Market Analysis Feb 18, 2023: BTC Up 10% Despite Stock Market Volatility

The stock market experienced a decline following a statement from a non-voting member of the FOMC suggesting that interest rates should be kept high to combat inflation. Meanwhile, the value of Bitcoin has increased by 10%. What factors led to the increase in Bitcoin’s value, and what is the complete analysis?

The Pintu trader team has collected various data that analyze macroeconomics and the crypto market movement in the past week. However, kindly pay attention that all information in this market analysis is for education purposes only, not financial advice.

block-heading joli-heading" id="summary">Summary

- 📉 Equities and bond prices experienced a decline after two non-voting members of the FOMC suggested that interest rates may need to remain high for an extended period to combat inflation.

- 💡Meanwhile, BTC’s value has increased nearly 10% over the week despite experiencing a death cross.

- 🚀The upward cross of the 50-day Moving Average over the 200-day Moving Average is a positive sign and increases the likelihood of a continuation in the upward direction towards the $30,000 range.

Macroeconomic Analysis

On Friday, equities and bond prices experienced a decline due to remarks from Bullard and Mester, two non-voting members of the FOMC, suggesting that interest rates may need to remain high for an extended period to combat inflation. This was in response to the latest economic indicators, which revealed a tight labor market and continued consumer spending, with inflation potentially not decreasing quickly enough.

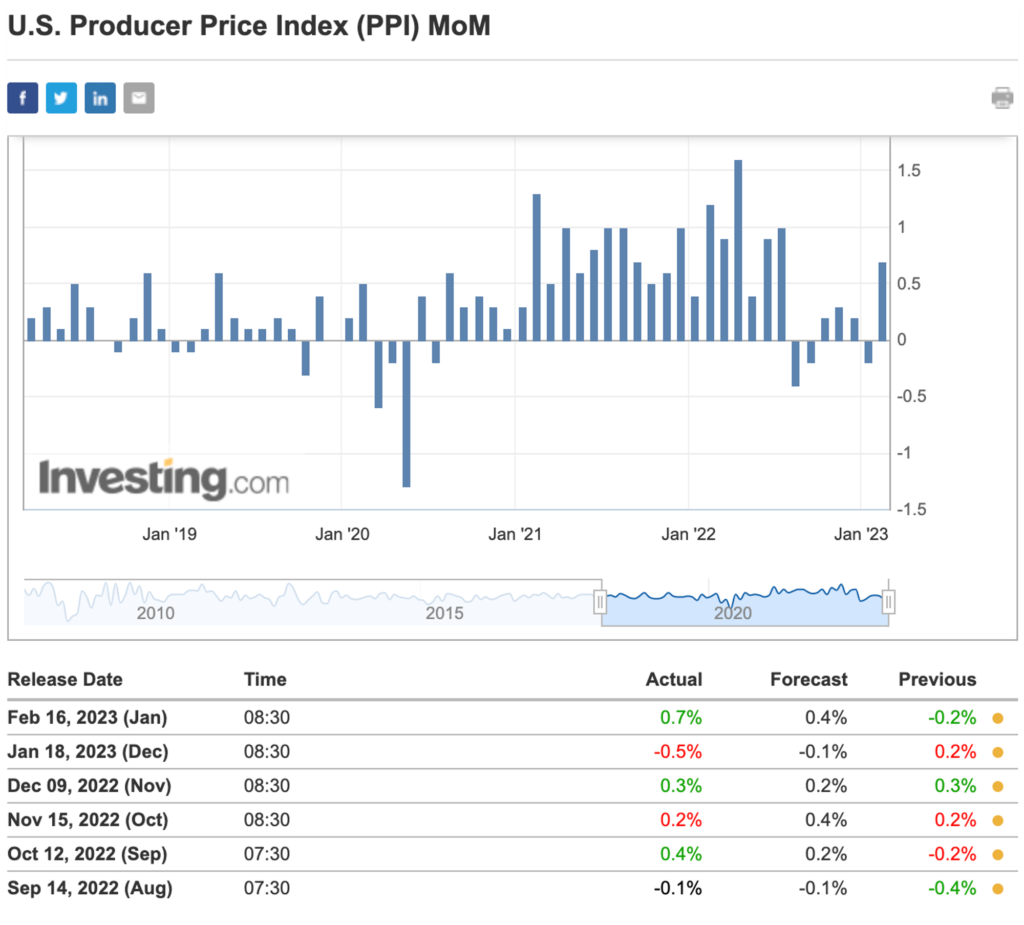

The PPI for January, which was released this morning, rose by 0.7% m/m, exceeding the consensus forecast of 0.4%. While the PPI’s inflation rate for services is at 5.0%, lower than its goods inflation rate of 7.5%, the CPI and PPI inflation rates have both continued to moderate in January. Furthermore, the PPI’s current measure of prices has risen by 6.0% YoY, although this is much lower than its peak in March 2022 and is the lowest it has been since early 2021.

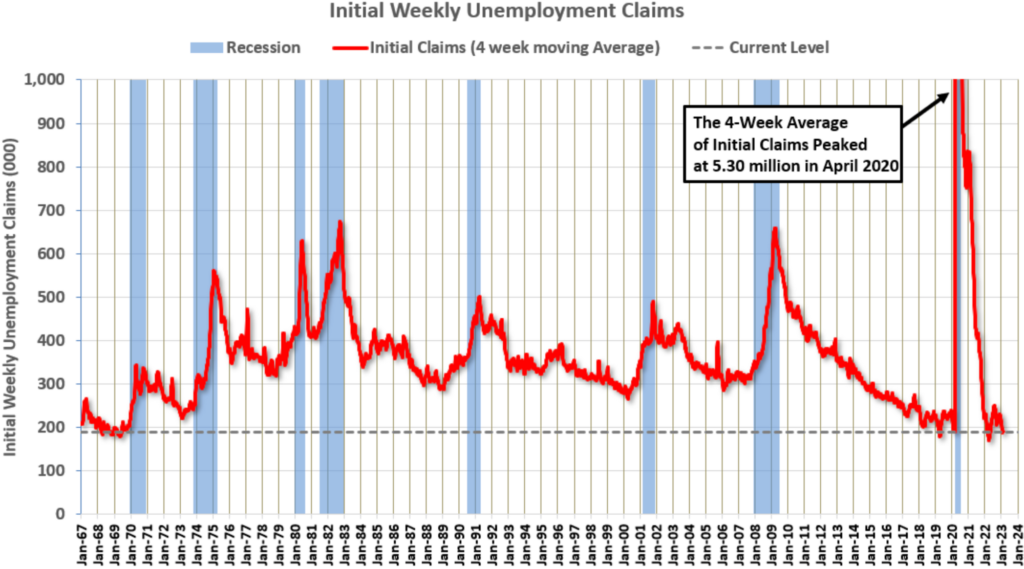

Last week, there was an increase in the number of workers who filed for unemployment benefits, but the figure remains historically low, indicating a strong job market, despite announcements of layoffs by some companies. According to the Labor Department, initial jobless claims rose by 13,000 to 196,000, which is significantly lower than the 2019 average of about 220,000 claims per week when the job market was similarly tight. The four-week moving average of weekly claims, which is a less volatile measure, decreased slightly to 189,250.

Bitcoin Price Analysis

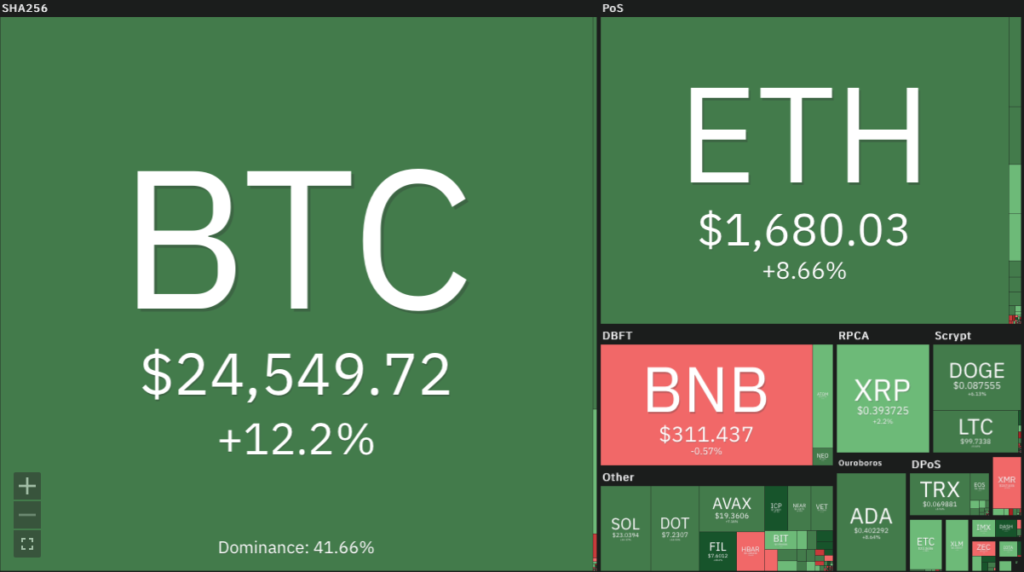

BTC has risen almost 10% over the week despite the death cross happening. It got rejected at the 200 weeks MA, a historically important crossover point to define whether we have bottomed.

Cointelegraph reports that Bitcoin has performed strongly last week, following the release of several US macroeconomic data points which suggest that inflation is decreasing. These data points include the Consumer Price Index (CPI), which, despite undergoing a change in calculation, largely met expectations. Additionally, the latest unemployment data indicates that the Federal Reserve's tightening policy is proven to be effective.

The price is currently making another attempt to break through the $25K resistance level on the daily timeframe, following a previous rejection and bearish pullback that occurred several weeks ago. Based on the bullish momentum seen in the last day’s candle, there is a high probability of a breakout above the $25K level.

Additionally, the recent upward cross of the 50-day moving average over the 200-day moving average is a very positive sign and further increases the chances of a continuation in the upward direction towards the $30K range.

However, if there is an unexpected rejection from the current area, a retracement towards the $21K level, where the 50-day moving average is located, could occur.

Total Crypto market has found its support at the 200 weeks MA for the 5th straight week, a good indicator of market strength.

ETH/BTC is at the 55 weeks EMA support line. We have been above the support line since July last year.

On-Chain Analysis

- 📊 Exchange Reserve: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days was lower than the average. They have a motive to hold their coins. Investors are in a fear phase where they are currently with unrealized profits that are slightly more than losses.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 📈 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

Altcoins News

- 🖼 Blur Releases Native Token. After months of anticipation, zero-fee non-fungible token (NFT) marketplace Blur released its native token Tuesday. The token will allow traders to participate in the platform’s governance protocol, as well as profit from the marketplace’s success through community ownership. According to data from DappRadar, Blur’s 24-hour trading volume stands at about $9.5 million, second only to leading marketplace OpenSea, whose trading volume is around $12 million.

- 👟 Stepn to Airdrop GMT. Stepn, a cryptocurrency platform that rewards users for taking certain actions, plans to distribute its GMT tokens to people who own its Genesis sneaker non-fungible tokens (NFTs). The distribution is based on a snapshot taken on February 12, which is a static record of a blockchain at a particular point in time. The snapshot identified Genesis sneaker holders who had their NFTs in their spending wallets, excluding those who had listed them for sale. Stepn launched the Genesis sneaker collection in August 2022.

- 🚠Polygon to launch zkEVM mainnet beta in March. Polygon, the provider of Ethereum layer-2 solutions with the MATIC ticker, has finally announced the scaling upgrade that its users have been waiting for. The beta launch of its zero-knowledge Ethereum Virtual Machine (zkEVM) mainnet is scheduled for March 27. According to a blog post on Feb. 14, Polygon has conducted three and a half months of rigorous testing, and the system is now deemed ready for the mainnet launch next month.

Crypto News

- ⚖︠Paxos ‘categorically disagrees’ with the SEC. As quoted from Cointelegraph, the United States Securities and Exchange Commission (SEC) has accused Paxos Trust Company, the issuer of Binance USD (BUSD) stablecoin, of not registering BUSD as a security under federal securities laws. The SEC issued a Wells Notice to Paxos Trust Company defining BUSD as a security. Meanwhile, the New York Department of Financial Services instructed Paxos to stop issuing new BUSD tokens. Paxos disagreed with the SEC’s accusation and is prepared to take legal action in US courts.

cryptocurrency-market-performance-over-the-past-week">Cryptocurrency Market Performance Over the Past Week

Best Performing Crypto

- Alchemy Pay (ACH) +88%

- Filecoin (FIL) +77.68%

- Kusama (KSM) +44.7%

- Perpetual Protocol (PERP) +31%

Worst Performing Crypto

- LooksRare (LOOKS) -21.6%

- Oasis Network (ROSE) -1.48%

- Livepeer (LPT) -0.84%

- Pax Gold (PAXG) -0.6%

References

- William Suberg, Why is Bitcoin price up today?, Cointelegraph, accessed on February 20, 2023

- Cam Thompson, NFT Marketplace Blur Releases Native Token for Community Ownership, Coindesk, accessed on February 20, 2023

- Editorial Staff, SEC sues Do Kwon, Paxos ready to litigate, SBF’s VPN: Hodler’s Digest, Feb. 12-18, Cointelegraph, accessed on February 20, 2023

- Osato Avan-Nomayo, GMT token airdrop on way for early Stepn NFT holders, The Block, accessed on February 20, 2023

Share