What is Optimism?

Ethereum is home to many DeFi apps, Web3, and NFT platforms. However, due to its popularity, Ethereum is known for being congested and having high gas fees. This leads to Ethereum scalability problems.

Optimism is one of the blockchains that attempts to address the Ethereum scalability issue as a layer-2 solution. Through optimistic technological rollups, optimism can handle transactions more quickly and inexpensively. Find out more about Optimism and how it works in the following article.

Article Summary

- 🔗 Optimism is a layer-2 blockchain built on top of Ethereum. Optimism using optimistic rollups as scaling technology to reduce the Ethereum gas fee.

- ⚡ Optimistic rollups combine various transactions from the main chain, then rolled them up into one transaction. All the data processing is done on Optimism’s blockchain. But, the results are sent back to the Ethereum blockchain as a new block to be validated.

- 🚧 After successfully launching the OP Stack, Optimism is now preparing a Bedrock update as an effort to improve the quality and speed of transactions.

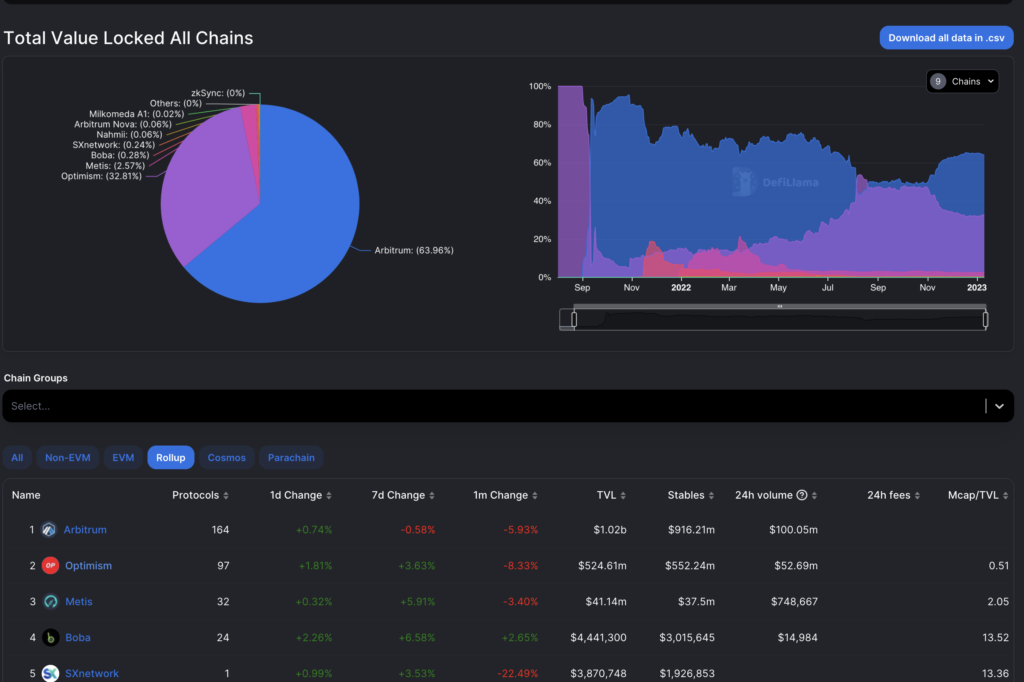

- 🔄 Optimism is the second largest Ethereum layer-2 with TVL reaching US$ 523.61 million. The three biggest protocols in Optimism are Synthetix, Velodrome, and AAVE V3.

- 🪙 Optimism has a native token named OP, which is used for transaction fees and a governance token.

What is Optimism?

Optimism is a layer-2 blockchain built on top of the layer-1 network (Ethereum). As a layer-2, Optimism seeks to be a solution to the scalability problems faced by Ethereum. As we know, Ethereum currently only has a transaction speed of 15 TPS. In comparison, Optimism offers a transaction validation process of up to 2,000-4,000 TPS. This is inseparable from the optimistic rollups technology brought by Optimism. With Optimism, users can access Ethereum’s dApps with lower, faster transaction fees, resulting in a better experience.

Optimism is the second largest Ethereum layer-2, with Total Value Locked (TVL) reaching 524.61 million US dollars at the time of writing, based on data from Defi Llama. Arbitrum is the largest Ethereum layer-2, with TVL reaching 1.02 billion US dollars.

Optimism was founded in June 2019 by Jinglan Wang, Karl Floersch, and Kevin Ho in California, United States. In March 2022, Optimism managed to secure US$ 150 million in series B funding from major investors such as Andreessen Horowitz and Paradigm.

Following a successful migration rehearsal on the Goerli test net, Optimism is currently preparing the Bedrock update, which is planned to hit mainnet sometime in the first quarter of 2023. Some of the updates that Bedrock will present are reducing the deposit time from layer-1 to layer-2 up to 4x faster, reducing the cost of sending data to layer-1 by 20%, and supporting the implementation of various alternative proof systems (including Zero Knowledge).

Learn more about the various types of layers in the blockchain in the following article.

How Does Optimism Work?

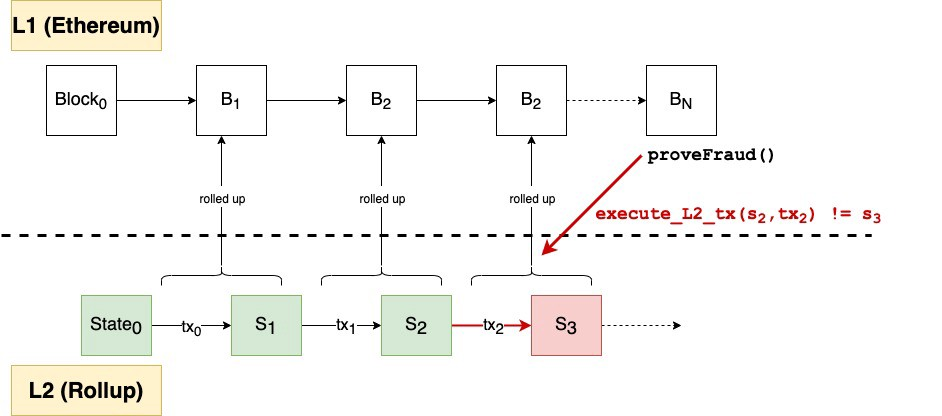

Optimism works with optimistic rollups, a layer-2 technology built on top of an existing blockchain network, in this case, Ethereum. Optimistic rollups combine various transactions and roll them into one for later processing. Hence the technology is called rollups. The data that has been merged into one is then processed on Optimism’s blockchain. When the process is complete, all final transaction data will be returned to the Ethereum blockchain as a new block to be validated.

By combining various transactions into a single bundle, the gas fees are significantly reduced. This is because the gas fee is split among all transaction owners instead of paid by only one party. With rollup technology, gas costs can be reduced by up to 100 times. Rollups don’t just cut costs; they also speed up transaction processing and let users participate freely.

Currently, every block created on Optimism will be stored on the Canonical Transaction Chain (CTC), a special smart contract on Ethereum. CTC has a code that ensures that new Ethereum transactions cannot modify existing block lists. Optimism can inherit and implement Ethereum’s security and decentralization aspects through this technology.

Each block in Optimism is created by a party known as a “sequencer.” Initially, the sequencer will confirm the transaction, then create a block on Optimism’s layer-2. These blocks are called rollups (a collection of Ethereum transactions). After that, the sequencer will execute the block by compressing it so that the transaction size becomes much smaller. Once completed, the transaction data is sent back to Ethereum.

You can read and learn more about smart contracts in the following article.

Fault Proof Mechanism

Another essential technology in optimistic rollups is fault-proof or fraud-proof, a mechanism to prove the validity of transactions. With this mechanism, optimistic rollups assume that every transaction is valid until proven otherwise. Hence it was called “optimistic.”

However, Optimism will run fraud-proofing to re-verify the transaction if the system or user suspects fraud or invalid data. Users can test the validity of a bundle of transactions within seven days after the transaction is completed.

The advantage of Optimism’s fault proof is that the mechanism is only needed when there is a problem. Thus, the required computing power is low so it has a good level of scalability. However, the problem lies in the challenge period. The duration of the challenge period will determine how long users have to wait to be able to withdraw their funds.

💡 Currently, Optimism has seven day challenge period. Thus, users have to wait seven days to be able to withdraw their funds from Optimism.

Optimism Collective

Optimism’s governance is carried out through the efforts of the Optimism Foundation and the Optimism Collective. The Optimism Collective operates through a bicameral system, which divides governance-related issues equally between the two entities. In this case, there are two Decentralized Automation Organizations (DAO) in Optimism Collective: Token House and Citizens’ House.

To get the rights to become a Token House or Citizens’ House, you must hold Optimism’s native token, the OP token. By joining the Token House, you will vote on technical decisions related to the development of Optimism, for example, software updates and project incentives. However, not all OP holders can become Citizens’ House. Only the top contributor group is selected. Members of the Citizens’ House will be responsible for distributing the revenue earned for public use that helps the operation of the Optimism ecosystem.

Find a complete explanation and how DAO works in the following article.

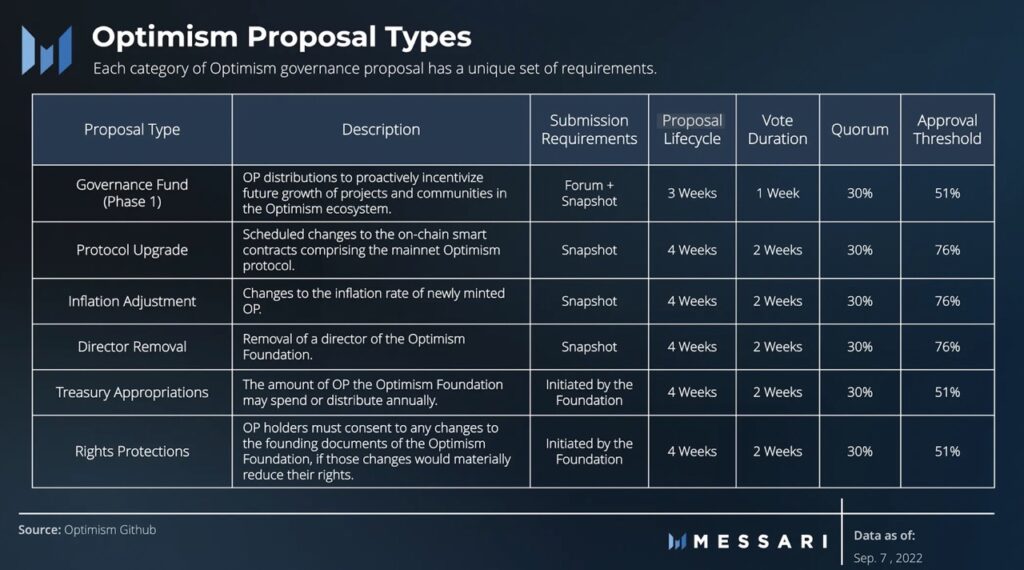

In the Optimism Collective, Token House members can submit changes to the Optimism protocol through several predetermined proposals. Token House members can submit six main types of proposals: Governance Funds, Protocol Upgrades, Inflation Adjustments, Director Removals, Treasury Appropriations, and Right Protections. Later, each proposal will go through a discussion process and receive feedback first, then a vote will be held to determine the decision.

💡 However, this dual governance has yet to be fully operating. It's because the Token House and Citizens' House projects are still in the early phases of development. Thus, there is still a possibility that there will be changes in the future, along with the development of Optimism itself.

Optimism Ecosystem

As one of the layer-2 with the largest TVL, Optimism has a variety of protocols in its network. Considering Optimism has a low gas fee, it’s not surprising that the majority of the protocols in Optimism are DeFi.

According to DeFi Llama, Synthetix is the largest protocol on Optimism, with TVL reaching 112.08 million US dollars. Then, Velodrome and AAVE V3 took second and third place, with TVL of US$101.64 million and US$85.08 million, respectively. At the time of writing, there were 70 protocols in Optimism that at least had a TVL of USD 10,000.

Optimism Tokenomics.

After thoroughly discussing Optimism and the technology behind it, now is the time to discuss Optimism’s native token, the OP token.

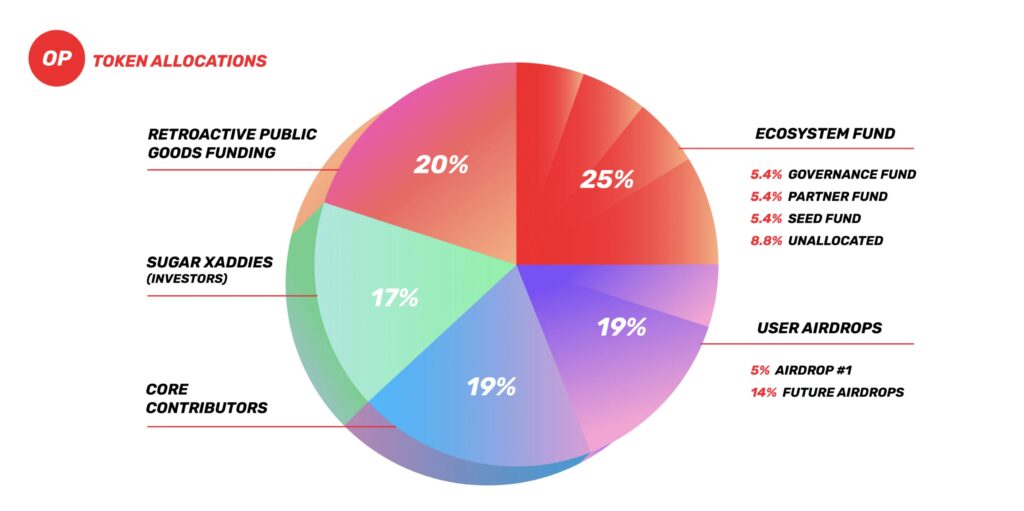

Currently, one of the primary uses of the OP token is for transaction fees. In addition to transaction fees, OP token holders can take a vote regarding Optimism’s development in the future. The OP token itself has a total supply of 4.29 billion tokens. The supply of OP tokens currently circulating is only 5% of the total supply. It is noted that OP Token has an inflation rate of 2% annually. Here is the detail about OP token allocation:

Based on the token allocation above, 19% of the tokens, or around 816 million tokens, will be distributed to users via airdrops. Meanwhile, the first airdrop was carried out in April 2022. At that time, 5% of the airdrop allocation, or around 214 million OP tokens, had been distributed to users. Then the remaining 14% will be distributed at the next airdrop.

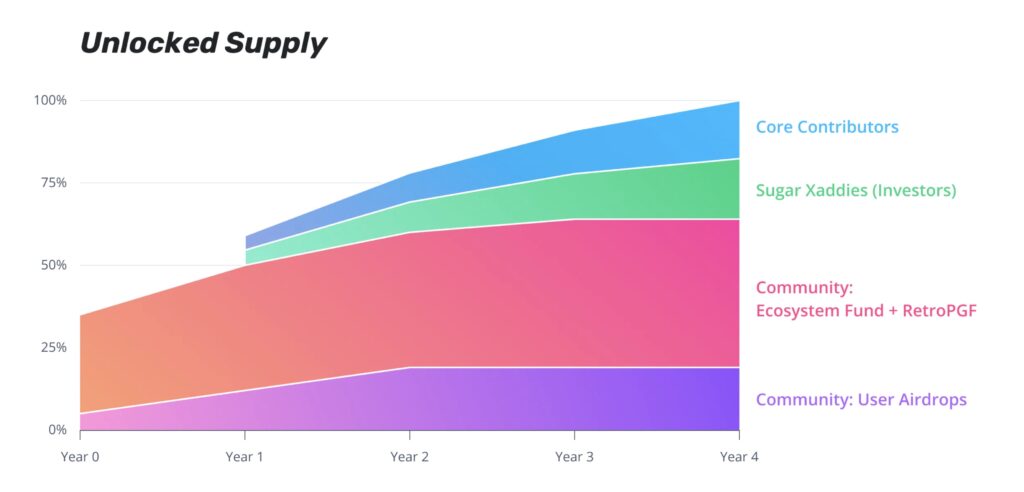

As much as 20% and 25% of the OP token allocation will be distributed for retroactive public goods funding (RetroPGF) and ecosystem funds, respectively. RetroPGF is the main mechanism of the Optimism Collective to distribute rewards to the public, which positively impacts the development of Optimism. In contrast, the ecosystem fund is a proactive program that aims to stimulate development in the Optimism ecosystem by providing funding for various projects and communities. Below is the distribution schedule for the OP tokens unlocked supply since it was first launched:

Optimism as Investment

OP token reached its highest price on August 4, 2022 for 2.17 US dollars. After that, OP price plummeted to below 1 US dollar. However, entering of this year, the OP token price is increasing, and as of January 19, 2023, it was already at 1.70 per US dollar with a 24-hour trading volume of 221.09 million US dollars. Currently, OP tokens has a market cap of 398.25 million US dollars and is 83th on CoinMarketCap rankings.

Optimism and OP tokens have several advantages that make them attractive as investments. One of the main factors is the potential use and innovation of Layer-2, which will be even more significant in the future. This is inseparable from the need for fast and affordable transactions. In the year between 2020 to peak demand in 2021, the gas fee on the Ethereum increased by up to 1,300%. Therefore, Optimism’s optimistic rollups technology can be seen as a solution to overcome the high transaction costs.

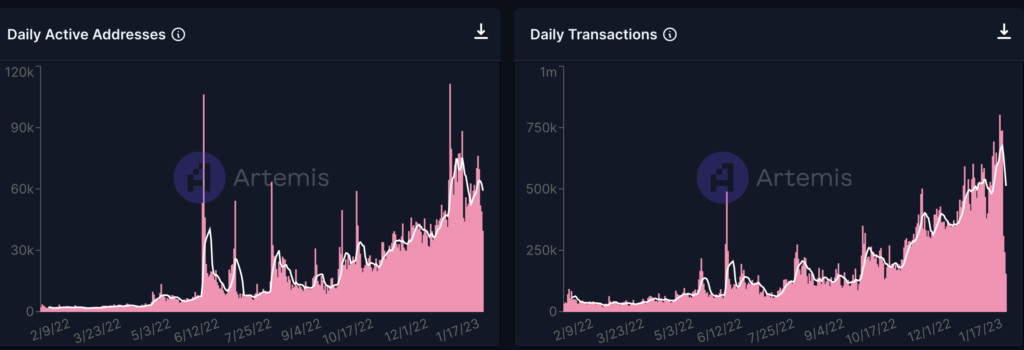

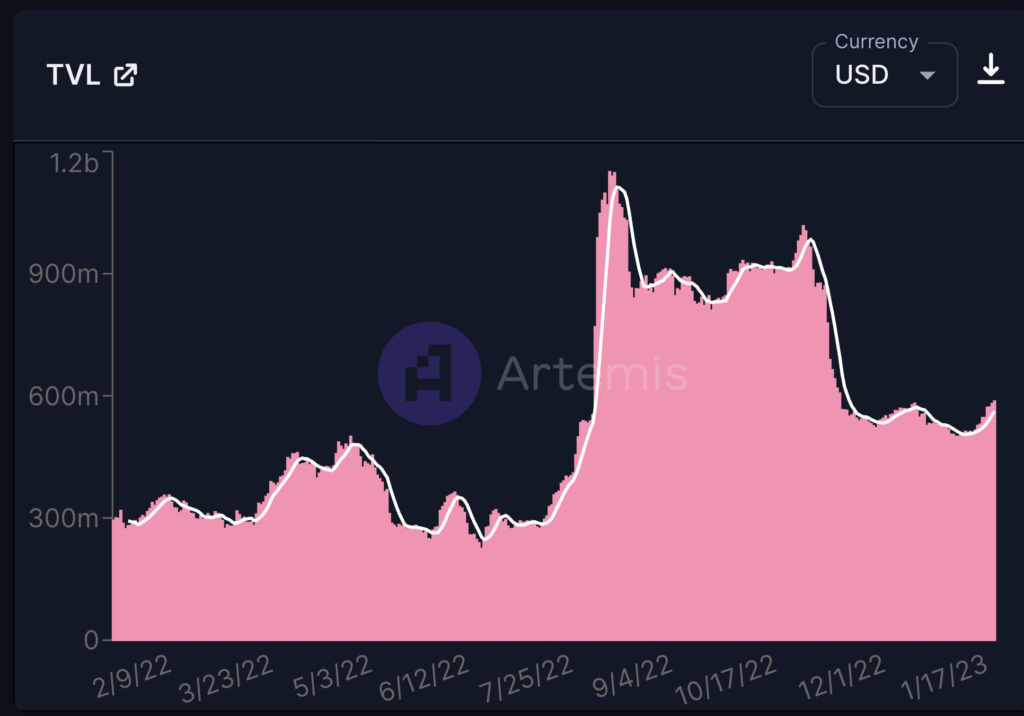

Furthermore, in 2022, Optimism has shown good performance, as seen by the increasing number of users and daily transactions. As shown in the image above, Optimism’s network seems unaffected by the bear market conditions throughout 2022. Optimism also recorded TVL reaching a level of US$ 1.1 billion before finally dropping back to US$ 500 million at the end of 2022.

The Improvement of Optimism Network.

This growth trend will likely continue, as you can see the increase in transactions and daily users throughout 2022. Optimism also has announced that it will be rolling out a Bedrock update to improve its technology. Through this update, it is expected that Optimism will be the lowest-cost optimistic rollup on Ethereum. When Ethereum implements EIP-4844, transaction fees at Layer-2 will be even cheaper. Apart from that, through Bedrocks, Optimism also targets reducing the deposit time from the original 10 minutes to 2.5 minutes.

Moreover, Optimism has also launched the OP Stack in the last year, which can provide significant progress in developing its network. Meanwhile, the OP Stack is a modular blueprint for creating any type of blockchain using the Optimism codebase. Developers can use the OP Stack to create whatever they want. Optimism explains that they want to create a super chain through the OP Stack where a group of blockchains is tightly integrated.

With these various updates, Optimism can eventually switch from layer-2 in spirit to layer-2 in practice. As such, Optimism will also inherit all aspects of Ethereum’s security on a larger scale.

OP Token Risks

Considering that Optimism is one of many with the technology to overcome the problem of scalability and high gas fees on the Ethereum, competition with other blockchains is one of the risks. Arbitrum, which also has rollups technology, is Optimism’s strongest competitor.

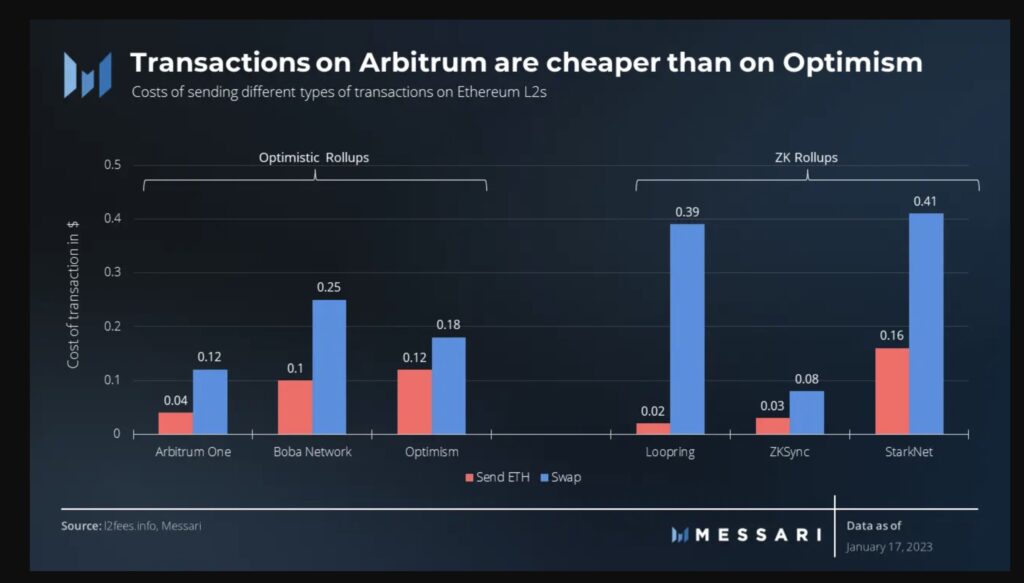

In terms of TVL, currently, Arbitrum has a TVL of US$1.2 billion and a market share of 63%. Then, in terms of transaction fees, Arbitrum is much cheaper than Optimism. Sending ETH and DEX Swap on Arbitrum only costs 4 cents and 12 cents, respectively. Meanwhile, for the same transaction on Optimism, a fee of 12 cents and 18 cents is charged, respectively. The competition between the two will be even more fierce in determining who is the layer-2 with the best rollups technology.

Apart from competitors with similar technology, Optimism also must compete with Zero Knowledge (ZK) technology. Throughout 2022, ZK’s technology experienced rapid development. Entering 2023, this technology will be tested for its potential and successful implementation. If ZK can match or even exceed the speed and transaction costs of Optimism’s technology rollup, then that could be a risk to Optimism itself.

💡 Zero Knowledge is a technology that allows transactions in the blockchain to be processed by simply reading a zero-knowledge proof (zkp) without needing to present the complete data. With this, the network doesn't need to spend large computing power ti process the transactions. zk technology can significantly increase throughput (TPS) and reduce user transaction costs.

Following are the differences between Optimism’s optimistic rollups and ZK-rollups:

| Optimistic Rollup | ZK-Rollup | |

| Fund withdrawal period | Several days | Few minutes to hours |

| EVM compatibility | Easier to prove EVM execution | Harder to prove EVM execution |

| Computation costs | Lightweight | Computationally intensive |

| Complexity of technology | Low | High |

| Type of cryptographic proof used | Fraud proofs | Validity proofs |

| Data compression | All transactions must be compressed and committed on-chain | Only transactions relevant for computing the state delta need to be compressed and committed on-chain |

Then, like other crypto projects, the OP tokens has high price volatility. So, you should do your own research and consider the benefits and risks before buying OP tokens.

How to Buy Optimism on Pintu

You can start investing in OP tokens by buying it in the Pintu App. Here is how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for OP token.

- Click buy and fill in the amount you want.

- Now you have OP token as an asset!

Beside OP tokens, you can also invest in various crypto assets such as, BTC, BNB, ETH, and others safely and easily through Pintu.

Pintu is also compatible with popular wallets such as Metamask to facilitate your ttransactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for knowledge and educational purposes, not as a financial advice.

Reference

Traver Normandi, State of Optimism Governance, Messari, accessed on 16 January 2023.

Bybit Learn, What Is Optimism (OP): The Simple Layer 2 ETH Scaling Solution, Bybit, accessed on 16 January 2023.

Ivan Cryptoslav, What Is Optimism? The Ultimate Guide to the Optimism Ecosystem, CoinMarketCap, accessed on 16 January 2023.

Robert Stevens, What Is Optimism? Using Rollups to Help Scale Ethereum, DeCrypt, accessed on 16 January 2023.

Rahul, Nambiampurath, What Is Optimism? The Defiant, accessed on 16 January 2023.

ConsenSys, 2023 CMC Crypto Playbook: The Present and Future of Layer 2 Roll-ups, CoinMarketCap, accessed on 18 January 2023.

Kunal Goel, Optimism: A Glass Half Full, Messari, accessed on 19 January 2023.

Share

Related Article

See Assets in This Article

ZK Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-