Crypto Market Analysis December 29, 2025: Institutional Investors Cautious and Bitcoin Stuck in Consolidation Phase

Bitcoin, Ethereum, and Solana are still moving in a consolidation phase at the end of 2025, amid negative sentiment pressure. Here is an in-depth summary of this week’s market conditions based on technical analysis, on-chain indicators and macroeconomic developments.

Article Summary

- Bitcoin ETF Netflow has remained in the negative zone in recent days, indicating increased investor caution amid monetary policy uncertainty.

- The US inflation rate has shown a relatively consistent downward trend in recent months, so the Fed has not seen any urgency to cut interest rates.

- On-chain: Bitcoin transaction fees are at their lowest level since January 2011. This has the potential to put pressure on miners’ profitability as the revenue from transaction fees could be insufficient to cover high operational costs.

- Bitcoin and Ethereum At Crucial Levels: Bitcoin needs to break the $88,456 level to become bullish again. Ethereum, on the other hand, is holding above the support area.

- Solana manages to Rebound: the crucial level for Solana is at $127.11 (EMA-20), if broken Solana could potentially rally.

Fear & Greed Index: Surviving the “Fear” Stage

As the turn of the year approaches, the crypto market doesn’t seem to be breathing a sigh of relief. Investor sentiment is still stuck in the “Fear” zone with an index score of 30, stagnant compared to last week. The absence of a year-end rally (Santa Claus Rally) this time was triggered by macroeconomic pressures and bearish signals from institutional fund flows.

Institutional Highlights: Red Trend on Bitcoin ETF Netflow

One of the most striking indicators this week has been the consistent sell-off of institutional investors through the Bitcoin Spot ETF. Market data suggests there is a strong risk-off sentiment among large players.

- Outflow Sequence

Based on historical data this week, the Bitcoin Spot ETF recorded consecutivenet outflows. Not a single day recorded significant positive inflows towards the end of the month.

- Peak Withdrawal

The selling pressure peaked on December 26, 2025, where a net outflow of -3.16K BTC was recorded in a single trading day.

- Negative Accumulation

This trend continues a series of previous withdrawals, including on December 24 (-2.00K BTC) and December 23 (-2.13K BTC).

The consistency of these outflows indicates that institutions are reducing their exposure to risky assets, most likely in response to the uncertainty of US monetary policy ahead of 2026.

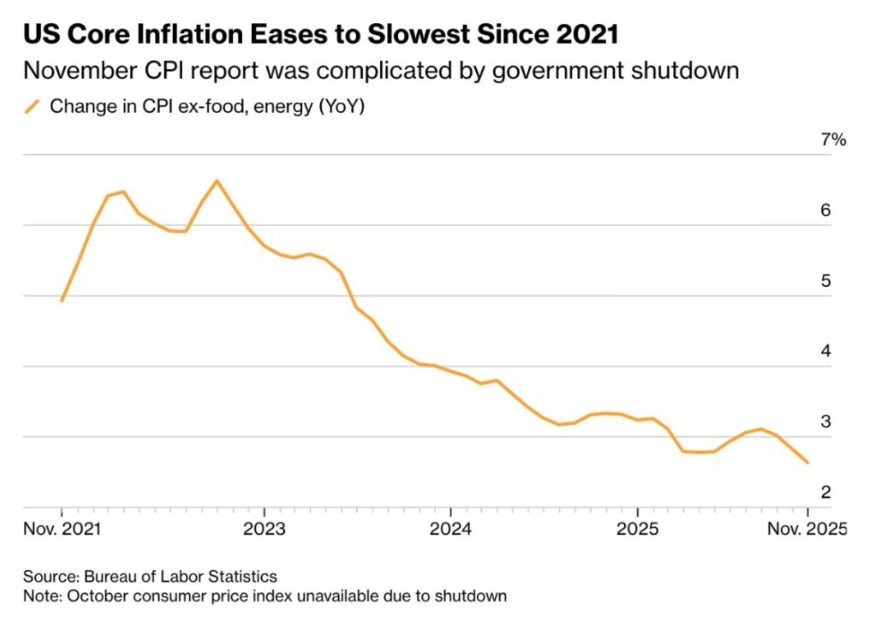

Reasons No US Interest Rate Cut

Investors’ hopes of seeing aggressive monetary policy easing appear to be on hold. Although the Fed has cut interest rates three times in a row, US central bank officials are now putting the brakes on market expectations.

Federal Reserve Bank of New York President John Williams emphasized that there is no urgency to cut interest rates further at this time. “The cuts we’ve made have put us in a pretty good position,” he said, while emphasizing that the main target remains to bring inflation down to 2%.

Jeff Mei, COO of BTSE, warned that if the Fed holds interest rates through Q1 2026, Bitcoin could potentially fall to $70,000 and Ethereum to $2,400.

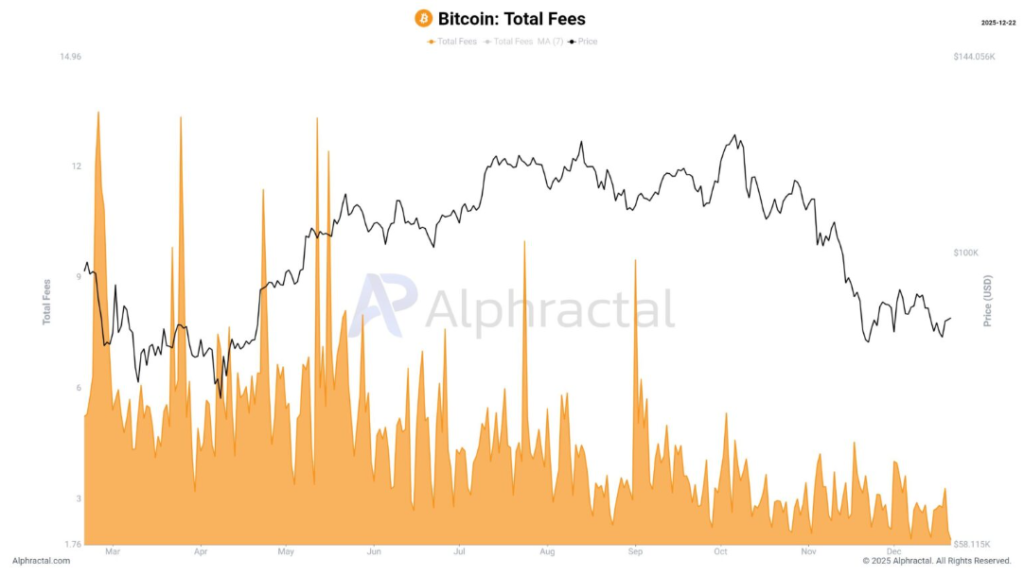

The Impact of Bitcoin Transaction Fees

On the technical side of the network (on-chain), a rare phenomenon occurred. Transactionfees on the Bitcoin network plummeted to their lowest historical level since January 2011.

This is a “double-edged sword”. For users, transfer fees have become very cheap. However, forminers, the decline in fee income amidst high operating costs drastically erodes profit margins. This situation creates a risk of miner capitulation, where they are forced to sell Bitcoin reserves to cover costs, potentially adding to selling pressure in the market.

Technical Analysis: Bitcoin, Ethereum, and Solana

From a technical perspective, the price movements of major assets such as Bitcoin, Ethereum, and Solana are still in the determination phase, here is the analysis:

Bitcoin (BTC)

Bitcoin is still stuck in the consolidation phase. The main defense (support) is in the area of $83,821 – $86,284. To get bullish again, BTC needs to break the Dynamic Resistance (EMA-20) at $88,456. Beware that if the price breaks down, the downside target could reach $80,641.

Ethereum (ETH)

Showing resistance in the $2,719 – $2,798 area. The toughest challenge now is to break the $2,985 level to restore positive sentiment.

Solana (SOL)

Solana managed to rebound and is now testing the crucial level of $127.11 (EMA-20). If it is able to breakout, SOL has a chance to rally towards $144.80.

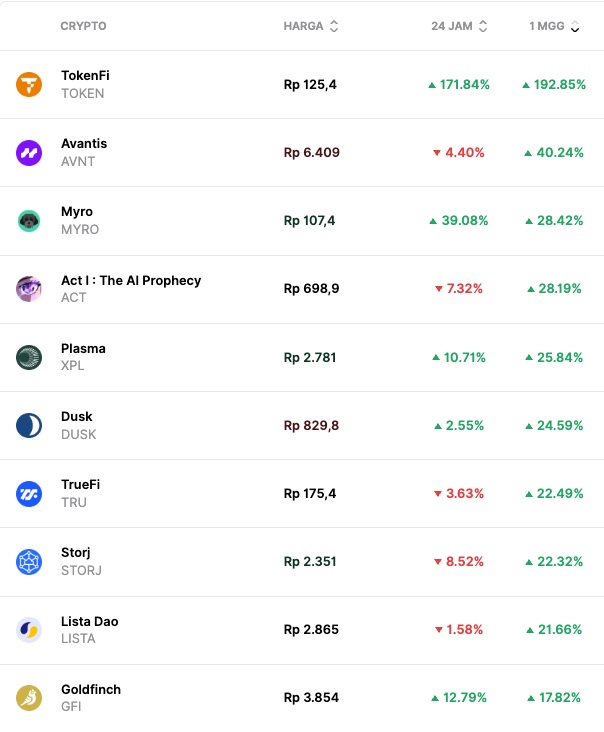

Crypto Asset Performance in the Last Week

Top Performing Crypto Assets

- TokenFi ($TOKEN) +192.85%

- Avantis ($AVNT) +40.24%

- Myro ($MYRO) +28.42%

- Act I: The AI Prophecy ($ACT) +28.19%

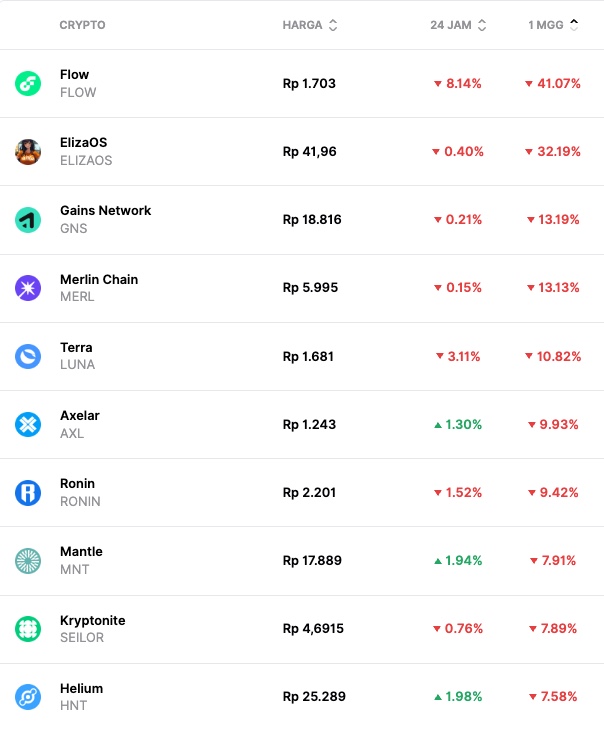

Worst Performing Crypto Assets

- Flow ($FLOW) -41.07%

- ElizaOS ($ELIZAOS) -32.19%

- Gains Network ($GNS) -13.19%

- Merlin Chain ($MERL) -13.13%

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Conclusion

This week demands extra vigilance. The combination of heavy institutional fund outflows via ETFs, Fed uncertainty, and potential miner capitulation makes the markets extremely sensitive. Traders are advised to wait for technical breakout confirmation before making any major decisions.

Reference

- ARLI FAUZI,“Bitcoin Network Fee Touches Historical Low, Miners Sell BTC Again?“, Volubit.id

- ARLI FAUZI, “Considering the Fed’s Q1 2026 Policy Outlook and Its Impact on the Crypto Market“, Volubit.id

Share

Table of contents