Crypto Fundamental Analysis Part II

Fundamental analysis is one of the most important instruments for investors and traders. However, the fundamental analysis of crypto can be very complex and different. Many assets have different aspects that cannot be compared directly with other assets. Each sector has different metrics and measurement tools. This article will continue the discussion of fundamental analysis using different indicators and measurement tools.

Article Summary

- ⚖️ Fundamental analysis is a way to measure the true value of an asset relative to its current price.

- 🧠 The way to conduct a fundamental analysis of crypto is very different from a fundamental analysis of traditional assets such as stocks.

- ⚙️ The fundamental crypto analysis continues to evolve along with the innovation of new sectors and protocols in the crypto industry. Investors are constantly looking for new ways to get more precise analysis.

- 🤔 There are four measurement tools to see the true value of crypto, namely using metrics and data, assessing PMF or Product-Market Fit, looking at team capabilities, analyzing tokenomics, and conducting competitor analysis.

About Crypto Fundamental Analysis

Fundamental analysis is one of the analytical tools used to measure the true value of an asset. Investors or traders will then determine whether or not the current price matches that true value. A price higher than the original value makes an asset overvalued and vice versa.

In the crypto world, most novice investors and traders will be confused about determining the true or fundamental value of a crypto. This also applies to traders who come from the traditional financial world such as stocks. Unlike stocks and their companies, cryptocurrencies do not have financial statements and many metrics such as price divided by earnings (P/E) do not apply to cryptocurrencies.

Fundamental analysis for cryptocurrencies can be done in many ways using a variety of metrics. For example, 10 investors may use 10 metrics to analyze one project. This happens because every few months there is always a new type of project in a sector that did not exist before.

Don’t forget to read the fundamental analysis article on Pintu Academy.

Why Cryptocurrency Fundamental Analysis Continues to Evolve

Crypto fundamental analysis continues to evolve with the dynamics of the crypto market. For example, in the 2021 bull market, fundamental analysis meant doing a TVL analysis and market capitalization or comparing the technology. Now, fundamental analysis means reading metrics such as protocol revenue figures, number of daily users, and tokenomics of coins or tokens.

Therefore, how to do crypto fundamental analysis is always evolving alongside innovations and trends. Part I of the fundamental analysis article already covered how to do basic fundamental analysis. This time, we will develop it further and look at other instruments for analysis.

How to Do Crypto Fundamental Analysis

1. Utilizing Protocol Data and Metrics

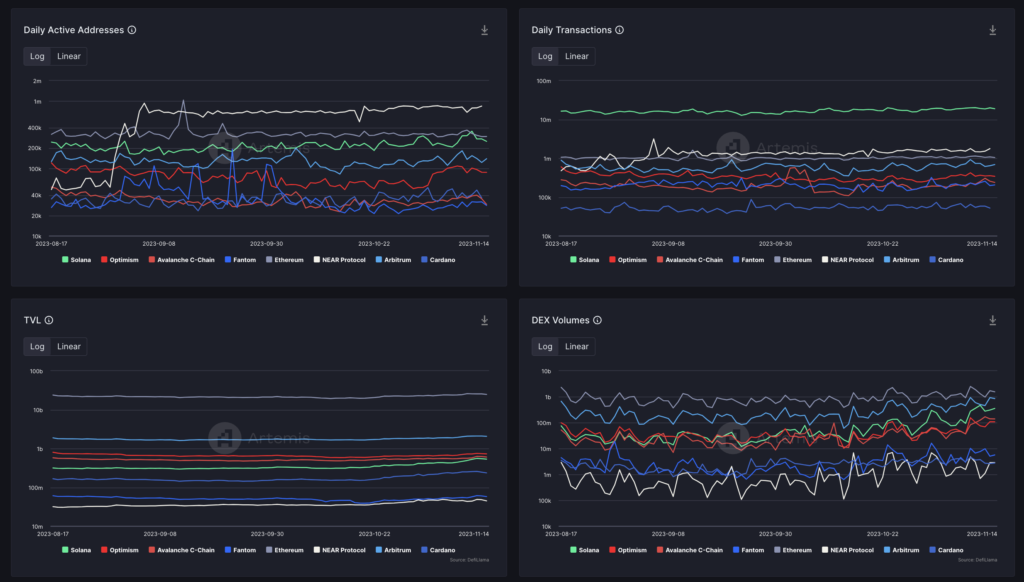

Fundamental analysis has always relied on the use of data and metrics. Data and protocol metrics are becoming increasingly accessible. Furthermore, platforms like Dune Analytics even allow users to directly pull data from the blockchain and publish data dashboards for others to use.

However, with so much data at our disposal, which data is crucial for fundamental analysis? Some basic metrics such as market capitalization, TVL (total funds locked up), and FDV (market capitalization if all tokens circulate) will always be useful. The difference in fundamental analysis will come when you analyze blockchain protocols and projects.

For example, TVL and transaction volume metrics are crucial in analyzing DeFi platforms like GMX. However, user numbers and daily transactions will be more important for L1 and L2 projects. Fundamental analysis should be context-dependent.

Revenue is also starting to be frequently used in looking at the fundamental value of a project. Revenue figures are an indicator of activity as each protocol will get a share of transaction fees. In addition, this figure is also a measuring tool to assess the sustainability of a protocol.

Some sites that you can use to access data and metrics: DeFiLlama, Token Terminal, Artemis Dashboard, Dune Analytics, and DappRadar.

2. On Product-Market Fit

Every token and coin should be connected to a product with clear use cases. The 2021 bull market shows that a sustainable product is essential for the future of a crypto project. In this sense, the bear market was a wake-up call. So, many people now realize that a good crypto project must have a product in high demand.

The meaning of "product" here is whatever a crypto project is trying to create. In protocols, the product is a platform like DEX or NFT marketplace. For L1 or L2 blockchain projects, product means the entirety of what they offer such as experience for the development team and blockchain speed.

Product-Market Fit (PMF) is the ability of a product to meet the needs of the market. So, a protocol with good PMF will be in high demand, fit into what consumers need, and will grow organically. Curve, Compound, and UniSwap are examples of products with strong PMF.

Here are some indicators to see if a product has a strong PMF or not:

- High Demand: The product addresses and fulfills the needs of users in the market so the demand is high.

- User Retention: The product can retain its users over time, showing that it provides value.

- Organic Growth: The product’s user base continues to grow organically due to positive market feedback.

- Scalability: The product has good scalability so that it can cater to an increasing number of users. Scalability also relates to product safety and security.

- Profitability: The product can generate a sustainable revenue stream.

- Competitive Advantage: The product stands out in the competitive landscape due to its unique features, quality, and user experience.

3. Developer Team Capability

Team capability is an important aspect that is often overlooked when researching a project. You can avoid scams and rug pulls by knowing the team behind a project.

In fundamental analysis, you can consider several aspects such as product quality, execution speed, response to criticism, and marketing strategy. All these aspects can help you see the potential of a project.

The most important aspect of looking at a team’s capabilities is from the product side. You can evaluate a team using the questions below:

- How quickly does the team push out crucial updates and new features?

- Are they concerned about security? Is the smart contract audited and by whom?

- How does the team respond to criticism and suggestions from users? Are they ignorant, defensive, or quick to respond?

You can test the three questions above against various well-known crypto projects and the answers should be satisfying. Conversely, apply these to a failed project and you’ll find plenty of red flags.

The best way to see how a team works is to join the official Discord or Telegram group and see how the development team interacts with the community.

Finally, marketing strategies are very important in the crypto world. The growth of a project is often closely related to an active community that is willing to become “a walking marketing”. Ambassador programs and the like are becoming increasingly common for new projects such as Injective Protocol.

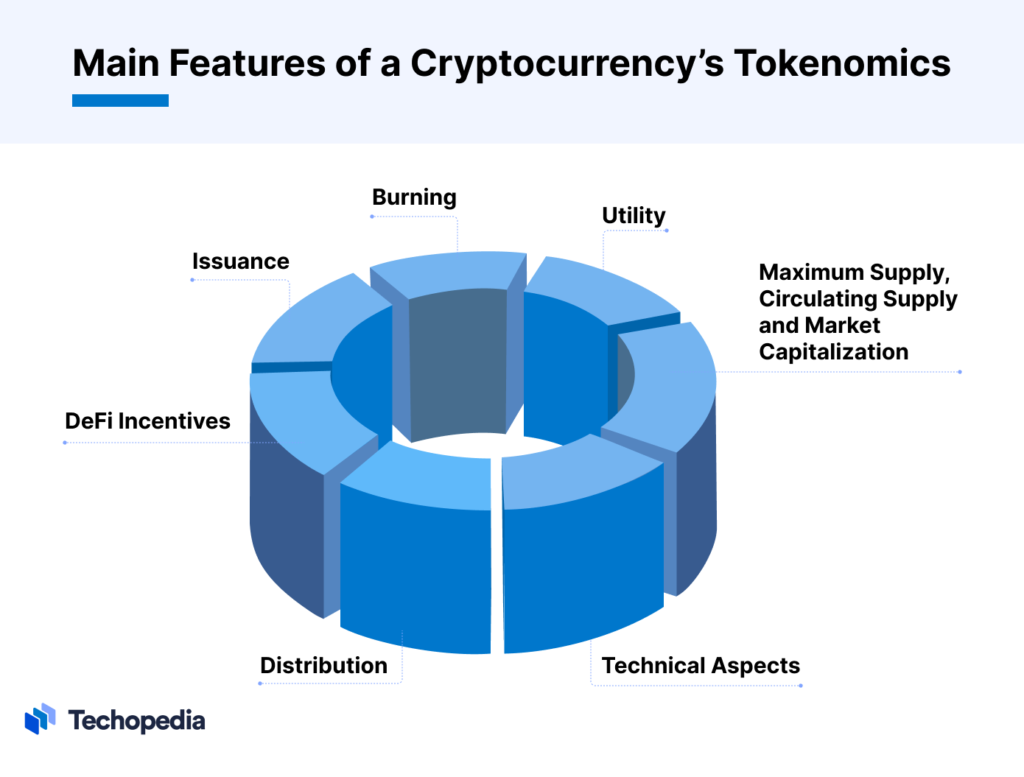

4. Tokenomics

The previous fundamental analysis article explains the importance of understanding token economics or tokenomics. It explained how token distribution and vesting schedules have a big influence on the selling pressure of a token. This time, we will focus on something else that is equally important: the use cases of tokens or coins.

Once again, the bear market teaches us the importance of understanding the function of a token. DeFi platform tokens like UNI have declined by almost 99% since 2021. Many people argue that UNI has no function. Many UNI token holders have been protesting about UNI’s lack of function for a long time.

The bear market is an “aha!” moment for many investors and traders. Many experienced investors are now paying close attention to the integration of tokens into their products. They start to question “What is the function of the asset other than speculation?“.

In response, many tokens now provide real yield to their owners. For example, UNIBOT gives a portion of platform revenue to token holders. GMX gives out yield from protocol revenue to token holders who are willing to lock their GMX tokens.

Tokenomics is increasingly becoming an important aspect of determining investment decisions. In turn, projects are realizing the importance of integrating tokens into products. They seek to provide real functions for tokens as well as additional incentives for users to buy and hold them.

5. Competitor Analysis

Measuring the competitive edge of a project is closely related to the previous four fundamental analysis instruments. So, you can use all of the tools above to compare an asset to its competition in the same sector. In crypto, every sector has its leader.

You should invest in crypto projects with a clear competitive advantage. Otherwise, you might be choosing the wrong asset.

There is a phrase that is often echoed by people in the crypto community, "Winners keep winning". What this means is that the winning assets in a sector will continue to rise. So, you must identify assets with the potential to become a sector leader.

The easiest way is to look at the basic statistics of protocols within the same sector. For example, you want to analyze protocols in Arbitrum’s DEX ecosystem. You can decide to look for sector-leading projects or look for undervalued projects relative to their competitors.

You can open DeFiLlama and start comparing the TVL figures, transaction volume, and market capitalization of each project. The data will immediately show the protocol with the largest numbers.

Ideally, you also find undervalued projects with a small market capitalization but excellent statistics. Please pay attention to which aspects of a project stand out and what they lack. After looking at the projects and deciding on the ones with good potential, you can start researching the PMF, team capabilities, and tokenomics aspects.

Conclusion

This article discusses the importance of fundamental analysis in valuing crypto to understand its true value. Fundamental analysis of crypto differs from traditional assets such as stocks because crypto does not have standardized financial statements and metrics such as P/E do not apply.

Conducting a crypto fundamental analysis involves the use of various metrics that are constantly evolving in line with market dynamics. Another important aspect of conducting fundamental analysis is to look at the importance of Product Market Fit, the capability of the development team, tokenomics, and competitor analysis.

How to Buy Cryptocurrency on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

So, you can trade various cryptocurrencies on Pintu such as BTC, ETH, and SOL. In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions.

Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- @2lambro, “Are u always losing in crypto anon? Lambro unfiltered thoughts & hope to save u”, Twitter, accessed on 10 November 2023.

- @stacy_muur, “Good Dapps, Bad Dapps: Key Factors That Drive Success Rates in DeFi. In the past 7 years, I’ve been building Web3 products”, Twitter, accessed on 12 November 2023.

- Adedamola Ojedokun, “The Ultimate Guide to Crypto Fundamental Analysis: Strategies and Best Practices”, 3commas.io, accessed on 13 November 2023.

- @long_solitude, “Crypto Products, But Increasingly Useful”, Zee Prime Capital, accessed on 14 November 2023.

Share