Introduction to Crypto Fundamental Analysis

For decades, investors and traders are always looking for various ways to identify assets for profits. From analyzing price charts, company balance sheets, and market macro conditions. Warren Buffet, one of the iconic successful investors, uses fundamental analysis as one of the pillars in determining which assets to chooses. Now, fundamental analysis has become one of the most widely used analytical techniques in the stock asset market. Together with technical analysis, they can help investors and traders determine promising assets. Now, fundamental analysis is often used in the crypto world for the same purpose. So, what is crypto fundamental analysis? How do you use it so you can choose the right asset? This article will explain the fundamental analysis in detail.

Article Summary

- 💸 Fundamental Analysis (FA) is the process of measuring asset value based on economic factors, management, technology, and other aspects related to it. Fundamental analysis is a way of measuring the ‘true’ value of an asset, relative to its position in the market

- ⚖️ The analysis is an important part of the process of choosing an asset because it gives us an overview of the asset we will choose. In the context of the crypto market, fundamental analysis is also important in helping us determine the value of a crypto asset.

- 🔎 Crypto fundamental analysis involves identifying the project’s real value through reading its whitepaper to find information about the team, the technology, tokenomics, and what problems does it solves. The team behind the project is also important to avoid scams and false projects. Understanding all of these will enable you to identify whether the project has good fundamentals or not.

What is Fundamental Analysis (FA)?

Fundamental Analysis (FA) is the process of measuring asset value based on economic factors, management, technology, and other related aspects. In stock, fundamental analysis means looking at a company’s balance sheet, profits and management structure, to name a few. Fundamental analysis is a way of measuring the ‘true’ value of an asset, relative to its position in the market. Through FA, we can determine whether an asset has reached its potential value or not.

In the crypto world, fundamental analysis means determining the value of a crypto asset in terms of what it wants to achieve and what its position is in the crypto market in general. Finding the true value of a crypto asset means analyzing what problem the technology is trying to solve and whether it has a role in the market. Apart from that, the crypto FA is also concerned with understanding the team behind the project and the token economy.

Fundamental analysis is one of two analytical methods in selecting and buying crypto assets. The other method is a technical analysis which analyzes price charts and predicts the movement of assets.

Why is crypto Fundamental Analysis important?

Fundamental analysis is an important part of choosing a cryptocurrency because it provides a bird’s eye’s view of the asset. Just like researching stocks, the FA in crypto requires us to find information about the organization and team as the ‘company’ behind a crypto asset. This analysis is also useful in distinguishing between scam projects and projects with value.

Fundamental analysis is also important in helping us determine the value of a crypto asset. If a project has strong fundamentals but the market capitalization is still low and not yet popular, the project is undervalued. This means that the project has not yet reached its potential relative to its fundamental value.

On the other hand, a crypto project that has a high market capitalization but weak fundamental value can be called overvalued. Crypto assets that fall into this category may have marketing that can attract many people or it has a strong community so many people buy and keep it.

How to do crypto Fundamental Analysis?

On-chain analysis

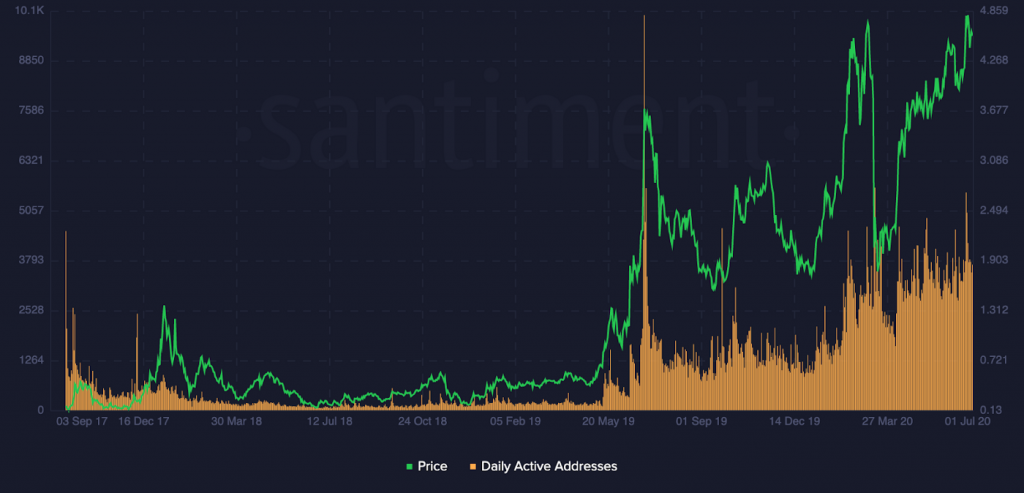

An on-chain analysis is an analysis that you do by getting various kinds of data related to blockchain from certain crypto assets. The data you are looking for relates to the blockchain usage of the asset. This analysis is useful to see the number of activities and users of the crypto asset.

Some important data that you need to pay attention to when doing on-chain analysis are the number of active addresses and the number of transactions. Both of these data refer to the number of active users and the number of transactions that occur on the blockchain. The activity that occurs on the blockchain can give you an indication of whether the asset has consistent active users or not. In addition, data such as transaction volume and the number of staked assets in PoS (proof-of-stake) cryptocurrencies can also be used to measure the intensity of active users.

You can get various data on-chain using popular sites like CoinMetrics and Glassnode. Some data can be accessed for free while others require you to pay.

Reading Whitepaper

A whitepaper is a document that contains complete information about a crypto project. In a company, this document is similar to a prospectus. A good whitepaper is systematic, with little to no writing errors, and contains complete information. If a crypto project has an unprofessional whitepaper or doesn’t even have a whitepaper, you should be careful because it may be a scam.

Analyzing the whitepaper is an important part of the fundamental analysis because it contains a lot of important information about a project. Reading the whitepaper can give you a big picture of the project starting from what problems it solves, who its target market is, what technology it uses, and who is the team behind it.

Several questions you need to ask when reading a whitepaper:

- Why was it created and what problem does it want to solve?

- How do you use the technology? Is it designed for mass adoption?

- Who is the team behind the project? You need to dig into their background!

- Does it have a roadmap? If so, is the roadmap explained in detail?

- Who are the investors? What percentage of tokens do early investors hold compared to the public sale?

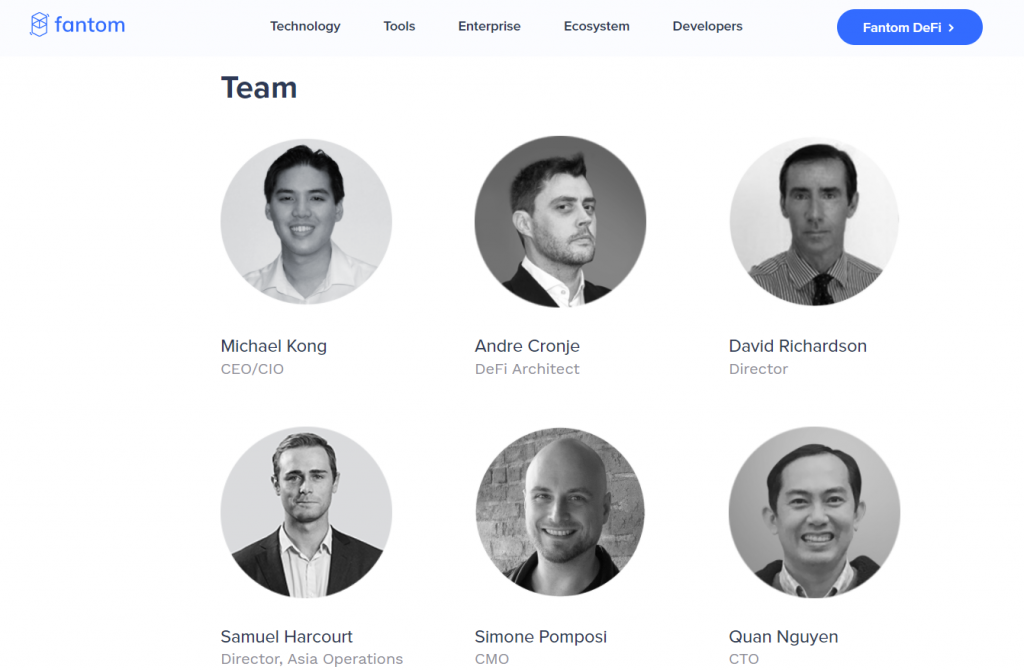

Digging up information about the team

In a world where innovations and new projects are constant, knowing the team behind a cryptocurrency is important. Crypto scams known as rug pulls are common where the team behind a project takes investors’ money away through manipulation of the smart-contract code. Therefore, you need to carefully research the team behind the crypto project. You need to pay attention to their background, track records, and whether they have been involved in fraud cases or other criminal acts.

In addition, you should be careful with crypto projects whose developers are ‘anon’ (short for anonymous) and do not provide a public identity. While privacy is everyone’s right, many anonymous crypto projects end up being scams. Serious crypto projects with mostly anonymous developers usually have at least a few public teams that handle specific areas like community or marketing. Always be careful when viewing projects with an anon team.

Understanding the token economy (tokenomics) in crypto fundamental analysis

One of the most important but often overlooked aspects is the token economy or tokenomics. The token economy is about the distribution of tokens, how it is circulated into the market, and the creation of new tokens. All of these are important elements that can affect asset prices at various stages.

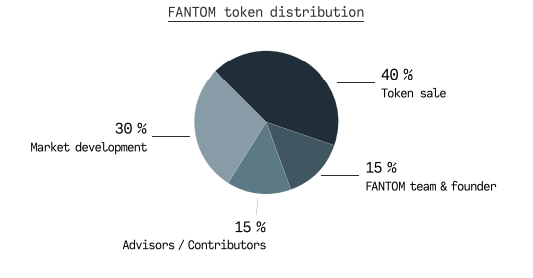

The image above shows the distribution of FTM tokens, 60% for the team and investor tokens while 40% are for the public. Ideally, the share of tokens sold to the public should be larger than that of team and investor tokens. However, the 60-40 distribution is common in many projects and as long as the team behind it is actively developing the asset’s ecosystem, this can still be tolerated.

In addition, what you need to pay attention to is the vesting period, which is the locking period of tokens for early investors (seed investors). This period is important because if investor tokens can be released only a few months after launch, it is likely that investors who have made a profit of 1000% or more will sell their tokens. This large token sale will result in a supply shock and send asset prices into a free fall. The vesting period should ideally be within 1, 2 or 3 years after the token launch so that investors can only sell it in small quantities at regular intervals.

You have to be careful with projects with unequal token distribution percentages (eg 80% investors and 20% public) and have a short vesting period (only 6 or 8 months). Projects like this usually only benefit early stage buyers and their investors, similar to a Ponzi scheme.

Understanding the target market, community and competitors

The last thing you need to pay attention to when doing fundamental analysis is to understand the market context of the asset you are researching. This means that you must have an understanding of the role of these cryptocurrencies in the crypto market. You need to understand what problems it solves and how it provides those solutions. In addition, who is the target market for these assets? Some crypto assets are created to achieve mass adoption so the technology is designed to be as easy to use as possible (Fantom, Terra Luna, Ethereum). However, there are also some cryptocurrencies created for other crypto developers and institutional users such as Chainlink, Ocean Protocol, and The Graph.

Once you understand the market context and the role a particular asset plays, you need to map out who its competitors are. Does it have advantages that its competitors do not have? Or does it have a stronger community than other competitors? These things need to be researched to assess the fundamentals of a cryptocurrency.

What are the characteristics that differentiate between legitimate crypto projects and scams?

Recognizing red flag in a crypto project

- No whitepaper

- The white paper contains many writing errors, unsystematic, unclear, and ambiguous

- The team behind the project has a history of fraud or does not have any related experience

- Bad tokenomic: The team and investors own the majority of the token

- No smart-contract audit process

- Very little public information regarding the project and the token

- Inactive social media with fake followers

Characteristics of genuine crypto projects

- A clear, systematic, and detailed whitepaper

- A credible team with the appropriate skills and experience

- The technology created can provide a solution to an important problem in the crypto world or the real world

- Have a fair token economy with slight differences between public sale and investor/team token

- The team behind crypto projects is transparent and regularly discloses information regarding project developments

- An active social media and strong community

Buying cryptocurrency assets

You can start investing in cryptocurrencies in the Pintu app. Through Pintu, you can buy cryptocurrencies such as LUNA, BTC, etc in an all-in-one convenient application.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can learn more about cryptocurrencies through the various Pintu Academy articles that we update every week! All Pintu Academy articles are made for educational purposes only, not financial advice.

References

- A COMPLETE GUIDE TO FUNDAMENTAL ANALYSIS OF CRYPTOCURRENCIES – DCX Learn, DCX learn, accessed on 16 February 2022.

- Fundamental Analysis in Cryptocurrency Trading, Gemini, accessed on 16 February 2022.

- Fundamental Analysis vs. Technical Analysis: Which One Is Better?, Coin Market Cap, accessed on 16 February 2022.

- How to Do Fundamental Analysis For Cryptocurrency, Liquid, accessed on 17 February 2022.

- Jeff Dorman, Jeff Dorman: Fundamental Investing Is Alive and Well in Crypto, Coin Desk, accessed on 17 February 2022.

- EXMO, What is fundamental analysis in crypto trading | by EXMO | exmo-official, Medium, accessed on 17 February 2022.

- Interdax, How On-chain Analysis Helps Crypto Traders | Interdax Blog, Medium, accessed on 17 February 2022.

Share

Next Article

The cryptocurrency asset market is one with a high level of volatility. Crypto prices often fluctuate and change drastically within just 1 day. Therefore, trading in such a scenario is difficult. Professional traders understand that they need proper analysis to make a profit. One of the important tools in analyzing the price of crypto assets […]