What is Jupiter Exchange (JUP)? Solana’s Best DEX Aggregators

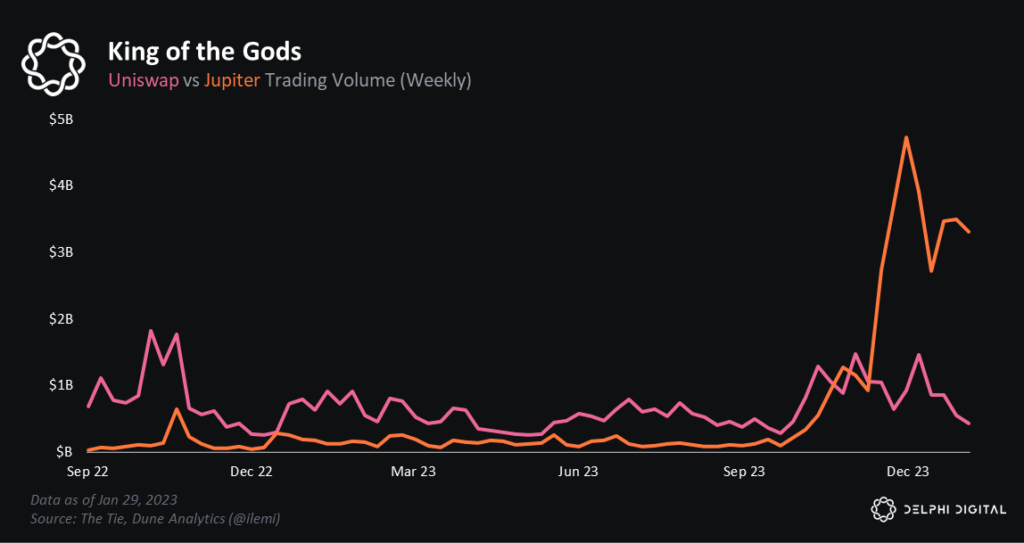

Since mid-2023, the crypto community started noticing many new protocols in Solana. These protocols were born in the middle of the bear market following the downfall of FTX, a major investor in Solana. Jupiter stands out as one of the biggest apps in Solana that was born out of these conditions. So, what is Jupiter Exchange? Why is the launch of the JUP token so highly anticipated by thousands of Solana users? We’re going to take a complete look at Solana’s biggest DEX, Jupiter.

Article Summary

- 🪐 Jupiter Exchange: Jupiter is Solana’s largest DEX aggregator, which aggregates price data from various DEXs to provide users with the best prices.

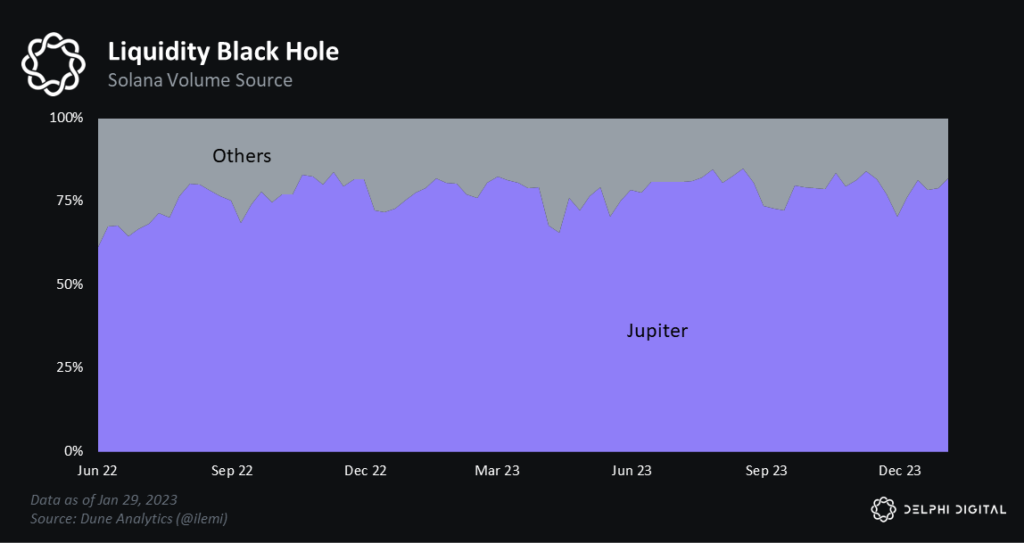

- 💪 Jupiter Domination: Jupiter dominates Solana’s decentralized trading market with nearly 80% of all Solana DEX trades going through Jupiter, offering efficiency and low costs by eliminating protocol fees for swaps.

- 📱 Jupiter’s Top Features: Jupiter offers features such as swaps, limit orders, DCA (Dollar Cost Averaging), and perpetual trading.

- 🪂 JUP Tokens and Investments: The launch of the JUP token attracted attention due to its fair allocation and massive airdrop to users. Although the opening JUP price was disappointing, Jupiter’s position as the largest DEX in Solana provides great potential.

What is Jupiter Exchange?

Jupiter Exchange is a DEX aggregator that collects price data from various DEXs on Solana and selects the best price for users. Jupiter is the largest DEX aggregator in Solana. In total, Jupiter has processed $42.7 billion in transaction volume and 114 million swaps.

Jupiter’s DEX aggregator is considered the most efficient in Solana as it connects the liquidity of all DEXs in Solana. This allows users to get the best price when exchanging assets. Jupiter also does not charge users any protocol fees. All of this makes Jupiter one of the most widely used protocols in Solana.

Lately, Jupiter has become increasingly popular because it launched its token, JUP. The JUP token is Jupiter’s governance token that will be integrated with many upcoming features such as Jupiter Launchpad.

JUP launched on January 31, 2024. In addition, 1 billion JUP will be given via airdrop to users who used Jupiter before November 2, 2023. This JUP airdrop will take place in four stages.

Pros of DEX Aggregator

Currently, Jupiter dominates Solana’s decentralized trading market. Almost 80% of all Solana DEX trades come through Jupiter. This figure shows how users prefer to interact with aggregators rather than directly with DEXs.

So, why do users prefer DEX aggregators over other Solana DEXs like Raydium? The answer, of course, is that aggregators give users the best price.

Simulation of DEX swap vs. DEX aggregator:

- You want to buy BONK using SOL for $100. If you go straight to Raydium, you will likely get a final value of around $99.41.

- If you use Jupiter, Jupiter might detect that Raydium is not the best DEX to use at that moment and choose Meteora instead. As a result, you get $99.8 worth of BONK.

In a simulation with small numbers like the one above, the difference between Jupiter and other DEXs might seem small. However, imagine you’re a whale making a $10,000 exchange. A $0.4 price difference turns into $50 or even $100. This difference will continue to increase alongside the value.

Jupiter’s Features

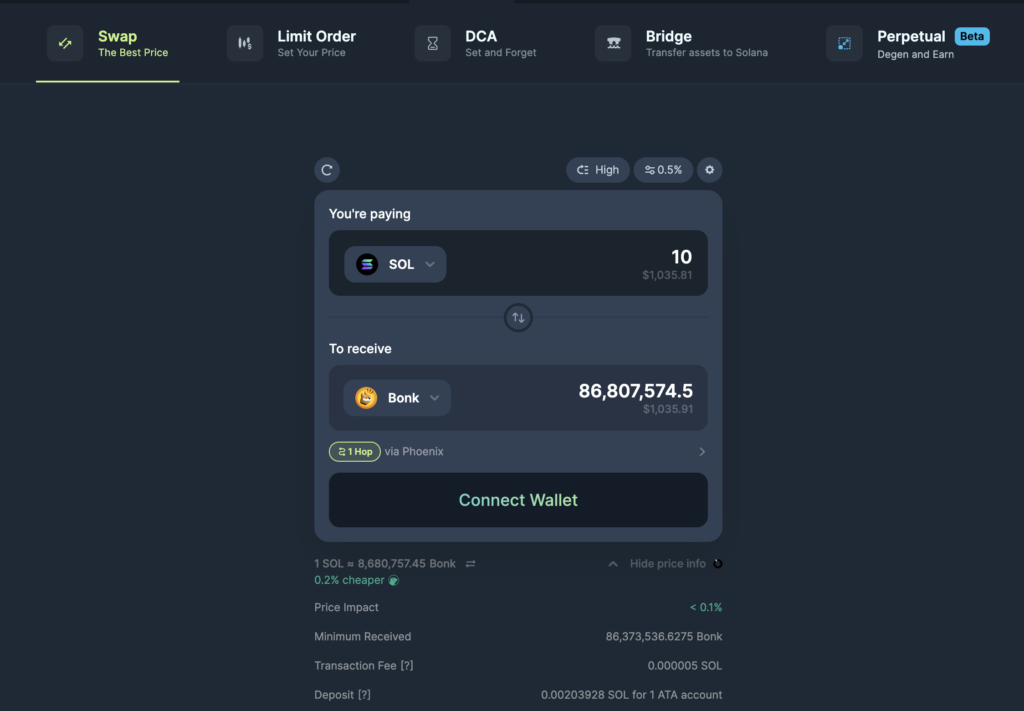

1. Swap

The image above is the Jupiter interface when you are about to swap or buy tokens. As explained, Jupiter collects price data from various DEXs and chooses the most optimal route. We can see that the price difference displayed is very small.

In addition, Jupiter will display a warning if you choose too high a slippage or the price difference becomes too large. The most ideal slippage is 0.3% for tokens that are moving normally and 1% for tokens that are experiencing extreme fluctuations.

Jupiter does not charge a protocol fee for each swap. You only need to pay Solana transaction fees and token transaction fees (if any). The amount you get is inclusive of any transaction fees that may exist.

2. Limit Order

Jupiter’s Limit Order feature is similar to the Limit Order you can use on Pintu. The difference is that users must pay attention to the liquidity of each asset. The possibility of your LO not being filled is greater than on CEX like Pintu due to limited liquidity. Even so, Jupiter is still ideal for small asset purchases.

In addition, Jupiter is also the first DEX that can provide this feature in Solana. The team also has plans to develop this feature to make it more efficient.

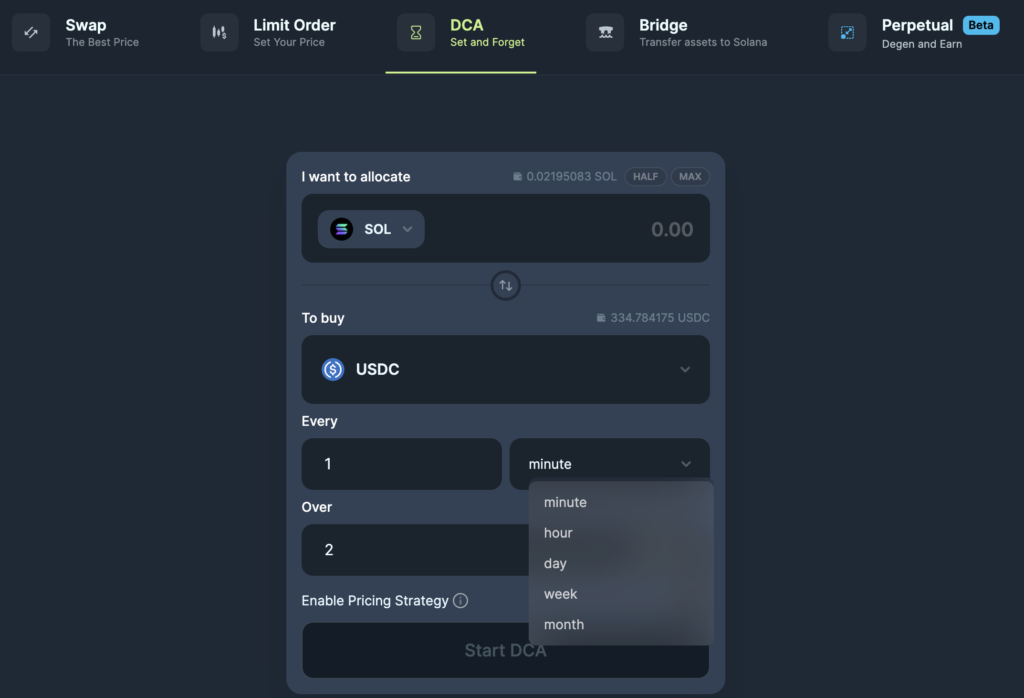

3. DCA

Like the Limit Order feature, Jupiter is also the first DEX in Solana that provides DCA or Dollar Cost Averaging feature. If you’ve ever used the DCA on Pintu, you’ll know that there’s a frequency we can choose, whether it’s days, weeks, or months.

In Jupiter, you can set DCA purchases by the hour or even the minute. Uniquely, this feature is widely used by whales who want to make purchases of thousands of dollars but divided into $10 per minute to reduce the price impact.

4. Jupiter Perpetual Trading

One of Jupiter’s newest features is perpetual trading. Users can trade futures directly on Jupiter for SOL, BTC, and ETH. In addition, users can also provide liquidity and earn 70% of the profits that Jupiter gets from traders with an APY of around 100%.

This Jupiter Perp feature uses an innovative model because it directly utilizes funds from the LP (liquidity pool). With this model, the process of opening positions can be done easily without any liquidity and slippage problems.

JUP Token as an Investment

As mentioned, the JUP token was successfully launched on January 31, 2024. About 1.35 billion JUP has been circulated in the market with 1 billion JUP tokens given as an airdrop to users. As in the image above, the total of 10 billion JUP is divided in half with 5 billion for the team and 5 billion for users. The Jupiter team has confirmed that the JUP airdrop will be divided into 4 phases with a total of 4 billion JUP as airdrop rewards.

Want to be eligible for the next JUP airdrop and find other airdrops in Solana eco? Read this article: Solana Airdrop Strategies in 2024!

This kind of split allocation is very rare in crypto projects. Usually, projects will sell a large number of tokens to investors as a fundraising effort. In Jupiter’s case, investors can only buy JUP openly at the same price as retail users.

The Jupiter team opened the price of JUP at $0.4 or around 6,000 rupiah. As shown in the picture above, JUP reached 12,000 rupiah high and then dropped back to around 9,800 rupiah. Considering how big Jupiter is, JUP’s price movement at the opening was quite disappointing.

At JUP launch, the Phantom wallet stopped working due to the number of people who wanted to buy and claim the airdrop. Solana's transaction numbers at the JUP launch were fairly stable at around 2,000 TPS and Solana is still working normally.

The charts above (from the top left) are ONDO, ALT, MANTA, and JTO. MANTA is the only asset that has managed to stay above its initial opening price. Meanwhile, JTO and ALT are undergoing significant corrections below their listing candles. ONDO is at a crucial support point and has the possibility of falling below the listing price. JUP’s movement seems to be more similar to ALT and JTO than MANTA.

Jupiter Roadmap and Potential Catalysts

Although the movement of the JUP token has been quite disappointing, we should not forget its position as the largest DEX in Solana. Jupiter controls almost 80% of the DEX market share in Solana. Furthermore, the Jupiter team has many plans to develop the Jupiter platform with new features.

Some of the projects that Jupiter is developing are Jupiter Labs and Jupiter Start. Labs is a project where Jupiter will work with DeFi protocols to create new features such as a new stablecoin in Solana. Meanwhile, Jupiter Start is a process to introduce potential new projects and launch them on Jupiter’s Launchpad.

The Jupiter team explained that Labs and Start will fully involve the Jupiter community from start to finish. A Jupiter DAO will be created for this involvement. So, JUP owners will be able to choose which projects to enter and various other aspects.

Finally, it has been decided that the JUP airdrop will be divided into 4 stages. The current plan is to airdrop every JUPUARY or January every year. This means that the next JUP airdrop will be in January 2025. If Jupiter manages to maintain its position until the next JUPUARY, Jupiter has the potential to become one of the largest protocols in Solana.

Conclusion

Jupiter is the largest DEX aggregator in Solana. By aggregating price data from various DEXs, Jupiter ensures its users always get the best price. Jupiter also offers various advanced features such as swaps, limit orders, DCA, and perpetual trading. The launch of the JUP token, while initially disappointing in terms of price, marks an important step in Jupiter’s evolution, with the promise of annual airdrops and plans to continue growing its ecosystem. As the DEX market leader in Solana, Jupiter is in a unique position to continue to grow and innovate, bringing added value to users and JUP token holders.

How to Buy JUP on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy JUP on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for JUP.

- Click buy and fill in the amount you want.

- Now you are a Jupiter investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Welcome | Jupiter Station

- Shaurya Malwa, “Solana Trading Aggregator Jupiter Sees Trading Volumes Jump Ahead of JUP Issuance”, CoinDesk, accessed on 30 January 2024.

- “JUP: The Genesis Post – $JUP Launch”, Jupiter, accessed on 30 January 2024.

- meow, “JUP PIE CATS Over the last week, as everyone in the world was hunting me for JUP updates, I must confess to being very inspired by this video instead”, X, accessed on 31 January 2024.

- Meow, “State Of Jupiter: Jupuary 2024 – $JUP Launch”, Jupiter, accessed on 1 February 2024.

Share