Market Analysis Jul 17th 2023: Ripple Labs’ win pushes BTC up 3.5%

The euphoria of Ripple Labs’ victory last week was warmly welcomed by the crypto market, which as a whole rose 6.5% week-over-week. Even Bitcoin reacted positively, rising 3.5%. After that, however, BTC consolidated back to its resistance point at the $30,000 level. Could the victory of Ripple Labs not be enough to turn the crypto market bullish yet? Find out more in the Pintu Academy analysis.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 🆘 US inflation experienced a significant decrease in June, with the CPI only rising by 3% compared to the previous year. However, the Federal Reserve (The Fed) is planning to raise interest rates in July.

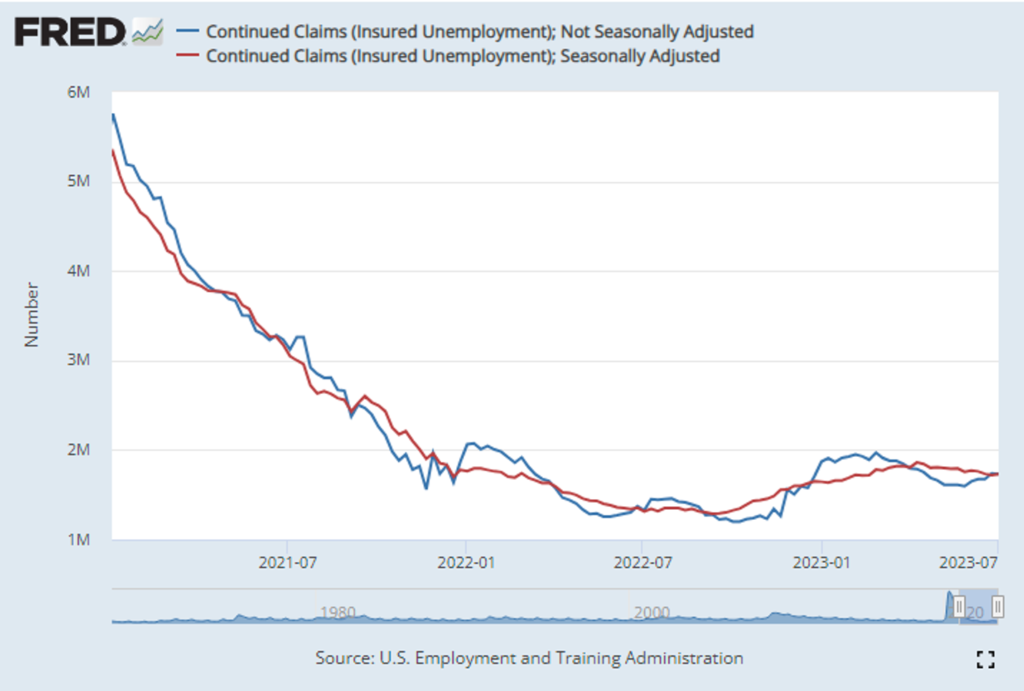

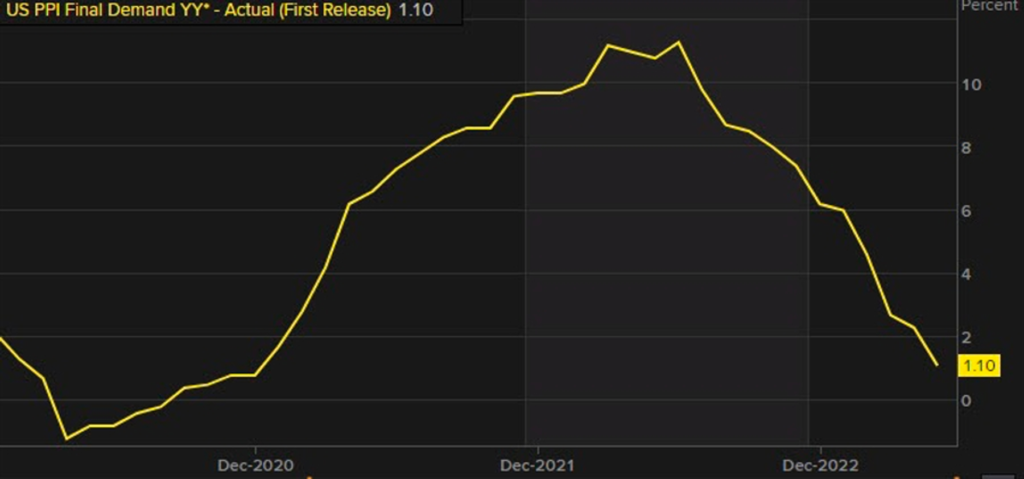

- 📉 Unemployment benefit claims show a decrease, while producer prices show minimal growth, indicating a weaker inflation environment.

- 🔴 The crypto market experienced a surge triggered by Ripple Labs’ court victory. BTC showed horizontal price movement over the week and struggled to break through the resistance price of $30,000.

- ✍🏻 Ethereum price support is at the 100 Week exponential moving average (EMA) with resistance at the psychological price level of $2,000.

Macroeconomic Analysis

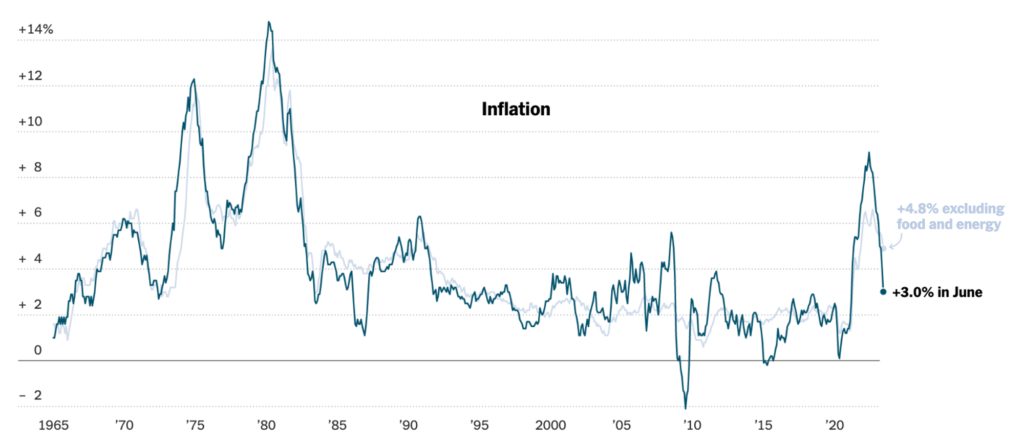

US inflation eased significantly in June, which is good news for consumers, the market and the Fed. Looking at the Consumer Price Index (CPI) for June compared to a year ago, it rose only 3%, which is the slowest rate of increase in more than two years.

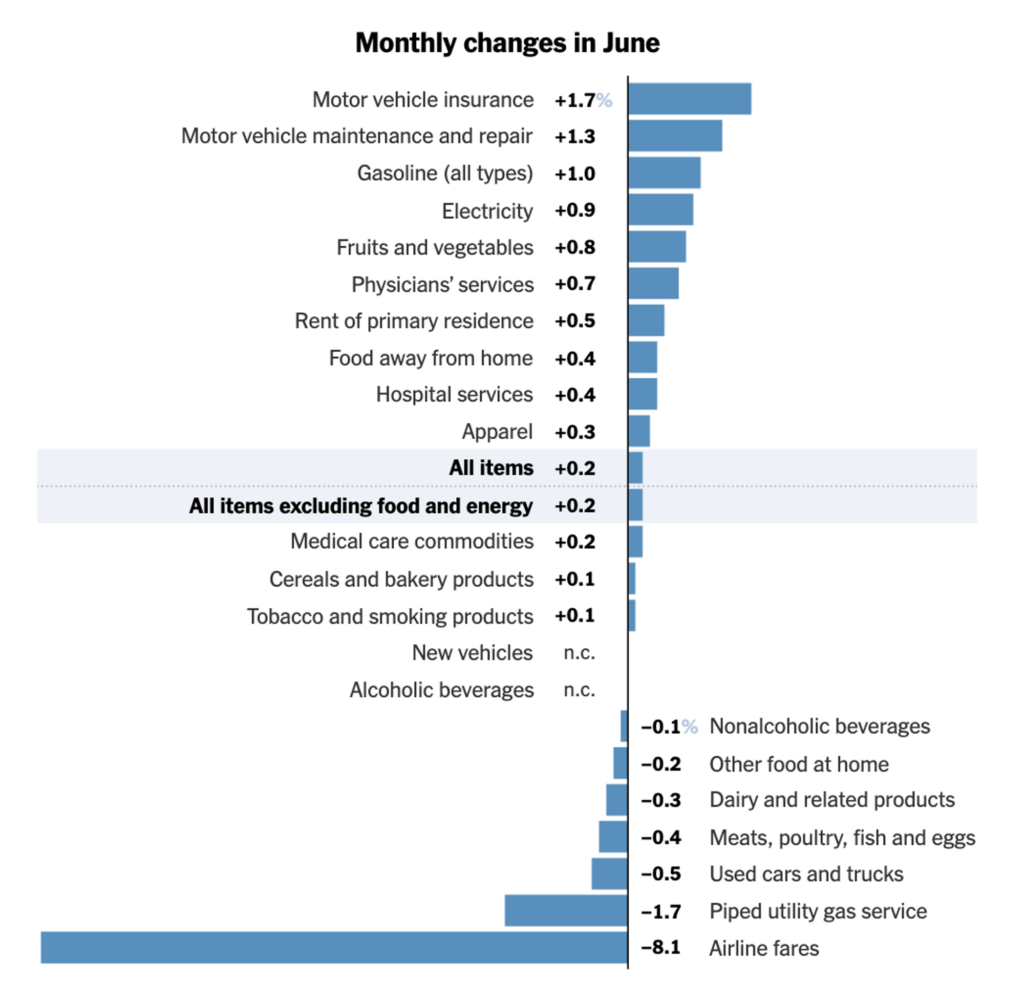

Specifically, excluding food and energy, the CPI rose only 0.2% month-on-month. This core data, which economists consider a more accurate indicator of inflation, rose 4.8% year-over-year. While this is the slowest rate of increase since late 2021, it is still above the Fed’s target.

Although the report came as a surprise, it will not prevent the Fed from raising interest rates as expected in July. However, there are doubts about the need for another rate hike in the future.

The housing sector is the main driver of the monthly increase, with the cost of living up 0.4%. In addition to the increase, several sectors experienced decreases, including air fares, which fell 8.1%, and prices for used cars and trucks.

Federal Reserve Chairman Jerome Powell focused specifically on core services excluding housing, which was relatively stable in June compared to the previous month. Year-over-year growth slowed to 4%, the smallest increase since the end of 2021.

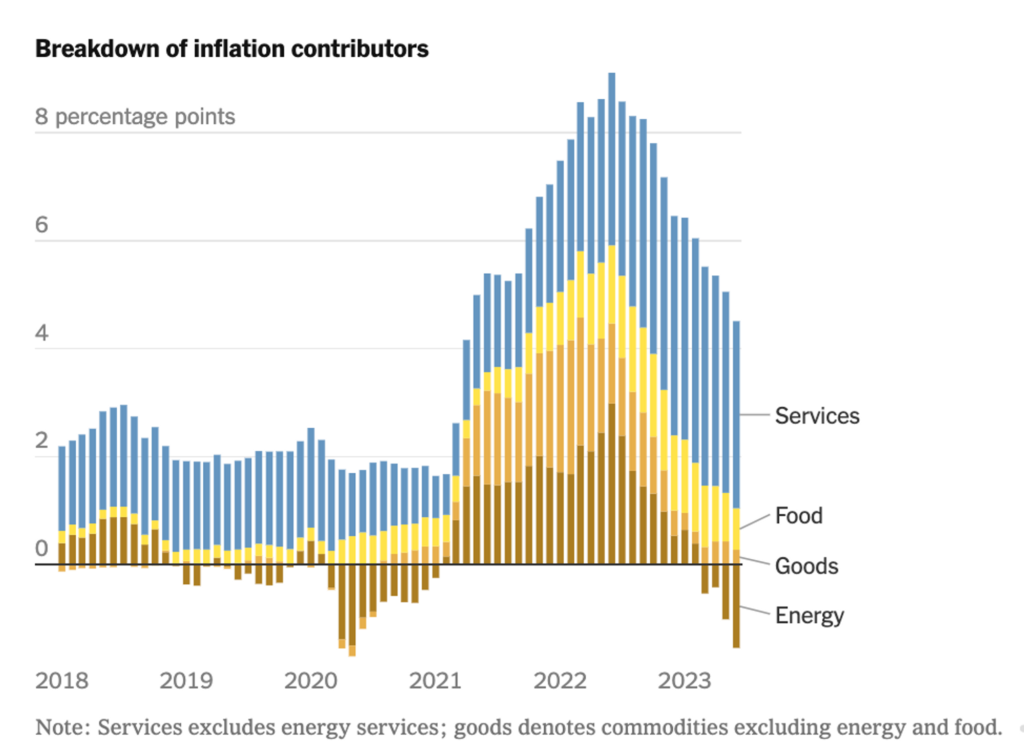

Further analysis from the image below shows that the slowdown in inflation is spreading to the goods and services sector, with falling gas prices contributing significantly to the overall slowdown in inflation.

The slowdown in inflation was greeted with optimism by investors as stocks opened on a positive note. The S&P 500 Index rose 0.86%, the Nasdaq 100 gained 1.11%, and bond prices also jumped. However, this early rally lost momentum as Federal Reserve officials pointed out that despite the improvement in core inflation, the numbers were considered to be double the central bank’s established target.

Despite the fact that the CPI fell to 3% in June and the increase in core inflation was lower than expected, Richmond Fed President Thomas Barkin, a neutral, non-voting member, expressed his view that US inflation was still too high. As a result of these comments, bond yields rose from their lows.

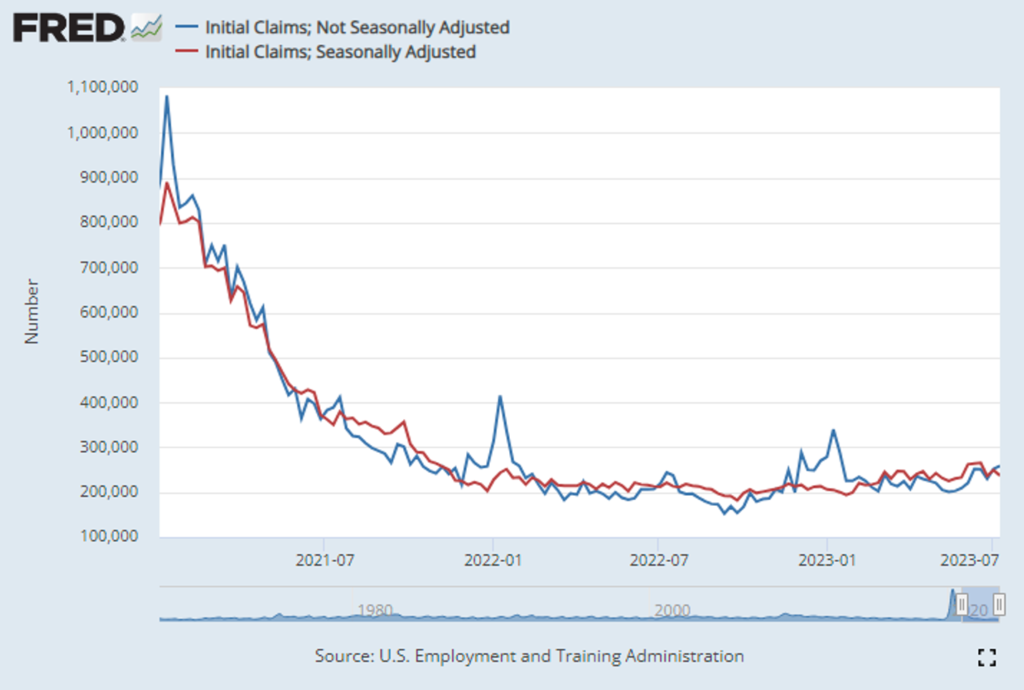

Moving on to the latest report from the Department of Labor, released on Thursday, it indicated a decrease in initial claims for unemployment benefits in the United States. The figures showed a decrease of 12,000, bringing the total to 237,000 for the week ending July 8th. These results suggest that the labor market remains robust despite a slowdown in job gains.

To provide a more stable presentation of the data, the four-week moving average of initial claims, which helps reduce volatility, fell to 246,750.

The reported number was below the consensus estimate of 250,000. Continuing claims, which include individuals who have been receiving benefits for more than one week, rose to 1.73 million through July 1.

Based on data released by the Bureau of Labor Statistics on Thursday, it was revealed that producer prices in the United States showed minimal growth in June compared to the same period last year. This is yet another indication of a weak inflationary environment, which is likely to reassure officials at the Fed.

According to the report, the producer price index for final demand showed a moderate increase of 0.1% from the previous year, which is the smallest increase recorded since 2020. In addition, on a monthly basis, the PPI also increased by 0.1% after declining in the previous month.

The normalization of the global supply chain, the stabilization of commodity prices, and a shift in consumer demand toward services rather than goods have generally helped to reduce inflationary pressures at the producer level.

While transportation and warehousing costs have declined significantly, service costs have risen slightly. On the other hand, the prices of goods remained relatively stable, resulting in lower prices for consumers, indicating a deflationary condition. In fact, the price of goods fell by 4.4 percent year-on-year, the largest decline in three years.

The PPI excluding food and energy recorded a year-on-year increase of 2.4%. This annual increase is the smallest since January 2021.

BTC & ETH Price Analysis

The cryptocurrency market experienced a significant surge following Ripple Labs’ victory in the U.S. District Court on July 13. In its ruling, the U.S. District Court found that the sale of Ripple’s XRP tokens on exchanges and through algorithms did not fall under the category of investment contracts. However, the court ruled that the institutional sale of these tokens did, in fact, violate federal securities laws.

As a result of the ruling, the price of XRP surged by as much as 96%, outperforming all other crypto assets. The overall crypto market also rose 6.5% week-over-week.

After the flurry of XRP news, BTC rose by 3.5%, but then fell back to its low of $31,000. Overall, BTC experienced a horizontal price movement within a week. Currently, BTC is still facing price resistance at US$30,000. If it is able to successfully break above this resistance, BTC has the potential to start rising again and significantly towards higher resistance levels. This potential is due to the accumulation of buy stop orders placed above the resistance price. The significance of these orders could potentially cause a short squeeze, which in turn will increase upward pressure on the price.

After successfully breaking above the $1,800 level and the 50-day moving average at $1,850, ETH has been showing choppy movement on the daily chart. At one point, the price rose to the psychological level of $2,000, but has since consolidated. ETH’s current price support is at the 100-week exponential moving average (EMA) and resistance is at the psychological level of $2,000.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Investors are in a Anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- As part of the transition to Polygon 2.0, the Polygon team has proposed the POL token to replace the existing Matic. Described as a “3rd generation token,” the POL will allow its holders to become validators on the network, authenticating chains and networks associated with Polygon. This transition is expected to take place over a period of four years or more. Polygon 2.0 aims to be a network of networks, facilitating the scalability of Ethereum with multiple Polygon-based chains, bridges and the integration of zero-knowledge proofs, with the ultimate goal of creating the “Value Layer of the Internet”.

- Multichain, a leading bridging protocol, has announced the suspension of its operations due to a lack of operational funds and difficulties resulting from the detention of its CEO, Zhaojun, by Chinese authorities. Since his detention, the Multichain team has been unable to contact Zhaojun or access critical information and operating funds. They also recently learned that all project funds, investments, and server access are under the CEO’s control. In addition, Zhaojun’s sister, who reportedly controls some of the preserved funds, has also been detained. This series of events has resulted in a loss of $130 million from the Multichain token protocol.

News from the Crypto World in the Past Week

- Standard Chartered Bank, one of the largest banks in the UK, has predicted that the price of bitcoin could reach $120,000 by 2024. This bank had previously predicted that bitcoin could fall to $5,000 by 2023. However, this prediction did not materialize and now a new bitcoin price prediction has been released by Standard Chartered. As of last April, they revised their prediction that bitcoin could reach $100,000 to $120,000.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Ripple +54.46%

- Stellar (XLM) +33.85%

- Compund +31.51%

- Solana (SOL) +29.72%

Cryptocurrencies With the Worst Performance

- Maker -7.16%

- Litecoin (LTC) -2.43%

- Kava (KAVA) -0.48%

- Wrapped Bitcoin (WBTC) -0.15%

References

- Frank Chapparo, Standard Chartered revises bitcoin price target to $120,000, Theblock, accessed on 15 July 2023.

- Liam J. Kelly, Polygon Outlines Launch of New POL Token in Latest Network Upgrade, Decrypt, accessed on 15 July 2023.

- Pawan Surya, CEO’s Arrest Forces Multichain to Shuts Down Operations, cryptotimes, accessed on 15 July 2023.

Share

Table of contents

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-