What is Arbitrum?

Arbitrum is being touted as the next-generation blockchain platform that aims to solve the scalability issues of Ethereum blockchain technology. It is the most significant layer two on Ethereum, using rollup technology with a TVL of over 1 billion US dollars. So, what is Arbitrum, how does it work, and what are its advantages? Let’s take a look at the following article!

Article Summary

- 🔗 Arbitrum is a layer 2 blockchain designed to increase scalability on the Ethereum blockchain.

- 🔄 Arbitrum leverages optimistic rollups technology. It collects transaction data, resolves them on the Arbitrum rollup chain, and then inputs the transaction data back to the Ethereum blockchain.

- 🛡️ Two Arbitrum chains are operating on the Ethereum network: the Arbitrum Rollup chain, called Arbitrum One, and the AnyTrust chain, called Arbitrum Nova.

- 💰 Arbitrum is the largest layer 2 on Ethereum, using rollup technology with a total value locked (TVL) of 1.44 billion US dollars.

What is Arbitrum?

Arbitrum is a layer 2 blockchain designed to increase scalability on the Ethereum blockchain. With Arbitrum, you can do everything on Ethereum with cheaper and faster transactions. For example, access to Web3 applications, deploy smart contracts, and more with Ethereum’s security system.

Currently, Ethereum can only process 20-40 transactions per second (TPS). When that limit is reached, users must compete each other to get their transactions processed, causing gas fees to rise. Therefore, Arbitrum offers high scalability that can process up to 40.000 TPS. It is because this platform leverages optimistic rollups that can speed up transactions at a low cost.

Arbitrum is developed by Offchain Labs, a US-based company focused on building scalability solutions on the Ethereum network. Offchain Labs was founded by Ed Felten, a professor of computer science at Princeton University and former deputy CTO (Chief Technology Officer) at the White House during President Obama’s administration. Along with his two partners, Steven Goldfeder, and Harry Kalodner, they published research results on Arbitrum technology in 2018.

In April 2021, Offchain Labs secured Serie A funding of 20 million US dollars. Shortly after, the company received another Serie B funding of 100 million US dollars. Lightspeed Venture Partners provided the funding. Polychain Capital, Ribbit Capital, Redpoint Ventures, Pantera Capital, and Mark Cuban are other investors involved.

How Does Arbitrum Work?

The technology behind Arbitrum is an optimistic rollup. Rollup is a type of data compression technique on blockchain transactions. It involves ‘rolling up’ a batch of transactions into a single transaction. The benefit is that the blockchain only needs to process one transaction, the ‘rolled up’ transaction, and does not need to confirm every single transaction.

Optimistic rollup is a specialized technique for rolling up transactions off-chain. To accelerate the data validation, the optimistic rollup assumes that the transactions in the rollup are valid.

Arbitrum’s optimistic rollup is executed on top of Arbitrum’s rollup chain. Arbitrum collects the transaction batch, settles it on the Arbitrum rollup chain, and then inputs the transaction data back to the Ethereum blockchain.

Arbitrum says that every transaction confirmed through this process is stamped with an “AnyTrust Guarantee,” and all validators agree on the validity of the transactions contained in a block. Validators stake ETH before they can confirm a transaction; by staking ETH, they are incentivized to act honestly.

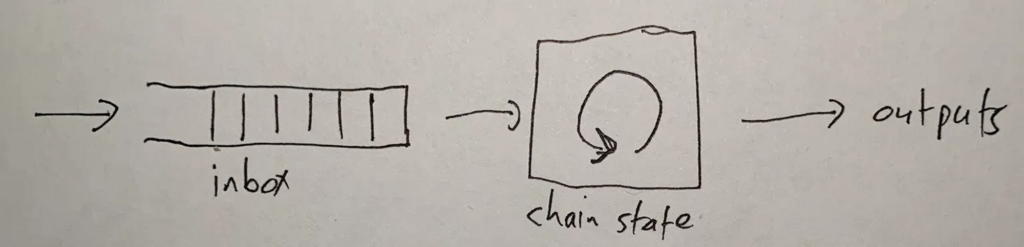

Arbitrum Transaction Cycle

The Arbitrum Transaction Cycle is a process for executing transactions on the Arbitrum blockchain.

1. Sequencer Receives Transaction

The process starts with the Sequencer, a node that accepts transactions from users either directly or through the Delayed Inbox of the Layer 1 chain.

2. Sequencer Requests Transaction (off-chain)

When a transaction is received, the Sequencer executes the transactions with the help of the Nitro Virtual Machine, and provides the user with a transaction receipt. This promptness is referred to as “instant,” as it doesn’t require further on-chain confirmation and typically takes only a second or two to complete.

3. Sequencer posts transactions in one batch (on-chain)

The Sequencer then posts a batch of transactions to Layer 1 every few minutes.

4. Validator asserts RBlock (rollup block)

The Validator then asserts an RBlock by running the Virtual Machine over the transactions and making an on-chain assertion about the latest state of the chain.

5. RBlock confirmed at Layer 1

If there are no issues, the RBlock is confirmed at Layer 1, updating the Outbox root.

Simply put, the smart contract asks the Arbitrum blockchain to do something by placing the transaction into the Inbox chain. Then Arbitrum processes it and issues a transaction receipt.

Read also What is Layer 2 Crypto?

Arbitrum One and Arbitrum Nova

There are two Arbitrum chains on the main network Ethereum: the Arbitrum Rollup chain, called Arbitrum One, and the AnyTrust chain, called Arbitrum Nova. Arbitrum One migrated to the Nitro system on August 31, 2022. Arbitrum Nitro, which runs on top of the Arbitrum One network, brings improvements. Such as 7-10 times faster transaction speeds, more advanced data compression techniques that lower costs, and a better user experience.

Arbitrum Nova utilizes AnyTrust technology. It is believed to be the right solution for projects with high transaction volumes, such as gaming that frequently mints new items and social applications. At the same time, Arbitrum One remains focused on DeFi and NFT projects.

AnyTrust is a variant of the Arbitrum Nitro technology that lowers fees by accepting mild trust assumptions. AnyTrust chain does not have the same level of decentralization and security as the rollup chain. Therefore, AnyTrust can offer lower fees.

Advantages of Arbitrum

1. Compatible with Ethereum Virtual Machine (EVM)

The Ethereum network utilizes the Ethereum Virtual Machine (EVM) as its “computer” for executing smart contracts. Arbitrum has its own superior “supercomputer” known as the Arbitrum Virtual Machine (AVM). For higher-level instructions on Arbitrum Nitro, Arbitrum utilizes Web Assembly (WASM) instead of AVM.

Arbitrum also natively supports all Ethereum development tools without any additional specialized plugins. It includes all smart contract languages, such as Solidity, which works well on Arbitrum. Therefore, dApps originally developed on Ethereum can easily migrate to Arbitrum with minimal code modifications.

2. Fast Transaction Processing and Low Fees

With the Arbitrum Nitro upgrade (the old Arbitrum One called Arbitrum Classic), the optimistic rollup technology on this platform has advantages in transaction processing speed, lower fees, ease of operation, and more compatibility with EVM.

As mentioned earlier, Arbitrum Nitro can process transactions 7-10 times faster than its predecessor (Arbitrum Classic).

3. It Has the Ethereum Security Level

To run its system, Arbitrum uses ETH tokens. Therefore, it is secured by the Ethereum base layer because it does not have its token. Compared to other Layer 2 blockchains, such as Polygon, it has its token (MATIC) and is secured through its proof of stake consensus mechanism.

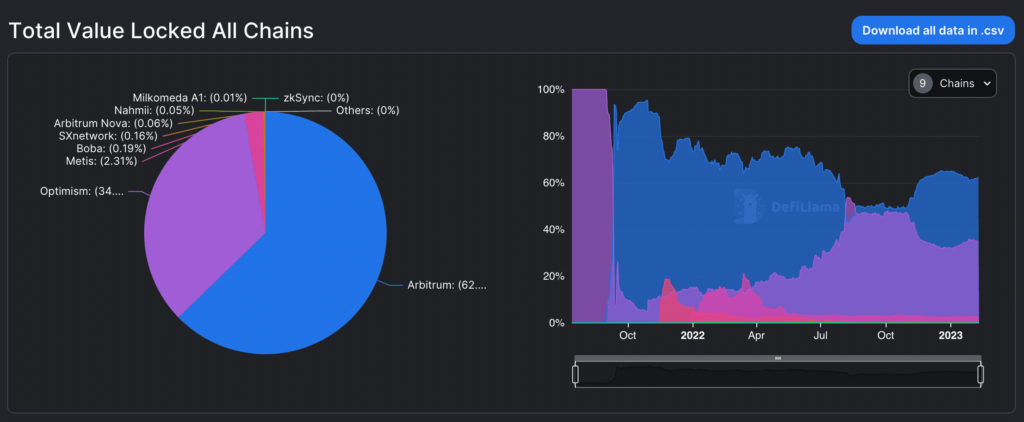

4. Largest Layer 2 rollup on Ethereum

Arbitrum is the largest layer 2 on Ethereum running rollup technology with total locked funds of 1.44 billion US dollars. Currently, there are 184 protocols on Arbitrum, including GMX, Aave, Uniswap, and others.

Risks of Arbirtrum

1. Challenge Period

The optimistic rollup design involves a challenge period of up to seven days. The challenge period is applied when a transaction is detected incorrectly. This period is put in place to give people multiple opportunities to check that all blocks are correct transactions. Thus, users who want to withdraw their tokens from Arbitrum, must wait for these seven days.

2. The Validator is Not Decentralized Yet

Arbitrum’s validator is still in the process of becoming fully decentralized. Arbitrum currently employs permissioned validators. The company has recently announced plans to expand its pool of validators by inviting more organizations to join its network

The organizations that are part of the secure Arbitrum chain network as validators are Consensys, Ethereum Foundation, L2BEAT, Mycelium, Offchain Labs, P2P, Quicknode, DLRC, and Unit410.

3. Potential Loss of Funds

Fund loss can occur if none of the validators check the published status. Fraud proofs assume at least one validator who is honest and capable of accepting malicious code upgrades. Additionally, funds can be lost if there are errors in Nitro’s one-stop implementation and the highly complex WASM.

Fraud proofs are claims for suspected invalid transactions. These transaction checkings take seven days to complete.

Arbitrum Key Performances

According to data from DefiLlama, Arbitrum has a TVL of $1.4 billion US dollars. It is the fifth largest of any L1 or L2 and records a market share of 3% of TVL across all chains. Arbitrum’s market share has increased significantly over the past year, up from 1% among all chains a year ago. This increase is partially due to the growth of applications in the Arbitrum ecosystem, such as the GMX perpetual exchange.

Read more about GMX here.

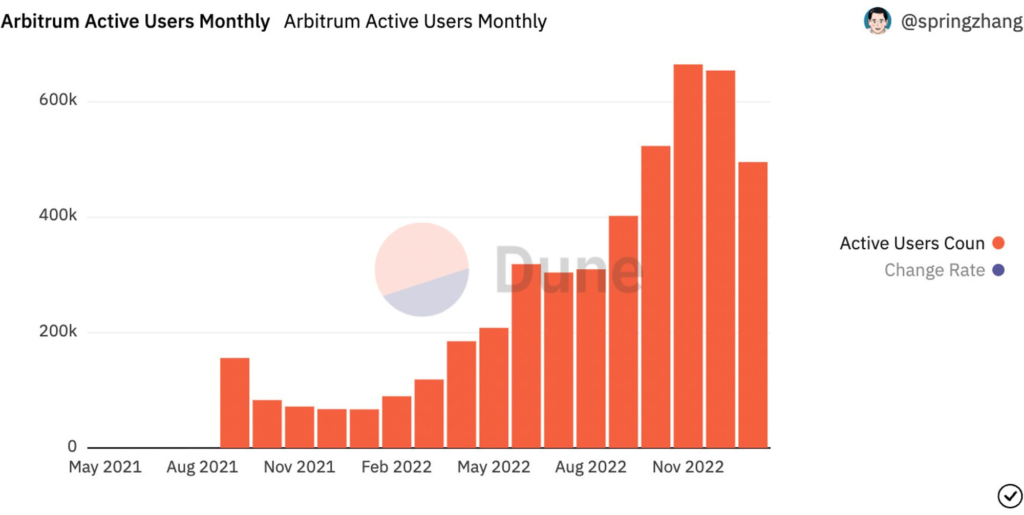

Citing the data from Bankless above, in the last quarter of 2022, Arbitrum recorded an average of 614.279 Monthly Active Addresses (MAA), a growth of 81.3% over the previous quarter, and an increase of 728.7% from a year earlier.

Overall, despite the risk of network centralization, Arbitrum has a fairly strong foundation and is expected to continue its growth this year.

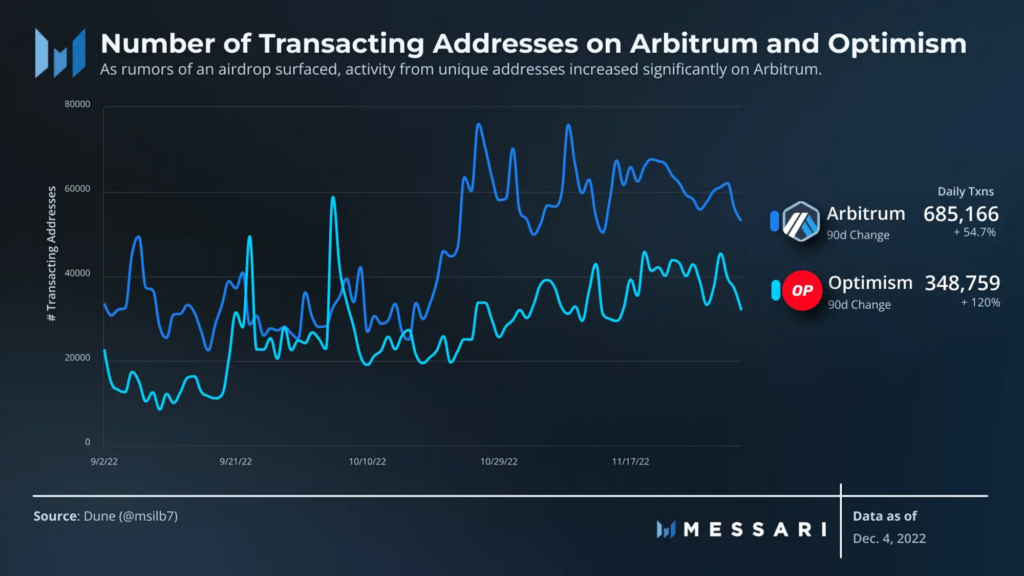

Arbitrum vs. Optimism

Arbitrum is not the only Layer 2 blockchain that is a scalability solution on the Ethereum network. It has a main competitor, namely Optimism. Both use optimistic rollup to speed up the transaction process on Ethereum. However, there are some fundamental differences between the two, which are as follows.

In solving the problem of incorrect transactions, Arbitrum uses multi-round fraud proofs and is executed off-chain. Meanwhile, Optimism uses single-round fraud proofs. Arbitrum’s multi-round fraud proofs system is more robust, cheaper, and more efficient than Optimism’s single-round fraud proofs system.

Furthermore, both Arbitrum and Optimism are compatible with EVM (Ethereum Virtual Machine). In building dApps on its ecosystem, Arbitrum has its virtual machine, Arbitrum Virtual Machine (AVM), while Optimism uses EVM. That’s why Arbitrum supports programming languages compiled by EVM, such as Solidity, Flint, LLLL, Vyper, Yul, and others, while Optimism only supports Solidity.

From the community side, Arbitrum does not have a decentralized autonomous organization (DAO) system. Offchain Labs fully govern it. In contrast, Optimism has a DAO governance system called Optimism Collective. The holders of the Optimism native token (OP) have the right to participate in decision-making to determine the development of the protocol.

Read also What is Optimism?

The chart above shows that the number of wallet addresses making transactions on Arbitrum has increased since October 2022. It happens due to the Arbitrum Nitro upgrade and rumors about releasing Arbitrum tokens that will be distributed through the airdrop mechanism.

Arbitrum Token

On Thursday, March 16, 2023, Arbitrum Foundation announced that Arbitrum will release ARB tokens that will be distributed by airdrop system on March 23, 2023. The ARB token is an ERC-20 standard token and functions as a governance token while making Arbitrum implement a decentralized autonomous organization (DAO).

The Arbitrum DAO will have the power to control important decisions at the core protocol level, from how technology is improved to how revenue can be used to support the ecosystem.

Regarding the ARB token airdrop, Arbitrum is working with Nansen, a crypto analytics company, to determine who is eligible for the ARB airdrop. You can visit gov.arbitrum.foundation to check if you can claim ARB tokens.

To get an ARB token airdrop, users need to collect at least three points. Many activities can earn users points to qualify for the airdrop, including bridge funds, making transactions of a certain value, and depositing liquidity in Arbitrum. Points earned before the launch of Arbitrum Nitro are worth twice as much as those earned afterward. A minimum of three points is required to qualify for an airdrop.

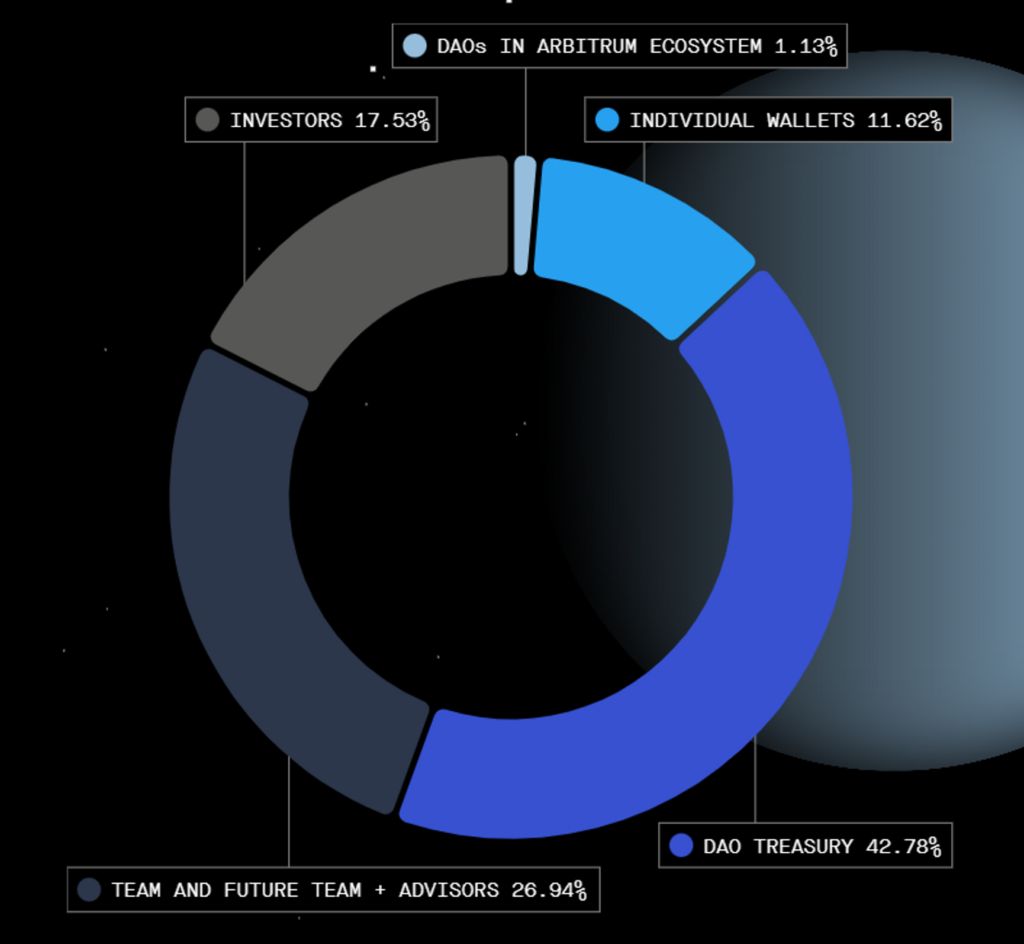

ARB has a maximum supply of 10 billion ARBs. 56% of the total is allocated to the community. From the community allocation, 12.75% will be distributed in the ARB airdrop on Thursday, March 23, 2023. Arbitrum also allocates 44.47% of ARB tokens to the team, advisors, and investors.

The amount is high because it may raise concerns about potential “dumping” or massive selling of tokens. ARB selling pressure can also be created by those who sell immediately after getting the airdrop. In addition, the tokens for teams and investors have a 4-year vesting schedule with the first token opening occurring a year after launch (March 23, 2024).

How to Buy ARB Token on Pintu?

You can start investing in ARB by buying it in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for ARB.

- Click buy and fill in the amount you want.

- Now you have ARB as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Door Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Arbitrum Team, Overview: The Lifecycle of an Arbitrum Transaction, Arbitrum, accessed 6 Februari 2023

- Blockchain Council Team, Understanding The Arbitrum Bridge: An Ultimate Guide, Blockchain Council, accessed 6 Februari 2023

- Julie-Anne Chong, Arbitrum: The Complete 101 Guide, Coin Bureau, accessed 6 Februari 2023

- Eshita Nandini, Layer-2 All-Time High Gas Speed, Messari, accessed 6 Februari 2023

- Robert Stevens, What Is Arbitrum? Speeding Up Ethereum Using Optimistic Rollups, Decrypt, accessed 7 Februari 2023

- Offchain Labs Team, Introducing Nova: Arbitrum AnyTrust Mainnet is open for Developers, Offchain Labs, accessed 7 Februari 2023.

- Arbitrum Team, Arbitrum: The Next Phase of Decentralization, Medium, accessed 17 Maret 2023.

- Sam Kessler, Arbitrum to Airdrop New Token and Transition to DAO, Coindesk, accessed 17 Maret 2023.

Share