Introduction to Cryptocurrency

Cryptocurrencies, such as Bitcoin and Ethereum, have been on the rise as a popular investment instrument over the past few years. For those who are new to crypto investments or simply want an introduction into this world of digital currencies we’ve put together some helpful information about what it is, why you might want to invest in them, how they work & their potential benefits!

Article Summary

- 💰 Cryptocurrencies are digital assets that are decentralized and fully live on the internet. Crypto has no physical form and can be sent or transacted to anyone anywhere without a central authority such as a bank or other financial institution.

- 🔗 Cryptocurrencies are secured using cryptographic technology, which ensures that all transactions with crypto cannot be manipulated.

- 👨🏻💻 Crypto was originally created as an alternative currency that is global and can be used by anyone and anywhere. In Indonesia, crypto is categorized as an investment asset regulated by Bappebti.

Introduction to cryptocurrency

Cryptocurrency is a digital currency that is decentralized and secured using cryptography. Unlike fiat currencies such as the rupiah or the US dollar, whose circulation is regulated by the Central Bank, crypto assets can be sent and used without the need for any central authority. Therefore, crypto gives you the freedom to store, send and receive your own assets.

The word crypto itself comes from the word cryptography, which is a technique of hiding information with a mathematical algorithm. In crypto asset transactions, cryptography guarantees transaction security and the identity of the sender and recipient of assets.

The technology behind crypto also ensured that all transactions are immutable and cannot be reversed, which protect the users from double spending or the possibility of the same assets being spent twice.

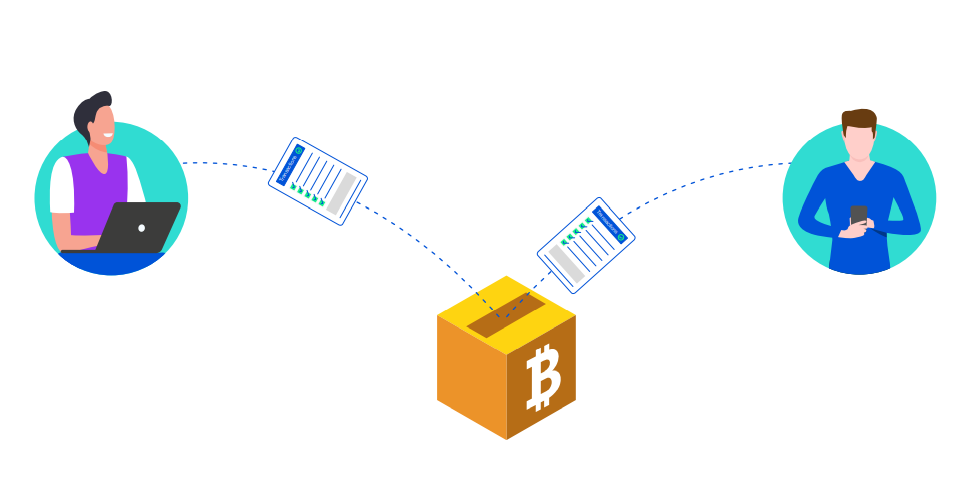

What is double-spending problem? As you know, it is very easy to copy data in the digital world. When you email a file from your computer to your friend, you are essentially creating a copy of the file. One of the biggest challenge of creating electronic money is to ensure that the same money cannot be spent twice. Before the invention of blockchain technology, we solve this problem by having a centralized entity (i.e. Banks and e-wallet players such as OVO) to perform debiting and crediting of accounts. Blockchain technology replaces the need of this centralized entity with distributed computers (miners) that can verify transactions independently, but also work together to form consensus / agreement on the latest transaction history on top of the blockchain..

What is Blockchain?

Crypto uses a technology known as blockchain. Blockchain is actually a database that cannot be replaced or changed. You can only add data in this database but you cannot delete or modify it in the future.

Each of these is grouped into structures called “blocks”, which are then linked to the previous block. The blocks are linked via digital fingerprints, which are called hashes, which make them very easy to detect if someone tries to cheat, change or modify past transactions.

Each block is connected like a chain, that’s why this database system is called blockchain. Blockchain ensures that no one can manipulate past transaction history.

When someone makes a cryptocurrency transaction, the transaction will be grouped into one block. The block containing a collection of transactions is then validated by miners or miners by solving complex mathematical puzzles that require large computing power. After a block has been created, the other computers on the network need to verify the data (reach a consensus) before finally adding a new block to the chain or blockchain.

Why Crypo is Important?

Forms of money have continued to evolve over time: from sea shells to beads, from gold to paper money. Now we have entered the digital era and it’s time to use digital money with even more sophisticated advantages. Here are some reasons why the existence of crypto assets is important:

Without Intermediaries

With crypto, you can transact directly from the sender to the recipient, without the need for an intermediary to mediate the transaction. Each transaction is only made by the sender to the recipient, and can be done directly from each user’s wallet.

Affordable and Fast

When you send crypto assets to other people in any part of the world, the crypto assets sent will arrive within seconds and be finalized on the spot. This is because crypto can be used globally and has no geographic barriers.

Censorship Resistance

No one can censor or stop crypto asset transactions because crypto is designed with a decentralized network, with miners or validators spread all over the world. Therefore, it is not possible for any single actor or authority to censor or stop crypto transactions.

Secure

With a decentralized system, it is nearly impossible to hack crypto assets. To be able to manipulate blockchain data, you must master 51% of miner’s or validator’s computers, and this is almost impossible to do.

Types of cryptocurrencies

There are many cryptos circulating in the market, such as Bitcoin, Ethereum, Binance Coin, Tether, and so on. But broadly speaking, there are two types of crypto, namely native coins and tokens.

Native coin

The native coin is a digital asset/coin that was created simultaneously with the creation of a blockchain itself. For example, Bitcoin is a native coin circulating on the Bitcoin blockchain, and Ether is a native coin on top of the Ethereum blockchain.

In general, to increase the number of native coins in circulation, these native coins need to be “mined” like a metal commodity. In the crypto world, mining is the activity of validating, processing, and securing transactions in a decentralized manner. “Miners” who successfully carry out the process will receive a reward in the form of native coins from the blockchain system. Bitcoin blockchain miners will receive BTC.

The value of a coin on the market is determined entirely by supply and demand. If more people use it (eg for investment or other means of exchange of value) more than what available in the market, then its value will increase.

On the contrary, if more coins are sold than buyers, the value will decrease.

All transactions on the blockchain require real coins as fees that are paid to miners. For example, if you want to send BTC on the bitcoin blockchain, you have to pay the miners a fee in BTC.

Token

In the crypto world, there are certain blockchains that allow programmers/developers to create applications (smart contracts) and new digital assets (tokens) on top of the blockchain. One of the most popular blockchains for developing applications and tokens is Ethereum.

Tokens are cryptos that are issued “hitchhike” as projects on other blockchain platforms (eg Ethereum). Tokens are issued for specific purposes and the amount can be adjusted by the token developer.

Tokens can be digital securities, stock representations (security tokens), or be used to provide access to a function (utility token) such as cellular pulses used to make calls.

One form of token application is the issuance of stablecoin. Stablecoins are issued as a form of digital representation of the original assets that support them. The original assets are kept by the developer.

What Are the Functions of Cryptocurrency?

Like currency, crypto assets can be used to buy and sell goods. However, in Indonesia, crypto assets are currently included in the commodity category, so they cannot be used as an official medium of exchange to buy and sell goods.

Crypto assets as commodities have enormous potential as investment instruments because their value continues to grow as the number of users increases. Here are some examples of its functions, and how these digital assets can be utilized.

Investing

One of the things that can be done with crypto assets is to invest. However, before investing in crypto assets, you must first study the fundamental aspects, such as the purpose of these crypto assets, the technology behind them and the team behind their creation.

Some investors who believe in the fundamentals of a crypto asset will hold (HODL) the crypto asset for a long time. The easiest way for beginners to invest is by buying and accumulating crypto assets bit by bit, using a method called Dollar Cost Averaging.

The most important thing about investing in crypto assets is that you can start investing with small amounts. Even with only IDR 11,000, you can easily buy crypto assets using the Pintu application.

Read also: What is Dollar Cost Averaging?

Trading

Many crypto users take advantage of the volatility of asset values for trading. This means they are looking to profit from crypto assets in the short term. This is accomplished by finding the best time to buy crypto assets at low prices and sell them at higher prices.

A trader needs to use technical analysis to look at price history, charts and other means of information to predict price movements. Trading crypto assets can be profitable but also carries high risks because the price of each crypto asset is very volatile.

Unlike stock or forex trading, crypto asset trading runs 24/7 all year round with no downtime. It takes discipline and also high flying hours to master crypto asset trading.

References

- Antonopoulos, A. M. (2017). Mastering Bitcoin: Programming The Open Blockchain. O’Reilly.

- Antonopoulos, A. M. (2021). Mastering Ethereum. Stanford University Press.

- Popper, N. (2016). Digital Gold: The untold story of bitcoin. Penguin Books.

- The Shariah Factor in Cryptocurrencies & Tokens. IslamicMarkets.com. (n.d.). Retrieved November 14, 2021, from https://islamicmarkets.com/publications/the-shariah-factor-in-cryptocurrencies-tokens

- DAPP statistics. State of the DApps – DApp Statistics. (n.d.). Retrieved November 14, 2021, from https://www.stateofthedapps.com/stats/platform/ethereum

- Bitcoin Price Today, BTC to USD Live, Marketcap and Chart. CoinMarketCap. (n.d.). Retrieved November 14, 2021, from https://coinmarketcap.com/currencies/bitcoin/

- Shin, L. (2021, November 9). What makes an NFT worth millions of dollars? Four experts debate. Medium. Retrieved November 15, 2021, from https://medium.com/@laurashin/what-makes-an-nft-worth-millions-of-dollars-four-experts-debate-68facba8bc6e

- Coinbase. (n.d.). What is staking? Coinbase. Retrieved November 15, 2021, from https://www.coinbase.com/learn/crypto-basics/what-is-staking

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-