What Is Hyperliquid (HYPE)?

Hyperliquid took the crypto market by storm after airdropping 31% of its supply, worth almost $1.2 billion. However, what’s more amazing is that its token, HYPE, rose around 1,600% in 22 days. This is because Hyperliquid blows other perpetual DEXes out of the water in terms of volume, tokenomics, and speed. This article will run you through what Hyperliquid is, how Hyperliquid works, and the potential of the HYPE token.

Key Takeaways

- Dominance in Perpetual DEX Trading: Hyperliquid consistently tops volume and revenue charts, securing a dominant 66% share of the perpetual DEX sector and rivaling centralized exchanges.

- Unmatched Trading Infrastructure: The platform’s robust technological stack, including HyperBFT, HyperCore, and HyperEVM, delivers unparalleled speed (200k TPS) and deep liquidity with fully onchain order books, positioning it as the fastest decentralized trading platform.

- HYPE airdrop: Hyperliquid’s airdrop of 31% of its token supply. This sets the stage for a dramatic 1,600% surge in HYPE’s value within just 22 days, underlining its rapid adoption and strong market enthusiasm.

- Strong Investment Proposition with Growth Catalysts: HYPE’s fair launch, coupled with ongoing ecosystem enhancements like expanding spot trading, HyperUnit’s developments, and further HyperEVM features, creates a compelling investment opportunity.

The King of Decentralized Perpetual Trading: What Is Hyperliquid?

The decentralized perpetual trading sector has had a huge awakening since the start of 2024. This is a relatively new sector born in the depths of the 2022 bear market. Since its inception, dYdX has been the de facto king of this sector, with GMX and Synthetix trailing behind.

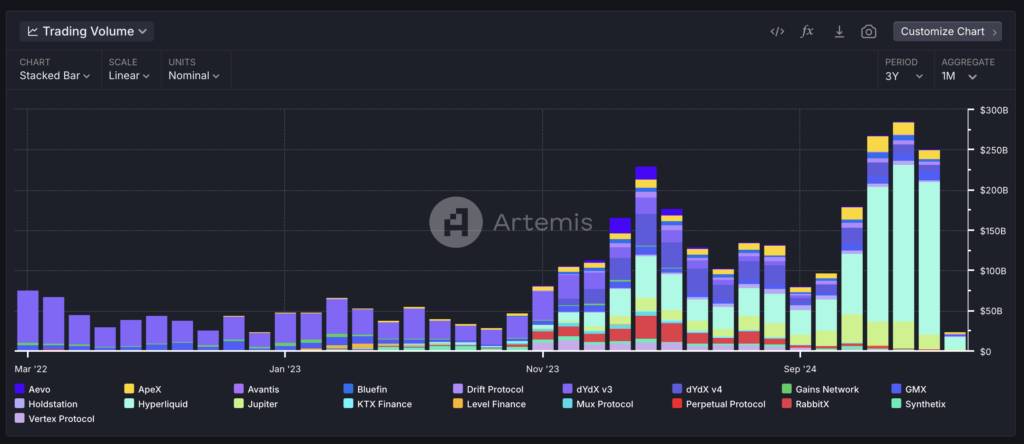

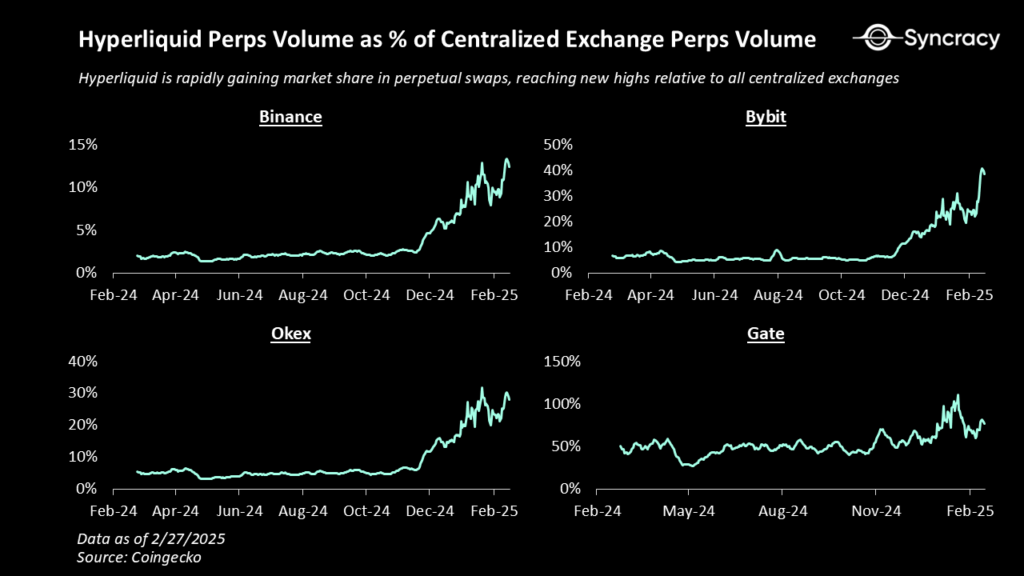

Hyperliquid is a decentralized spot and futures trading platform. It is also an L1 blockchain with smart contract capabilities. Since February 2024, Hyperliquid has been topping the volume charts of the perpetual DEX sector. As seen below, Hyperliquid dominates since the second half of 2024 and into 2025.

At its peak, Hyperliquid has 66% domination over the sector with a $195 billion trading volume (January 2025). If we see the chart, Hyperliquid’s trading volume has been increasing since HYPE launched in November 2024. The attention from HYPE seems to help the Hyperliquid flywheel.

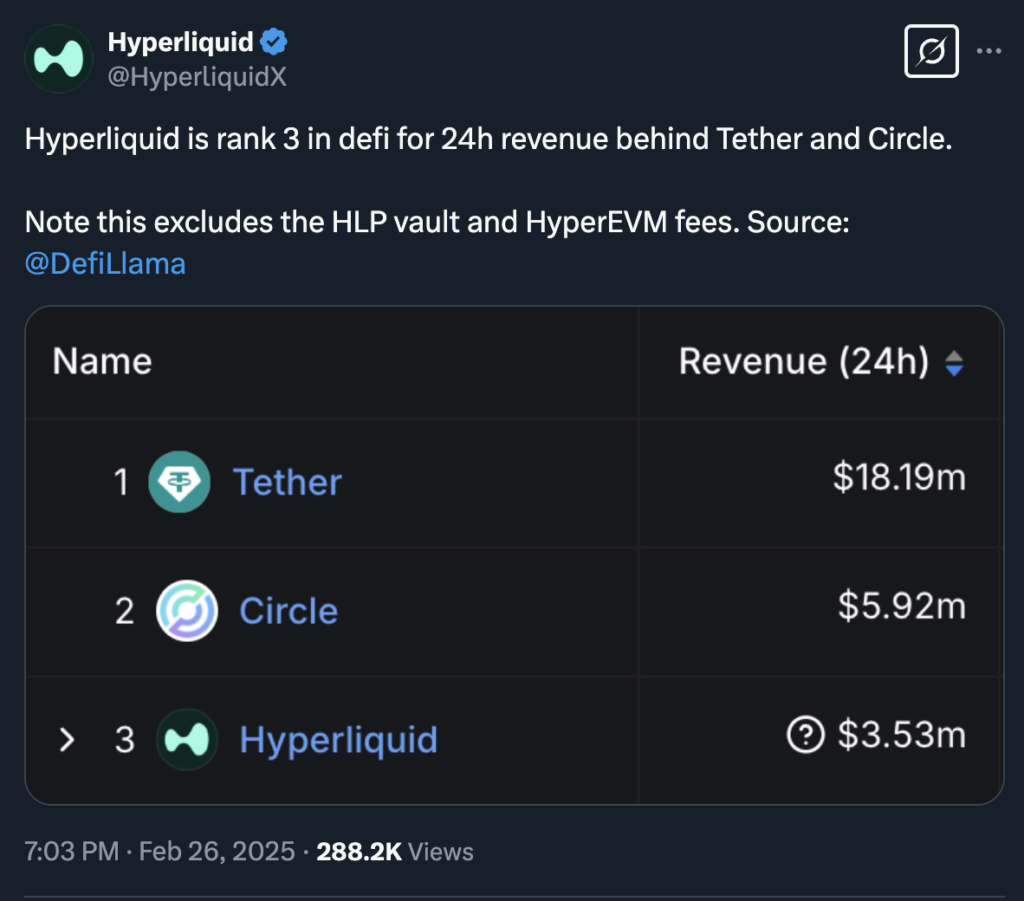

In addition, Hyperliquid consistently places itself in the top 10 revenue-generating protocols. On February 26, Hyperliquid is one of the top 3 revenues alongside Circle and Tether. This is unprecedented for a decentralized perpetual protocol. Many analysts already tout Hyperliquid as the first onchain decentralized exchange that can rival its centralized counterpart.

What Are the Core Features of Hyperliquid?

- Onchain and Decentralized Order Books: Hyperliquid marks the first truly onchain order book in the crypto industry with deep liquidity that can cater to both small and large traders.

- Hyper Speed and Fast Execution: Hyperliquid’s technological architecture is specialized for speed and finality. The current transaction per second for Hyperliquid is 200k, making it the fastest decentralized trading platform.

- Permissionless Listing: The listing process in Hyperliquid for new projects is entirely decentralized. Anyone can take advantage of Hyperliquid’s thick order book by listing through the Hyperliquid Auction House.

How Does Hyperliquid Work?

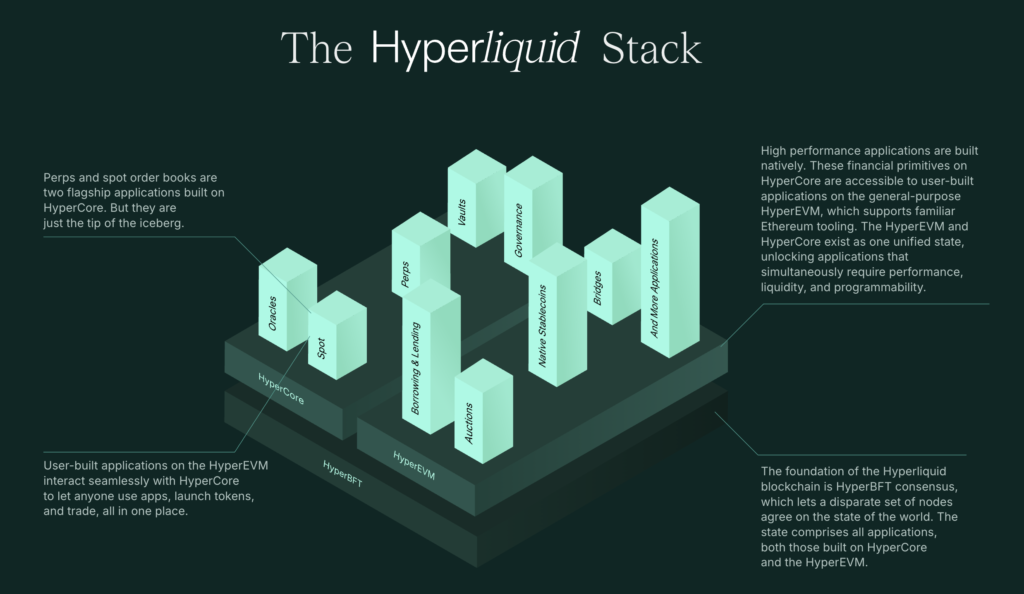

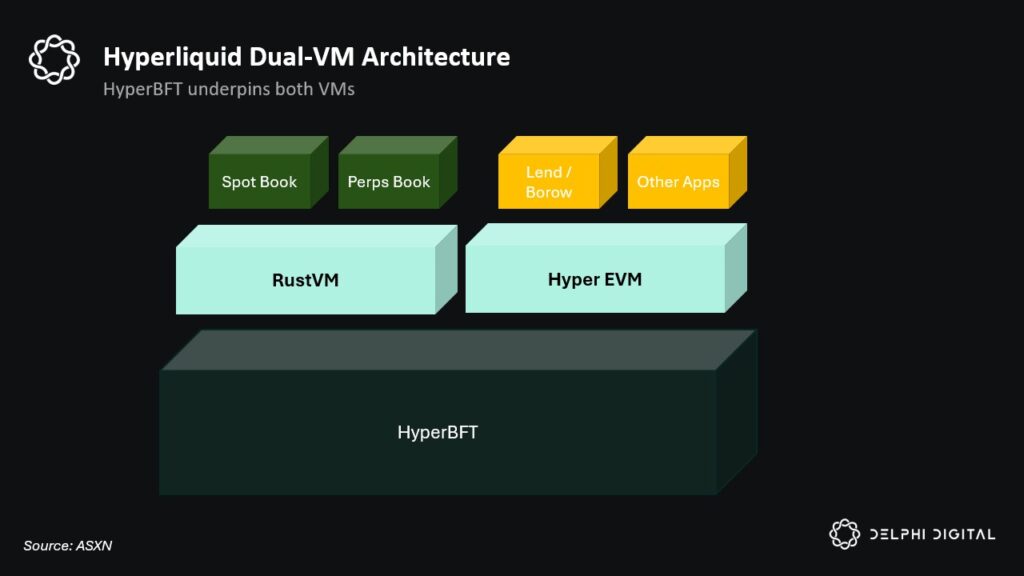

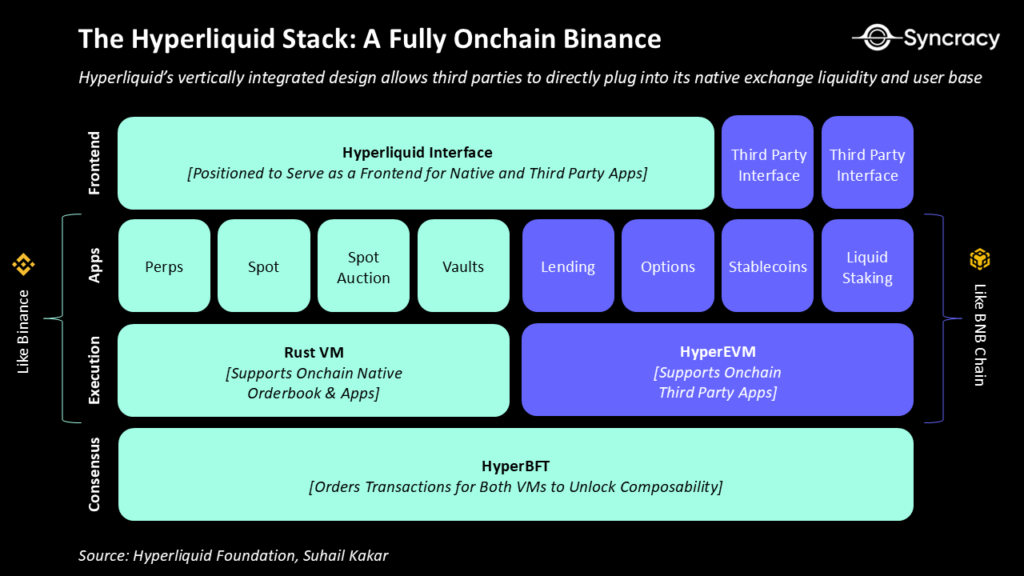

Hyperliquid is a purpose-built L1 blockchain specialized for optimizing liquidity and trading. At the core of these features is Hyperliquid’s technological stack consisting of HyperEVM, HyperCore, and HyperBFT. These are the foundation of Hyperliquid, powering high-speed trading and an ecosystem of L1 apps.

HyperBFT is the hotstuff-based consensus mechanism in Hyperliquid that secures both HyperEVM and HyperCore. HyperBFT enables Hyperliquid to produce a block time of 0.2 seconds and a maximum TPS of 200k per second. This makes Hyperliquid one of the fastest perpetual DEX in crypto with near-instant trading executions. Hyperliquid even remarks that the 200k TPS is not the ceiling and that TPS can theoretically reach millions per second—the bottleneck towards a million TPS is execution.

HyperCore

HyperCore is the cornerstone of Hyperliquid and is responsible for various components related to trading. So, it manages all the trading components of Hyperliquid, such as the order book for perps and spot DEX, staking, margin and liquidation, clearinghouse, and oracles.

HyperCore is the magic component that enables Hyperliquid to have decentralized order books where transactions are settled fully on-chain. HyperCore also interacts with Hyperliquid’s in-house consensus mechanism, HyperBFT, to ensure minimal latency for trading (the current delay is 0.2 seconds).

Lastly, HyperCore and HyperEVM make up the global state of Hyperliquid. Although Core and EVM are two separate components, there is no need for a bridge or any methods of proofing. Builders and projects looking to build on Hyperliquid will enter through HyperEVM and eventually interact with HyperCore for liquidity and token launch.

HyperEVM: Hyperliquid as an L1

HyperEVM is an EVM engine that allows builders to deploy their apps on Hyperliquid. HyperEVM was launched on February 18. If HyperCore is the trading core, HyperEVM is the Ethereum computer inside. So, the EVM engine is the game-changer that differentiates Hyperliquid from other competitors.

So, how does the EVM engine connect to HyperCore? Builders create apps on HyperEVM, launch their products, and list the tokens on HyperCore order books through the auction house. Then, the developers link the token to HyperCore and the HyperEVM contract. This process is entirely decentralized, and projects have access to highly liquid order books from day one.

HyperEVM is built for DeFi projects. As the team outlined, liquidations on lending protocols can be implemented directly to Hyperliquid order books. This Eliminates the risk associated with AMM-based lending protocols. This feature is still unavailable on the current version of HyperEVM— the team implements HyperEVM slowly to reduce protocol-wide risks.

Notable projects in the HyperEVM ecosystem: HyperUnit, Hyperlend, Felix Protocol, HypurrFi, and Hyperswap.

HYPE Coin Potential As An Investment

HYPE is Hyperliquid’s native coin. On launch, 31% of HYPE directly goes to Hyperliquid users without any vesting period. The team also doesn’t onboard VCs, the HYPE launch is one of the fairest launches for a multi-billion protocol.

Additionally, Hyperliquid already found its PMF and has a steady number of growing users, even after the launch of HYPE—most protocol metrics decline significantly after its TGE. Hyperliquid has over 400k cumulative users with around 16k active users weekly and is currently one of the most profitable protocols in the entire industry (4th in the last 30 days).

So, many analysts naturally see the next step for Hyperliquid is to be a potential competitor for CEX. In fact, the graph above shows that Hyperliquid already rivals CEXes such as Gate and is slowly climbing up towards OKEX and ByBit perps volume.

Messari’s valuation model for HYPE puts the base case FDV at $13B (this is HYPE’s current FDV as of March 16) and a bull case of $33.5B. Meanwhile, Syncracy Capital puts the bull case for Hyperliquid as a potential core asset in the cryptoeconomy alongside BTC, ETH, and SOL. Syncracy sees Hyperliquid as the premier financial aggregator in crypto. Lastly, Mint Ventures compares Hyperliquid with BNB as it has many similarities through the Binance Chain and Binance as a CEX.

HYPE offers a unique proposition as an investment. Hyperliquid combines a decentralized exchange and smart contract platform within a unified ecosystem. As a trading platform, Hyperliquid is the leading perpetual DEX with a significant PMF (product-market fit) in the crypto industry. However, what remains to be seen is how HyperEVM can grow the Hyperliquid ecosystem.

The last aspect to consider when investing in HYPE is that the market cap is already high at $4.5B (with an FDV of $13.5B). The HYPE price is down 65% from its ATH (March 16). So, investors should consider the risk-to-reward ratio and determine the key catalysts that can propel HYPE back to its ATH.

Hyperliquid Roadmap

Despite already processing a trillion of perpetual trading volume, Hyperliquid is a relatively new protocol. HyperEVM was only launched a few weeks ago. As we’ve discussed, there are 3 key aspects: futures trading, spot market, and HyperEVM.

Three key catalsyts for Hyperliquid:

- Expansion of spot trading market: Currently, Hyperliquid’s spot market volume is just a small fraction of the perps market, only around 2.6%. Additionally, only the HYPE trade is seeing large volume as the rest of the tokens are mostly memecoin or Hyperliquid-native projects.

- HyperUnit: HyperUnit is a third-party team building on Hyperliquid. The team seeks to facilitate liquid, onchain trading of any asset to Hyperliquid. HyperUnit has successfully launched native spot BTC on Hyperliquid’s spot market. So, they are now looking to launch other major altcoins like ETH, SOL, etc.

- HyperEVM Development: Currently in alpha, HyperEVM is missing many features. Interactions between HyperCore and HyperEVM are still incomplete, and advanced features on the EVM, such as precompiles are yet to be implemented. Once implemented, developers will be able to build many DeFi projects like lending protocol, AI agent, options protocol, and stablecoin products.

Conclusion

Hyperliquid has swiftly emerged as a trailblazer in the decentralized perpetual trading sector. It leverages innovative technology and fair tokenomics to achieve incredible growth and PMF. Its impressive trading speeds, deep liquidity, and consistent revenue generation underscore its leadership in the perpetual DEX space, while the strategic expansion of its ecosystem hints at long-term growth potential. However, as with any high-stakes crypto investment, the high market cap and significant post-ATH pullback necessitate a careful evaluation of the risk-to-reward balance for potential investors.

References

- “About Hyperliquid”, Hyperliquid Docs, accessed on April 4, 2025.

- Mint Ventures, “A Quick Overview of Hyperliquid: Current Product Status, Economic Model, and Valuation”, Medium, accessed on April 5, 2025.

- @HedgewaterDAO, “Hyperliquid: The Only PvE Chain Left,” X, accessed on April 11, 2025.

- @TxnSheng, “Everything You Need To Know About Hyperliquid,” X, accessed on April 12, 2025.

- @Delphi_Digital, “Imagine DeFi apps with access to liquidity, near-instant finality, and integrated spot and perpetual order books,” X, accessed on April 13, 2025.

- Sunny Shi, “A Valuation of Hyperliquid”, Messari, accessed on April 13, 2025.

- Sunny Shi, “What’s Next for Hyperliquid?,” Messari, accessed on April 14, 2025.

- Ryan Watkins, “Hyperliquid Thesis: The Road to Financial Aggregation”, Syncracy Capital, accessed on April 14, 2025.

Share