What is The Graph (GRT)?

The popularity of Artificial Intelligence and Big Data trends has gained significant traction, especially with the emergence of ChatGPT and Google’s new product, Bard. This has led to a price surge of over 230% for The Graph token since the start of 2023. So, what is The Graph, and how does it work? Let’s find out all about it in this article!

Article Summary

- 🤖 The Graph is a decentralized protocol that indexes and queries data from blockchains like Ethereum. The Graph token is called the “AI token” because it is an essential tool in building AI applications on top of blockchain data with its subgraph.

- 🧠 In The Graph system, the subgraph functions like a unique application programming interface (API) in the program that enables data retrieval (query) from the blockchain. It indexes and fetches data from blockchains like Ethereum and then uses it in a decentralized network.

- 🦾 The Graph network relies on Indexers, Curators, and Delegators to keep the network functioning and secure the blockchain.

- 🪙 GRT is a utility token on The Graph network. It has the primary function of indexer staking and curator signaling in providing indexing and data curation services to the network.

What is The Graph?

The Graph is a decentralized protocol that indexes and queries data from blockchains like Ethereum. It aims to ease building decentralized applications (dApps) using data from blockchains such as Ethereum and the Interplanetary File System (IPFS) or decentralized file storage system for blockchains.

While The Graph protocol does not directly rely on Artificial Intelligence (AI), it is often referred to as an “AI token” because it is seen as a critical infrastructure layer that allows AI applications to be built on top of blockchain data. It is because The Graph’s technology eases developers to access and fetch large amounts of blockchain data, which is a crucial component of many AI applications.

Furthermore, The Graph is not specifically designed for AI applications. However, developers can leverage The Graph for various dApps besides AI applications.

DApps developers can configure their smart contracts so that The Graph can understand their data and convert it into a subgraph. It is similar to how websites create index files so that search engines like Google can access them.

The Graph “Google of Blockchain”

The Graph is nicknamed the ‘Google of Blockchain’. It is because Google uses advanced algorithms and machine learning techniques to index and organize large amounts of data on the internet. In the same way, The Graph protocol uses powerful indexing algorithms to search and retrieve blockchain data quickly and efficiently. In short, Google is today’s internet search engine, while The Graph will be the Web3 search engine of the future.

When building dApps on a network like Ethereum, data is required, one of which is on-chain data. Although Ethereum has a lot of open data, it isn’t easy to comb through specific data to create more complex dApps. Indexing blockchain data is very difficult for developers.

The Graph solves this problem through its technology by making it easy for developers to retrieve simple and complex data to build dApps.

Indexing is reducing the time needed to search for specific information—for example, the index in a book. In blockchain technology, indexing is needed to search and retrieve data from the blockchain faster.

Learn more about what Ethereum is and how it works here.

Who Founded The Graph?

The Graph was founded in 2018 by Brandon Ramirez, Yaniv Tal, and Jannis Pohlmann. All three have an engineering background and have worked together for several years. Before founding The Graph, Brandon Ramirez and Yaniv Tal also worked together at Mulesoft, an API development company that was sold to cloud-based software company Salesforce.

The main reason they founded The Graph was based on their personal experience when they had difficulty extracting data to build applications on the Ethereum blockchain at the time. Therefore, they planned to create The Graph to ease the building of dApps by making it easier to obtain data by indexing and querying.

In 2020 The Graph launched its main network. The project aims to make Web3 available to everyone and allow dApps to be created without needing a central server or authority.

How Does The Graph Work?

The Graph is a decentralized oracle system that handles data processing for the Web3 ecosystem. In this system, subgraph functions like a special API in the program that allows retrieving data (query) from the blockchain. It fetches data from the blockchain like Ethereum, uses it in a decentralized network, and allows the formation of smart contracts using the technology.

DApps submit queries through a specialized programming language, GraphQL.

Subgraph is a specialized API built on top of blockchain data. A subgraph is a specialized tool that helps developers get data or information on the blockchain.

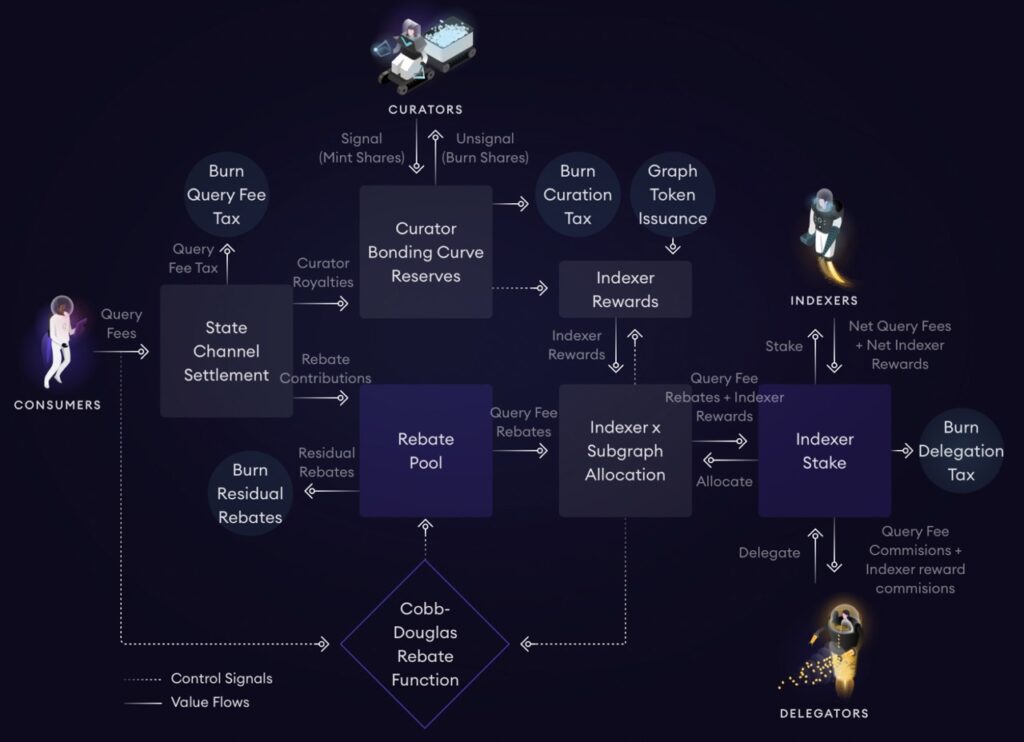

There are four leading roles that run The Graph system, as follows:

- Consumers: Consumers pay Indexers for data retrieval (query). They are usually end users but can also be a web service integrated with The Graph.

- Indexers: Indexers are operator nodes (Graph Nodes) that process and store data on-chain. They are rewarded for their work with GRT tokens.

- Curators: Curators determine the trustability of data sources. They signal subgraphs and notify Indexers which subgraphs should be used.

- Delegators: Delegators are participants who deposit GRT tokens on behalf of Indexers. They earn rewards without operating graph nodes.

When consumers request data through a graph node on the network, the graph node searches the data through relevant subgraphs to find the requested information. Then, Indexers select which subgraphs to retrieve data based on curation signals provided by Curators who rate the subgraphs based on their quality.

Then, Indexers start indexing the subgraphs. This process can take several hours to days, depending on how much data is indexed.

After the indexing process is complete, Consumers can start querying the subgraph to get the data they need. Consumers must pay with GRT tokens for each query submitted. The query engine executes this process. Indexers then distribute the query fees to Delegators and Curators.

The Graph is often compared to Chainlink. Chainlink focuses on feeding on-chain and off-chain data to the blockchain, while The Graph leverages a simple API (subgraph) to query the blockchain.

Read also What is Chainlink?

Advantages of The Graph

- Touted as the Google of Blockchain, The Graph can function as a Web3 search engine by quickly indexing data from the blockchain to create dApps.

- The Graph creates a global API that dApps development teams can use to simplify operations and reduce the processing time of creating dApps. Applications built on The Graph run efficiently while maintaining their decentralized nature.

- The Substream feature, launched last November 2022, accelerates the indexing process by allowing data to be transformed in parallel. Thus, creating AI and non-AI-based dApps will be faster and more efficient.

- The Graph solves the problem related to the difficulty of indexing and querying data on the blockchain. The properties of blockchain networks, such as chain reorganization, finality, and block structure, make it difficult for developers to extract accurate query results from blocks.

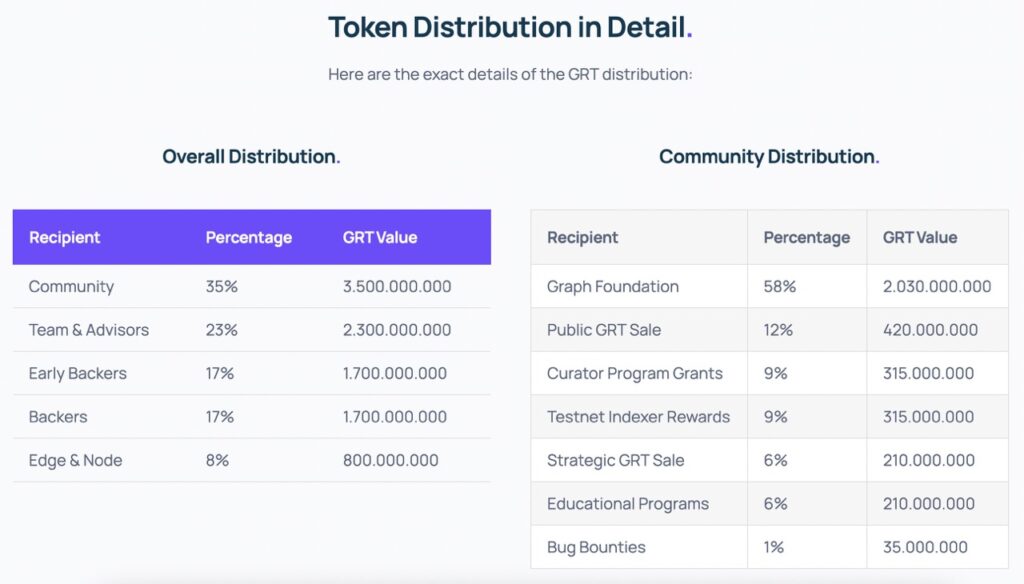

GRT Tokenomics

GRT is a utility token of The Graph. It have two main functions: indexer staking and curator signaling. GRT is locked by protocol participants (Indexers, Curators, and Delegators) to provide indexing and curation services to the network.

To ensure Indexers do their job, they must stake 100,000 GRT tokens. If Indexers provide incorrect data or poorly index, their stake may be deducted.

Then, to ensure that Curators guide Indexers to high-quality data, they should stake 10,000 GRT tokens on the subgraph bonding curve, which is the curation signal used by Indexers. Although Curators’ GRT tokens are not deducted for poor performance like Indexers, they will be subject to a 1% tax when curating new subgraphs.

The Graph does not have a max supply. It initially minted 10 billion GRT tokens. At the time of writing, there are already more than 8 billion GRT tokens in circulation. The team has a policy of issuing 3% of tokens annually to reward protocol participants.

The Graph is designed with token-burning mechanisms to balance the issuance of new tokens. Approximately 1% of the GRT supply is burned each year through various network activities, which continues to increase as network activity continues to grow.

These burn activities include a 0.5% delegation tax whenever Delegators delegate GRT to Indexers, a 1% curation tax when Curators signal a subgraph, and 1% of query fees for blockchain data.

GRT as Investment

Since the beginning of 2023, the price of the GRT token has soared by more than 230%. On January 1, 2023, GRT was still at 0,05 US dollars. Today (February 17, 2023), it is at 0.17 US dollars. This drastic increase occurred along with the popularity of AI.

Previously, GRT reached its highest price on February 12, 2021, by touching the price of 2,88 US dollars. According to Coinmarketcap, GRT is in the 41st position based on the amount of market capitalization, which is more than 1.5 billion US dollars.

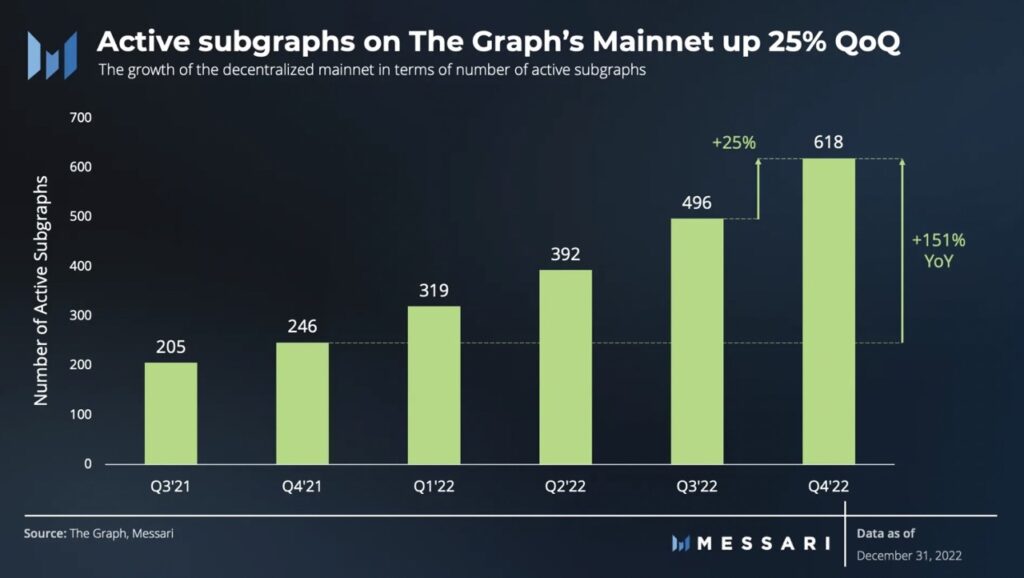

The Graph’s performance can be measured in part by the growth of the subgraph. The first subgraph was launched on The Graph mainnet in 2021. According to data from Messari, over the past six quarters, the number of subgraphs launched on the mainnet has continued to grow. As of December 2022, there were 618 active subgraphs on the mainnet. A 25% increase from the previous quarter (QoQ) and a 151% increase from the previous year (YoY).

As of February 2023, there were 693 subgraphs on The Graph mainnet, an increase of more than 10% compared to December 2022. Several dApps utilize subgraphs to execute their data strategies and maintain data transparency, such as Uniswap, Livepeer, Aave, Synthetix, and others.

In addition, Messari, a leading crypto analytics company, announced on February 7, 2023, that it had built subgraphs to index Aave V3 data. Thus, users can easily track Aave V3 data, and the subgraph helps organize data related to lending, protocol activity, and pool data (TVL, APR, revenue, and liquidation).

Conclusion

Along with the development of crypto technology, more and more projects are offering data supply solutions. The Graph (GRT) is one of them that wants to change the way users interact with data.

The Graph facilitates the secure and decentralized buying and selling of data and provides a new level of data ownership and authority. In addition, the project is also built by a team with a lot of expertise in their respective fields.

However, The Graph is limited in indexing data because it does not support multiple blockchains. Some of the networks that have been integrated with The Graph include Ethereum, Near, Arbitrium, Avalanche, Celo, Fantom, Moonbeam, IPFS, and PoA.

How to Buy GRT Token on Pintu?

You can start investing in GRT by buying it in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for GRT.

- Click buy and fill in the amount you want.

- Now you have ENS as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Door Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- The Graph Team, Whitepaper, The Graph, accessed 14 Februari 2023.

- Brandon Ramirez, The Graph Network In Depth – Part 1, The Graph, accessed 14 Februari 2023.

- Editorial Team, The Graph: The Future of Decentralized Data Access, Coin Bureau, accessed pada 14 Februari 2023.

- Jakub, The Graph – Google Of Blockchains?, Finematics, accessed 15 Februari 2023.

- Mark Hooson, What Is The Graph (GRT) Cryptocurrency? Forbes, accessed 15 Februari 2023.

- Mihai Grigori, State of The Graph Q4 2022, Messari, accessed 15 February 2023.

Share

Related Article

See Assets in This Article

GRT Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-