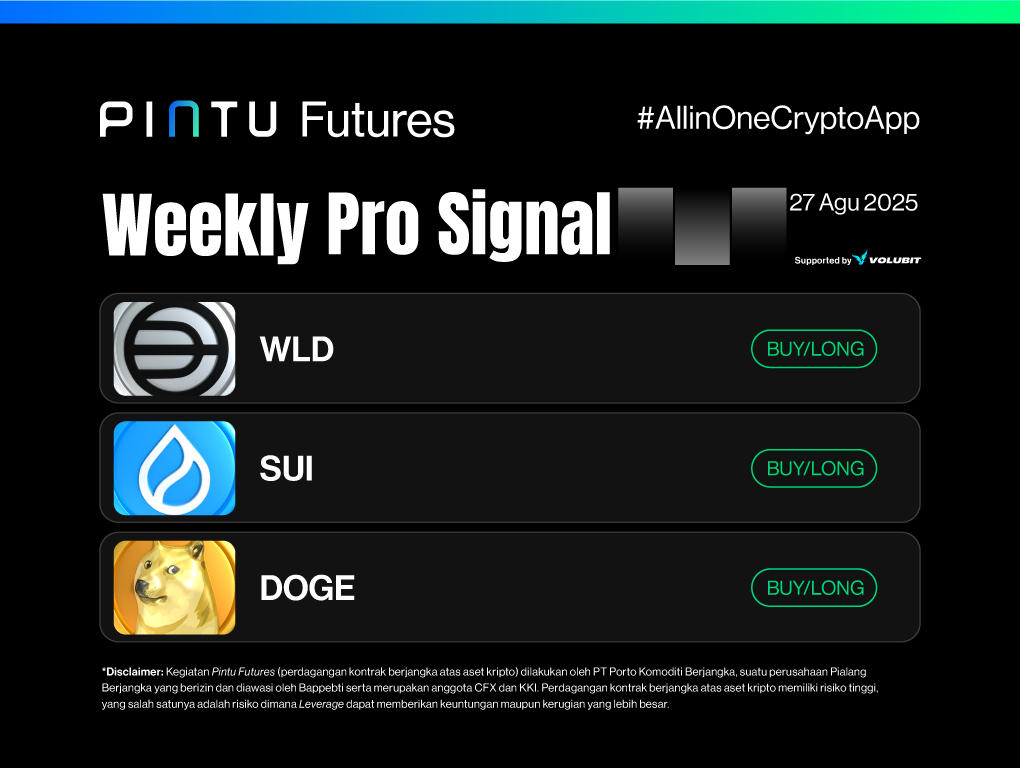

Weekly Signal Pintu X Volubit – August 27, 2025

Signal Summary Futures Trading:

- Worldcoin

- Entry: $0.9374 – $0.95

- Stop Loss [SL]: $0.8654

- Target Profit [TP]:

- TP1: $1

- TP2: $1.1

- Sui

- Entry: $3.44–3.45

- Stop Loss [SL]: $3.3

- Target Profit [TP]:

- TP1: $3.69

- TP2: $3.89

- Dogecoin

- Entry: $0.217–$0.219

- Stop Loss [SL]: $0.2071

- Target Profit [TP]:

- TP1: $0.234, TP2: $0.244

1. Worldcoin (WLD) – AI Category

WLD shows potential bullish momentum after breaking out from the 21 Exponential Moving Average on the 4-hour timeframe. WLD has the potential to test previous highs in the $1 and $1.1 areas, with a potential correction to the $0.9374 area, which can be used as a limit entry point.

Potential Buy/Long Setup for WLD

Entry: $0.9374 – $0.95

Stop Loss [SL]: $0.8654

Target Profit [TP]: TP1: $1, TP2: $1.1

2. Sui (SUI) – Layer-1 Category

Currently, SUI is bouncing off its support area around $3.3-$3.4. Historically, this level has been a strong support.

Anticipating a strong bounce from this level, it is predicted that SUI will experience an upward movement, targeting the $3.69 and $3.89 areas, which were the highs formed some time ago and could act as resistance.

Potential Buy/Long Setup for SUI

Entry: $3.44–3.45

Stop Loss [SL]: $3.3

Target Profit [TP]: TP1: $3.69, TP2: $3.89

3. Dogecoin (DOGE) – Memecoin Category

Currently, DOGE is bouncing off its support area around $0.208, a level that has historically served as strong support.

Anticipating a strong bounce from this level, it is expected that DOGE will experience a price increase, with target areas at $0.234 and $0.248, which are the highs formed previously and may act as resistance.

Potential Buy/Long Setup for DOGE

Entry: $0.217–$0.219

Stop Loss [SL]: $0.2071

Target Profit [TP]: TP1: $0.234, TP2: $0.244

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially when using leverage, it’s recommended to use a risk per trade of 1% of the total capital.

Disclaimer: Pintu Futures (cryptocurrency futures trading) is operated by PT Porto Komoditi Berjangka, a licensed and regulated Futures Brokerage Company under Bappebti, and is a member of CFX and KKI. Cryptocurrency futures trading carries high risks, one of which is the risk that leverage can lead to greater profits or losses.

Share

Related Article

See Assets in This Article

DOGE Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-