Canton Price Surges After JPMorgan Coin Expansion: Can It Keep Rising?

Jakarta, Pintu News – Following the announcement of JPM Coin’s expansion into the Canton Network by JPMorgan, Canton’s price surged more than 15%. This institution-driven momentum puts Canton at a critical crossroads between breakout or consolidation. This movement shifts the focus to real-world settlement utility rather than short-term speculation, cementing Canton’s role in a tokenized financial infrastructure.

Price Structure and Breakout Potential

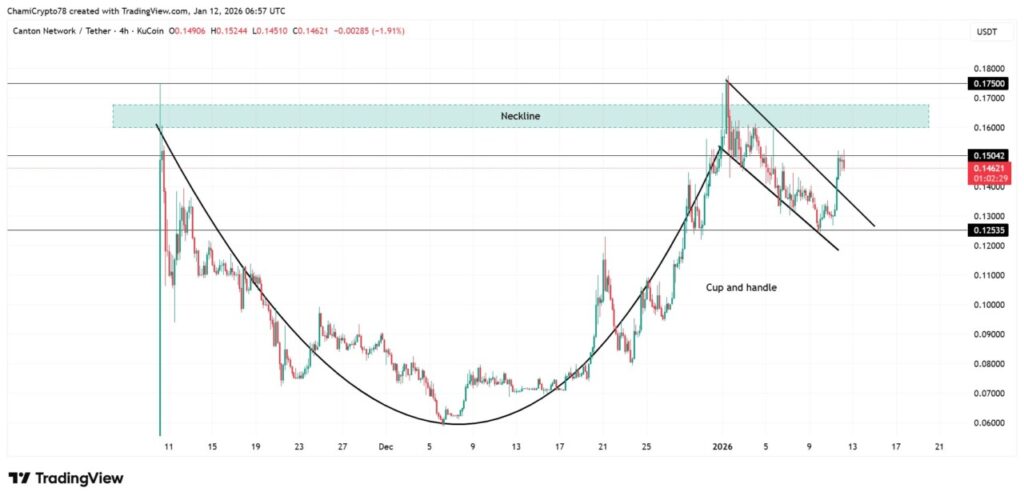

Canton’s price structure shows a classic cup-and-handle continuation setup, rooted in clear technical levels. The round base formed between $0.060 and $0.090 marked a long accumulation phase, during which the downward pressure gradually eased. The price then rose aggressively to the neckline zone between $0.160 and $0.170, completing the cup structure.

However, rejection near $0.175 triggers a controlled pullback, forming a handle within the descending channel. Importantly, buyers defend the $0.125-$0.130 support zone, keeping the bullish structure. Meanwhile, $0.150 acts as a key pivot separating the continuation from the consolidation. Hence, acceptance above the neckline will validate the pattern, while rejection is likely to extend the handle without validating the setup.

Also Read: 6 Robert Kiyosaki Prediction Facts: Silver to US$100 and New All-Time High in 2026?

Increased Leverage and Open Interest

Derivatives data shows Open Interest increased by over 15%, pushing the total up to $27.5 million at press time. This expansion signaled aggressive positioning rather than passive spot accumulation. Open Interest increased alongside price volatility, highlighting the active deployment of leverage. However, leverage introduces as much fragility as momentum. Quick positioning may magnify reactions near key technical zones.

In addition, high Open Interest tightens the liquidation threshold on both sides. Therefore, price stability above the support becomes critical. If Canton maintains the structure while Open Interest remains high, leverage could trigger continuation. Conversely, a sharp rejection near resistance could quickly unload positions, injecting volatility into the short-term price action.

Trader Skepticism and Liquidation Risk

Despite the surge, Binance top trader data shows around 65% of accounts holding short positions, reflecting continued skepticism. This imbalance creates asymmetric risk in the current setup. Normally, a strong rally would change traders’ bias to long. However, here, distrust dominates.

This divergence is important. However, the continued short exposure also suggests that traders are expecting a rejection near resistance. Therefore, the market is between a forced close and renewed selling. Recent price action has not rewarded aggressive shorts, gradually shifting risk to bearish positions rather than confirming them.

Conclusion

Canton is at an important crossroads where JPMorgan’s institutional catalyst collides with leverage-enhanced skepticism. Clean maintenance above the neckline could open up continuation through short pressure. Failure likely means consolidation, not structural breakdown.

Also Read: Monero Hits Record High, Investors Leave Zcash!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Canton jumps 15% after JPMorgan expansion; Can CC bulls force a breakout?. Accessed on January 14, 2026