What Is Terra (LUNA)?

The digital payments industry is one of the fastest-growing sectors in Asia with multiple big players such as Apple Pay, Samsung Pay, Kakao Pay, Alipay, and more than 45 others. In Indonesia, large companies such as GoTo, Shopee, and Dana have their own digital payment systems. In cryptocurrency, Terra is one of the digital payment projects that utilize blockchain technology. Then, what is Terra ? How does it work and why is it often called a stablecoin factory? This article will cover all aspects of Terra.

Summary

- 🌏 Terra aims to create a decentralized stablecoins ecosystem using blockchain technology

- 🌕 LUNA is a cryptocurrency with a deflationary value that acts as a counterbalance to keep Terra’s stablecoins price stable

- 💸 Terra’s financial ecosystem provides many options for users to compound their assets with generous interest rates.

Definition of Terra (LUNA)

Terra is a blockchain network that aims at creating a decentralized digital payments ecosystem using a type of cryptocurrencies known as stablecoins. Stablecoins are crypto-assets pegged to fiat currencies with a 1:1 value. The most popular stablecoin asset within Terra is TerraUSD (UST). In addition, Terra is a blockchain with smart contract capabilities that can support its own DApps ecosystem.

💡 Stablecoins are basically fiat assets built on blockchain. So, 1 UST is equivalent to $1 dollar, 1 TerraKRW (KRT) is equivalent to 1 Korean Won, etc.

The native cryptocurrency of the Terra network is LUNA. According to Coinmarketcap, Terra has a market cap of $27 billion dollars at a price of $100 dollars per 1 LUNA (December 2021). This figure places Terra as the 9th largest cryptocurrency in the world. LUNA does not have a maximum supply amount because its supply always adapts to the number of stablecoins in circulation, acting as a counterweight to balance the value of stablecoin.

History of Terra

Terraform Labs was created by Do Kwon and Daniel Shin in South Korea in 2018, and they began developing Terra shortly after. Kwon was a staff member at Microsoft while Shin is the founder and CEO of payment technology company Chai and the founder of Korean e-commerce company TMON. The vision of the Terra project is to create an infrastructure to drive the massive adoption of digital payments utilizing blockchain technology.

Terra was created as a payment solution in a volatile financial ecosystem that surrounds the cryptocurrency world. Through the use of stablecoins, Terra provides assets with the stability of fiat money but is decentralized and utilizes the security of the blockchain network. Currently, Do Kwon, the CEO of Terraform Labs, is in charge of the operation and the development of the Terra project.

How Terra works

In Terra’s mission to create blockchain-based digital payments, it issues assets that are pegged to fiat money including TerraUSD (UST) as its most popular asset. Unlike USDT and USDC, Terra’s Stablecoin is not backed by dollars, Korean won, or other fiat currencies. Instead, Terra issues an algorithmic stablecoin like UST backed by Terra’s native token, LUNA.

Terra keeps the UST price-stable with the dollar through LUNA token burning. LUNA holders can exchange LUNA for UST or other stablecoins. LUNA exchange and burn system benefits UST as well as LUNA because the supply of LUNA will continue to decrease as UST usage increases (making LUNA increasingly scarce). The Terra algorithm reads the supply of LUNA tokens to decide to either contract or expand the pool depending on the demand for UST and other Terra stablecoins.

💡 For example, the demand for UST is on the rise, Terra’s algorithm recognizes this and provides an incentive in a system called Seigniorage to convert LUNA into UST. On the other hand, if there is too much UST supply, Terra’s algorithm provides incentives to users to convert UST into LUNA. The amount of incentives awarded is decided by the algorithm and is shared between the user and the Terra community fund pool.

Also read: What is a Stablecoin?

Apart from the interaction between LUNA and UST, Terra itself is a blockchain platform that uses a proof-of-stake system. This means that you can stake LUNA in Terra’s network. In addition, Terra also has smart contract capabilities and can be the foundation for creating its own DeFi ecosystem. This fact adds to the value of Terra as a project with multiple utilities and use cases.

What makes Terra unique?

- 💸 LUNA deflationary nature: As a crypto asset, LUNA has a unique role because its supply will continue to decrease when converted to stablecoin. In theory, this will cause LUNA’s price to increase in the long-term

- 🏭 Stablecoin Factory: Terra’s main function is to create various stablecoin assets that can be used for digital payments. Currently, no other blockchains are capable of this

- 💳 Digital payment using blockchain: Various stablecoin assets of Terra will be used in payments utilizing blockchain technology.

What can you do with LUNA?

Converting to UST

LUNA, like other crypto assets, has fairly high volatility because its price fluctuates following the market trends in cryptocurrencies. Therefore, when the market is in a bear market, you need to secure your crypto assets to an asset with a stable price. This is where stablecoins have an important role. You can store your money in UST to diversify your asset, buy the dip, or avoid loss in a bearish market. If you already have LUNA, you can convert it directly into UST.

This diversification method is very important when market conditions are volatile every day. Many experienced crypto traders and investors use stablecoins as risk management.

Staking

Terra is a blockchain with a PoS algorithm that allows you to stake. Staking is one of the simplest ways to earn passive income from your crypto assets. According to Stakingrewards, you will earn about 8% interest when staking in the Terra network.

You can stake directly on the Terra site or look for a third party that provides validator services where you can deposit your LUNA. Always make sure you deposit your assets to a trusted validator because the network can slash your asset if the validator fails to validate transfers. Staking helps secure the Terra network as a whole and you earn interest on all transactions within the blockchain.

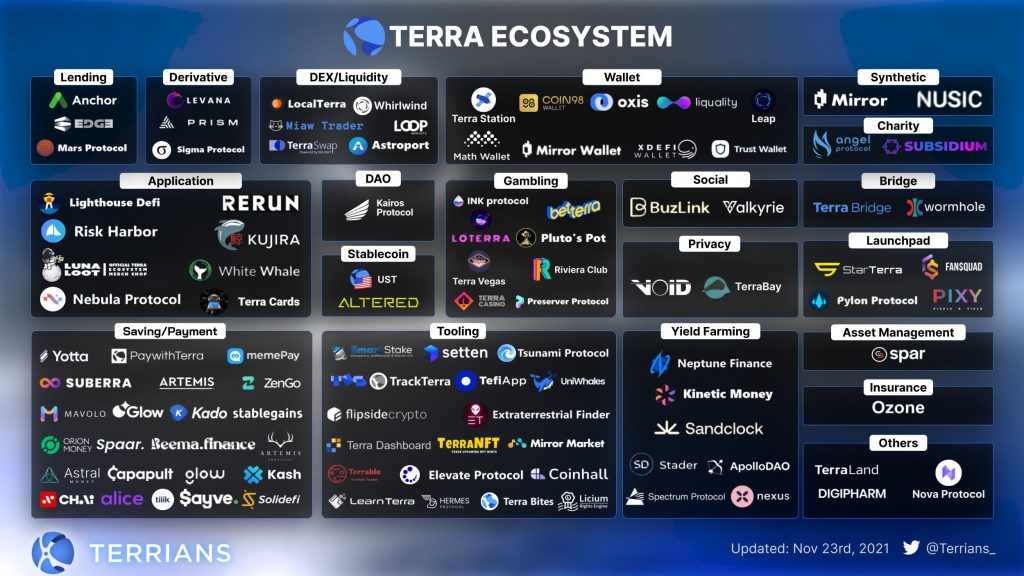

Using DeFi in Terra ecosystem

The decentralized finance sector is the largest DApps industry within the Terra network. The ecosystem provides a wide variety of lending applications, DEX, AMM, and Yield farming. Terra has a collection of DeFi applications that you can use to earn passive income. In December 2021, Terra managed to surpass Binance in total value locked (TVL), making it the 2nd largest DeFi industry after Ethereum. Terra’s 13 projects have a total of $18.2 billion dollars in their TVL. Anchor is the DeFi app with the largest TVL worth $7.7 billion dollars.

Here are some popular DeFi apps in Terra:

- Anchor Protocol: Application for lending and depositing stablecoin assets from Terra. The app offers a fairly high-interest rate of around 20%. Anchor Protocol is the biggest DeFi application in Terra and it has low risk.

- Mirror Protocol: This application allows you to own various crypto assets as well as conventional assets such as shares in the form of Massets. For example, MAPL for Apple stock.

- TerraSwap: TerraSwap is a decentralized exchange (DEX) on top of the Terra network for exchanging various crypto assets

- Astroport: Astroport is a combined application of DEX and automatic market makers (AMM) that you can use to earn passive income and become a liquidity provider for DEX Astroport

LUNA as investment

LUNA has various functions in the Terra blockchain network including as governance token, staking, DApps transaction fees, and also in balancing Terra’s various stablecoin assets. So, these functions provide a great incentive for Terra users to hold and use their LUNA. This makes LUNA a good investment because it continues to rotate in the Terra ecosystem. In addition, the token burning system when converting LUNA to stablecoin and vice versa keeps reducing the supply which makes it deflationary.

According to a price chart from Coinmarketcap, LUNA experience an increase of more than 7000% in 2021. This increase happens because of the launch of the network in early 2021 and followed by an increase in the popularity of its ecosystem in late 2021. UST’s growing market capitalization and LUNA’s community also helped LUNA prices have increased. In addition, the Terra DeFi industry continues to grow with a TVL increase of almost 42,000% compared to December 2020.

However, one of the concerns about stablecoins is government regulation in many countries. Elizabeth Warren, one of the senators from the United States, says that stablecoin is a threat to its users and the country’s economy. Sentiment like this raises concerns about the future of stablecoins. In addition, the commitment of many countries to create a CBDC (Central Bank Digital Currency) to compete with stablecoins also creates competition for Terra who wants to be a digital payment solution.

Buying LUNA

You can start investing in Terra by buying LUNA in the Pintu app. Through Pintu, you can buy LUNA and other cryptocurrencies in an all-in-one convenient application.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

References:

- Cryptopedia staff, Terra’s Crypto Stablecoin Ecosystem and LUNA Coin, Gemini, accessed on 16 December 2021

- Investopedia, Terra Definition, Investopedia, accessed on 16 December 2021

- Terra Money, Terra Money – Introduction, accessed on 17 December 2021

- Shrimpy, What Is Terra (LUNA)? Terra DeFi Blockchain Explained, Shrimpy, accessed on 20 December 2021

Share

Related Article

See Assets in This Article

LUNA Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-