Crypto Q3 2024 Market Analysis

The second quarter of 2024 has been an important quarter for the crypto industry. In April, BTC experienced its fourth halving. So, just like the previous halvings, it corrects. The volatile movement of BTC impacted the performance of most altcoins in the second quarter. In June, many altcoins hit their 2024 lows. So, what about the potential for altcoins in Q3 2024? Will Q3 bring a significant recovery for the crypto industry? We will discuss it in this quarter’s crypto market analysis.

Article Summary

- BTC Volatility Post Halving: In Q2 2024, BTC experienced volatile movements with a significant correction after the fourth halving, which affected the performance of the majority of altcoins.

- Altcoin Declines in Q2: Many altcoins reached their lowest prices of 2024, with the memecoin and RWA sectors being the few that remained positive performers.

- Q3 2024 Potential: There is hope for recovery in Q3 with BTC starting to show gains, driven by the potential of Ether ETFs and other macroeconomic catalysts.

- Key Catalysts: Interest rate cuts, Ether ETF launch, and the impact of the US election are expected to be the main drivers for recovery and growth in the crypto industry in Q3 2024.

Crypto Market in Q2 2024

Bitcoin

BTC moves sideways during the second quarter of 2024, with a drastic drop occurring in early June until the end of June. Bitcoin’s correction at the end of June brought it back to a low of around $58,000 in early May. The correction occurred after BTC failed to break the ATH and bearish news from markets such as MT. Gox BTC sale and the German government.

During the second quarter of 2024, bearish sentiment dominated heavily, especially with the news of MT. Gox and the German government selling high amounts of BTC. However, BTC’s movement was very much in line with previous post-halving movements.

Ethereum

ETH rallied from $2,900 to $3,900 on the news of ETF acceptance by the SEC. However, during June, it fell back to $2,900. The weak movement of ETH could even be seen from April when it experienced a deep correction.

Nevertheless, many believe that the launch of an ETF will be the biggest catalyst for ETH in 2024. This is reinforced by BlackRock’s commitment to make Ethereum the network of choice for its RWA project.

Altcoin

BTC’s correction throughout the second quarter of 2024 devastated the prices of many altcoins. Altcoins like AVAX and TIA reached new lows in 2024. These movements show that altcoin selection is very important. In the last quarter, only a few altcoin sectors performed well.

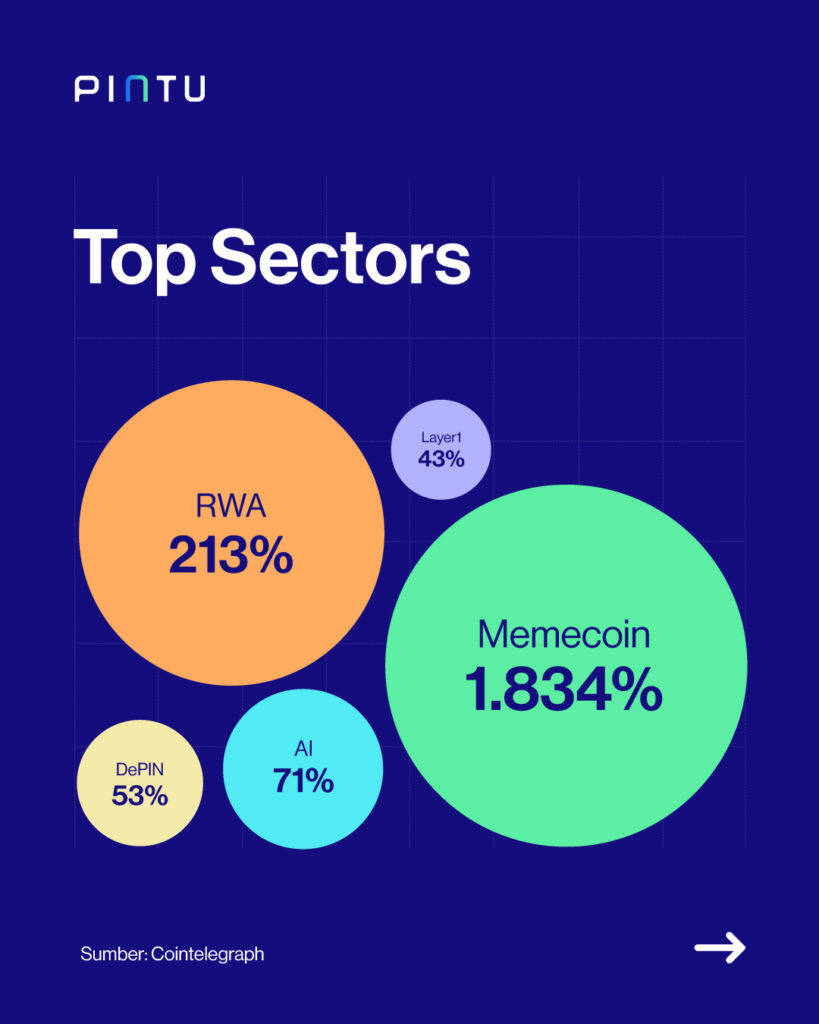

Memecoin and RWA were the two best-performing altcoin sectors in Q2 2024. Memecoins like MOG and PEPE were the top gainers during April-June. Meanwhile, RWA sector leader ONDO climbed from a low of $0.55 and set a new ATH of $1.49.

Crypto Market Third Quarter 2024

Bitcoin

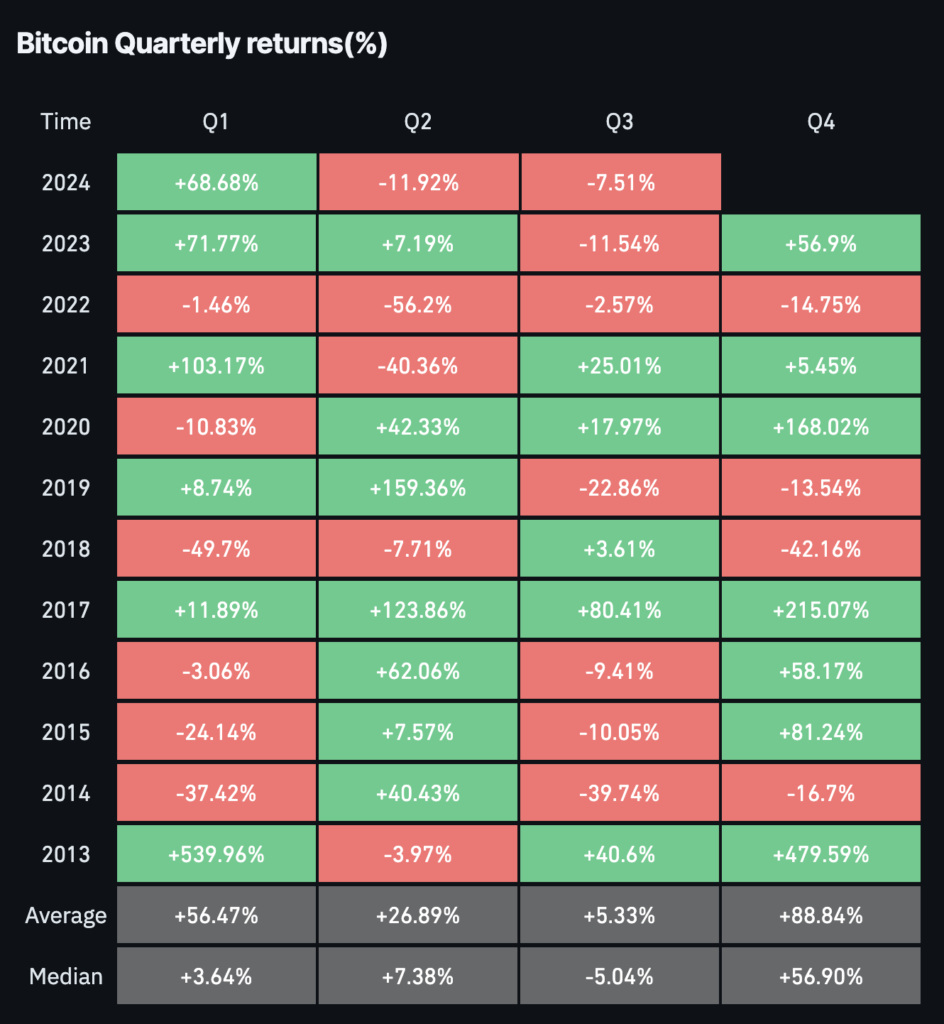

Q3 is generally one of the worst quarters for BTC on par with Q1. However, if we look closely, the third quarter provided gains in the last two bull markets, 2017-2018 and 2020-2021. So, the third quarter is a positive quarter for BTC if it is in a bull market phase.

The movement of BTC at the beginning of the third quarter also gives hope for the prospects of the next few months. Bitcoin managed to reverse and climb 23% from the low of $53,200. Now, we are just waiting for BTC to retest to the range high of $72,000. Then, we need to see if Bitcoin can form a new ATH or fail to break the resistance.

ETH

ETH started the third quarter with a significant recovery. As of July 13, ETH managed to touch the price level of $3,490 again. This movement occurred after rebounding from the support at $2,800. This gives hope to investors who are waiting for further announcements regarding the Ether ETF.

The Chicago Board Options Exchange (CBOE) announced that ETH could be traded as a Spot ETF on July 23. Five institutions can already trade ETH: 21Shares, Fidelity, Invesco Galaxy, VanEck, and Franklin Templeton. Data on the first day of trading should be available on 24th July.

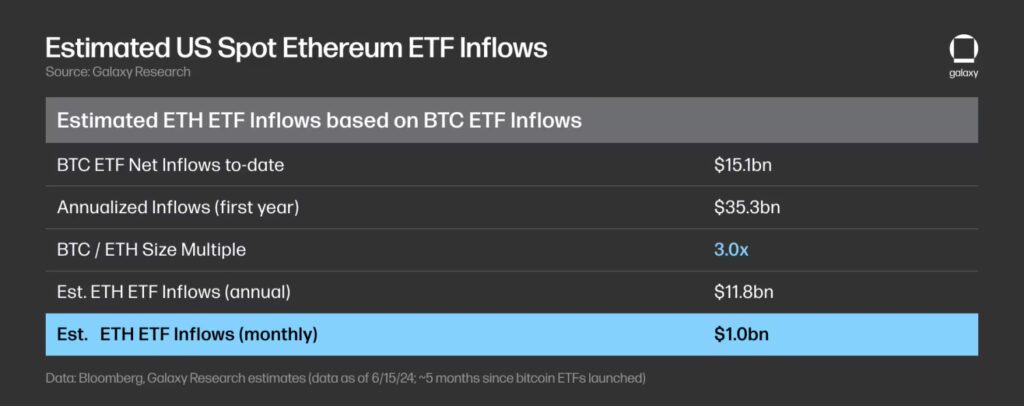

The market response to the launch of the Ether ETF is likely to affect the movement of ETH, the Ethereum ecosystem, and the altcoin market. Galaxy Research predicts flows to ETH will be around $1 billion within 6 months. Despite this, even BTC experienced a correction in the first few days of the ETF launch in spite of significant fund flows.

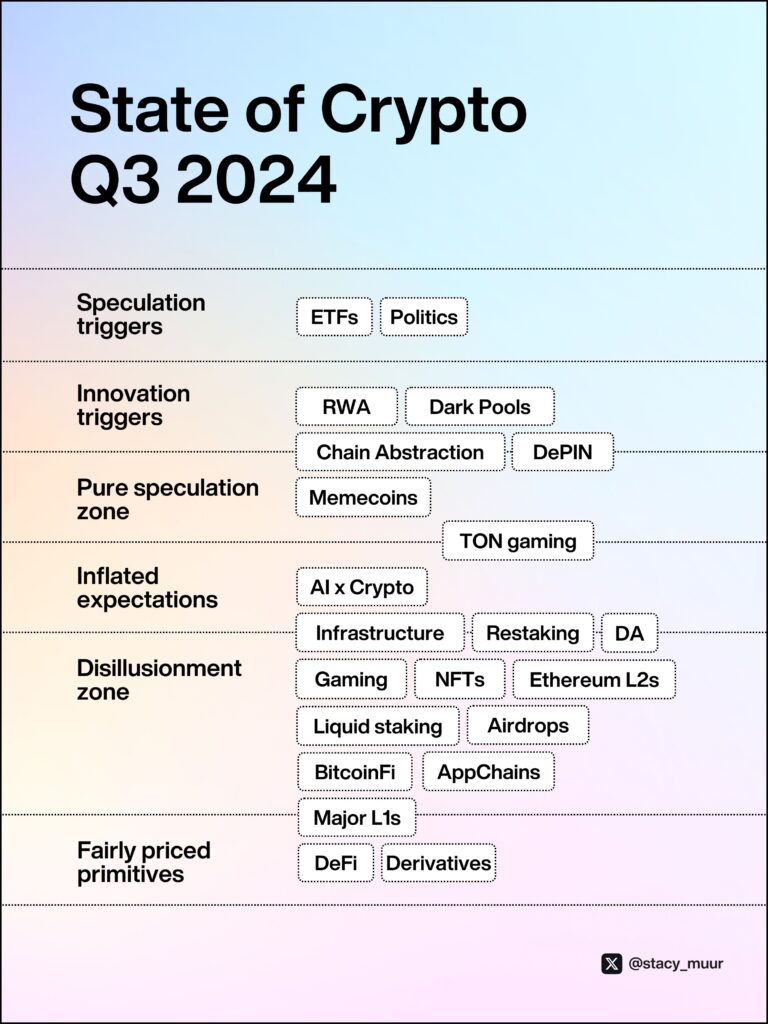

Potential Crypto Narratives in Q3 2024

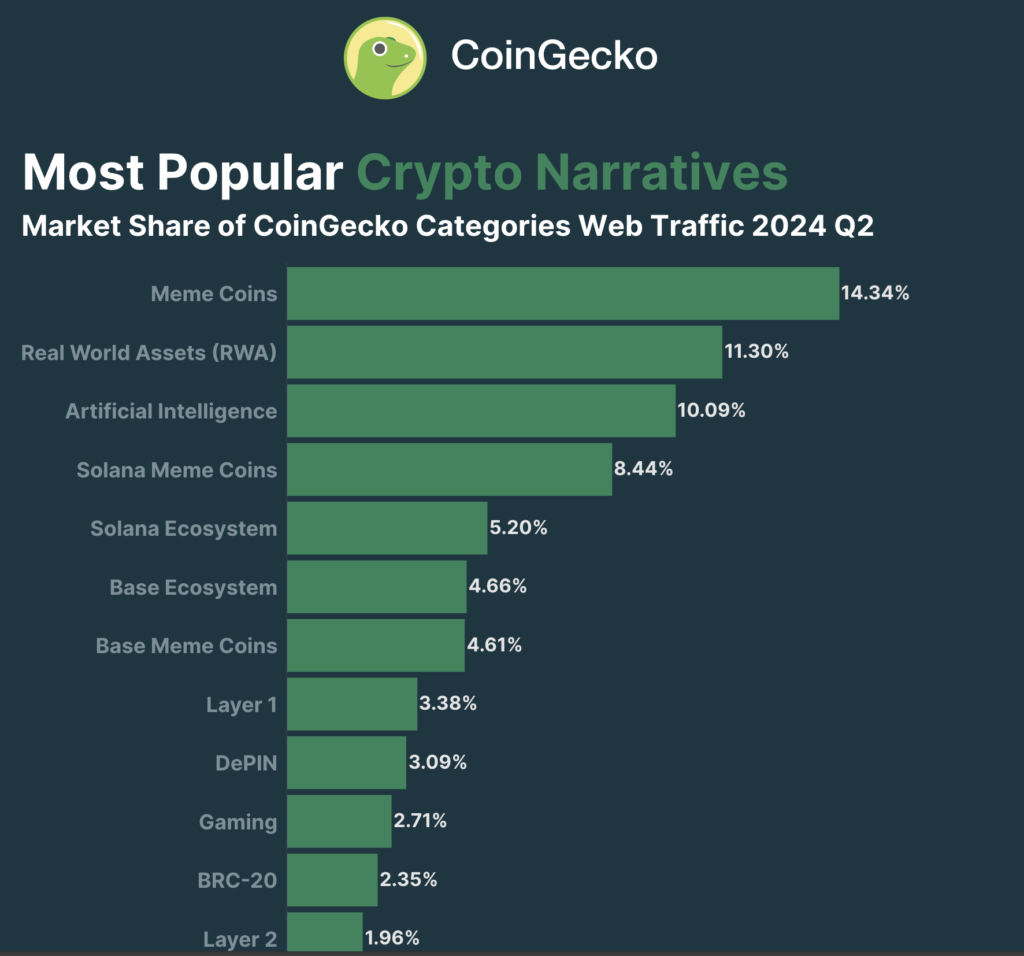

Memecoin

The memecoin sector is one of the best-performing altcoin sectors in 2024. WIF, PEPE, MOG, and POPCAT are some of the memecoins with the highest price increases and managed to break the $900 million market capitalization. The memecoin sector is arguably the prime altcoin sector in 2024, even beating RWA and AI.

Solana consistently prints DEX volumes above $3 billion every week due to very high memecoin activity. The majority of new memecoins that reach fantastic market capitalizations come from Solana.

During the second quarter of 2024, the majority of memecoins experienced extreme corrections of up to -80%. However, BTC’s rising price conditions and the catalyst of Ether ETFs managed to push many memecoins back up. This scenario again demonstrates the principle of memecoins having more drastic corrections when things turn bearish and experiencing the fastest recovery when BTC turns bullish.

If BTC remains stable and returns to ATH, memecoin can experience another mini altseason. Not to mention, the two altcoins with the largest memecoin ecosystems —SOL and ETH— are already back to pre-May and June dump.

RWA (Real-World Assets)

RWA is one of the biggest innovations in the crypto industry in recent years. The concept of tokenization has even been endorsed by BlackRock CEO Larry Fink. BlackRock launched the first investment instrument on the blockchain in March 2024 named BUIDL. The RWA narrative has the potential to be one of the biggest blockchain implementations for the financial sector.

Currently, the two largest RWA projects are MakerDAO and Ondo. Both have small market capitalizations in the $1-$2 billion range. When compared to many other sectors like L1, L2, and DeFi, RWA is still very low—especially since large institutions like BlackRock are interested in the sector.

Alongside the launch of the Ether ETF, the RWA narrative has the potential to become a hot narrative in Q3 2024. MakerDAO also recently announced a $1 billion RWA initiative. Ondo and BlackRock (via Securitize) explained that they will participate in MakerDAO’s initiative.

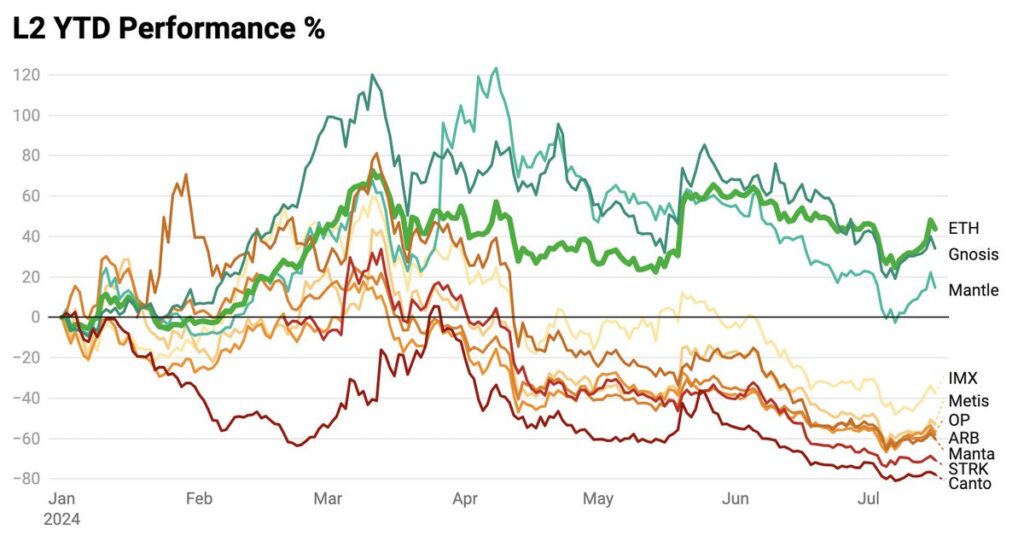

Ethereum Ecosystem

The Ethereum ecosystem is in a unique situation during the second quarter of 2024. Several major altcoins such as OP, ARB, and MANTA experienced poor price movements. Furthermore, ARB reached a low of $0.5 since 2023. The positive momentum of altcoins in the Ethereum ecosystem is very limited to a few projects.

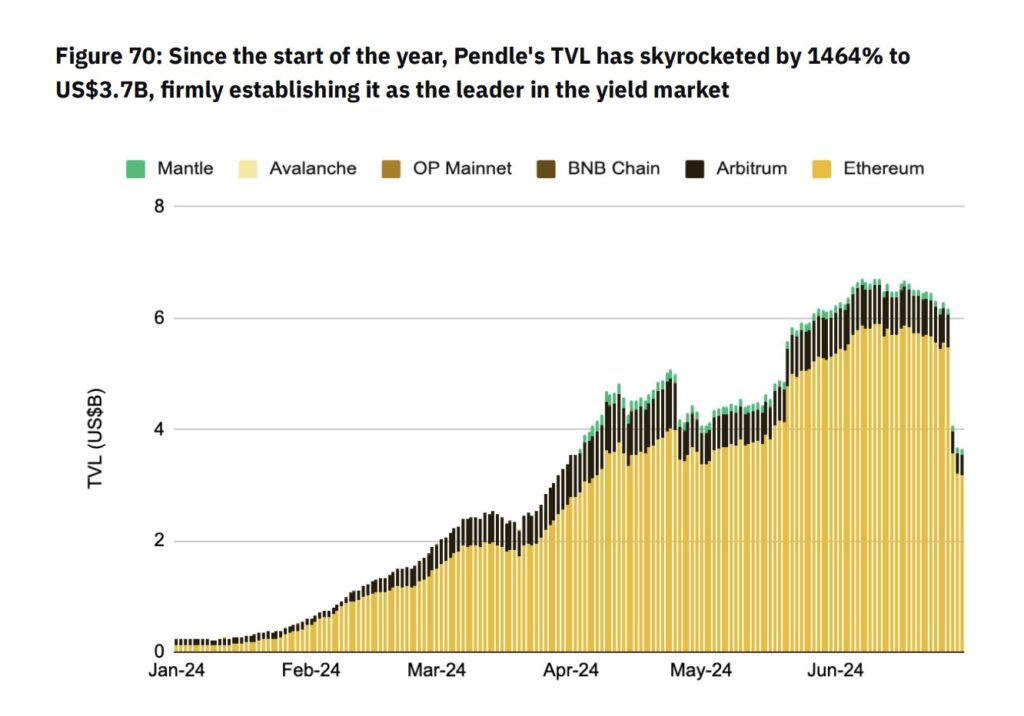

One of the protocols with the best metrics and price movements in the Ethereum ecosystem throughout 2024 was Pendle. Since the beginning of the year, Pendle’s Total Value Locked (TVL) has risen 1,464% to $3.7 billion (currently $3.9). Pendle was able to capitalize on the popularity of points and the potential for airdrops by facilitating the trading of Eigen points and various other protocols.

Beyond that, Ethereum’s L2 ecosystem continues to grow with TVL reaching $43, up 91% from early 2024. However, as an investment instrument, no L2 token could rival ETH’s price performance throughout 2024. Some altcoins in the Ethereum ecosystem that managed to rival ETH were PENDLE, ONDO, and ENS.

Crypto catalysts for Q3 2024

The third quarter opened with a price recovery in BTC and various altcoins. As mentioned, the third quarter in a bull market is usually a green for BTC. In addition, three important catalysts will occur in Q3 2024: interest rate cuts, Ether ETFs, and the US election. All three can create positive momentum for the crypto industry.

Read more about the potential and impact of the US election on Crypto in the following article: The US Election and Its Effects on the Crypto Market - Pintu Academy.

A large flow into ETFs would indicate a considerable institutional investor interest in crypto assets other than BTC. This could be a catalyst for the Ethereum ecosystem, especially for the DeFi and RWA industries. You can see the ETF numbers on Farside’s website when all exchanges have opened.

In addition, the US election can deliver positive impacts to the crypto industry in the form of a more supportive government and clear regulations. One candidate who has been a vocal supporter of BTC and the crypto industry is Donald Trump. Trump is even a keynote speaker at the Bitcoin Conference 2024 event in Miami. Analysts see that BTC will respond positively to Trump’s victory.

Lastly, the third and fourth quarters of 2024 coincide with a planned interest rate cut in the US. Citigroup, Goldman Sachs, and Nomura expect the first rate cut in September. The lower the interest rate, the more liquidity there is in the market. This is likely to be the driving factor for the parabolic movement in BTC and other assets.

Beyond the three above, some catalysts in altcoin projects:

- Nakamoto Upgrade Stacks (August 28)

- MATIC token migration to POL (September 4)

- FTM to S token change (yet to be determined)

- Merging of 3 AI projects into ASI (yet to be determined)

- Announcement of MakerDAO’s new token and stablecoin (unspecified)

Conclusion

The second quarter of 2024 was a challenging period for the crypto industry, characterized by post-halving BTC price fluctuations and significant declines in altcoins. These movements resulted in drastic price declines in many crypto sectors. However, some sectors managed to perform well, such as memecoin and RWA. Going into Q3, there is hope for a recovery with potential catalysts from Ether ETFs, interest rate cuts, and the impact of the US election.

References

- Coinpedia Markets, “Q2 2024 Crypto Report: Insights on Bitcoin and Altcoins“, Medium, accessed on 16 July 2024.

- Lucas Outumuro, “Q2 2024 Onchain. The Impact of the BTC Halving, ETH ETF“, Into The Block Medium, accessed on 17 July 2024.

- Grayscale, “Grayscale Research Insights: Crypto Sectors in Q3 2024“, Grayscale, accessed on 18 July 2024.

- @dunleavy89, “(1/11) Where are we in the current crypto cycle and where do we go from here? In this thread I’ll cover: -Cycle timing”, X, accessed on 19 July 2024.

- “Half Year Report 2024”, Binance Research, accessed on 22 July 2024.

Share