How To Earn Interest on Crypto?

The crypto industry opens up many financial opportunities that were previously complex and time-consuming. Activities such as saving at a bank that used to take a long time can be done in seconds. What’s more, crypto savings have much higher interest rates than traditional banks. This article will show you several ways to earn crypto interest.

Article Summary

- 🏦 There are various ways to earn interest through cryptocurrencies. This article discusses three ways: yield farming, staking, and earn compound interest. You should choose the method that suits your knowledge and risk tolerance. Pintu Earn is a safe option for newcomers to the crypto industry.

- 💸 Yield Farming: The practice of lending crypto as liquidity providers to earn interest, but with the risk of impermanent loss.

- 🔒 Staking: The locking of crypto assets to support the security of a blockchain network, offering direct rewards from the projects involved.

- 💼 Earn Compound Interest: Storing crypto assets on a specific platform to generate compound interest, offering flexibility without asset lock-in periods.

How to Earn Interest on Your Crypto?

The high price volatility of crypto assets makes them promising for trading with huge profit potential. However, this volatility also opens up the potential for equally large losses.

Therefore, many DeFi protocols provide alternative ways to earn profits apart from trading. Three ways to earn interest on crypto assets are through yield farming, staking, and earning schemes. All three have their advantages and disadvantages and target different types of users.

Here are some ways to earn returns with your crypto assets.

1. Yield Farming

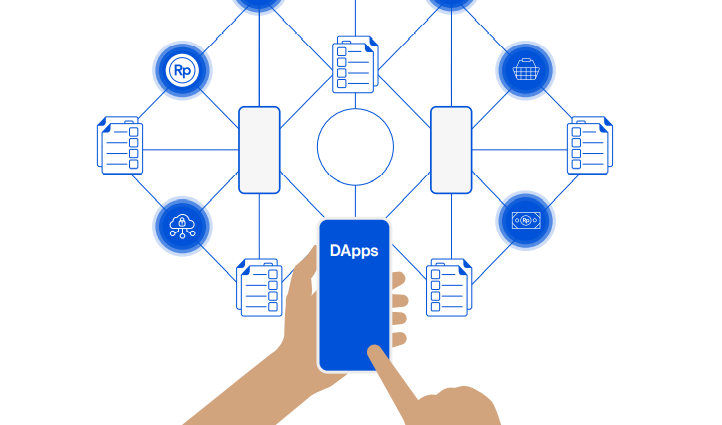

Along with the development of decentralized applications (dApps) on blockchain such as Ethereum, many decentralized finance (DeFi) applications offer interest for their users.

One way to earn interest from DeFi applications is yield farming. Yield farming is the practice of lending and locking crypto to generate rewards. Crypto lending applications such as Compound and AAVE are among the applications that facilitate yield farming. The incentive given to the lender is usually in the form of a percentage float interest within a certain range.

Another form of yield farming is becoming a liquidity provider on the DEX platform. The incentive to the liquidity provider is a percentage of the pool’s trading fee (e.g. ETH-BTC pair pool).

An example of becoming a borrower on Compound:

On Compound, interest is called Annual Percentage Yield (APY), and the interest rate varies depending on the asset. As of December 2023, if you deposit stablecoin USDC into Compound, you'll get an APY of 9.9%. This rate will go down and up depending on how many borrowers are in the pool.

Unlike being a borrower, being a liquidity provider comes with the added risk of impermanent loss. Almost all DEXs with Automated Market Maker (AMM) systems have this risk. Impermanent loss is a temporary loss that liquidity providers commonly experience as a result of price fluctuations in the liquidity pool. If you are not familiar with this, avoid becoming a liquidity provider.

Read also: What is DeFi?

2. Staking

Staking is a mechanism to help secure a Proof-of-Stake (PoS) network. Users will lock a network’s native token. Stakers will be directly rewarded by the project. The staking mechanism is only possible on PoS networks such as Ethereum, Cardano, and Solana.

In addition to the staking mechanism, DeFi protocols also utilize staking as a way to lock in token liquidity in exchange for incentives. Currently, many DeFi protocols offer staking to provide added value for their users and increase their TVL.

3. Earn Compound Interest

Many crypto exchanges now offer a way other than yield farming and staking, namely the earn scheme. Crypto platforms with an earn feature provide interest for users who store their assets in the app.

Earn features work like a regular savings account. You can deposit assets such as BTC or other altcoins. Your crypto assets will earn compound interest, and you can withdraw your assets at any time.

The interest rate on cryptocurrency platforms is usually much higher than saving money with conventional financial institutions. Many platforms offer interest that can reach 5% or even up to 10%. In addition, the earn compound interest feature on crypto apps is usually not paid per month but per day or hour.

Choosing the Safest Way to Earn Interest on Your Crypto

You should choose a way to earn interest in crypto that suits your knowledge of the crypto industry and your risk management. If you don’t understand where and how you’re earning interest, you’re more likely to lose money.

For example, experienced crypto users should be able to find the most profitable and safest yield farming protocols. Meanwhile, new users may be tempted by high-interest rates from protocols they don’t know and get scammed. So, new users are better off utilizing earn or staking features as they offer competitive interest rates while offering safety.

Pintu is one such cryptocurrency platform that offers staking as well as earn features.

Using Pintu Earn

The Earn feature in the Pintu app is one of the safest ways to earn interest on crypto. This feature offers the security of saving in a traditional bank but with higher interest rates. You can earn a maximum interest of 10% on USDT and USDC assets or 7% on BTC. In addition, you can choose flexi mode or lock your assets for 30 and 60 days.

The image above is the maximum interest from Pintu Earn if you stake PTU tokens. The more you stake PTU, the higher the potential interest from Earn you can get.

The Earn feature is perfect for those of you who do DCA on crypto and don’t want to sell them in the short term. You can store these assets in Earn while earning passive income from Pintu Earn.

Tutorial on Using Pintu Earn

Using the Earn feature on Pintu is very easy! Just like trying other features, you can do everything directly on the homepage of the Pintu application.

Here’s how to start earning crypto asset interest through Pintu Earn:

- Open Pintu app

- Select “Earn” on the main page

- Choose between Flexi or Locked (locking for 30 or 90 days)

- Select an asset and decide how much you want to put in Earn!

- Now you will earn passive interest from the assets you save in the Earn!

References

- What happens when cryptocurrencies earn interest? Harvard Business Review. (2021, March 4). Retrieved December 2, 2021, from https://hbr.org/2021/02/what-happens-when-cryptocurrencies-earn-interest

- Yield farming vs. staking: Which one is better? BeInCrypto. Retrieved December 2, 2021, from https://beincrypto.com/learn/yield-farming-vs-staking/

- Yahoo! (n.d.). How to earn interest on Crypto. Yahoo! Finance. Retrieved December 2, 2021, from https://finance.yahoo.com/news/earn-interest-crypto-134001859.html

- CoinMarketCap. (2021, November 10). What is yield farming?: CoinMarketCap. CoinMarketCap Alexandria. Retrieved December 3, 2021, from https://coinmarketcap.com/alexandria/article/what-is-yield-farming

- Businessinsiderinternational. (2021, September 21). What to know about staking – the process of locking up crypto holdings to earn rewards and interest. Business Insider Australia. Retrieved December 3, 2021, from https://www.businessinsider.com.au/staking-crypto

- Markets. Compound. (n.d.). Retrieved December 6, 2021, from https://compound.finance/markets

- “How to DeFi?”, CoinGecko (2020)

- Staking. Solana. (n.d.). Retrieved December 6, 2021, from https://solana.com/staking

Share