Bitcoin surges to $93K, will this trend last? (7/1/26)

Jakarta, Pintu News – Bitcoin recently reached its annual peak of $93,000, fueled by massive buying by whales and James Wynn’s risky strategies. However, the big question that arises is whether this rise can be sustained amid market uncertainty and technical indicators that point to potential overbought.

Whale Buying and Bitcoin Surge

On January 5, whales including Binance and Coinbase bought more than $3.5 billion worth of Bitcoin (BTC) in just 10 hours. This shows growing institutional interest in Bitcoin (BTC), especially with the influx of funds into Bitcoin ETFs reaching $458 million last week.

However, the question that remains is whether this bullish momentum will continue or the market will experience a pullback. With Japan announcing plans to fully embrace blockchain technology and designating 2026 as the “First Digital Year”, this adds more fuel to the fire of Bitcoin (BTC) price gains. However, investors remain wary of the potential volatility that could follow.

Also Read: Bitcoin (BTC) Prepares for a Surge: Potential Rise to $104,000 in the Near Future?

James Wynn’s High-Risk Positions

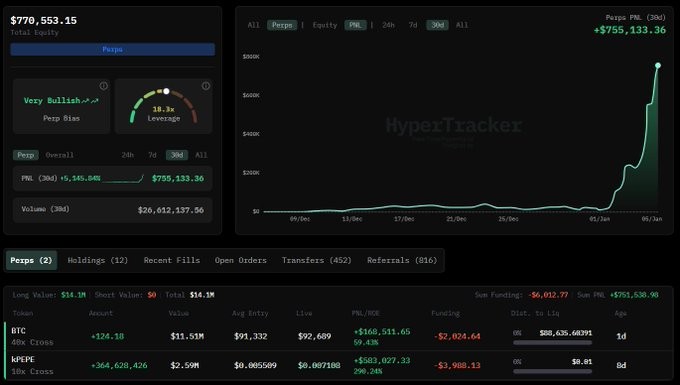

James Wynn, known for his poor trading performance in 2025, has increased his long Bitcoin (BTC) position to $14 million with 40x leverage. Currently, he has a floating profit of over $750,000. This risky strategy could bring huge returns or significant losses if the market reverses.

Wynn’s decision to double his Bitcoin (BTC) position, despite having a mixed performance record last year, raises doubts among investors. Is it a good time to follow his lead or on the contrary, avoid the trades he makes?

Continuation of Bitcoin’s Rally to $93K

Bitcoin (BTC) recently managed to break the important resistance level of $93,000. However, the RSI indicator shows a reading of 74.68, which signals an overbought condition, while the MACD shows a slowing momentum. If Bitcoin (BTC) fails to break this resistance further, a correction to the $90,000 level is possible.

On the other hand, if Bitcoin (BTC) manages to break the $93,000 resistance, it could push the price towards $95,000, alleviate selling pressure and possibly even reclaim the $98,000 zone. This would signal a return of market confidence in Bitcoin (BTC).

Conclusion

With all these factors, investors and market watchers should remain vigilant and conduct their own research before making investment decisions. While there is potential for further gains, risks remain high in this highly volatile market.

Also Read: New Record! Ethereum Records $8 Trillion Worth of Stablecoin Transactions

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Ambcrypto. Bitcoin rallies to $93k as James Wynn doubles down assessing. Accessed on January 6, 2026