Fall From Recent High, What Will Happen to LUNA & LUNC?

The collapse of Terra native token and TerraUSD (UST) stablecoin in May 2022 was recorded as the biggest crash in crypto history. LUNA and Luna Classic (LUNC), two Terra tokens, however, unexpectedly saw their prices increase by more than 200% last week.

The rise, though, was short-lived as both asset prices began to fall. On September 14, LUNA and LUNC were down 54,68% and 45,28%, respectively from the peak of the rally last week.

So, what really happened to LUNA and LUNC? Is the significant jump in price due to the development of the network? Or maybe, it was due to mere speculation that takes advantage of momentum?

block-heading joli-heading" id="article-summary">Article Summary

- ⚠️ Two Terra tokens, LUNA and LUNA Classic (LUNC), skyrocketed by over 200% last week. The presence of the staking feature and the tax burn proposal of 1.2% of each transaction is allegedly driving the price increase of the two assets.

- 📉 However, the price spike did not last long. As of Wednesday, September 14, the price of LUNA was corrected by 54.68% to USD 3.00, while LUNC’s price was 45.28% to USD 0.0003.

- 🔎 The presence of staking and tax burn features is considered not to have a significant long-term impact on reducing supply and increasing LUNC prices. This is because a large number of LUNA holders are indicated to be ‘unstaking’ after the announcement of the tax burn proposal, which means they are preparing to sell their assets.

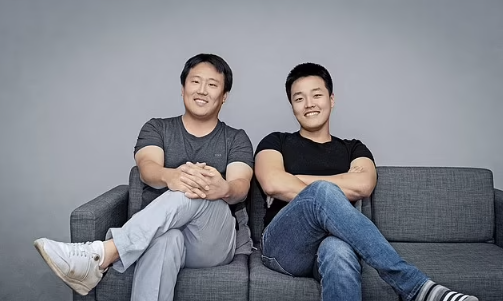

- 🚨 Meanwhile, a South Korean court issued an arrest warrant for Do Kwon, founder of Terraform Labs on September 14, 2022. Quoted from Bloomberg, the arrest warrant is related to a violation of capital market regulations.

What Happened to Terra and LUNA?

The future of LUNA as Terra’s “protocol token” was uncertain after it experienced a sharp decline in value last May as a result of its stablecoin algorithm’s failure to retain its peg value. Terra’s blockchain network was also impacted, and its users suffered enormous financial losses.

In the midst of the collapse of the Terra network, Do Kwon continues to work on improving the Terra network through Terra Ecosystem Revival Plan 1 & 2. Terra Builders Alliance in May also launched a proposal to create blockchain without algorithmic stablecoins through a hard fork. As a result, there are currently two Terra networks operating in parallel.

The old Terra network that had LUNA tokens has now been renamed Luna Classic (LUNC). Meanwhile, the newly launched blockchain network comes with a native token that returns to carry the name Luna (LUNA) or often called Luna 2.0. Unlike the previous generation, the second generation of LUNA has a supply of 1 billion and is no longer paired with stablecoins.

LUNA and LUNC Prices Soar Unexpectedly

The rise of LUNA and LUNC began on September 9th when a breakthrough occurred in the Terra ecosystem.

LUNA managed to rally more than 200% over the weekend, with the price jumping from US$2 to US$7. However, the rally did not last long because the price of LUNA has now fallen by more than half and is currently in the area of US$ 3.0.

The same thing happened on LUNC, a native token from the first Terra blockchain. The price had surged more than 250% to 0,0005 US dollars at the end of last week. Similar to LUNA, the rally did not last long, and currently, the price is at 0,0003 US dollars. It means the price has fallen 45,38% from its peak.

In the crypto market, a drastic hike of an asset price then followed by a correction is nothing new. These price movements are usually caused by a certain sentiment that triggers hype among investors. This particular event is usually called ‘buy the rumor and sell the news’.

💡 ‘Buy the rumor and sell the news’ is a term in investment world which means: If good news expected in the future, the price of asset will move up in anticipation of it, thus encouraging buying action. Then, when the news occur, investor who have made previous purchase will realize the profit by selling it.

1,2% Tax Burn Proposal to Reduce Supply

On 9th September, the LUNC community passed “Proposal for the 1.2% Tax Parameter Change” which calls for a 1.2% tax burn on each Terra blockchain transaction. Edward Kim, a member of the community, outlined the details of the tax burn program in his proposal.

According to Kim’s proposal posted on Terra’s research forum, the tax will be imposed on every on-chain transaction, and then burnt.LUNC’s supply will be reduced, turning it into a deflationary asset.

Kim’s proposal received positive feedback whereas around 83% of its members, agreed to the proposal. However, the tax burn scheme is not necessarily applied to transactions that happens on centralized exchange considering every trading transaction on exchange happens outside of the blockchain network.

Furthermore, the size of the LUNC trading volume in the future will have an impact on how effective the tax burn is. This tax burn campaign may not necessarily have a substantial influence on the LUNC value because there haven’t been many recent advances on the Terra blockchain.

The implementation of the tax burn proposal will undoubtedly be a sell-the-news event. There is hardly any genuine development work occurring at LUNC to maintain interest or utilization.

The Launch of Staking Features

In addition to the tax burn proposal, another sentiment that likely triggered the price was staking feature which was launched on 27 August. Based on LuncStaking_Bot, as of 9th September, around 610 billion out of 6,9 trillion LUNC have been staked by its users.

It means, that 9% of the total LUNC supply has been removed from circulation. This number also continues to increase, considering that at the first time this feature was launched, only 2,6% supply was staked.

Keep in mind that the staking feature does not necessarily reduce the existing of LUNC supply. Because staking actually adds new selling pressure considering Terra Classic network currently did not have any added value. In the end, the stakers will always sell the return earned because the token cannot be used for other apps or protocols.

Uncertain Future for LUNA and LUNC

The future of the old Terra network (including LUNC and UST token) remains uncertain. Especially with little to no incentive to build projects on top of the network. As for the new Terra network, it still raises big question: how many protocols and development teams who already on the network will endure and be trusted for the future development.

Ultimately, the activity and uses & cases of the Terra network will determine the future of LUNA and LUNC.

Meanwhile, a South Korean court has issued an arrest warrant for Do Kwon, founder of Terraform Labs on September 14, 2022. Quoted from Bloomberg, the arrest warrant is related to a violation of capital market regulations.

Kwon said in an interview to Coinage last month that South Korean prosecutors hadn’t been in contact with him and he hasn’t been charged with anything — even though law enforcement is barring his employees from leaving the country.

“It’s kind of hard to make that decision, because we’ve never been in touch with the investigators. They’ve never charged us with anything.” Kwon said in the video interview.

💡 Crypto assets have extreme volatility, especially altcoin whose movements are strongly influenced by sentiment and news. Therefore, before making any investing decisions, be sure to fully understand the associated risks and have a backup plan in place.

References

- Oluwapelumi Adejumo, Terra’s Luna Classic Outperforms Bitcoin, Ethereum Over the Last 30 Days, Beincrypto, accessed on 12 September

- Yashu Gola, Terra back from the dead? LUNA price rises 300% in September, Coin Telegraph, accessed on 12 September

- Samuel Wan, Community-led Terra Classic (LUNC) now worth 12x more than Do Kwon-led Terra LUNA, Cryptoslate, accessed on 12 September

- Edward Kim, Proposal for the 1.2% Tax Parameter Change, Terra Research, accessed on 13 September

- Hooyeon Kim, South Korea Seeks the Arrest of Terraform Labs Founder Do Kwon, accessed on 14 September

- Manish Singh, South Korea issues arrest warrant for Luna founder Do Kwon, accessed on 14 September

Share

Related Article

See Assets in This Article

LUNA Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-