US CPI Data to be Released on January 13, 2026, What Impact on Crypto?

Jakarta, Pintu News – US inflation data to be released next week is expected to have a significant impact on the Bitcoin and other cryptocurrency markets. The release of this data is crucial as it will be taken into consideration in the upcoming January FOMC meeting, which could influence the interest rate decision by the Federal Reserve (Fed).

The Influence of Inflation Data on Fed Policy

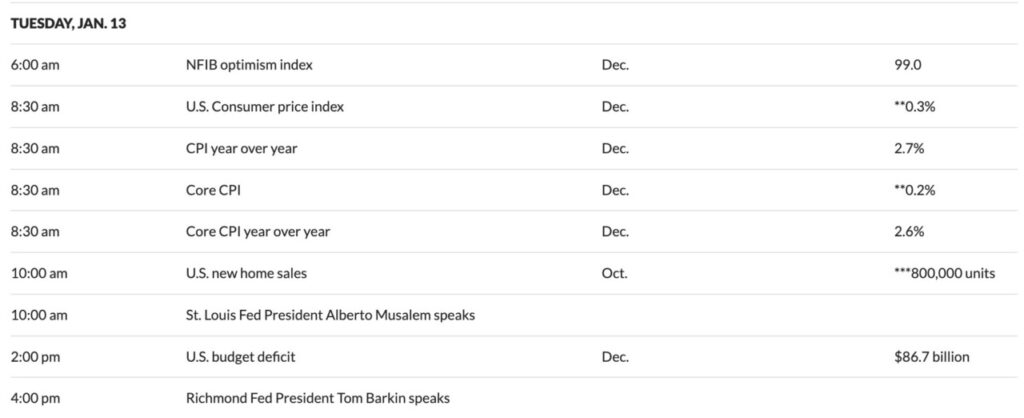

The December inflation data, which will be released on January 13, includes annual readings for CPI and core CPI. This is the first macro data released this year, which will give an idea of the current state of the US economy.

Last November’s inflation data showed a significant drop, with CPI falling to 2.7% and core CPI falling to 2.6%, which was the lowest level since March 2021.

However, New York Fed President John Williams has stated that there may be distortions in the inflation readings caused by the US government shutdown. Therefore, this December’s report is crucial to determine whether inflation in the US is actually showing a decline.

This data will be highly influential in the January FOMC meeting, where the Fed will decide whether to cut interest rates for the fourth consecutive time.

Also read: Crypto Analyst Predicts Shiba Inu (SHIB) Price Increase Up to 246%, Rare Pattern Emerging?

Bitcoin and Crypto Market Reaction to Inflation Data

Inflation data usually triggers volatility in Bitcoin and crypto markets on the day of its release. A low inflation reading is considered positive for the markets, as it would strengthen the argument for further interest rate cuts by the Fed. It could also support the ongoing crypto market rally, with the price of Bitcoin (BTC) having risen above $90,000 earlier in the year, an increase of 6% since the start of the year.

Conversely, a reading higher than expectations would be negative for the market, possibly leading to short-term selling. According to notes from the FOMC meeting, most Fed officials expect to make further rate cuts if inflation continues to decline. If inflation continues to show a decline, the Fed will likely prioritize the labor market, which is still showing weakness.

Also read: Bitcoin (BTC) Price Heads to $100,000: Is This a Bullish Phase or a Bulltrap?

Long-term Outlook for Bitcoin and Crypto

The dynamics between the Fed’s monetary policy and the crypto market has shown a strong correlation in recent years. Decisions about interest rates and general macroeconomic conditions have a major influence on the exchange rate of Bitcoin and other cryptocurrencies.

Investors and traders in the crypto market often use data such as CPI as an indicator to make investment decisions. With the current situation, the crypto market may continue to fluctuate based on macroeconomic developments and policies from the US central bank. Therefore, monitoring economic indicators and monetary policy is very important for crypto market participants.

Conclusion

Next week will be a pivotal moment for global financial markets, including Bitcoin and other cryptocurrencies. US inflation data will provide further clues as to the Fed’s monetary policy direction and its potential impact on markets. Investors and analysts around the world will be awaiting the results of this data with great anticipation.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. U.S. CPI Data Release Next Week: How Will It Impact Bitcoin and Crypto Market. Accessed on January 7, 2026

- Featured Image: Freepik Premium License