Understanding Different Types of Crypto Trading Order

One of the great things about investing in cryptocurrency is that all market participants have access to almost the same information and tools. The only thing that clearly differentiates is the knowledge and experience of each market participant. If you are a new investor or novice trader, you can learn to increase your success by understanding the fundamentals. One of them is on using the various types of orders in crypto trading. Understanding the types of crypto trading orders can help you make the right decision when you want to buy an asset. This article will explain the types of orders in full.

Article Summary

- 🔎 Trading is the activity of buying or selling within a financial market. Basically, trading is a transaction process that matches buyers (bid) and sellers (ask) in an order book (list of transactions).

- 🧠 Some of the most frequently used order types in crypto trading are Market orders, limit orders, and stop-limits. These three types of orders are very useful for avoiding losses, making profits, and executing various trading strategies.

- 📖 Your understanding of the different types of crypto trading orders can help increase potential profits and reduce losses. Some order types are also more suitable to a specific market condition than the order.

What are Trade orders?

Trading is the activity of buying or selling within a financial market. Basically, trading is a transaction process that matches buyers (bid) and sellers (ask) in an order book (list of transactions). Currently, crypto exchanges are able to provide various buying and selling methods to meet the needs of professional traders as well as beginners.

Tading orders are basically instructions to the exchange to buy and sell assets based on certain criteria and parameters. Skilled investors and traders use it to avoid losses and maximize profits. These orders are also useful if you have a specific strategy in minds such as buying the dip or DCA (dollar cost average).

Here are the different types of crypto trading orders.

Market Order

Market order is an instruction to buy or sell an asset at the currently available price (real-time price). This type of order is executed instantly and is the simplest and most popular order type. Various crypto exchanges usually replace the word ‘market order’ with ‘buy’ or ‘sell’ to make it easier for new users to understand. So, when you immediately buy or sell an asset, you are already using market orders.

This type of order is best for buying or selling popular crypto with high trading volumes such as BTC or ETH to avoid high slippage. Market orders are also suitable if you want to immediately sell or buy a crypto asset when it breaks through an important resistance or support point.

Also read: What is support and resistance points in crypto trading?

The Limitation of market orders

The majority of expert investors and traders usually do not use this type of order. Why? because the crypto markets are very volatile. So, veteran traders usually have determined the price point they want to trade in beforehand, they will not scramble to market buy/sell a rising/falling asset.

In addition, market orders are also not suitable when the volatility of the asset is high and the price is falling (or rising) rapidly. In this situation, you can get a higher or lower price than the real-time price when placing a market order. This is because the price is moving so fast and hundreds of other market orders are being placed at the same time. This is called slippage which can also occur when you buy assets with low liquidity.

💡 Slippage example: Rizki saw the price of US$500 per 1 ETH and decided to buy right away. However, due to the high volatility of ETH, Rizki get $520 dollars per 1 ETH. This happens because of the slippage. Most major crypto exchanges have their own parameters to avoid high slippage.

Limit Order

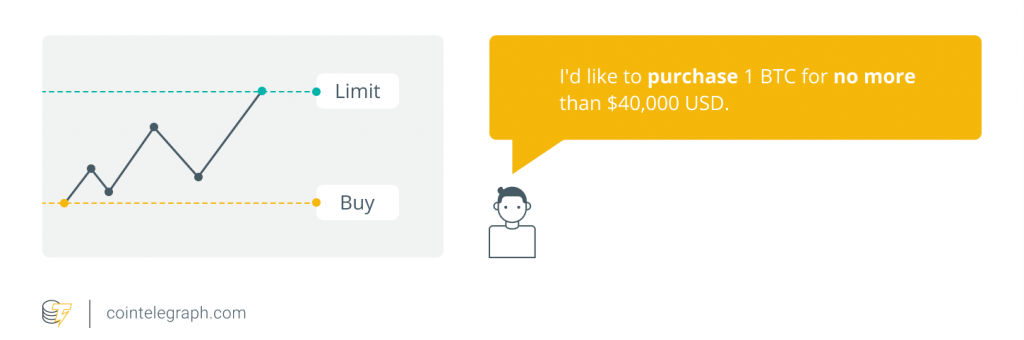

Limit order is an instruction to buy or sell an asset at a specific price automatically. A buy limit order means setting it at a lower price, while a sell order is set at a higher price. The purchase of your crypto asset will only occur when the asset touches your preferred price.

Experienced traders and investors usually use this type of order based on technical analysis. Traders usually determined crucial prices with the potential to provide short or long-term profits. Limit orders should be used in conjunction with technical analysis using trading indicators about the important price points of a crypto asset.

💡 Example of using limit order: Bitcoin price is now $50,000 US dollars. Bella has already done a technical analysis and she believes that the price of BTC will touch $40,000 in the next week. Bella then opened a limit order to buy 2 BTC $41.000. On the other hand, Bella also open a limit order to sell her 2,000 FTM at $1,5 dollars (the current price is $1.2 dollars) because she wants to take a profit.

Limit Orders Weakness

The majority of crypto exchanges have a queuing system for limit orders. That is, if there is a long queue at a certain price point, there is a possibility that some orders will not be executed. In a case like this, we can only wait. Crypto exchanges implement a tolerance system in limit order to ensure every order is filled. The tolerance determines a tight price range according to the limit price.

Read more: 4 Best Crypto Trading Indicators

Stop-Limit

Stop-limit is an instruction involving stop and limit prices to buy/sell an asset when it is within a predetermined range. Stop-Limit orders work by setting stop and limit prices. The stop price determines the limit order. So, once the asset reaches the stop price, a limit order will carry out the instruction to buy or sell. Stop-Limit orders combine the benefits of limit and stop orders.

- Stop orders, trigger a market order to buy or sell the asset as soon as it reaches a certain price (the stop price)

- Limit orders, which buy or sell assets at a specific price.

Basically, this type of stop-limit order allows the trader to set a stop price at an important resistance or support point (e.g. 200 EMA) and place a buy/sell order at the next limit price (higher if buying and lower if selling). The stop-limit strategy has a different function if you want to buy or sell crypto assets. Expert traders will use this type of order to prevent large losses and make profits in the event of a breakout.

If you want to sell, a stop-limit is useful to prevent big losses in case your assets suddenly fall. When buying an asset, a stop-limit is useful if the asset will experience an upward trend when it reaches the stop price you set.

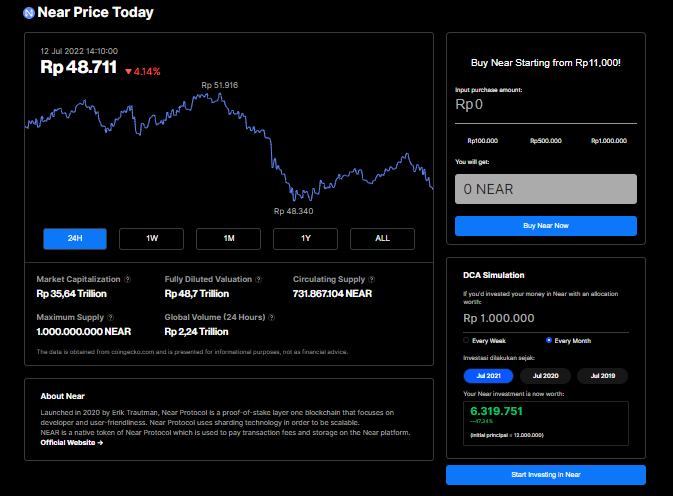

💡 Example of using stop-limit order: Rizki has 500 NEAR he bought at $3 US dollar. Seeing the market situation, Rizki is worried that NEAR will suddenly (the NEAR price is now $3.4). Therefore, Rizki placed a stop-limit order to sell 500 NEAR with a stop price of $3 and a limit price of $2.9. With this decision, Rizki will not suffer significant loss if the NEAR price drops.

Weakness of stop-limit orders

Like limit orders, the weakness of the stop-limit order type is that there is no guarantee that your order will be executed. This order type also works like a queue system according to the time stamp of each order and the nominal purchase. One trick you can do is to shift the limit point so that it has a greater chance of entering the first queue and not piling up at a crowded price point.

Read more: Choosing the Appropriate Crypto Trading Techniques

Why Do You Need to Understand Order Types?

- 🤑 Increase potential profits and reduce losses: Your understanding of the different types of orders in crypto trading can help increase potential profits and reduce losses because you have many ways to manage trades.

- ⚖️️ Adjusting to market conditions: The various types of orders for trading needs to be adjusted to market conditions and trends. Bull and bear market conditions require two different trading strategies and different order types.

- 🧠 Implementation of results from the technical analysis: Executing results from technical analysis usually also requires more complex order types than just buying at market orders. Orders such as stop-limit allow you to determine the price point you want while reducing the risk of large losses. Test the accuracy of your technical analysis using complex order types to reduce potential loss.

Buying Cryptocurrencies

You can buy various cryptocurrencies in Pintu in a safe and convenient way.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can learn more about cryptocurrencies through the various Pintu Academy articles that we update every week! All Pintu Academy articles are created for information and educational purposes only, not financial advice.

References

- Marko Mihajlović, Guide to Cryptocurrency Exchange Order Types | Advanced Guide to Trading Cryptocurrencies, Shrimpy, accessed on 4 July 2022.

- Trading Basics: Market Orders, Limit Orders, & More, Gemini, accessed on 5 July 2022.

- Crypto trading basics: A beginner’s guide to cryptocurrency order types, Coin Telegraph, accessed on 5 July 2022.

- What are market orders, limit orders, stop limit orders?, Bitpanda Academy, accessed on 6 July 2022.

Share