Crypto Market Report Q2 2023

Many people argue that the bear market is a reset for the crypto industry. Unsustainable crypto projects fail (Terra), crypto companies with shady practices go bust (FTX), and hundreds of altcoin assets experience drastic price drops. On top of the crypto market crash in 2022, the first and second quarters of 2023 laid the foundation for the industry’s recovery. In the second quarter, various trends dominate. Macroeconomic data and events also continued to influence the crypto market. In addition, Q2 also saw positive price movements for BTC. So, what happens in the second quarter of 2023? What should we prepare for the third quarter? This crypto market report will explain it in full.

Article Summary

- 💎 The second quarter of 2023 showed that the recovery in the crypto industry is underway, characterized by positive price movements of BTC and growth in various sectors.

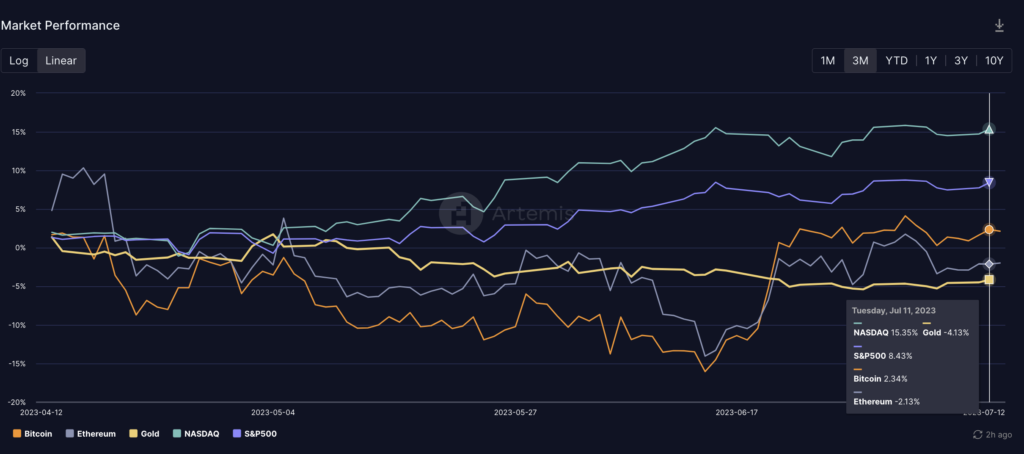

- ☹️ In this quarter, BTC and ETH did not outperform other asset classes like in Q1. Their performance declined with BTC gaining only 2.34% and ETH losing 2.13%.

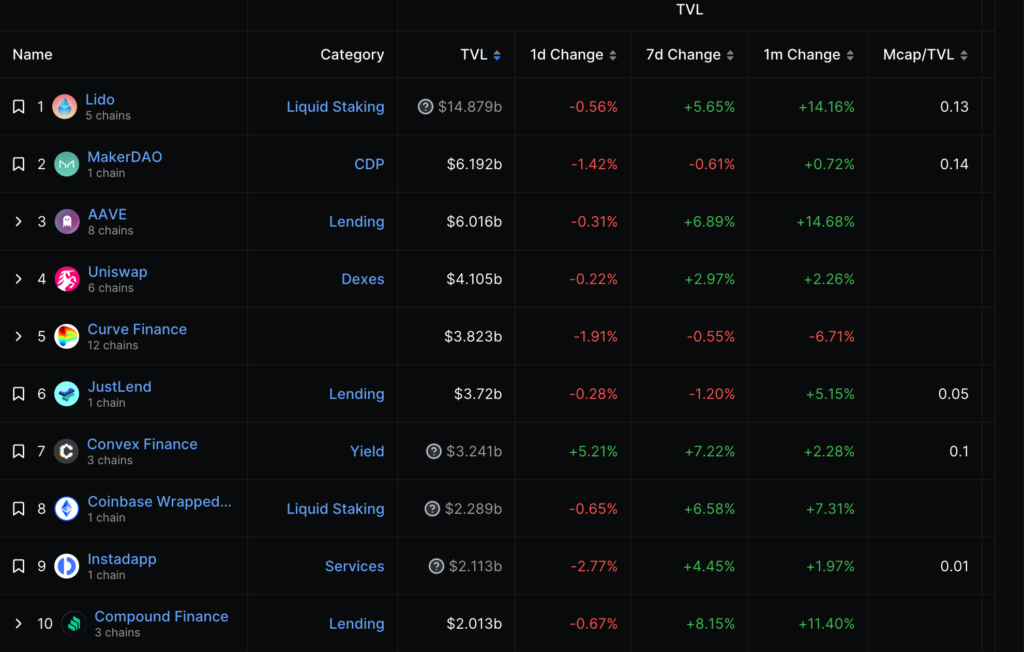

- 📱 The DeFi sector saw Total Value Locked (TVL) figures stagnate with a slight decline. However, the number of unique users grew from 33 million to 38 million in early May.

- 🧠 Several trends and narratives dominate Q2, including the birth of a new sector through the Shapella upgrade, the rise of Meme Coin and DeFi 1.0, and the filing of a Bitcoin ETF by BlackRock and other investment firms.

- ⚖️ As we enter the third quarter of 2023, investors and traders should prepare to respond to some of the potentially continuing trends and the impact of the SEC’s decision on the Bitcoin ETF proposal.

The state of the crypto market in the second quarter of 2023

After an explosive Q1 2023 for BTC and the crypto industry as a whole, there was a natural price correction in the second quarter. In the first quarter, BTC and ETH outperform all other asset classes, including NASDAQ and S&P 500 stocks. The altcoin sector also followed BTC with an increase in market capitalization of around 30%. The rise in altcoin market capitalization peaked at $407 billion dollars in mid-April and has been steadily declining since then.

However, as in the image above, BTC and ETH performed very poorly in the second quarter. Bitcoin saw a gain of 2.34% while ETH was -2.13%. This puts BTC and ETH in the top 3 worst performing assets in Q2 besides gold.

The BTC price chart in Q2 shows a correction after reaching the $30,000 resistance point. Bitcoin failed to break through the resistance and then corrects to the price of $25,000 in mid-June. However, toward the end of the first quarter, BTC again tried to break the $30,000 resistance. Currently, Bitcoin is still moving in the $30K price range for the past three weeks. The next movement of BTC will have a great influence on the crypto market.

In the DeFi sector, Total Value Locked (TVL) figures stagnate and slightly decline in the second quarter of 2023. The DeFi TVL figure touched $50 billion dollars in mid-April and then closed at $45 billion dollars at the end of the second quarter. However, the number of DeFi users (calculated through unique wallet addresses) increases from 33 million to 38 million in early May. This is the highest number of users in the past year.

In addition, several crypto market trends grab the attention of investors and traders in the second quarter. Some narratives were so strong that they had the potential to carry over into Q3 and even into the end of 2023. On the other hand, there were narratives and trends that only lasted a few weeks. This crypto market report will walk you through these trends.

Narratives and Trends During the Second Quarter of 2023

1. Shapella and the Birth of a New Sector

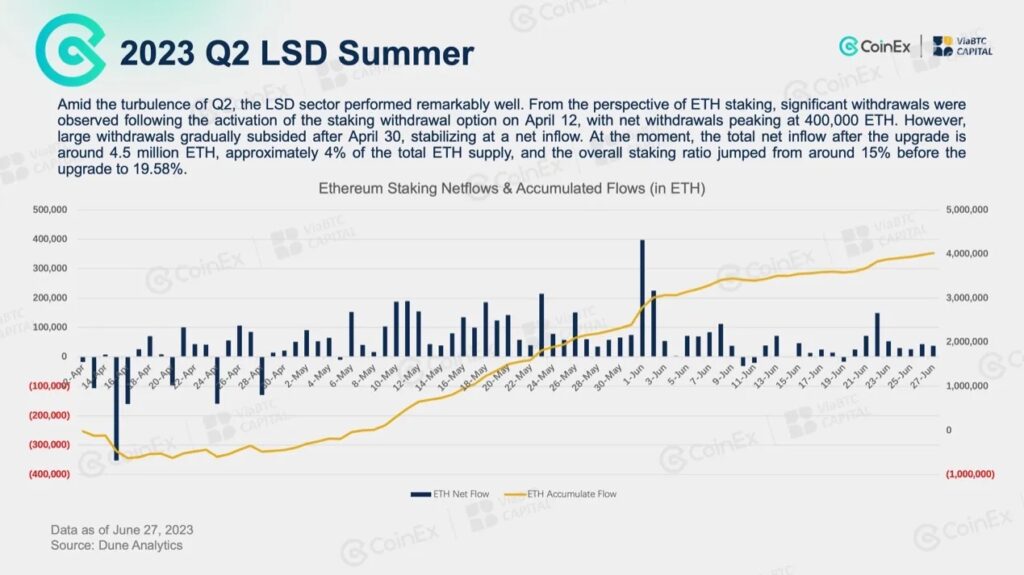

The Shapella upgrade in April 2023 successfully launches a new sector and asset class on Ethereum. Shapella catalyzed the birth of a new category that utilizes LST (Liquid Staking Token) assets, namely LSDFi. LSDFi (Liquid Staking Derivatives Finance) is a new sector that uses LSD tokens for various DeFi activities.

Read about Pintu Academy’s deep dive on what is LSDFi!

LSDFi has taken over the attention of the crypto DeFi community because it offers additional yield on top of the interest earned from ETH staking. Despite being only a few months old, the LSDFI sector currently has a TVL figure of $729 million dollars.

As shown in the image above, the amount of ETH in staking continues to increase and has reached 20% of the total ETH supply. LSDFi is a way for users who stake to benefit even more. So, this sector will continue to grow alongside the increase in ETH staking.

2. Memevolution: Meme Coin Takes Over the Market

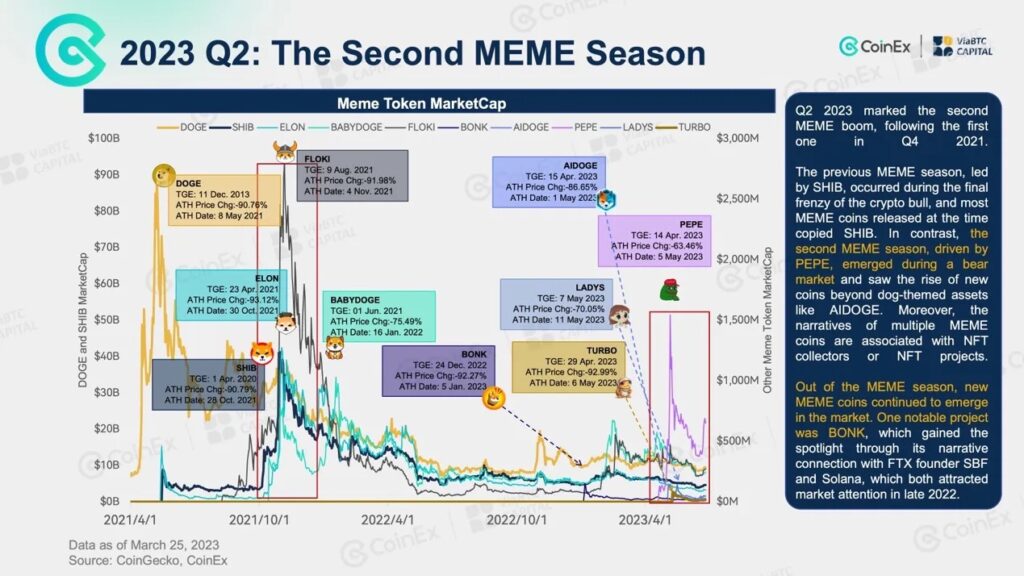

On April 14, 2023, a token called PEPE was created on Ethereum. This token did not have any utility and was not used in any application. Instead of disappearing on its own, PEPE experienced over 10,000% price appreciation in a month. PEPE’s market capitalization even reached $1 billion dollars, higher than crypto projects like Algorand, Stacks, Fantom, and Axie Infinity. PEPE becomes the catalyst for Memecoin Season 2.

PEPE’s success triggered the second memecoin season after the FLOKI, SHIB, and DOGE trends in 2021. AIDOGE, WOJAK, TURBO, and LADYS are some of the meme coins that trended alongside PEPE. As shown in the image above, the market capitalization of meme coins reached $50 billion dollars in April.

Don’t forget to read Pintu Academy’s article on how to avoid scams and rug pull when trading meme coin!

However, 99% of meme coins will eventually fade away and only a few will survive. Looking at the price chart, PEPE seems to be the only meme coin that can survive for some time to come.

3. The Resurgence of DeFi 1.0

At the end of June, a basket of crypto assets suddenly stole the attention of the crypto community. These crypto assets fall into the DeFi 1.0 category, which is “OG” DeFi projects created around 2020. Some of them are UniSwap, Curve, Compound Finance, AAVE, and MakerDAO. Compound Finance saw the highest gain among this group of assets at 118% in two weeks.

The resurgence of DeFi 1.0 assets surprised many as the tokens of this category have performed very poorly since last year. In addition, the rise in the price of DeFi 1.0 assets is also related to the upcoming updates to the platform of these projects. In June, UniSwap announced the UniSwap V4 update. Curve and AAVE both have plans to release their own stablecoins in the form of crvUSD and GHO.

Will this be a new beginning for DeFi 1.0 projects? We will need to see it in the near future. However, what is certain is that the DeFi 1.0 app is one of the most widely used and is already the backbone of the DeFi industry.

4. Bitcoin ETF

BlackRock, the world’s largest asset management company, submitted a Bitcoin ETF (Exchange-Traded Fund) proposal to the SEC (US Securities and Exchange Board) on June 15, 2023. BlackRock’s (which manages about $9 trillion dollars) ETF filing becomes the catalyst for investment firms like Fidelity, WisdomTree, BitWise, and Valkyrie to apply for ETFs as well. In fact, they copied Blackrock filings because 575 BlackRock ETF proposals were accepted by the SEC.

Bitcoin ETFs became the biggest news coming out of the second quarter of 2023. The ETF proposal is a signal that institutional investors are very interested in investing in Bitcoin. Furthermore, crypto investors and traders also approved it as BTC shot up after the ETF news came out. The SEC has a long time span to approve or reject Bitcoin ETFs.

What’s in store for the third quarter of 2023?

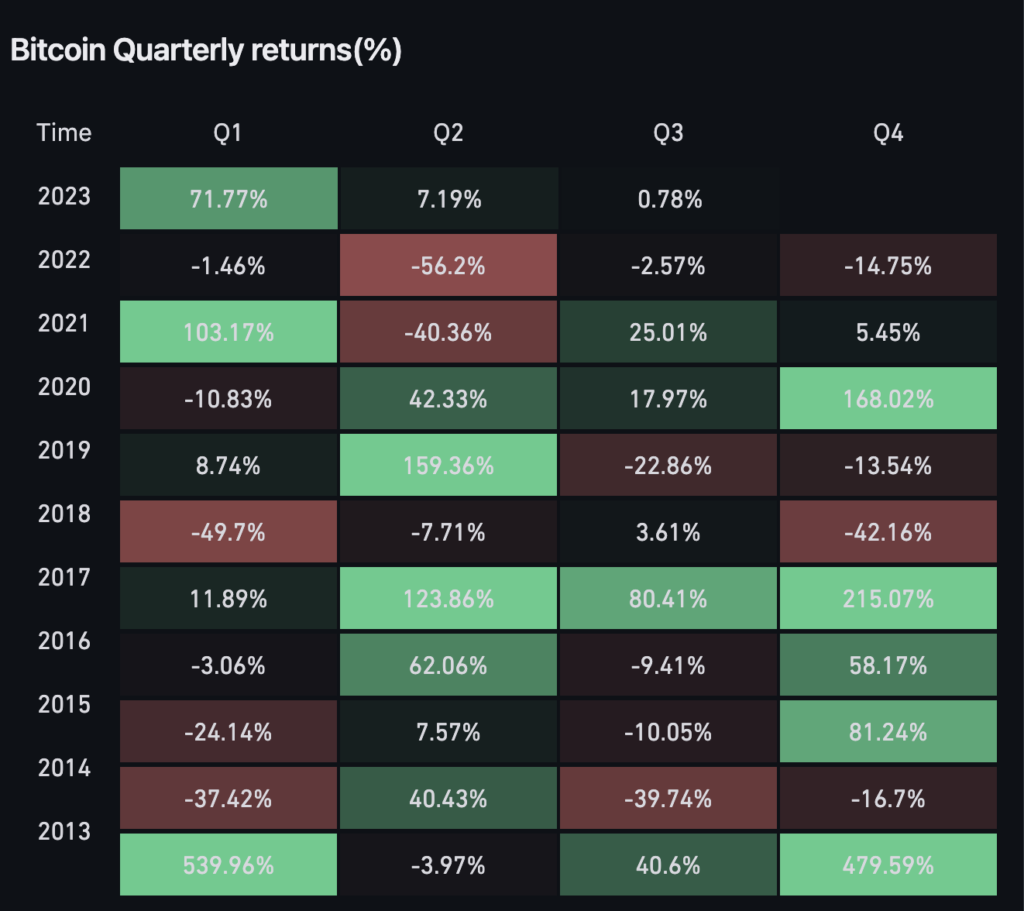

Data from Coinglass shows that the third quarter is generally a good period for Bitcoin. In the third quarter of 2020 and 2021, BTC movement was positive while in 2019 and 2022 Bitcoin provided negative returns for investors. The correction in 2019 came after a 159% price increase of BTC.

Meanwhile, Bitcoin is currently in a period of transition between a bear and a bull market. The $30K price is a strong resistance that BTC needs to turn into support to maintain positive momentum. External factors such as the Fed’s decision and news about ETFs also have the potential to have a significant impact in Q3.

In the context of the crypto industry, the majority of major catalysts are at the end of 2023 with Ethereum’s Dencun, Polygon 2.0, and UniSwap V4 upgrade. However, there is always the possibility that announcements such as Curve and AAVE stablecoins or Layer Zero airdrops could steer the market toward a new trend.

Read the Pintu Academy article on 3 potential crypto trends for the second half of 2023.

Conclusion

The bear market is considered a reset moment for the crypto industry, characterized by the failure of unsustainable projects and the decline in the price of altcoin assets. Despite the price correction in the second quarter of 2023, BTC price movements are still quite positive, and crypto market conditions show some interesting trends. The DeFi sector showed a slight decrease in Total Value Locked (TVL) but the number of users increased.

This crypto market report spots two new trends in the second quarter: the birth of the LSDFi sector and the rise in popularity of meme coins like PEPE. In addition, crypto assets from the DeFi 1.0 category such as UniSwap, Curve, Compound Finance, AAVE, and MakerDAO again attracted attention. The biggest news to emerge from the second quarter was the Bitcoin ETF proposal by BlackRock which gave a strong signal of institutional investors’ interest in Bitcoin. Despite corrections and fluctuations, the trends and narratives in Q2 2023 create the basis for further developments in Q3.

References

- CoinEx, “2023 Q2 Crypto Report(Web3 & Major Industry Updates)”, Medium, accessed on 11 July 2023.

- Todd Groth, “CoinDesk Market Index Q2 Review: Quiet Appreciation, Regulatory Uncertainty”, CoinDesk, accessed on 11 July 2023.

- Chase Devens, “PEPE by the Numbers”, Messari, accessed on 12 July 2023.

- @2lambro, “Most Crypto bros are worst than gamble addicts At least Gamblers know their odds of winning”, Twitter, accessed on 12 July 2023.

- Ignas, “Why I’m Bullish on DeFi 1.0”, Substack, accessed on 12 July 2023.

Share