Buy the Dip: What Is It and How Do You Do It?

The crypto market is a relatively new asset market, especially in Indonesia. Compared to the stock market that has been around for hundreds of years, the crypto market is still in its infancy. This situation provides a golden opportunity for many new investors because many of these assets have great potential. However, this also carries a big risk, namely drastic price fluctuations. Incorrect decisions can cause you to lose the money you put into crypto assets. Therefore, there are many investment strategies that can help reduce the risk of loss. One of them is the buy the dip strategy that can help you buy assets at the right price. So, what is a buy the dip? Why is this investment strategy important? This article will discuss the strategy in detail.

Article Summary

- 🤏 Buy the dip is a term commonly used in the world of crypto and stocks. It refers to the strategy of buying an asset when its price is dropping from its highest price.

- 💵 The buy the dip strategy is a great choice for long-term investors who want to accumulate one coin. Therefore, investors who use this method should not expect to make quick profits and should choose crypto assets with strong fundamentals.

- ⚖️ The advantage of buying the dip strategy is that you buy coins at a discount to keep them long-term. However, buying at the right time requires strong analytical skills so you don’t buy an asset right before it experiences a downtrend.

- 🤔 Executing the buy the dip strategy requires fundamental and technical analysis skills to determine the value of the asset you are buying and at what price you should buy it.

What is buy the dip?

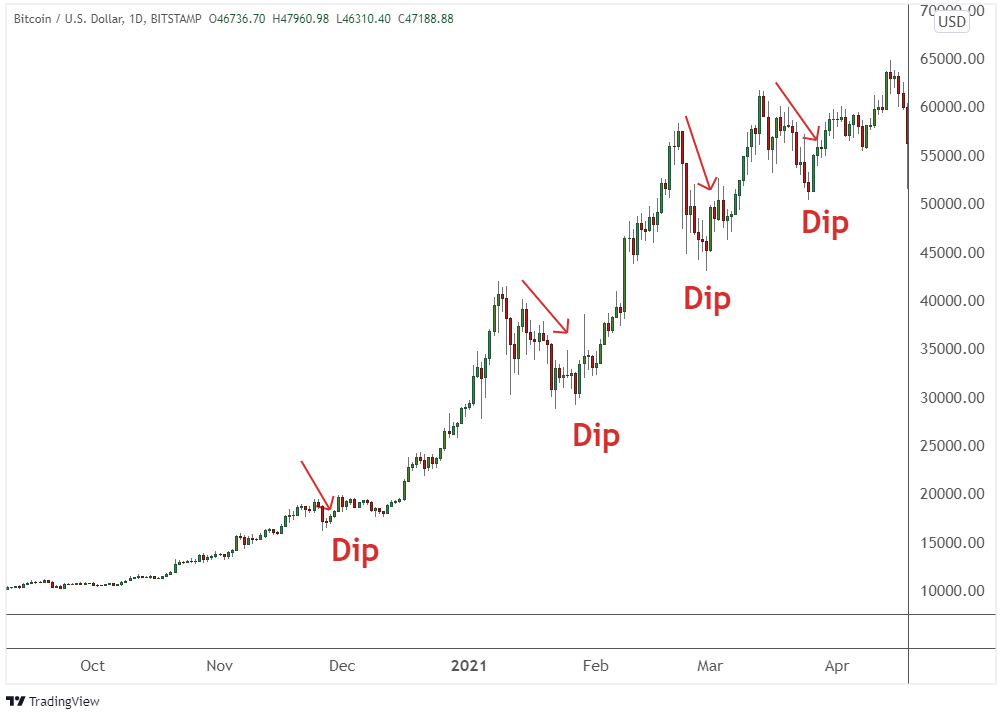

Buy the dip is a term commonly used in the world of crypto and stocks. It refers to the strategy of buying an asset when its price is dropping from its highest price. This strategy gives you a discount on an asset and when it recovers, you will make a profit. Like the asset market in general, the crypto market has its own cycles or ‘seasons’. There are times when the crypto market as a whole experience an upward trend (bull market) and there are also periods when it experiences a downward trend (bear market).

Also read: Distinguishing bull and bear market

The buy the dip strategy (the crypto community calls it BTFD) means that we buy an asset when its price falls. Professional investors usually set a limit for doing BTFD, for example, they will only buy a dip when the price drops by 30%. However, this limit is something that is determined by each individual investor because it depends on each person’s strategy.

The essence of the buy the dip strategy is that you will get long-term profits from buying an asset when the price is down. However, there are advantages and disadvantages to doing this strategy.

The advantages and disadvantages of using the buy the dip strategy

The buy the dip strategy is a great choice for long-term investors who want to accumulate one coin consistently. Therefore, the benefits that you will get from this strategy will occur over a long period of time. If you want to get profits quickly, this strategy is not suitable for you. The buy the dip strategy is also more appropriate for those of you who are just trying to get into the crypto world. Together with the DCA (dollar-cost-averaging) strategy, you can avoid experiencing large losses when you first start investing.

Also read: What is dollar-cost-averaging?

Here are some advantages and disadvantages of using the buy the dip strategy:

Advantages of buy the dip

- ⚖️ Buying assets at a discount: The buy the dip strategy allows you to buy crypto assets at a discount and prevents you from buying at the top or highest price of a coin. Buying when the price is down will give you a bigger profit when the asset returns to its ‘normal’ price or increases.

- 💵 Long term profit potential: Before buying a crypto asset in a dip, you need to trust the fundamental aspects of the asset. If you have done enough research and believe that the asset you choose has great utility and potential, then you have the potential for long-term profits.

- 📈 Buy the right dip before the asset price increases: In a bull market, the buy the dip strategy can give you an opportunity when the asset is in a minor correction phase before it experiences a drastic price increase. However, this technique requires accurate analytical skills.

Disadvantages of buy the dip

- 📉 Prices could still drop further: One argument against the buy the dip strategy is that you could buy an early dip and the asset continues to decline. In this situation, you will experience a bigger loss if it turns out that you buy shortly before the bear market. This situation can be avoided by conducting a technical analysis.

- 🤏 Small short-term profit potential: The buy the dip strategy is basically a long-term investment strategy with the expectation of long-term profits. Some professional traders might be able to determine the right moment to buy a dip and get a profit. However, this is very difficult to do.

- ❌ Prices don’t drop as you predicted: You may lose your profit potential when using a buy the dip strategy, especially in a bull market trend. The dip you are waiting for may not happen and the price will continue to rise.

Several things to note before buying the dip

Do a Fundamental Analysis (FA) of the coin you want to buy

One of the most important things in investing in cryptocurrencies is checking the fundamentals of the asset. Unlike the stock market, cryptocurrency projects do not have fundamental aspects such as profits and balance sheets. Therefore, fundamental analysis of crypto assets is carried out in a different way.

One of the most basic ways of doing fundamental analysis is reading the whitepaper published by every crypto project. All serious crypto projects will have a systematic, detailed, and clear whitepaper. If the whitepaper of an asset is not detailed, has typographical errors, and is difficult to read, there is a high potential for the asset to be a scam. In addition, other aspects such as the team behind a project and the token economy also need to be considered.

Here are some questions you should ask when conducting fundamental analysis of the crypto project you want to buy:

- What problem is this project trying to solve? How easy is it to use?

- Who made the project? How’s the track record? Is it suspicious?

- How is the token economy (Tokenomics)? Does it do a lot of initial sales (seed round)?

- Does it have a large and loyal community? Check the project’s social media.

- Does he have a whitepaper? If so, read it thoroughly!

Determining the market trend to buy the dip

The world of cryptocurrency is at a critical stage in its history. The number of individual and institutional users of cryptocurrencies continues to increase every year. Many countries are starting to see crypto as a commodity asset that needs to be regulated, not banned. However, even though the crypto asset market is getting bigger and the choice of assets is getting bigger, the crypto market has one big drawback. The trend of the crypto world market is determined by one of its most valuable assets, Bitcoin .

The upward and downward trend in the crypto market always starts with the Bitcoin price movement. Bitcoins down? All altcoin assets will fall. In fact, cryptocurrencies with a small market cap can experience a price drop of up to 80% in a bear market. Determining the trend of the crypto market means analyzing Bitcoin price charts. You can use various technical indicators such as EMA, RSI, and MACD to perform a technical analysis of Bitcoin.

How do you buy the dip?

The basic principle of buy the dip strategy

- Buy a dip when the price trend is on the rise (reducing the risk of the price going down further)

- Do buy the dip into coins with long-term potential (do a fundamental analysis first)

- Be careful when buying the dip in a bear market (the price could still drop further)

- Buy dip slowly using the DCA strategy (average in)

Perform technical analysis

Technical analysis (TA) is an analytical method of reading price charts using a variety of mathematical indicators to determine the movement of an asset. Through technical analysis, you can determine the future price movement of the asset, the trend that the asset is currently experiencing, and also the target price for buying or selling assets. Technical analysis is carried out using various trading indicators that can provide you with additional information about the asset.

Some of the simplest trading indicators for you to use are MA, EMA, and Volume. If you are new to doing TA, you must master these three elements because they are an important basis. In fact, some professional traders can predict asset movements using only these 3 things. After that, you can learn to use other indicators such as Bollinger Band, MACD, and RSI. These three indicators are very useful when we want to buy an asset.

MACD and RSI can give you information on whether an asset has reached its low point or not and see the momentum of falling and rising prices. If you want to use the buy the dip strategy, you should at least understand the use of the EMA and RSI indicators. When you can use multiple indicators, you can trust your own analysis instead of relying on others.

Also read: 4 best trading indicators in crypto

Find out why the price drop

One of the easiest ways to determine if a dip is going to have a temporary effect or the start of a bigger trend is to look at news and events happening within the crypto community or on a global scale. The crypto asset market can be affected by government policies, political events, as well as current economic events. You can find information about all this through news channels and also see the response from the crypto community through social media.

Bear and bull markets also have a close correlation with various kinds of news that are currently popular and their impact on the market. In a bear market, bad news on cryptocurrencies will definitely have a negative effect on the price of the crypto market. On the other hand, in a bull market, negative news or FUD (fear, uncertainty, and doubt) usually will not have a big impact on the crypto market or will only cause a temporary dip.

Important news like the Fed’s monetary policy will definitely have a significant impact on the crypto asset market as its decisions will impact most investors. The outcome of a policy like this can determine market momentum. However, looking at the news to determine how much the price has decreased or increased cannot be used as an accurate benchmark.

Fundamental, technical analysis, as well as looking at events that occur in the crypto community can be a more accurate benchmark to see a dip and also market trends. Always combine all of these things before making an investment decision that has a major impact on your financial condition.

Buying cryptocurrency

You can start investing in crypto assets by buying them in the Pintu app. Through Pintu, you can buy cryptocurrencies such as BTC and ETH in an all-in-one convenient application.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can learn more about cryptocurrencies through various Pintu Academy articles that we update every week! All Pintu Academy articles are made for educational purposes only, not as financial advice.

References

- Mallika Mitra, Does ‘Buying the Dip’ Actually Work?, Money, accessed on 11 February 2022.

- 6 Trading Strategies to Profit From The Turbulence in Crypto-Markets, Hacker Noon, accessed on 11 February 2022.

- Katie Brockman, Should You Buy the Crypto Dip? 3 Questions to Ask Yourself First, The Fool, accessed on 13 February 2022

- Rob Lenihan, Crypto Crash Sparks ‘Buy the Dip’ Refrain. What To Know Before Your Move ?, The Street, accessed on 13 February 2022.

- The Crypto Dips – 3 Reasons You Should Buy (and 3 Why You Shouldn’t), Liquid, accessed on 14 February 2022.

- TJ Porter, What Does It Mean to ‘Buy the Dips’?, The Balance, accessed on 14 February 2022.

- Claire Ballentine dan Charlie Wells, Investing Ideas: Should You ‘Buy the Dip’ When Bitcoin, Stocks, or SPACs Drop? – Bloomberg, accessed on 14 February 2022.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-