Crypto Market Analysis for 2023

The crypto industry has gone through a rough ride in 2022. However, there are many innovations and developments to get excited about going into 2023. Some of these are the adoption of cryptocurrencies by large companies and traditional financial institutions, the development of more sophisticated blockchain technology, and the acceptance of digital currencies by several countries around the world. As you can see, there are still many reasons to still be optimistic about the crypto market in 2023. This crypto market analysis will analyze the market in 2022 and look at its potential for 2023.

Article Summary

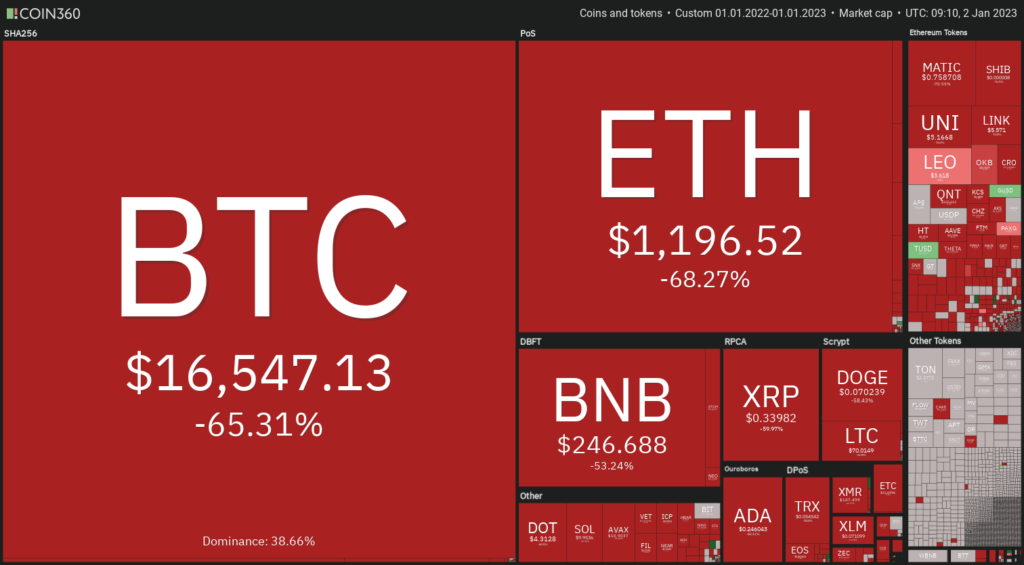

- 🩸 2022 was a painful year for the crypto world. Crypto market cap fell over 50%, Bitcoin corrected 64%, and ETH fell 67%. Even though the industry is experiencing a difficult period, developments in various crypto projects have managed to attract loyal users amid the deteriorating market conditions.

- 💎 Ethereum successfully migrates to a PoS network, making it more environmentally friendly and ushering in a new era of Ethereum. 2023 will be another significant year for Ethereum due to various updates that will make it competitive with newer L1s.

- 🚀 The biggest narrative this year is the development of Ethereum layer 2 particularly Polygon, Arbitrum, and Optimism. Polygon successfully retains its users throughout the year with various big-name collaborations while Arbitrum and Optimism manage to gain significant market share throughout 2022.

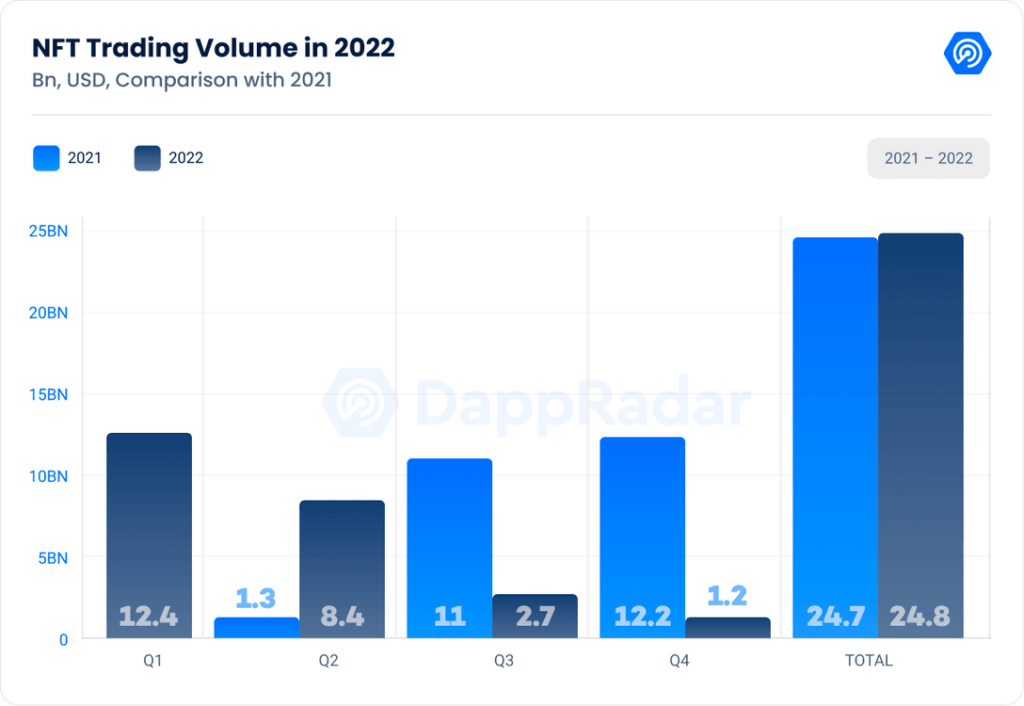

- 🖼️ This year the NFT industry faced its first bear market since becoming a big sector in the crypto industry. Since the second quarter of 2022, NFT sales have drastically decreased by more than 50%. However, the total value of NFT sales in 2022 still matches the 2021 sales figures. We also saw the inception of many NFT marketplaces that want to compete with OpenSea such as Looksrare, Blur, and SudoSwap.

- ⚖️ In the context of potential trends in 2023, several narratives to watch out for are the development of zk and layer 2, the expansion of the NFT market, and the increasing involvement of financial institutions through real-world assets (RWA) in the DeFi industry.

Crypto Market Conditions 2022

Bear market conditions in 2022 managed to ravage the crypto asset market. The total crypto market cap fell by over 50%, Bitcoin underwent a 64% correction, and ETH fell by 67%.

The crypto assets that ranked in the top 10 in early 2023 are also very different from the start of 2022. Terra (RIP), Solana, and Polkadot were victims of a vicious bear market this year as they were knocked out of the top 10. Terra’s devastation is especially worth highlighting, as $45 billion worth of money suddenly disappeared within the space of a few days. Moreover, for the first time in its history, Bitcoin recorded negative gains in four consecutive quarters in 2022

Read more about what’s happening in the crypto market in 2022 in this article: “Macroeconomic Issues and Their Impact on the Crypto Market in 2023”

Crypto Market Analysis 2022 and Potential for 2023

Even though 2022 left a big painful hole in the crypto industry, lots of developments and progress continue in various crypto asset projects. In Messari’s annual report, there is an interesting section called, “crypto is (still) inevitable“. This sentence emphasizes that the innovation brought by crypto does not just disappear even though the industry is going through hard times.

Crypto technology innovations through DeFi (Decentralized Finance), stablecoins, NFT (Non-Fungible Token), DAO (Decentralized Autonomous Organization), and Bitcoin are even more mature. Ethereum just made history by completing one of the most complex technological feats of the year, The Merge. Ethereum successfully migrates the network into Proof-of-Stake (PoS), reducing its energy usage by 99%.

Apart from Ethereum, there have been many other innovations and advancements that have taken place even though the industry has been hit hard by a bear market. In the following sections, we will analyze what happened in various sectors of the crypto industry in 2022 and look at its potential for 2023.

Ethereum

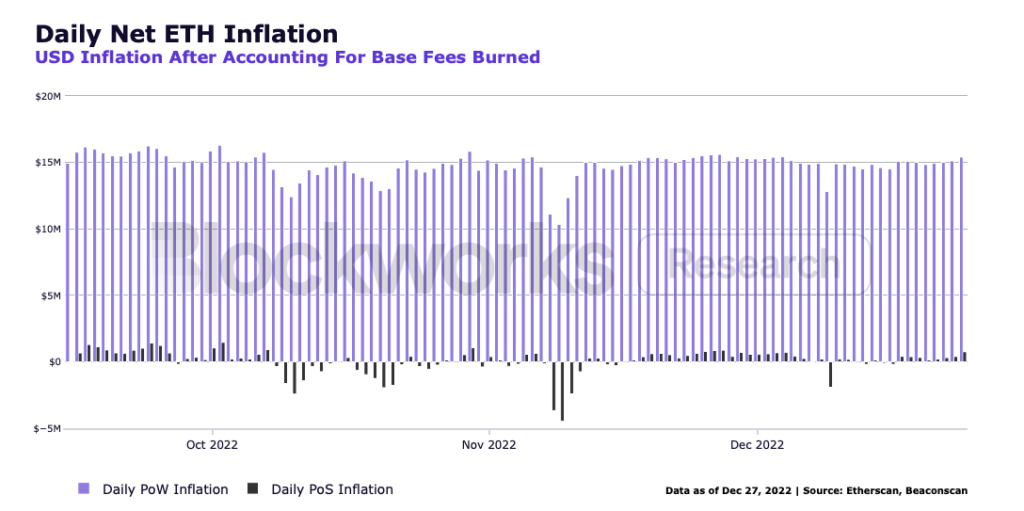

2022 is an important year for Ethereum. The Merge was successful and now Ethereum is a Proof-of-Stake (PoS) blockchain, on par with other layer-1 blockchains like Solana and Cardano. In addition to significantly reduced electrical energy, migration greatly reduces ETH inflation rates and the number of new ETH supplies.

Since The Merge, only 5.111 new ETH has entered the market, compare this figure to 1,3 million new ETH when Ethereum was still on PoW. The number of new ETH supplies entering the market so far is only 0.03% or 662 thousand ETH. As shown in the image above, ETH inflation had reached a negative number several times due to more ETH being burned than the new ETH issued.

Also read our article on the Merge: “What Happened To Ethereum After The Merge?“.

However, the ETH price continues to drop drastically during the 2022 bear market. The ETH price fell -67% for the whole year. This figure is slightly worse than BTC’s -64%.

What to look forward to from Ethereum in 2023?

- Shanghai Update: The Shanghai Upgrade is an Ethereum update that allows all staked ETH tokens to be withdrawn. With Shanghai, users can deposit and withdraw ETH in staking freely (the current staking rate is around 4%). Some Ethereum team explained that this update is a priority and targeted for March 2023.

- EIP-4188: The EIP-4188 update is a proto-danksharding implementation also called The Surge. Proto-danksharding is one of Ethereum’s two steps towards implementing sharding to significantly speed up transactions and cuts gas costs. EIP-4188 will have a significant impact on many Ethereum layer-2s such as Polygon, Arbitrum, and Optimism which use the rollup method. EIP-4188 will likely be released towards the end of the year (Cancun), once the Shanghai update has finished rolling out.

- EVM modifications and updates: EVM is the Ethereum software engine that is standard for hundreds of smart contracts on Ethereum and other blockchains. The Ethereum development team plans to do an EVM update via EOF (EVM Object Format) implementation. The latest discussion by Ethereum’s developers explained that EOF is in the Shanghai update plan. However, if until the end of January, the EVM update is deemed too difficult, it will be postponed.

In short, 2023 will be just as important a year for Ethereum as 2022. If The Merge was laying the foundation stone for a new era, 2023 is the building stage for Ethereum’s new home on the PoS network. The Shanghai upgrade and EIP-4188 will especially have a big impact on Ethereum users.

Layer-2 Projects

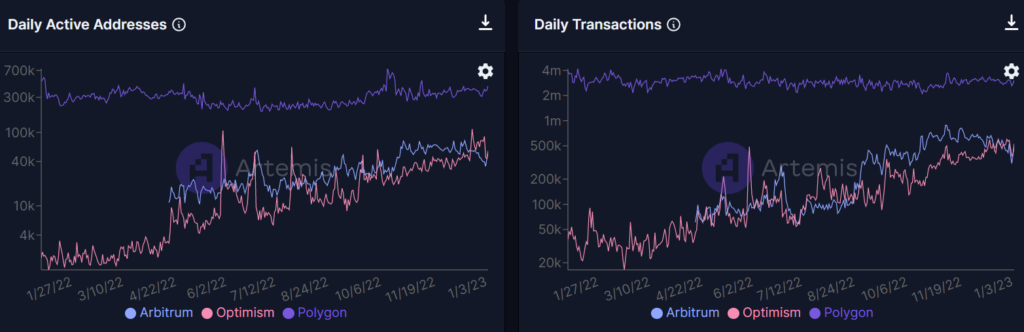

2022 is the best year for Ethereum’s layer-2. Arbitrum and Optimism are two layer-2 projects that are experiencing significant growth in users as well as daily transactions. As shown in the image above, the two networks do not seem to care about the bear market.

On the other hand, Polygon’s transactions and user numbers experience a sharp decline in early 2022 but managed to retain their users throughout 2022. One of the factors that allowed Polygon to retain its users was the many big brand collaborations. Throughout 2022, Polygon announce collaborations with Reddit, Meta, Starbucks, and Robinhood. With many collaborations with major institutions, Polygon succeeded to maintain the interest of its users. The NFT collection by Polygon and Reddit is already owned by 5.6 million users.

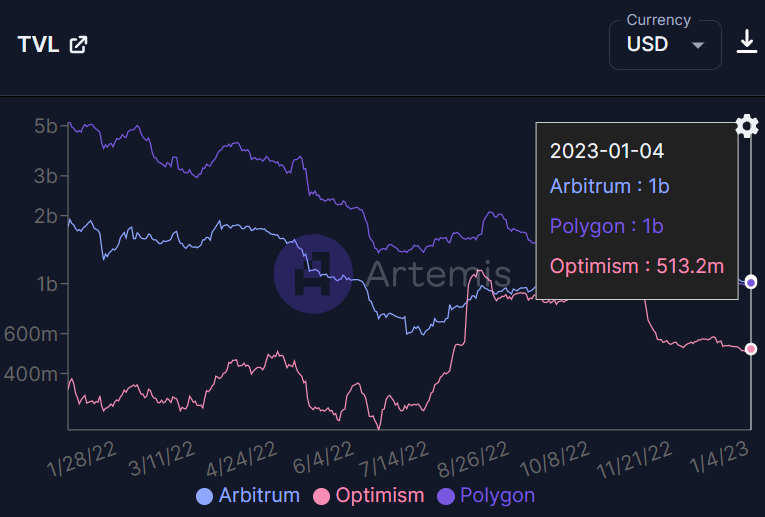

In TVL numbers, surprisingly Arbitrum managed to match Polygon with TVL reaching the $1 billion mark. Optimism briefly reached that number but fell back in the fourth quarter and ended at $500 million. This is something interesting because until now (January 5, 2023) Arbitrum does not have tokens (Optimism has OP). So, Arbitrum can attract a lot of liquidity and users even without speculative incentives in the form of crypto assets.

Arbitrum’s $1 billion figure comes from the DeFi industry on its very lively network. Arbitrum is home to Trader Joe, the DEX platform from Avalanche, and GMX, a decentralized trading platform that has gained popularity in recent months. Arbitrum is also the platform for TreasureDAO, a crypto gaming platform with dozens of games that combines NFT and DeFi elements. Additionally, this year Arbitrum launched Arbitrum Nitro, a significant update that speeds up transactions, reduces gas fees, and improves Arbitrum’s compatibility with the main Ethereum network.

On the other hand, Optimism launched the OP token at the end of April and the first stage of the OP airdrop. Some of the tokens are still being kept for the next airdrop stage in 2023. Like Arbitrum, Optimism is achieving high TVL numbers due to various DeFi applications migrating to its network (such as Synthetix).

One of the significant advances in Optimism is the launch of the OP Stack. The OP Stack is a modular blueprint for creating any type of blockchain using the Optimism codebase. Developers can use the OP Stack to create whatever they want. Optimism explains that they want to create a superchain through the OP Stack where a group of blockchains is tightly integrated.

What to look forward to from Layer 2 projects in 2023?

- Polygon and zk: Polygon zkEVM is still in the testing phase in October 2022. With zk (Zero Knowledge) technology, transactions at layer 2 will be faster with better privacy. Polygon also has two other projects related to zk, Polygon Hermez (zk-Rollup) and Polygon Miden (STARK-zk-Rollup).

- Arbitrum Token: The Arbitrum Token is likely to be launched in 2023 with an airdrop for users using this network.

- zkEVM: zkEVM technology could become an important catalyst for multiple layer 2s in 2023. zkEVM technology enables EVM programs to process all types of zk-rollup, making EVM speed drastically increase. Currently, the team that is developing zkEVM are Polygon, zkSync, and Scroll.

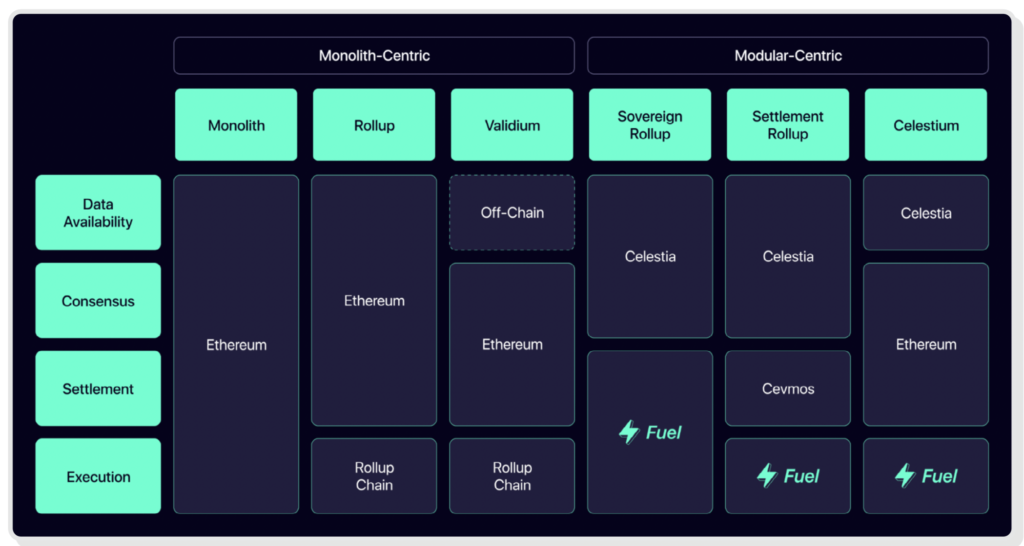

- Fuel and Celestia: Another potential 2023 trend is the rise of modular blockchains that function as layer 2 with a wider range of features. The two pioneers of this technology, Fuel and Celestia, have different approaches. Fuel is a modular execution engine that can replace the role of EVM and other execution layers. On the other hand, Celestia is a modular blockchain that can replace the data availability and the consensus mechanism layer. Both aim to provide flexibility to address scalability issues that various crypto projects face.

Smart Contract Platform

Solana

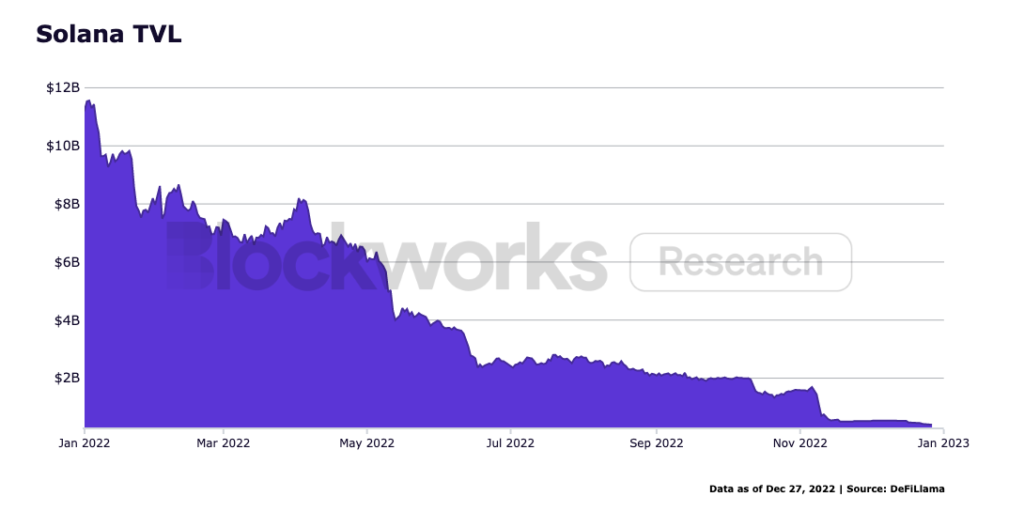

Post-FTX, Solana lost approximately 96% of its TVL in the FTX event resulting in a decrease of approximately $600 million. Solana’s TVL is now at around $230 million. The SOL token also experiences a huge decline of around 94% from its peak due to investors selling after the FTX incident. Alameda and FTX are also rumored to have 50.5 million SOL with a vesting schedule lasting up to 2028.

Furthermore, Serum, a popular DEX on Solana, was successfully hacked because the keys controlling its protocol updates were held by an account linked to FTX. Now, Serum is basically obsolete and another development team forked the protocol. Serum’s unique feature, the Central Limit Order Book (CLOB) has now been implemented in other DEXs on Solana.

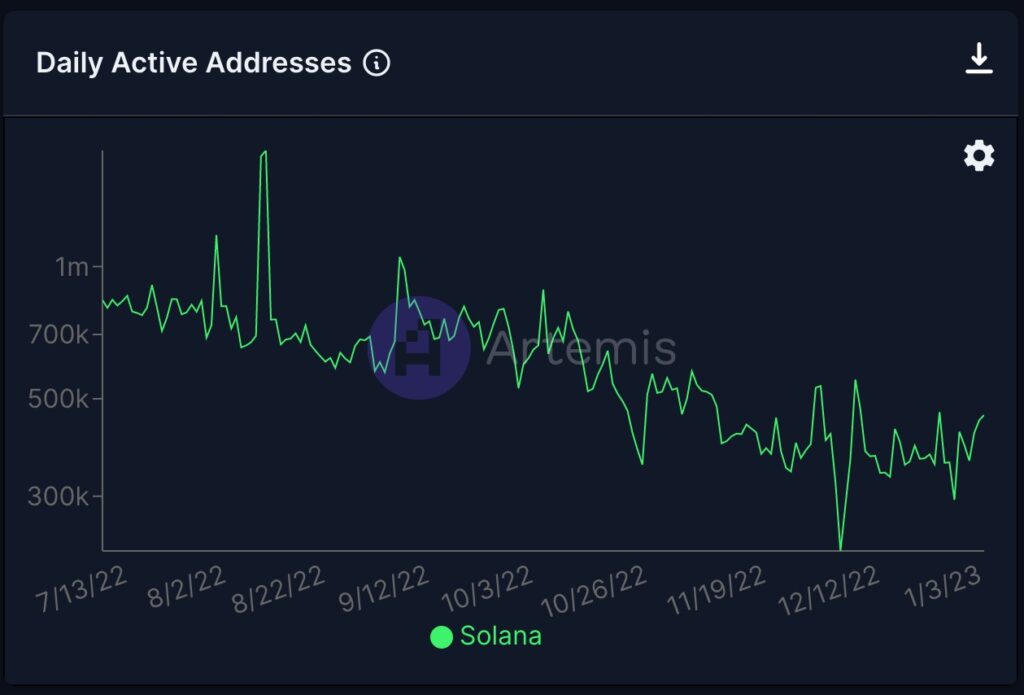

The FTX incident raises questions about Solana’s sustainability. Two of the biggest NFT projects at Solana, Y00ts and Degods, decided to migrate to Ethereum. However, the daily active user statistics show that there is still a lot of activity on the Solana network (around 300-500 thousand). A major contribution to this user activity comes from Magic Eden, the largest NFT marketplace on Solana. Since early December, Magic Eden has had daily active users ranging from 15 to 21k. Additionally, there are several updates planned for the Solana network in 2023.

What to look forward to from Solana in 2023?

- Firedancer: One of the biggest updates is Firedancer, heavily supported by Jump Crypto. Firedancer will improve the scalability, TPS, and stability of the Solana network.

- Saga Phone: The Saga Phone release plan from Solana is also continuing. Through Saga, users can run DApps directly from their devices.

Cosmos

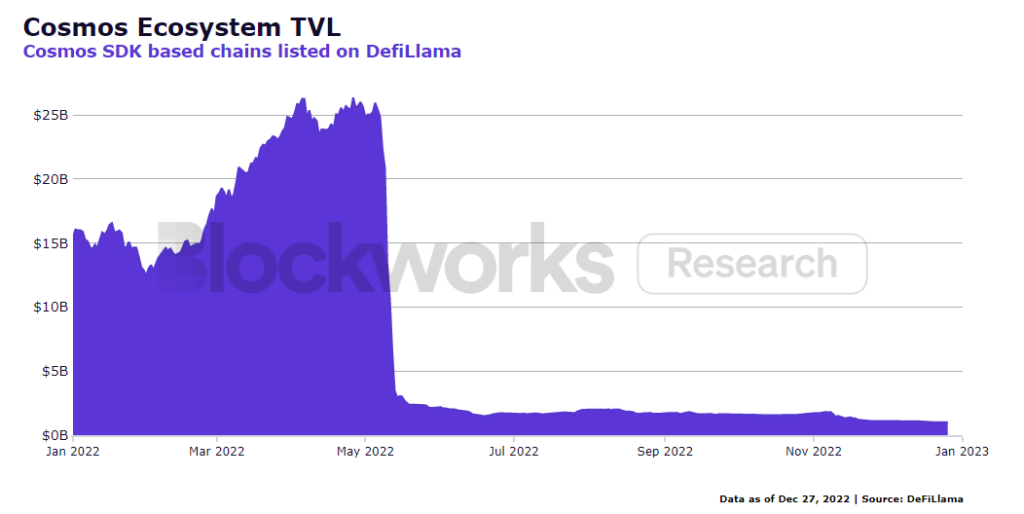

Currently, there are 53 chains connected to IBC in the Cosmos Ecosystem, with a total market capitalization of $9.7 billion. $745 million worth of money moved through IBC in the last 30 days, with the largest volume flowing through Osmosis, Cosmos’ largest DEX. Unfortunately, the Cosmos ecosystem’s TVL was destroyed in May by the Terra event. Terra’s Anchor Protocol was one of the biggest contributors to Cosmos’s TVL. This incident was also a stress test for Cosmos which proved that the network remained stable even though it had to process millions of dollars worth of transactions.

At the end of 2022, talk of an ATOM tokenomics update is hot. The Cosmos development team submitted a proposal for a complete overhaul of ATOM’s role in Cosmos Hub. The ATOM 2.0 proposal also describes the role of Interchain Security (ICS). However, several validators in the Cosmos community rejected this proposal with a 37.4% “No with Veto” vote, which means the proposal did not pass. They felt that the ATOM 2.0 proposal was too broad and discussed too many things. Until now there has been no new proposal related to ATOM 2.0.

Read more on ATOM 2.0 and how it changes Cosmos in this article: “Cosmos Ecosystem Upgrade and ATOM 2.0“.

On the other hand, there is a trend in the growing Cosmos ecosystem, appchains, or application-specific blockchains. Appchains are blockchains that are specialized in running certain application functions such as Osmosis. One of the big appchains coming to Cosmos is dYdX which will be migrating from the Ethereum network. The concept of appchains in Cosmos gives the development team a lot of flexibility in designing their applications because each appchain in Cosmos is independent.

What can we expect from Cosmos in 2023?

- Appchains: Narratives about appchains are likely to grow in popularity in 2023. The smooth launch of dYdX will serve as a model for other developers of the success of appchains on Cosmos.

- ATOM 2.0: ICS implementation on Cosmos Hub is planned to launch in 2023. However, with the failure of the ATOM 2.0 proposal, many Cosmos Hub implementations will be delayed. In 2023, we can look forward to how the Interchain Foundation will revise its ATOM 2.0 proposal after hearing suggestions and criticism from several influential figures in the community.

- USDC in Cosmos: In October 2022, Circle announced the creation of Circle Chain in the Cosmos ecosystem. Circle Chain will make USDC as Cosmos’ native stablecoin. This was done to fill the enormous void left by Terra’s UST as Cosmos doesn’t have a native stablecoin for its ecosystem.

Other Smart Contract Platforms in 2023

- Cardano: Hydra layer 2 updates for the Cardano network which will increase the transaction speed significantly. Cardano is developing a layer 2 scalability solution on top of its network called Hydra. The first stage is the implementation of Hydra Head.

- Fantom: Fantom will focus on improving Fantom network performance over the next year through testing and launching FVM (Fantom Virtual Machine).

- Avalanche: Avalanche’s latest update is Avalanche Warp Messaging (AWM) which enables inter-subnet interaction within the Avalanche network. This is an important milestone in completing interoperability within the Avalanche ecosystem.

- Near Protocol: Near Protocol has just completed phase 1 of sharding in September 2022. Also, Near has released its roadmap for 2023 and 2024 relating to network performance updates and implementation of phases 2 and 3 of sharding (dynamic resharding).

- Polygon: Polygon has many projects related to zk technology for 2023. One of the most anticipated is zkEVM Polygon. Currently, zkEVM is in the testing phase and is targeted for launvh in the next few months.

The DeFi Industry

An important topic in 2022 is the lessening. trust in centralized crypto exchanges (CEXs). CEX has a systemic risk because all the assets stored in it are in the hands of high-ranking authorities within the company. FTX events are a clear embodiment of this systemic risk. The Decentralized Finance industry is the antithesis of CEX. A decentralized exchange (DEX) has no control over the assets of its users. UniSwap cannot withdraw its users’ deposits and use them for other investment companies.

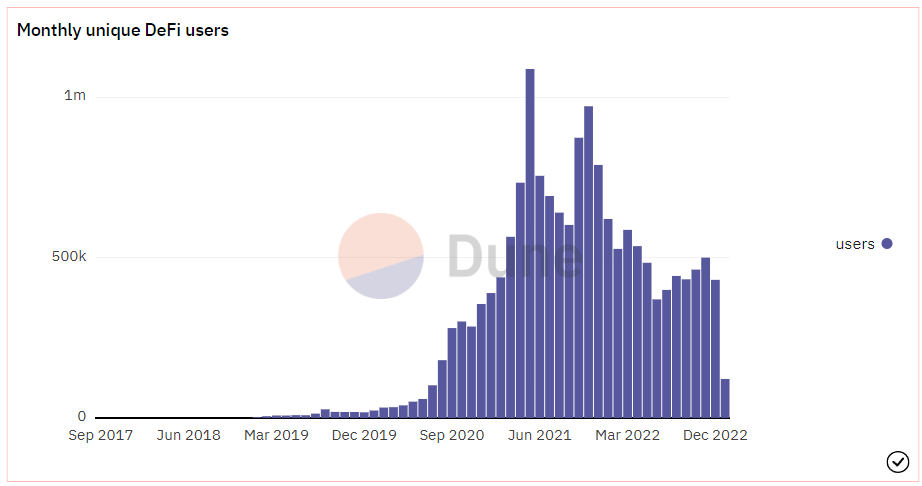

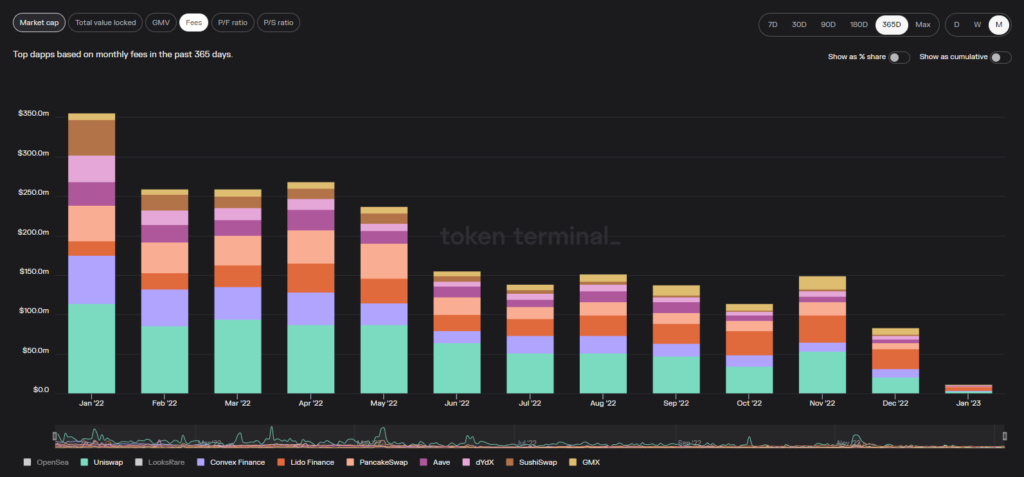

As in the picture above, the DeFi industry has experienced a decline since Q2 2022. This decline began after the collapse of Terra. Furthermore, the FTX event is rubbing salt in the wound and the industry is still recovering.

Nonetheless, some applications in the DeFi industry are experiencing positive developments, moving against the grain of the majority of the market. We can divide these applications into two narratives, Liquid Staking and Arbitrum-Optimism.

First, along with the update of The Merge and the introduction of the staking feature, many retail users choose to use delegation services to large stakers like Lido. As a result, Lido is now the DeFi application with the largest TVL figure at $6.62 billion (January 10, 2023). Along with the Shanghai update, Lido and several other protocols such as Rocket Pool will gain attention because of the potential for institutional investors to use staking.

What is liquid staking? Liquid staking is a protocol that provides decentralized staking services and provides a new token (stETH for Lido) as proof of funds deposited. Then, you can use the tokens in various DeFi applications to earn additional interest.

Second, the growth for Ethereum’s two layer-2 blockchains will definitely continue into 2023. Arbitrum and Optimism have managed to attract a large number of users to their network through new protocols such as GMX and TreasureDAO as well as older protocols expanding their market. If we combine the TVL of Arbitrum and Optimism, its TVL figure exceeds that of Polygon and the majority of other layer-1 altcoins ($1.5 billion). If this is the TVL number in a bear market, we can imagine the potential for both once the crypto market stabilizes.

What can be expected from DeFi in 2023?

- Arbitrum vs. Optimism: The battle between the two most popular layer-2 at the moment is likely to heat up even more in 2023. Both of them could attract attention with Optimism which will continue the OP airdrop and Arbitrum which has yet to launch tokens. Apart from that, the Ethereum update in 2023 will also make layer 2 rollup transaction speed and fees even more competitive.

- Liquid Staking Derivatives: Currently, interest in Ethereum’s staking feature is very high. Staking platform Lido Finance has the largest TVL numbers in DeFi. With the Shanghai update allowing staking deposits and withdrawals, more and more people will be interested. Lido can become the platform that can dominate the Ethereum liquid staking market.

- RWA (Real-World Assets): In July 2022, MakerDAO began opening up the use of real-world assets (RWA) in DeFi. Users can now print DAI and provide collateral using non-crypto assets. The amount of RWA assets that have been collateralized in a loan with MakerDAO is $600 million. This was the start of RWA assets in the crypto world.

- DeFi Trading Platforms: With confidence in CEX declining, the demand for trading platforms in the DeFi industry continues to increase. Popular DeFi trading platforms today are GMX and dYdX. Even so, neither of them offers a trading experience as good as CEX. The demand for derivative assets such as options and futures contracts is also still high and there is no DeFi platform that can fulfill it yet.

The NFT Industry

The NFT industry managed to break into the mainstream market in the 2021 bull market. Major NFT projects like BAYC are collected by many artists and many NFT collections sell for millions of dollars. This momentum managed to last until the first half of 2022 and fell drastically in May 2022. Quarters III and IV showed how big the impact of the bear market was on NFT sales, which decreased by more than 50%. Nonetheless, total NFT sales in 2022 managed to keep pace with 2021 sales. In terms of unique traders or unique users who collect NFTs, there were around 10.5 million in 2022. This figure is a 100% increase from around 5.1 million in 2021.

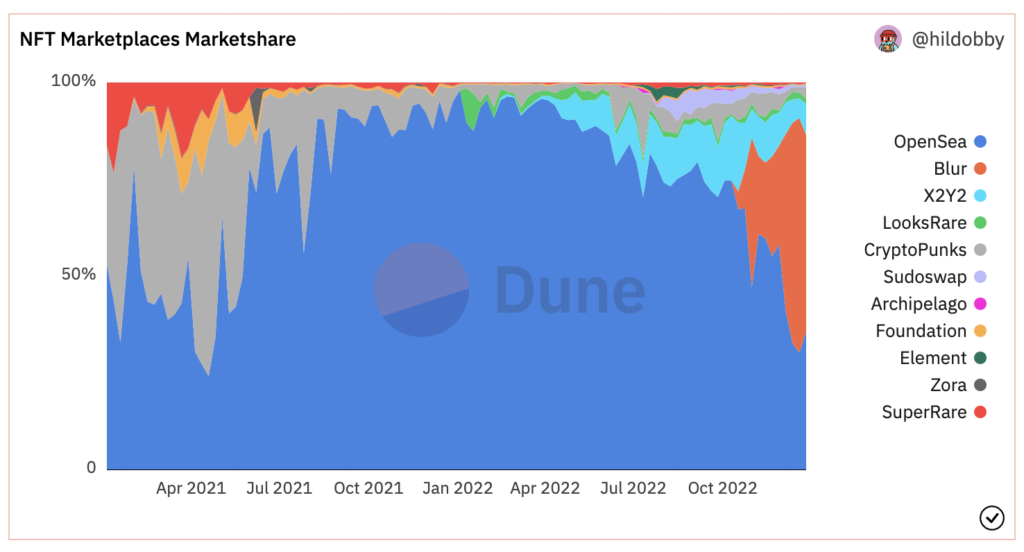

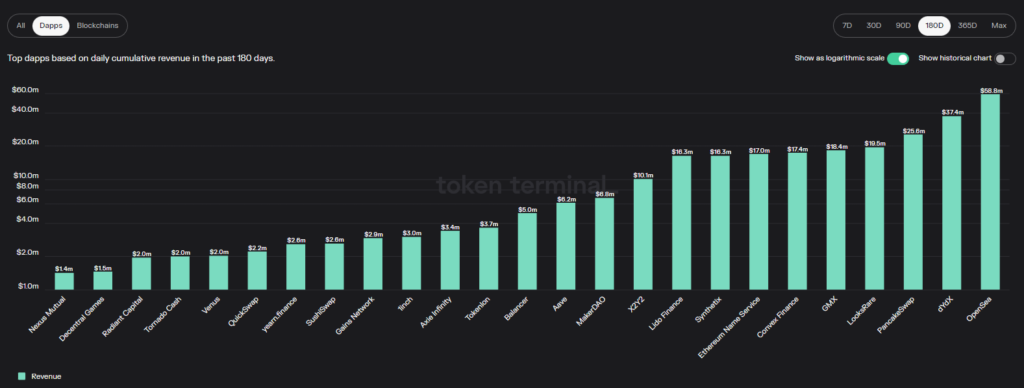

In the context of the NFT marketplace, OpenSea will still dominate throughout 2022 with figures reaching 96% at the start of the year. This figure continues to decrease as there are various other NFT marketplaces that can take the NFT market from OpenSea. In fact, OpenSea’s dominance reaches as low as 30% by the end of 2022.

The decline in OpenSea’s dominance is due to several new marketplaces such as Blur which is only three months old. Blur is an NFT marketplace for professional NFT traders who want to take advantage of features such as floor-sweeping. In 2023, we will see if Blur can be an alternative to OpenSea or if it will decline and take a smaller portion, like LooksRare.

Additionally, the debate over royalties is a hot topic within the NFT community. On the one hand, royalties are a way for NFT creators to earn income from the success of their projects. On the opposite side, many argue that royalties are unfair to buyers and exploitative. The creator of the BAYC collection reportedly earned $54 million in secondary sales royalties. Other NFT projects such as Goblin town even apply a royalty of 7.5%. However, the creators of Degods decided to remove royalty on all secondary sales of their collection. We are likely to see the debate over royalties continue into 2023.

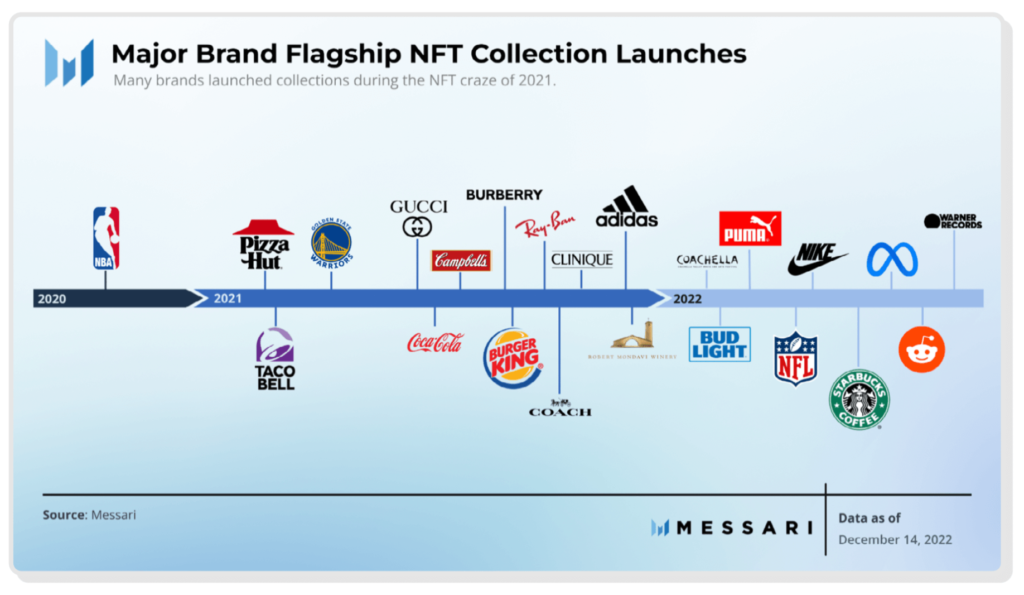

Lastly, many big names are also trying to break into the NFT world. Reddit’s NFT Collection managed to get mainstream attention from the NFT community and racked up $12 million in transaction volume. Meta also enables NFT on Instagram and Twitter profiles. In addition, Starbucks also launched Starbucks Odyssey, an NFT platform that will provide NFTs to customers as part of its loyalty program.

What to look forward to from the NFT market in 2023?

- Major brands entering the NFT market: With Meta, Starbucks, and Reddit entering the NFT market, we can anticipate several other big names like Nike launching their NFT projects in 2023.

- New NFT uses: SBT or Soul-Bound Tokens created by Ethereum are a potential innovation for creating digital identities that cannot be manipulated. Apart from that, the use of NFTs in industries such as music and movies is also starting to be explored and 2023 could be the year it becomes popular.

- New NFT Blue Chip Collection: In 2023, we will see various new NFT collections entering the blue-chip category, alongside popular collections such as BAYC and Cryptopunks. NFT projects such as Moonbirds, PudgyPenguins, and Beanz are some of the collections that are starting to pick up high transaction volumes.

Potential Crypto Trends for 2023

The ZK Bid and Layer 2 Developments

In 2022, talk of implementing zero-knowledge technology is very popular. The development of this technology has also been quite rapid, starting from rollup-based zk, and two types of proof, STARK and SNARK. The zk technology itself has actually been around since the 1990s. Some of the crypto asset projects currently in the process of developing zk implementations are StarkEx, StarkNet, Loopring, zkSync, and also Polygon. As mentioned before, several crypto projects are also in the process of developing zkEVM.

Zero Knowledge (zk) is a technology that allows transactions in the blockchain to be processed by simply reading a zero-knowledge proof (zkp) without needing to present the complete data. With this, the network does not need to spend large computing power to process transactions. zk technology can significantly increase throughput (TPS) and reduce user transaction costs.

If 2022 is the year zk technology develops rapidly, 2023 is the year where its potential and success will be tested. Most of Ethereum’s layer-2 technology currently utilizes Optimistic Rollup technology which combines transactions into one group. zk’s technology must be able to keep up with the speed and transaction costs that rollup provides.

Furthermore, adding fuel to the fire, Arbitrum recently released a piece about how rollup technology is the future of Ethereum, not zk. We will probably see stiff competition between zk-based layer-2 and rollup. Many parties are betting that zk technology will finally be widely used in 2023. However, Optimism and Arbitrum, which already have users, may develop more rapidly if zk implementation disappoints or face huge hurdles.

Apart from the two technologies above, modular blockchain implementation also needs attention. Fuel and Celestia are two new players in this sector. Both offer a modular design where each layer can be substituted as needed. The image below is an example of how a blockchain can be stacked using modular design, instrumenting the flexibility of the technology.

NFT Boom in 2023?

NFT adoption will peak in 2021 and 2022 will be the first bear market for NFTs. Many people say that NFT will die when NFT numbers drop dramatically in early 2022. However, seeing last year’s sales figures which can still compete with 2021, the NFT market is in a pretty good position. In addition, many NFT marketplaces have emerged to compete with OpenSea. Starting from Looksrare which utilizes DeFi elements, to Blur, an NFT platform oriented towards professional traders.

The interesting thing that happened was that several big names actually enter the NFT market despite the bear market situation. This shows the great interest of big brands such as Puma and Nike in the NFT industry.

In the collectible NFT sector, NFT blue chips still dominate. Yuga Labs is proving that it is already a big player in the NFT sector. The Otherside metaverse land sold out within three hours for a total of 16.7 million ApeCoin (valued at $317 million) sales, a new NFT mint record.

Furthermore, 2022 is the year in which the NFT experiment took place. NFTs are associated with sports, music, fashion, in-game goods, and even movies. In 2023, the utility NFT concept will be developed further and may be able to find many users. The development of utility-based NFTs will continue to accelerate as there are more games, applications, and exclusive NFT communities (such as moonbirds).

The Great DeFi Migration?

With the events of FTX and Celsius since mid-2022, the DeFi narrative is strengthening. UniSwap succeeded in becoming the first DeFi project to achieve Unicorn status. As in the image above, the DeFi industrial market saw a drastic decline in May 2022 (thanks to Terra and Celsius) but moved relatively steadily until the end of the year. In accordance with its status, UniSwap dominates as the DEX that absorbs the largest transaction fees. However, one of UniSwap’s drawbacks is that these fees do not accrue value to UNI token holders.

This is in stark contrast to the revenue graph (measured by protocol revenue returning to users and default token holders) below. DYdX, PancakeSwap, and GMX are the DeFi protocols with the largest revenue metrics. Taking lessons from 2022, DeFi protocols with high sustainability (in the form of healthy finances) pass through a bear market in a fairly stable situation.

One of the big influences from the infrastructure and technological innovation side to DeFi is the development of layer 2 technology. Performance related to transaction speed and transaction costs can have a direct impact on DeFi protocols. Faster transactions and lower transaction fees will make the DeFi industry even more tempting for both retail and institutional users. This is especially true for DeFi applications on Ethereum.

Additionally, the tokenization of real-world assets (RWA or Real-World Assets) that serve as collaterals for stablecoins (such as MakerDAO) also has the potential to bring many new institutional users to the DeFi industry. In this context, higher adoption of stablecoins in 2023 could also accelerate the DeFi industry.

Other Sectors in Crypto

- GameFi: In the 2022 bear market, we can see how most crypto games don’t have a sustainable model. Many big games like Sandbox and Axie Infinity cannot retain their users due to their incentive-focused schemes. In 2023, we may see a new generation of crypto gaming focused on gameplay, not the asset or token.

- Aptos and Sui: Aptos and Sui are two crypto projects that emerged from the former Meta’s (Facebook) Diem project. Aptos successfully launched its project in late 2022 (with some controversy) and Sui is still in the testing phase targeted for 2023. Both are preparing to enter the already crowded smart contract platform sector.

- Chainlink: Chainlink will finally launch v1 staking LINK in 2023. The staking feature itself is one part of a total overhaul of LINK’s tokenomics and its role in the Chainlink oracle ecosystem.

- Decentralized Social (DeSo): Decentralized social media applications started to gain attention in late 2022. DeSo wants to restore control over the data and content that each user generates on the platform. One of the promising protocols in this sector is the Lens Protocol which is currently in the closed beta testing phase and already has 100,000 users.

Buying Cryptocurrencies in Pintu

You can start investing in cryptocurrencies by buying them in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite crypto assets.

- Click buy and fill in the amount you want.

- Now you have crypto as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. You can download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Door Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Ryan Selkis, Messari Crypto These 2023, Messari, accessed on 2 January 2023.

- Matthew Fiebach, 2022 Year End Review: Network Coverage, Layer 1s & 2s, Blockworks Research, accessed on 2 January 2023.

- New Order | 2023 Crypto Thesis, New Order, accessed on 2 January 2023.

- Sander Lutz, Ethereum Devs Plan to Enable Staked ETH Withdrawals by March 2023, Decrypt, accessed on 3 January 2023.

- Samuel Haig, The Surge Comes Next for Ethereum… Eventually, The Defiant, accessed on 4 January 2023.

- Christine Kim, Ethereum All Core Developers Call #151 Writeup, Galaxy, accessed on 4 January 2023.

- Sara Gherghelas, Dapp Industry Report 2022, Dapprada, accessed on 5 January 2023.

- Ashwath Balakrishnan dan Jordan Yeakley, The Year Ahead for DeFi, Delphi Digital, accessed on 5 January 2023.

- The Great Reset: Navigating Crypto in 2023, Delphi Digital, accessed on 6 January 2023.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-