What is Unibot? Features, Future, and Why You Should Try It

Since the end of May 2023, the trend of trading crypto asset bots on the Telegram messaging app has exploded. Many Telegram trading bot projects have emerged to provide a decentralized trading experience that is much easier than on the DEX. Unibot is one of the most popular trading bot apps with over a thousand users every day. So, what is Unibot? What are the advantages of using Unibot for trading? This article will discuss them in detail.

Article Summary

- 🤖 The trend of crypto trading bots on Telegram has increased sharply since May 2023. Unibot, the most popular among trading bots, enables decentralized trading directly through Telegram with faster transactions and an easier experience.

- 🚀 Despite competition from Maestro Bots and Banana Gun Bot, Unibot excels in transaction volume and protocol revenue.

- 🧠 Unibot continues to be innovative by launching new products and features, such as Unibot X and the integration of Friend.tech account trading features.

- ⚖️ With a market capitalization still under $200 million, the bot trading sector has huge growth potential, with the possibility of rivaling traditional DEX usage.

What is Unibot?

Unibot is a trading bot that allows you to make decentralized trades from the Telegram messaging app. With Unibot, you don’t have to search for DEX like UniSwap or PancakeSwap. All you have to do is open the Unibot app inside Telegram, fund it with ETH, and you can buy any token on Ethereum.

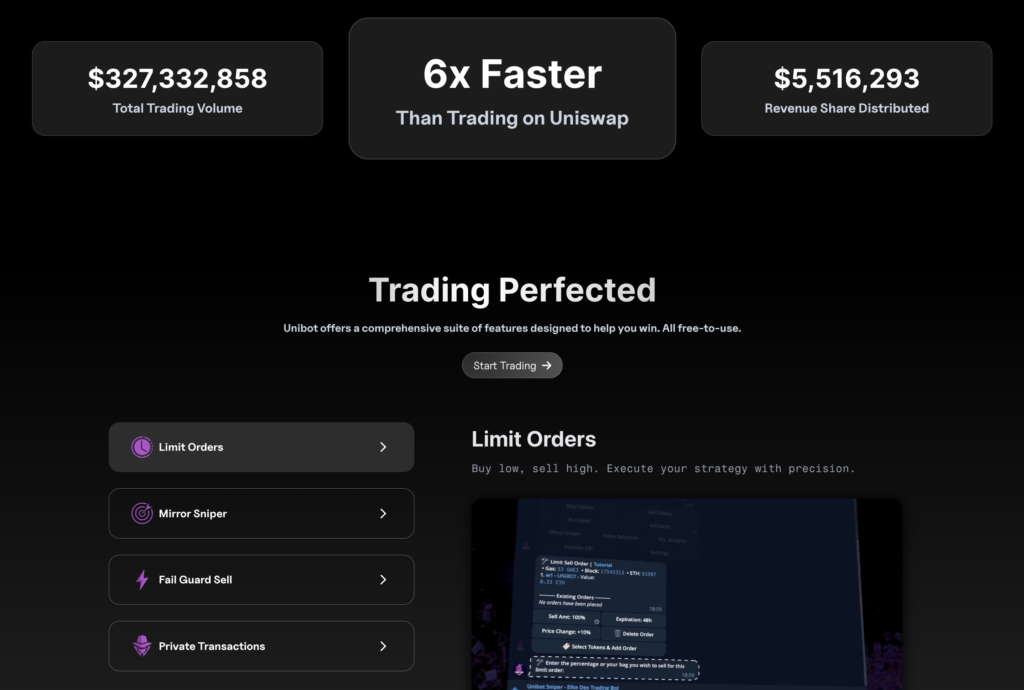

Trading bots on Telegram have suddenly become popular because they offer several advantages over regular DEXs:

- Easier experience without going through the long process in MetaMask.

- Faster trading (Unibot is 6x faster than UniSwap).

- Protection from MEV.

- Protection against transaction failure.

- Advanced trading features such as limit orders and sniping.

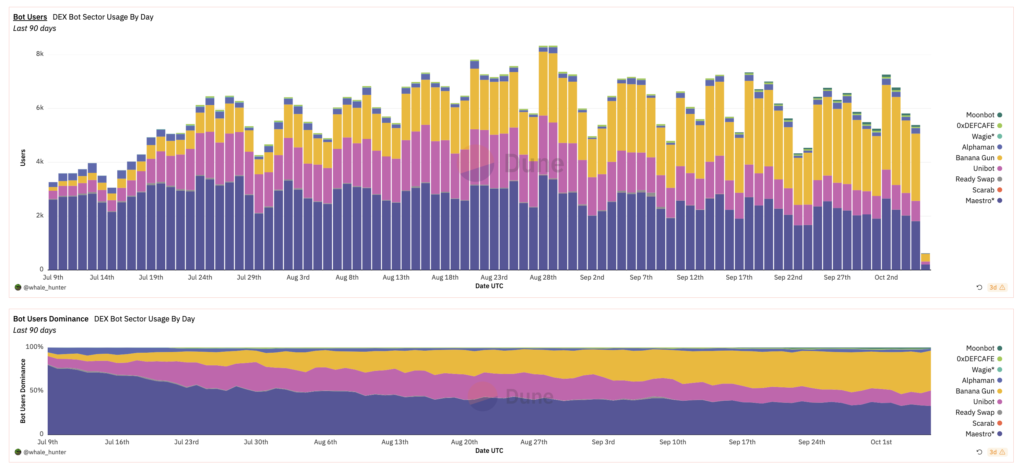

Currently, Unibot ranks 3rd in the trading bot sector based on average daily users. Unibot has an average daily user of 926, while the first position is held by Maestro Bots with 1,242 and followed by Banana Gun Bot with 1,187. However, Unibot leads in total transaction volume and protocol revenue. Unibot collected 9,015 ETH in revenue within 4 months and process $361 million dollars worth of transactions.

How Unibot Works

Unibot facilitates transactions by interacting directly with a token pair’s contract address. For example, the contract address of the USDT/USDC token on UniSwap V3 is 0x7858e59e0c01ea06df3af3d20ac7b0003275d4bf.

Unibot will directly interact with that contract address for buying and selling. This makes all Unibot trades much faster than through UniSwap. Unibot charges a 1% transaction fee for all users (you can get a discount if you have UNIBOT tokens).

If you buy on UniSwap using MetaMask, you have to go through an extra 2-4 steps for the wallet approval process from searching for tokens, and approving assets, to approving gas fees. With Unibot, you only need to specify the token you want to buy, enter the amount, and buy it all within seconds. Unibot simplifies the buying process and enables faster trading.

All private keys of the Unibot wallet are not stored by Unibot and are fully controlled by the user. Unibot explains that the wallet keys are stored using a state-of-the-art encryption system. You can also move your Unibot wallet to MetaMask and vice versa. However, always assume that your wallet on Unibot are hot wallet.

Unibot Features

1. Multi-Wallet Swap

When you first open Unibot, you will automatically have three wallets that you can fill and use. So, you can use all three wallets simultaneously to buy crypto. This increases speed and efficiency for expert traders.

2. Limit Order

Unlike UniSwap and most other DEXs, Unibot supports limit orders right within the app. A limit order is a trading feature where you can automatically buy an asset price at a certain amount. This feature is especially useful for experienced traders.

3. Copy Trading and Method Sniper

Copy trading is a feature that allows you to copy trades from other people’s wallets (usually whale wallets or traders who are considered experts). You need to enter the address of the wallet you want to copy and set the maximum amount you will spend on copy trading.

Method sniper is a feature where you can automatically buy newly launched tokens. You just need to add the token address and Unibot will automatically buy the token when the token pool is created. This feature is especially popular for memecoin traders.

4. Token Monitoring and Sniping

Unibot has a Scanner that tracks every newly created ERC-20 token. This token monitoring feature is directly related to the sniping feature and allows you to snipe newly launched tokens.

5. Fail Guard

The fail guard feature ensures that all transactions you will make are successfully executed. Fail guard performs a simulation first before executing the trade. That way, Unibot prevents you from wasting your gas costs and assets due to slippage errors or incorrect gas.

6. Private Transaction

Private transactions hide your transactions from MEV (Maximal Extractable Value) bots and sandwich attacks that might harm you. This is especially useful if you trade large amounts of money or suspect your account is being monitored by various bots.

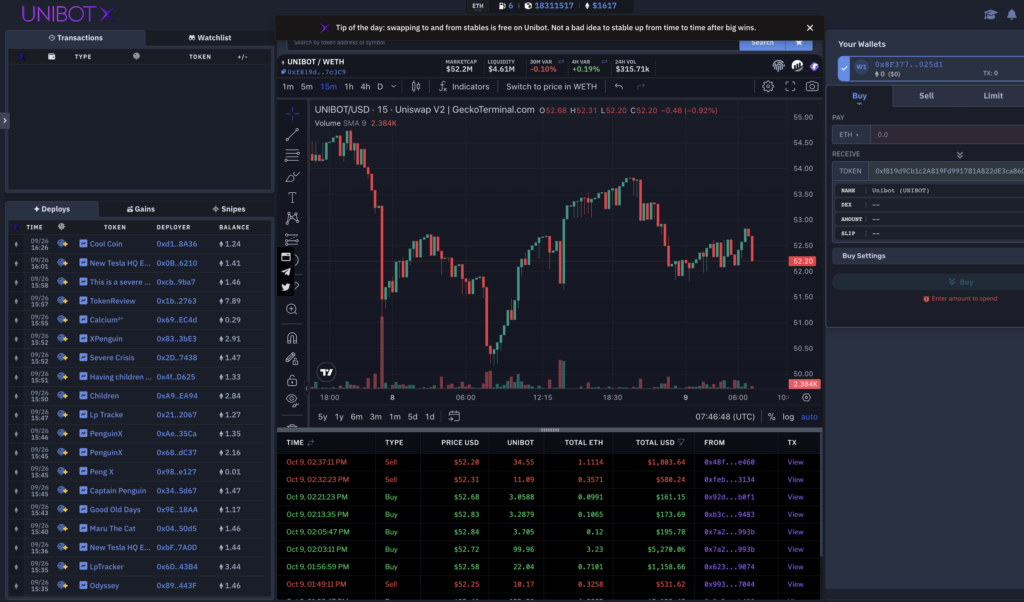

7. Unibot X

Unibot X is the latest product by Unibot that provides an alternative way of trading. Instead of trading in the Telegram app, you will have access to Unibot in your browser. As pictured above, the interface is very similar to CEX or perpetual DEXs like GMX.

Unibot X provides a more advanced trading experience and interfaces suitable for expert traders. You can access the feature on the Telegram app which will give you access after authenticating your Unibot wallet.

How to use Unibot

Here are the steps to start using Unibot:

- Download the Telegram app if you don’t already have it. You can download the messaging app on your mobile phone or computer.

- Open Unibot website in your browser.

- Click the “Start Trading” button on the Unibot website which will connect you to Unibot on Telegram.

- Choose “Open Telegram Desktop.” You will be redirected to Unibot in your Telegram app.

- Click “start” or enter /menu in your Unibot chat room.

- Send ETH to your wallet on Unibot or use the import wallet feature if you want to use an existing wallet.

- You can now use Unibot to trade!

UNIBOT Token Use Cases

The UNIBOT token was launched on 17 May through a fair launch system where all of its token supply was instantly minted without being distributed to anyone. The token has a supply of 1 million and has a 5% trading tax for UNIBOT (1% distributed to LPs, 1-2% to token holders, 2% to the team).

This token trading tax system is quite controversial but it is done because Unibot does not have investors, airdrops, or other types of fundraising.

So, what are the main advantages of owning UNIBOT tokens? Apart from speculation and investment, token holders will get a discount on transaction fees (maximum 50% discount if you have 1000 UNIBOT). You will also get 40% of Unibot’s profits and 2% of the total transaction volume if you have at least 10 UNIBOT (revenue sharing system).

These two mechanisms are great incentives that attract many people to buy UNIBOT tokens.

The Future of Unibot and Telegram’s Trading Bot Sector

The Telegram trading bot sector is currently very competitive. As in the image above, Banana Gun Bot (yellow color) which just launched its own token suddenly took a huge market share from the two leader protocols namely Maestro (purple) and Unibot (pink). Banana Gun dominates the bot trading sector with 45.7%, followed by Maestro (33%), and Unibot (17.7%).

While Maestro and Unibot have many advanced features that Banana Gun lacks, Banana has the better token sniping speed of the two. Banana Gun is proving to be very popular for traders who are frequently sniping newly launched tokens.

Many in the community believe that Unibot will become a leader in this sector because the Unibot team is so quick to release new features and products. Within four months, Unibot had already released the Unibot X product, integrated the Friend.tech account trading, and built a gas mode selection feature.

With the trading bot sector still in its infancy, the leader of the sector is yet to be ascertained. Trading bot projects are competing to offer various advantages to compete with their competitors. With a total market cap still under $200 million dollars, the sector has very high growth potential. It is not impossible for trading bots to even rival traditional DEX usage in the future.

Conclusion

Since May 2023, the trend of trading bots for crypto assets on Telegram has increased rapidly. Unibot is one of the most popular trading bot apps, allowing decentralized trading directly through Telegram. Unibot offers a number of advantages compared to DEXs, such as easier usage, protection from MEVs, features like limit orders, and more.

Although Unibot has competitors in this sector, such as Maestro Bots and Banana Gun Bot, they remain a major player with high total transaction volume and protocol revenue. The use of trading bots is gaining popularity due to its convenience, and the sector is expected to continue to grow and may even rival the use of traditional DEXs.

How to Buy Cryptocurrencies on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Jack Pahor, “UNIBOT- Free Research Report”, Substack, accessed on 9 October 2023.

- Game Tramble, “Unibot: The Telegram Uniswap Sniper”, Shoal Research, accessed on 9 Oktober 2023.

- Alex Lielacher, “[Unibot: A Comprehensive Guide to the Telegram Bot](https://beincrypto.com/learn/unibot-guide/#:~:text=Unibot will execute trades on,trading pairs on Uniswap V3.)”, Bein Crypto, diakses pada 9 October 2023.

- @whale_hunter, “Unibot Revenue”, Dune Analytics, accessed on 9 October 2023.

- @whale_hunter, “Dex Trading Bot Wars”, Dune Analytics, accessed on 9 October 2023.

Share