What are Blockchain Bridges?

Imagine you only have Bitcoin but want to explore decentralized applications (dApps) on the Ethereum blockchain. Unfortunately, BTC cannot operate on the Ethereum blockchain due to inherent limitations within each blockchain’s protocols and structures. Hence, you require a bridge platform to facilitate the transfer of BTC to Ethereum. This process involves converting your BTC into Wrapped Bitcoin (WBTC), an ERC-20 token standard pegged to the value of BTC. This article will delve into the concept of blockchain bridges and its advantages and risks.

Article Summary

- 🌉 A blockchain bridge connects different blockchains, enabling the transfer of crypto assets from one blockchain to another.

- 🔁 These bridges enable users to engage with diverse blockchain ecosystems and leverage applications across various platforms, enhancing interoperability.

- 🚨 Several risks related to blockchain bridges include fake bridge websites, smart contract vulnerabilities, human error, and bridge hacks.

- ✨ Some well-known examples of bridge platforms include Portal Bridge, Multichain Bridge, and Poly Network.

What are blockchain bridges?

Blockchain bridges, as its name suggests, are platforms that serve as bridges that connect two different blockchains, facilitating the seamless transfer of crypto assets between them.

Each blockchain operates within its unique environment, governed by specific rules and consensus mechanisms. Consequently, direct cross-blockchain asset transfers are not feasible without an intermediary bridge.

For example, when planning a trip to the US, you must convert your rupiah to US dollars at a money changer to use during your shopping spree. In cryptocurrency, a blockchain bridge functions like a money changer that facilitates crypto exchange, like ETH into SOL, between different blockchain networks like Ethereum and Solana.

How do blockchain bridges work

Blockchain bridges facilitate the transfer of crypto assets from one blockchain to another. There are two ways to bridge crypto: wrapping assets and utilizing liquidity pools.

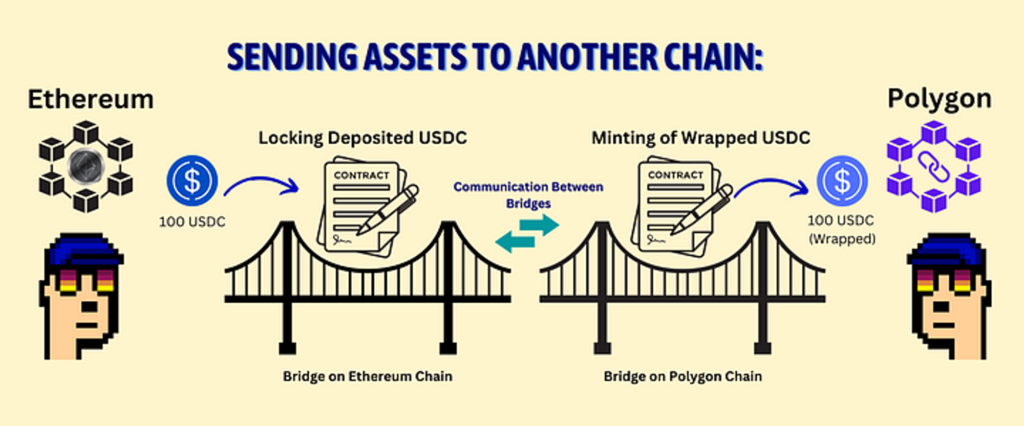

Wrapped Asset

In this method, the asset owner on blockchain A receives an equivalent asset on blockchain B. For instance, if you wish to transfer BTC from the Bitcoin blockchain to the Ethereum blockchain, you can achieve this through the WBTC Network. This process involves wrapping BTC into WBTC (wrapped BTC) using a smart contract. Such wrapping is necessary because BTC doesn’t work natively on the Ethereum blockchain, however WBTC (wrapped BTC) maintains a 1:1 value parity with BTC.

When you use a bridge, the smart contract locks the stored asset (BTC) during the transfer and mints the equivalent asset (Wrapped BTC) instead. When you bridge the asset back to the original blockchain, such as exchanging WBTC on Ethereum for BTC on Bitcoin, the WBTC is burned, and BTC is received in return.

Liquidity Pool

When you want to transfer WETH from Polygon to ETH on Ethereum, the bridge platform uses funds from its liquidity pool to send the user ETH on Ethereum.

Bridge platforms put assets into their liquidity pool through staking and farming programs. Users can lock their assets into the pool (become liquidity providers) for a reward. The bridge platform then uses the locked assets to complete bridging requests.

Advantages of the Blockchain Bridge

- Using dApps on multiple blockchains

When you use ETH as collateral on Aave to borrow another asset like USDC, the gas fee on the Ethereum mainnet is likely to be more expensive. Therefore, you can choose an L2 such as Arbitrum and bridge ETH from Ethereum to Arbitrum to interact on Aave, which offers a cheaper gas fee.

The bridge fee from Ethereum to Arbitrum using https://bridge.arbitrum.io/ is $3 – $9, but this fee can be cheaper or more expensive depending on the Ethereum network activity. In contrast, if you bridge from Arbitrum to Ethereum, the gas fee is more affordable at around $0.01.

- Exploring the blockchain ecosystem

When you have ETH but want to explore the Solana ecosystem, you must bridge your assets to Solana.

- Flexibility

With blockchain bridge, users have the flexibility to transfer assets from one blockchain to another, depending on their needs and preferences.

Risks of Blockchain Bridge

- Fake bridge websites: This risk emerges when users are redirected to a fake bridge website that mimics the official website. Depositing assets into such fake websites can result in theft. Therefore, it is crucial to ensure interaction solely with the official bridge website.

- Risk of smart contract bugs: Smart contracts in blockchain bridges may have bugs or weaknesses that attackers can exploit.

- Human error: This risk arises from unintentional mistakes, such as entering the wrong recipient’s address or an incorrect amount of assets during the bridge process.

- Bridge hacking: This risk occurs when an attacker successfully hacks into the infrastructure or protocols used by the blockchain bridge. It could result in unauthorized access to assets transferred over the bridge, theft of sensitive information, or manipulation of asset transfers.

According to Coindesk, a notable example of a bridge exploit is Wormhole. As per an analysis by blockchain analytics company Elliptic, the Wormhole attack occurred because the platform enabled the attacker to mint 120,000 WETH without needing to stake ETH. Subsequently, the attacker withdrew the obtained WETH without cost. To counter Wormhole’s losses, Jump Trading stepped in to cover the damages.

Three Most Popular Blockchain Bridge

1. Portal Bridge

Portal Bridge is a cross-blockchain asset exchange platform developed by Wormhole. The platform facilitates the transfer of crypto and NFTs. Portal is among the top three bridge platforms with a TVL of 1.6 billion US dollars.

Users can transfer assets to 24 blockchains available on Portal. Some available blockchains are Solana, Arbitrum, Injective, Near, Fantom, and others.

Previously, utilizing the Portal Bridge for asset transfers, particularly from Ethereum to the Solana blockchain, could make users eligible for Wormhole token airdrops.

2. Multichain Bridge

Multichain is a crypto bridge platform with the most blockchain network support at 54 blockchains. According to DefiLlama, Multichain has a TVL of USD 214 million, the 4th largest after Portal Bridge.

The platform applies lower bridge fees than other platforms and has no slippage. However, it sets a minimum amount of assets to be transferred, and the transfer time can reach 30 minutes or more.

3. Poly Network

Poly Network is one of the most popular cross-chain bridges in the crypto ecosystem. It has a TVL of over 335 million US dollars and support for 32 blockchains. One of Poly Network’s main advantages is its ability to bridge assets quickly, often within seconds.

In addition, the platform is known for its easy-to-navigate interface and full support for NFTs. However, it has limitations in bridging token pairs, which means that not all token pairs are available for transfer through Poly Network.

Conclusion

Blockchain bridge is a platform that serves as a bridge to connect two different blockchains. It enables the transfer of assets from one blockchain to another. Some popular bridge platforms are Portal Bridge, Multichain Bridge, and Poly Network.

With blockchain bridge, users have the opportunity to explore diverse blockchain ecosystems and use applications across multiple platforms. Despite the benefits, using blockchain bridges also comes with risks associated with fake bridge websites, smart contract bugs, human error, and bridge hacking.

References

- Ethereum Team, Blockchain bridges, Ethereum, accessed 29 February 2024.

- Fáwọlé John and Malanii Oleh, Blockchain Bridges 101: How Do They Work? Hacken, accessed 29 February 2024.

- Robert Stevens, What Are Blockchain Bridges and How Do They Work? Coindesk, accessed 29 February 2024.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-