What Is Telegram Trading Bot?

Since the beginning of June 2023, a new trend has been slowly spreading among the crypto community. What started as a discussion among traders using the Telegram app soon transformed into a full-fledged phenomenon by July and created a new narrative. If you don’t know what this is, it’s the trading bot trend. The narrative about Telegram trading bot protocols is now rampant and many new protocols have emerged. So, what is a Telegram trading bot? Is it safe and how to use it? This article will explain.

Article Summary

- 📈 Since June 2023, the trend of trading bots on the Telegram platform has grown rapidly, especially after the launch of Unibot and Maestro.

- 🤖 Trading bots on Telegram are automated applications that trade crypto based on user instructions, making the process of buying and selling assets easier and faster.

- 📱 These bots have become popular thanks to three main factors: the large number of cryptocurrency investors on Telegram, the ease of trading experience compared to other platforms such as DEX and MetaMask, and the benefits to users.

- ⚖️ While these bots provide convenience, there are still security risks. Therefore, it is important to enable 2FA and use authenticators. In addition, users should separate their trading bot account from their main account to avoid risks.

- 🧠 The two most popular bots are Unibot and Maestro. Unibot has advanced features with a revenue-sharing scheme for UNIBOT token holders, while Maestro, despite launching first, has no token and so receives less attention from the community.

What is Telegram Trading Bot

A Bot is an automated software that performs repetitive tasks according to its user’s instructions. It can operate faster and more accurately than a human. The word bot itself stands for robot and has been increasingly used by internet users in recent years.

The Telegram trading bot trend was pioneered by Maestro Bots who tried to integrate a bot trading system into the Telegram messaging app. Unfortunately, Maestro did not get much attention from the community. The trend explodes when Unibot came along, which followed Maestro’s system and added some features along with a revenue-sharing scheme.

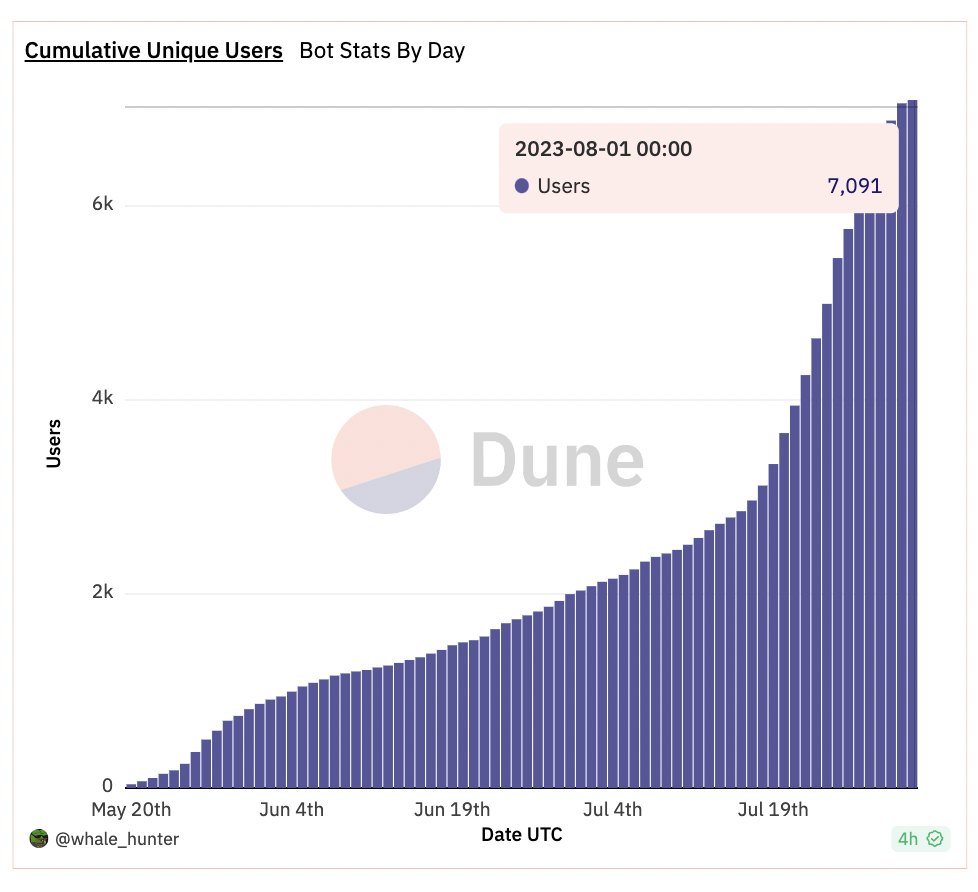

Basically, Telegram trading bots are bots in the Telegram app that you can instruct to trade cryptocurrencies in just one click. Most Telegram trading bots can buy, sell, copy trade, and even place limit orders. Currently, Unibot has 7,000 users. We should keep in mind that Unibt does this in just two months.

How Can Trading Bots Become So Popular?

So, why is this trading bot trend so popular? We can look at three factors that have influenced this trend.

First, Telegram is a messaging platform with 800 million users as of March 2023. Many trading communities and crypto users use Telegram to exchange messages. In addition, Telegram’s open-source platform is utilized by various trader groups to integrate crypto asset price alerts and scam-checking tools. Trading bots are an additional utility created by the development team.

Secondly, Telegram trading bots make trading easier. Compared to the complex DEX and MetaMask, you can purchase crypto with just one click. You don’t have to sign multiple times like in MetaMask and you also don’t have to go through the lengthy UX experience of UniSwap. Trading bots on Telegram make the decentralized crypto buying experience very easy.

Lastly, many bot trading protocols provide additional benefits to users. Some protocols have revenue-sharing schemes, discounts on transaction fees, and potential speculative gains from their respective tokens. These protocols can provide additional incentives while giving traders a quick and easy trading tool.

How Does Telegram Trading Bot Work?

When you use trading bots, you still buy the asset through DEX such as UniSwap as they have the largest liquidity. Trading bots on Telegram just replace the UI and UX of Web3 wallets like MetaMask and DEXs like UniSwap. With this, you don’t have to deal with the complex process of buying crypto assets in a decentralized manner.

Each trading bot has its own look and feel but they all serve the same purpose: to make your trading experience easier. The main function of most telegram bots is as a protocol for sniping or buying tokens instantly to give you an edge over other traders.

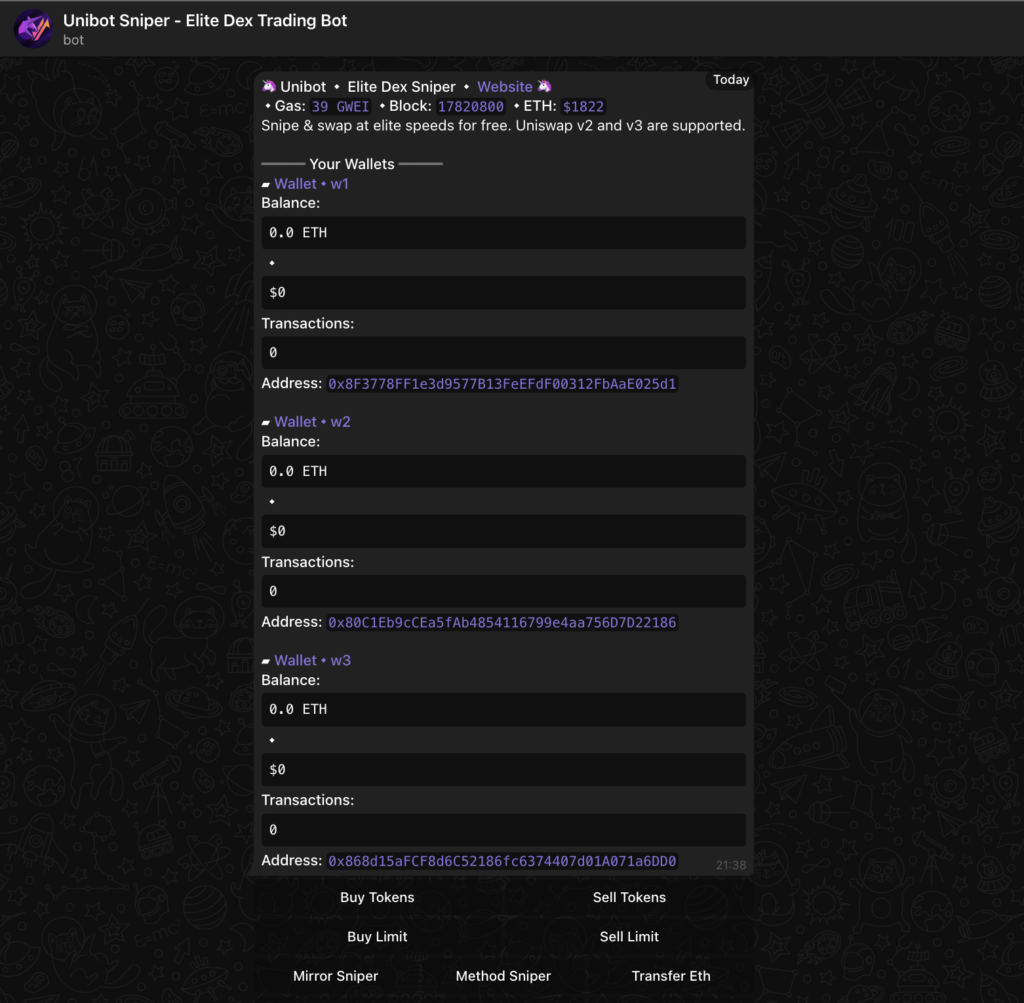

When you first open your trading bot, you will be given a new wallet address specifically for Telegram. You can replace this address with another MetaMask address. However, it’s best to keep your trading bot account separate from your main account to manage security risks.

You can start trading after filling your new wallet with crypto (usually ETH). Next, you can simply select buy tokens as shown above. You will be prompted to enter the contract address of the token you wish to buy (each token has its own contract).

Always copy the contract address from the official website! Check out sites like Dextools, Dexscreener, and CoinMarketCap/CoinGecko to prevent phishing links.

After entering the contract address, the trading bot will process your transaction and consider gas fees. With just two clicks, you can buy an asset without using CEX. Compare this experience to using UniSwap and MetaMaask which will require you to process three signatures and determine the transaction gas fee. This is the main reason why many people consider trading bots on Telegram a significant innovation.

About Security and Hacking Risks

- The private key of every cryptocurrency address on Telegram is encrypted using industry-standard encryption (AES512) and is not stored on any website.

- The security of trading bot encryption depends largely on how you secure your Telegram account. Make sure you enable 2FA and utilize authenticator apps like Google.

- You can directly transfer your Telegram wallet address to MetaMask and vice versa. Utilize this feature to remove your wallet from Telegram and keep it more secure in MetaMask.

- Digital wallets on Telegram are a type of hot wallet with high risks. Don’t keep all your assets in one place!

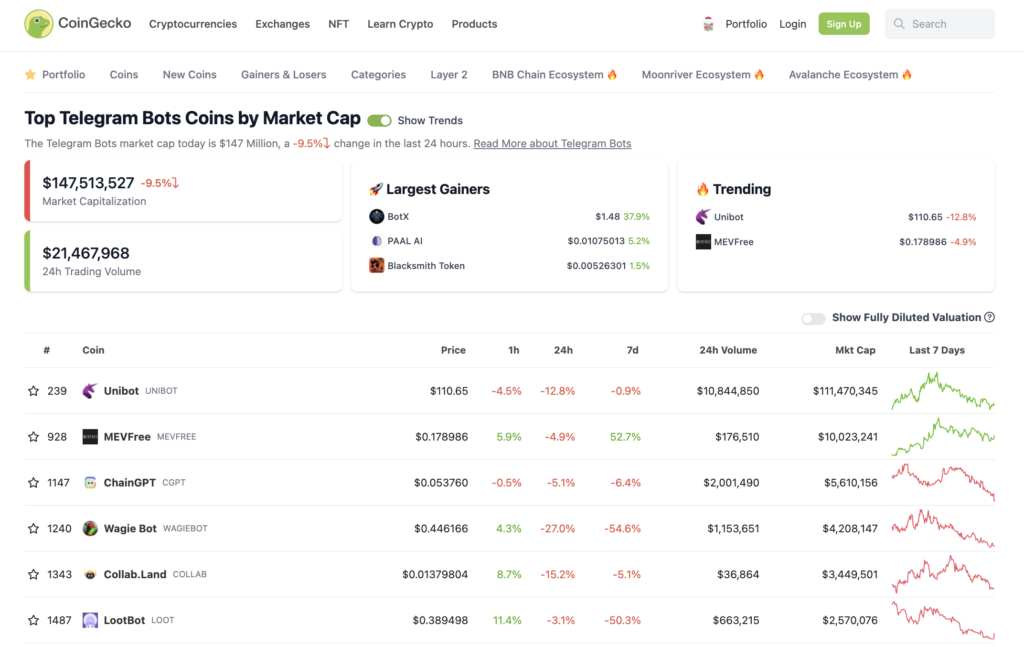

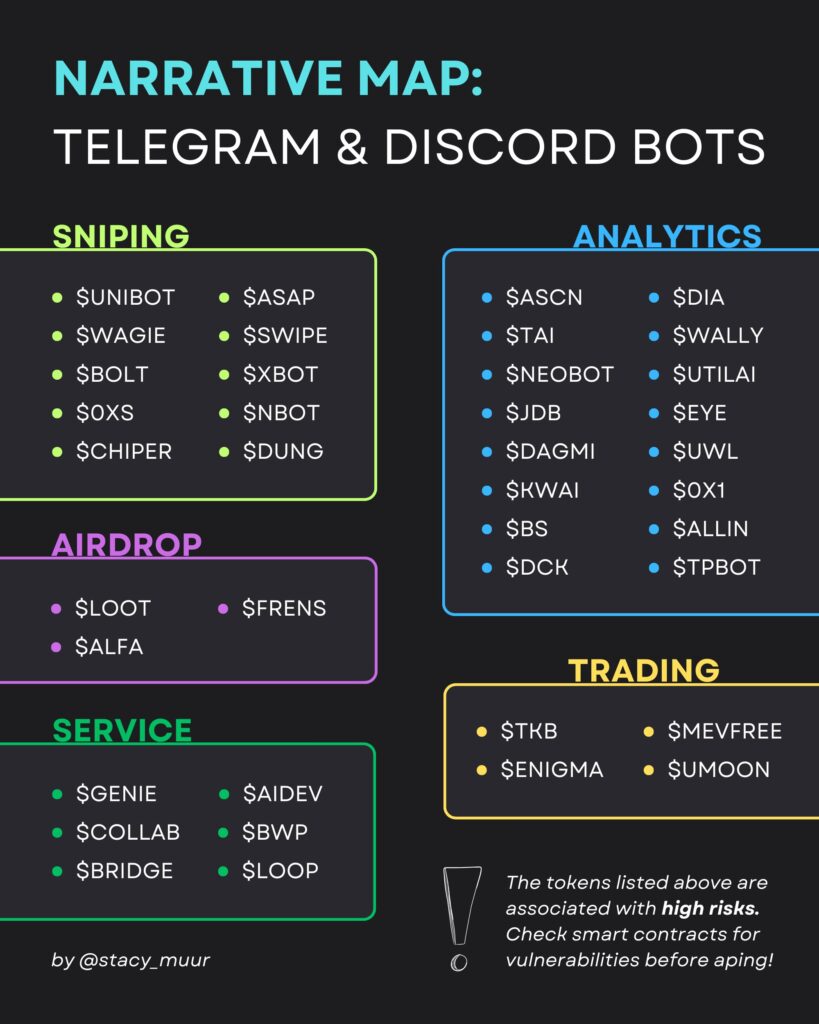

Overview of the Telegram Trading Bot Ecosystem

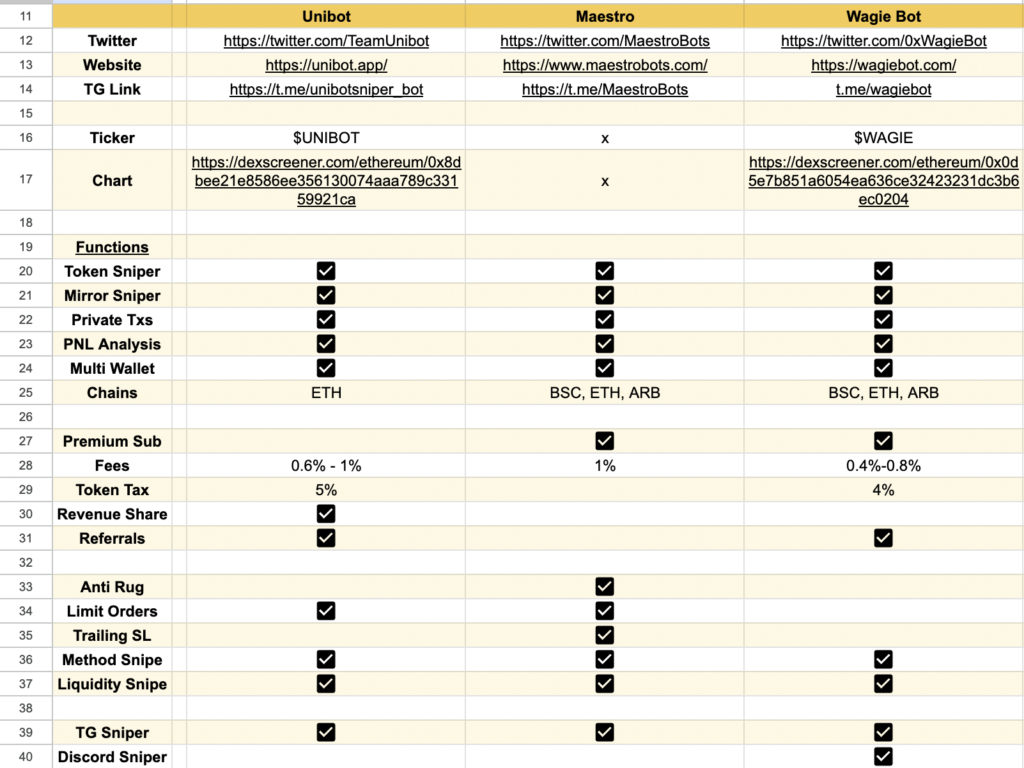

1. Unibot

Unibot is a Telegram trading bot protocol that started this trend. Users can use the Unibot protocol to trade on the Ethereum network. Currently, Unibot is the trading bot with the highest market capitalization of $132 million dollars. Unibot also has a very small total token supply of 1 million UNIBOT. This is the reason why the price of 1 UNIBOT is quite expensive at $127 dollars (as of August 2, 2023). In addition, the token gains more than 1000% within 2 months.

The features of Unibot are DEX sniping, mirror sniping (copy trading), profit-loss analysis, private swap, limit order, and MEV protection. As shown in the image below, Unibot users are steadily increasing. Unibot is currently the most popular trading bot. In addition, Unibot is also planning to launch Unibot X, a suite of premium features suitable for experienced traders. Unibot X is still in the testing phase and the most active users on Unibot can participate in this test.

In addition, one of the advantages of Unibot is the revenue-sharing scheme for UNIBOT token owners. UNIBOT token owners will get 40% of the transaction fees and 20% of the token tax. In addition, you will also get a discount on protocol transaction fees if you own 50 UNIBOT and use referrals to others.

Finally, Unibot is the largest Unibot protocol because it provides a cutting-edge trading experience and an easy-to-use interface. The Unibot team is also able to add various features and updates at a fast pace.

2. Maestro

Maestro Bots is the first trading bot protocol. Users can use Maestro to trade on the Ethereum, Binance Chain, and Arbitrum networks. Currently, Maestro does not have a token and has not announced plans to launch one. This is one of the reasons why Unibot was able to beat Maestro despite Maestro’s earlier launch.

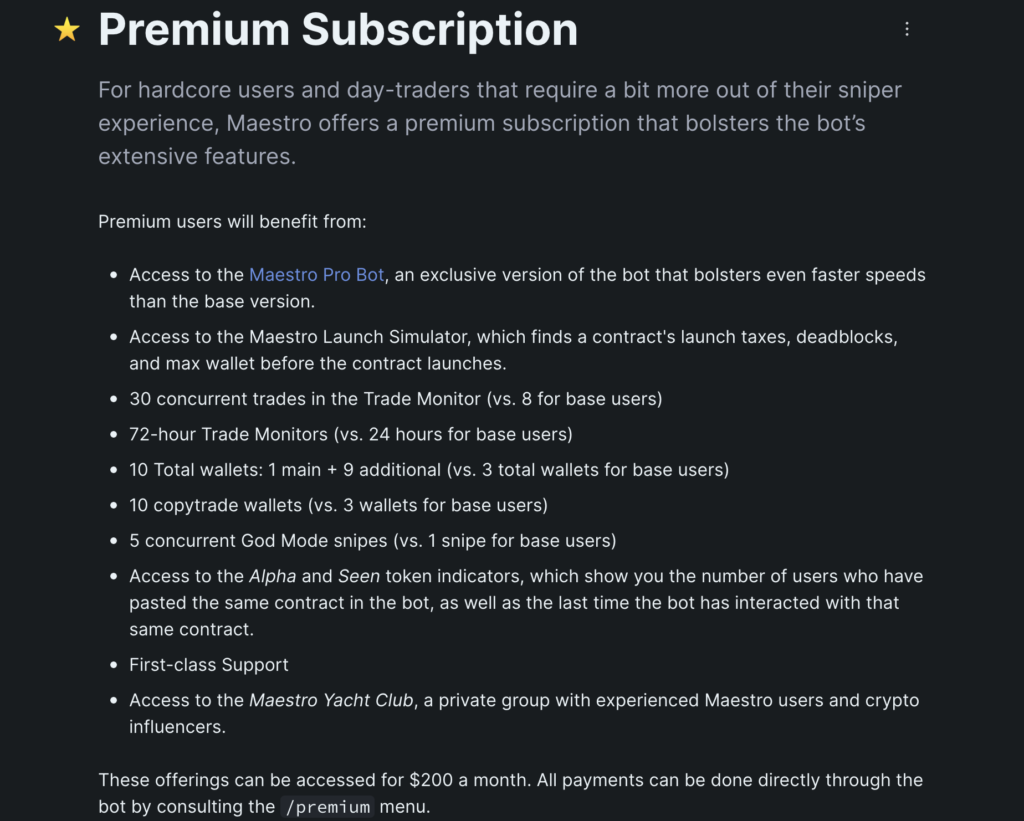

Instead of launching tokens, Maestro has a subscription model for users to access Maestro’s advanced features. Maestro’s subscription fee is $200 per month which will give you access to features such as faster bot transaction processing, 10 Telegram wallet addresses, 10 god mode snipe, and more. Maestro also charges a 1% transaction fee.

Additionally, Maestro has many features that Unibot lacks. Some of these include a bot to buy presale of projects that are about to launch, god mode snipe that will execute transactions much faster without the risk of MEV and sandwiches, and a whale tracker.

3. Wagiebot

Wagiebot is a trading bot protocol that followed Unibot in popularity. However, Wagiebot has various features that even Unibot does not have. It is actually one of the fastest trading bots as it has its own private nodes on the Ethereum, BNB Chain, and Arbitrum networks. In July, WAGIE managed to gain 6,762%. The current price of WAGIEBOT is $0.3 as it has declined by 70% in the last seven days.

The features of Wagiebot are almost similar to Unibot and Maestro in that it provides multi-wallet features, sniping, MEV-resistant orders, and even DCA strategies. In addition, Wagiebot integrates with the GMX trading platform so you can do perpetual trading directly on Telegram. Wagiebot also plans to create a trading bot on Discord and this is their goal after adding some features on Telegram.

The main function of the WAGIEBOT token is to give users a discount on transaction fees on Wagiebot. The Wagiebot discount system has tiers, the more you own WAGIEBOT, the bigger discount you will get. You will also benefit from more trades that can be executed simultaneously and more wallets.

Wagiebot has the advantage of more advanced technology and features than Unibot. However, as we know, the popularity of a crypto protocol does not depend solely on its technology.

Conclusion

Since June 2023, a new trend has emerged among the crypto community: the use of Telegram as a trading platform. These bots are automated software that perform repetitive tasks according to their users’ instructions and can operate faster and more accurately than humans. Trading bots have become popular due to their ease of use, efficiency, and profit potential.

Despite its initial lack of attention, Unibot, an example of a Telegram trading bot, has become popular because it is easy to use and has a profit-sharing scheme. There are three factors that have influenced this trend: the popularity of Telegram as a messaging platform, the ease of use of trading bots compared to other platforms, and the profits offered by these bots. Despite the security risks, trading bots on Telegram promise to revolutionize the way we transact crypto assets.

References

- “To Bot or Not to Bot? Will Trading Bots Kill Perp Dexes?,” Blocmates, accessed on 1 August 2023.

- @CJCJCJCJ_, “Everyone’s writing threads on the Telegram Bot narrative, but do you still dig left and right for a comparison,” Twitter, accessed on 1 August 2023.

- @Dynamo_Patrick, “The crypto industry runs on Telegram. And this has translated to massive success for Telegram trading bots recently,” Twitter, accessed on 1 August 2023.

- @stacy_muur, “Telegram bots are a frenzy. Allow me to present my ultimate thread: → a compilation of the most trending bots,” Twitter, accessed on 2 August 2023.

- @2Lambro, “30m → 140m mcap in 30 days Is telegram bots just a meme? (safemoon) Does $unibot justify 140m mcap bigger,” Twitter, accessed on 2 August 2023.

- @TheDeFinvestor, “A new hot narrative is brewing in DeFi. Telegram bots are popular, with $UNIBOT being up,” Twitter, accessed on 2 August 2023.

Share