Common Misconceptions about Bitcoin

With the increasing popularity of Bitcoin and cryptocurrency, questions and discussions about this new digital asset are getting more and more frequent. In this article, we will talk about the most common misunderstandings about Bitcoin. Time to fact-check and debunk a few of the most common misconceptions of this new asset in the article below.

Bitcoin is a bubble

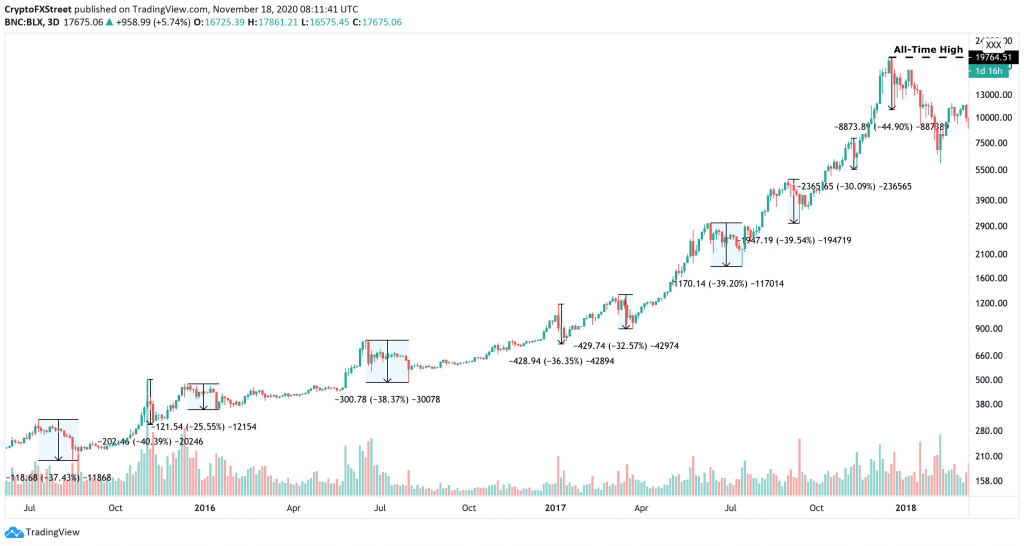

Bubble is a condition in which an asset has a very rapid price increase followed by a drastic price drop after reaching its peak. A bubble happens when the price of an asset increases far from its original value. Many think that Bitcoin is a bubble because of the drastic price increase since Bitcoin was created. Bitcoin price also goes up and down (volatile) in a short term, Bitcoin price can go up 100% and fall as much as 80%. However, if we zoom out, the price of Bitcoin in the long term actually always increases.

Bitcoin price also is affected by the halving. Bitcoin protocol sets the amount of newly minted Bitcoin. The number of new Bitcoins mined will halve every 210,000 blocks or every four years. Because the number of new Bitcoins is getting less and less, we can see that every four years Bitcoin experiences an upward or bullish trend in the first year after the halving and a downward or bearish trend in the next three years.

Bitcoin has no intrinsic value

Bitcoin’s intrinsic value lies in its network. In the old days when the telephone was first invented, the telephone had no value because only a few people used it. As more and more people adopt the telephone, the telephone network expands and the value of the telephone becomes a medium that connects people wherever they are.

Bitcoin has a decentralized monetary network. The bitcoin network is spread all over the world and is not controlled by a singular party. There are currently around 9000+ Bitcoin network connections which we refer to as nodes. Everyone can participate to run the Bitcoin network. Neither party can shut down the network and Bitcoin can work even if there is only one operating network.

Apart from the network, Bitcoin has the advantage of being a store of value like gold, because Bitcoin has a scarcity and can also be transferred instantly. Here is one quote from Satoshi Nakomoto, the creator of Bitcoin:

As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: – boring grey in colour – not a good conductor of electricity – not particularly strong, but not ductile or easily malleable either – not useful for any practical or ornamental purpose and one special, magical property: – can be transported over a communications channel If it somehow acquired any value at all for whatever reason, then anyone wanting to transfer wealth over a long distance could buy some, transmit it, and have the recipient sell it. – Satoshi Nakamoto

If we compare it with gold, for example, if the price of gold increases 3 times, there will be many people flocking to dig for gold or businesses that will look for ways to get more gold. When there are new gold mines or companies find more efficient methods to discover new gold pocket, the amount of gold can increase. When the number of gold increases, thus the gold price will decrease because the market will adjust the price to match with the existing supply.

Bitcoin can be a good store of value because the number of Bitcoins is limited. Whatever happens to the price of Bitcoin, the supply of Bitcoin will not be increased. If the price of bitcoin goes up 10 times, no miner can create an additional supply of Bitcoin no matter how hard they work, or how many bitcoin mining machines they have.

Bitcoin cannot be developed

Bitcoin is developed slowly to ensure that the Bitcoin monetary network system remains secure.

In a payment protocol there are three important aspects that we must pay attention to

- Security

- Speed of transaction settlement (settlement)

- Decentralization

Cash has advantages in speed of settlement of transactions (settlement) but does not have security because cash has a physical form, making it vulnerable to theft.

Visa and Mastercard are winning in terms of transaction speed but the settlement can only be done a few days later. Therefore, there are many cases of fake credit cards. In addition, Visa and Mastercard have a network that is centralized or managed by one company, so the network from Visa and Mastercard is not the safest.

Bitcoin has all those three aspects above Security, speed of transaction settlement, and decentralization. Bitcoin can complete up to 1800 transactions per 10 minutes and Bitcoin is also decentralized. Bitcoin uses a small block size in the blockchain to ensure security and accessibility to anyone.

However, with an additional layer of the network formed on top of the Bitcoin network such as the Lightning Network. Bitcoin can process transactions as fast as Visa and Mastercard where Bitcoin can accommodate 45,000 transactions per second, and settlement will be completed every 10 minutes (much faster than Visa and MasterCard settlement)

You can learn more about the advantages of Bitcoin with digital money in this article.

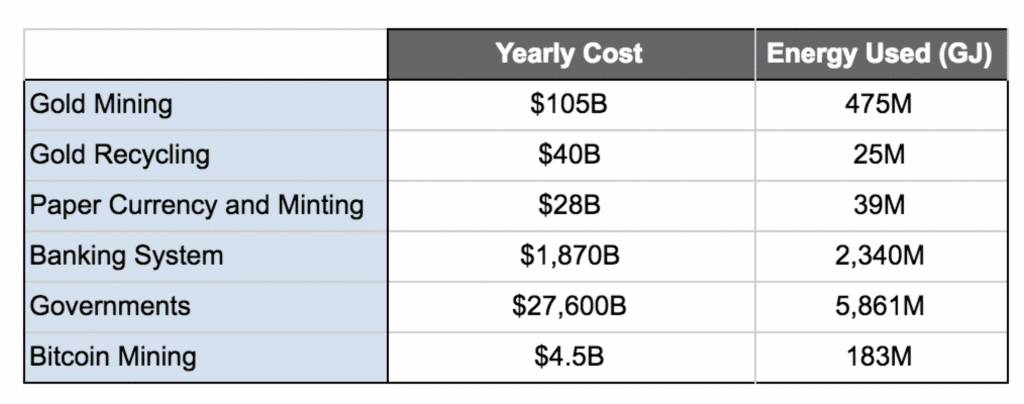

Bitcoin consumes a lot of energy

Bitcoin consumes much less energy when compared to mining gold or fiat currency. To produce a single piece of gold it takes energy to dig the ground, look for gold mines, process tons of rock to find a few grams of gold. Not to mention the environmental impact generated by gold mining.

Meanwhile, to run fiat currency, it takes energy to run the banking system, run ATMs around the world, and not to mention the energy expenditure for buildings and other banking infrastructure.

Bitcoin mining does require electricity, but because every miner who manages to form a new block will get a new Bitcoin from the system, every miner will have an incentive to look for the cheapest and most efficient natural resource. We can see that many miners are currently trying to find renewable energy such as hydroelectric, solar power, and so on.

Government will stop Bitcoin

The only way for governments to stop Bitcoin is to turn off electricity worldwide. Which this will not be possible because the government will surely suffer greater losses if this happens. What the government can do is regulate crypto assets. The market capitalization of crypto assets has already exceeded 7.2 Trillion USD so this industry is too late to be ignored.

We can see what has happened in countries like China, Nigeria, or India. When the country stopped trading crypto assets, peer-to-peer trading took off.

It’s too late to buy Bitcoin

It’s not too late to buy Bitcoin. Currently the price of 1 Bitcoin is in the range of $40,000. But Bitcoins can be broken down into hundred millionths of bitcoins or what we call sats. Currently $1 is roughly equal to 2,000 sats. This means that if you save $ 1 at this time, when the price of $ 1 is equal to 1 sats then $1 money can increase to $ 2,000

The best way to invest in Bitcoin as a store of value is to save or what we call dollar cost averaging. Use the dollar cost averaging calculator in the Pintu application to find out how much money you have to save to get the maximum profit.

Share