Behind the Calm Price Action, Here Are 3 Reasons Bitcoin Still Has Upside Potential

Jakarta, Pintu News – At first glance, the price of Bitcoin appears stagnant. In the last 24 hours, the price movement has barely changed, dropping only 0.2%. Even on a weekly basis, Bitcoin is only up about 0.7%. The market feels calm, with many traders calling this action range-bound. However, below the surface, some signals suggest that Bitcoin is not as weak as it appears.

Momentum is slowly shifting, sellers are losing confidence, and large holders continue to position silently. These factors explain why Bitcoin’s bullish price predictions made by experts like Tom Lee are still holding up, although there has been no breakthrough.

Momentum and Volume Signals Quietly Improve

On the daily chart, Bitcoin price continues to respect the $90,100 level. This zone has acted as a strong base during the last volatility, preventing a deeper drop even though the price failed to trend higher.

One of the most obvious early signals comes from On-Balance Volume (OBV). OBV tracks whether volume is flowing in or out of an asset, helping to identify hidden buying or selling pressure. OBV shows an increase in volume coming into Bitcoin, signaling accumulation that is invisible to many market participants.

This is a positive indicator that often precedes price increases. If this trend continues, we could see further increases in the Bitcoin price in the near future.

Read also: Will Shiba Inu Still Survive in 2026? On-Chain Data Answers

Holders and Whales Positioned Despite Stagnant Prices

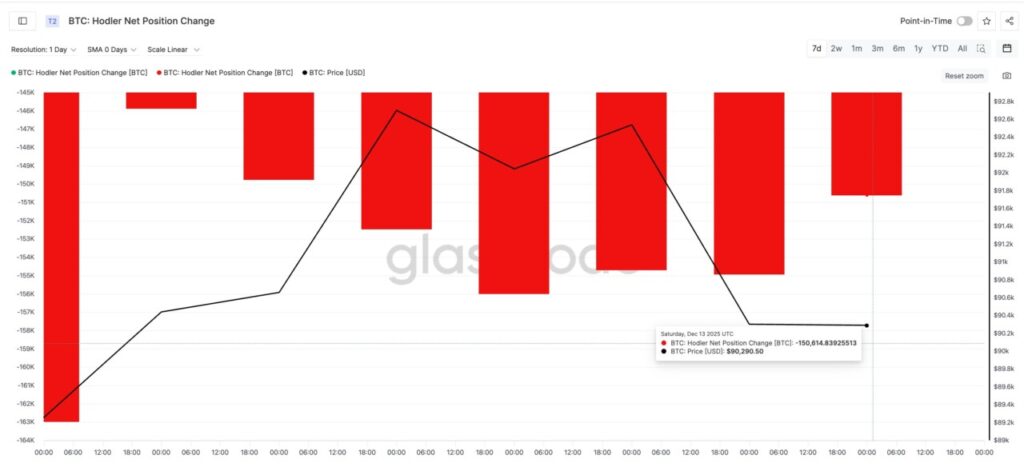

Momentum signals alone are not enough. On-chain data provides additional confirmation. Net Change in Holder Position tracks whether long-term holders increase or decrease their Bitcoin position. Negative values mean selling. Fewer negative values mean selling pressure is easing.

The strongest signal came from the pope. The number of entities holding at least 1,000 BTC remains close to its six-month high. This metric often reflects large, long-term investors. Their presence in large numbers indicates confidence in Bitcoin’s long-term prospects, even though the current price appears stagnant.

Also read: Bitcoin Price Prediction: Will BTC Remain Stagnant Until January 2026?

Bitcoin Price Levels that Determine Whether the ‘Bull’ Takes Over

For Bitcoin to turn this signal into action, price confirmation is required. The most important level remains $94,600. A daily close above this zone would mark an increase of about 5% from current levels and would break the upper limit of the current compression structure. That would signal that buyers have gained short-term control.

If $94,600 is exceeded, the next resistance lies near $99,800. A sustained move above that level could pave the way towards $107,500, if broader market conditions permit. That could be the first catalyst for Tom Lee’s aggressive view of $180,000, as stated earlier.

Conclusion

Although the market appears calm and the Bitcoin price is stagnant, indicators below the surface point to untapped potential. With improving momentum and volume, as well as strong positions from large holders, there are strong reasons to remain optimistic about Bitcoin’s price prospects. Investors and market watchers should pay attention to these signals as key indicators of possible price movements.

FAQ

Why does the Bitcoin price look stagnant at the moment?

As Bitcoin is still moving in a narrow range with low volatility, although internal indicators point to accumulation.

What does the increase in On-Balance Volume (OBV) mean for Bitcoin?

A rise in OBV signals an increased flow of buying volume, often signaling the start of accumulation before prices rise.

Are Bitcoin whales still active when the price isn’t moving?

Yes, the number of addresses holding at least 1,000 Bitcoin remains high, indicating large holders are still in position.

What price levels are most important for bullish confirmation?

A daily close above $94,600 is considered crucial to confirm buyers’ control in the short term.

Do current conditions support a long-term bullish view?

Momentum, volume, and on-chain data show that the market structure still supports a bullish outlook although prices have not moved significantly.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Tom Lee Bitcoin Prediction Analysis. Accessed on December 15, 2025

- Featured Image: Generated by Ai