Introduction to Smart Contract Technologies

The Technology of Smart Contract & DApps

Cryptocurrencies are commonly known as investment assets. However, the technology underlying cryptocurrency offers so much more than that. One of the innovations that is introduced by crypto is smart contracts, which enable developers to build applications on the blockchain network, called DApps (decentralized applications). In this article, we will learn more about the implementation of smart contract technologies.

Article Summary

- 💻 Smart contracts is a codes that can be programmed for anything and written on top of the blockchain. Smart contract executes the command that has been programmed automatically without involving a third party.

- 🔗 Ethereum is the most widely used blockchain for developing smart contracts. But, many developers are starting to use third-generation blockchains to create smart contracts. This blockchain seeks to bring a solution to the problems that Ethereum has.

- 🚨 Smart contract technologies are commonly used by developers to create decentralized apps (DApss), rights management (tokens), and NFTs.

What is Smart Contract?

Smart contracts are basically codes that can be programmed for anything. However, what makes it different from other computer programs is that smart contracts are stored on the blockchain. This makes all interactions with it irreversible. Smart contracts can define rules and automatically apply them via code. This means a third-party role to ensure the execution of transactions or activities is no longer necessary.

Given that every blockchain network is public, every transaction and agreement in a smart contract becomes transparent. This makes tracking transactions easier. Also, it has great security because it does not depend on a central authority. Through smart contract technologies, developers can create applications that take advantage of the security, reliability, and accessibility of the blockchain while offering peer-to-peer functionality.

Nick Szabo, a computer scientist, is credited with coining the term "smart contracts" in the 1990s. He defined a smart contract as a computerized transaction protocol that performs the agreements of a contract in 1994.

Initially, Szabo wanted to expand the use of electronic transaction methods. One of them is to transform a Point of Sale (POS) into a digital reality. Szabo also proposed the use of a contract for synthetic assets such as derivatives and bonds in his paper. However, smart contracts only became well known when Vitalik Buterin implemented them on the Ethereum network.

Find out more about Blockchain and how it works through the following article!

The Development of Smart Contract

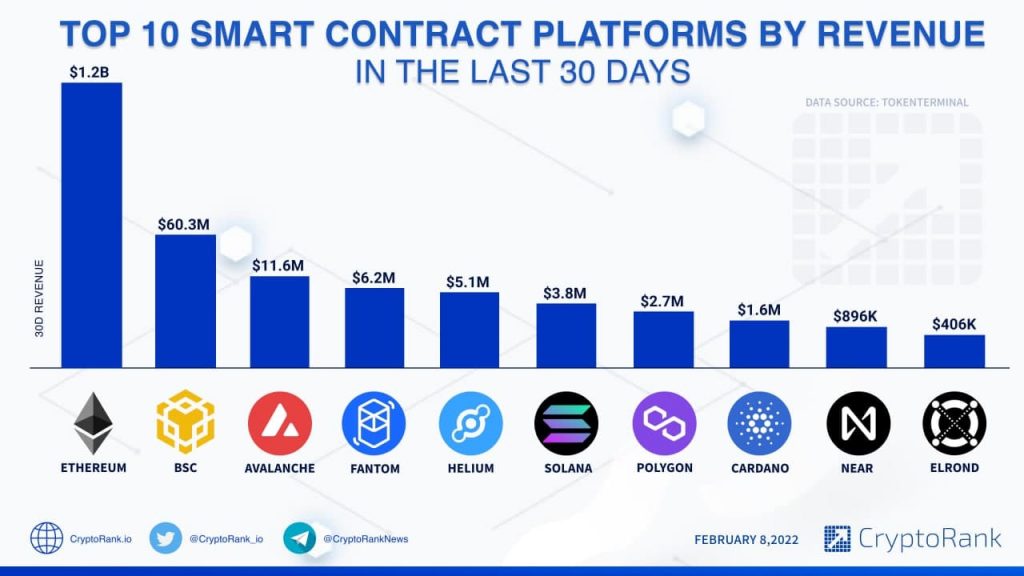

Ethereum, a pioneer in implementing smart contracts, became the preferred platform for many developers, leading to the birth of decentralized apps (DApps). Another use of smart contract technologies is for creating ERC-20 tokens, a standard token often used in the Ethereum blockchain.

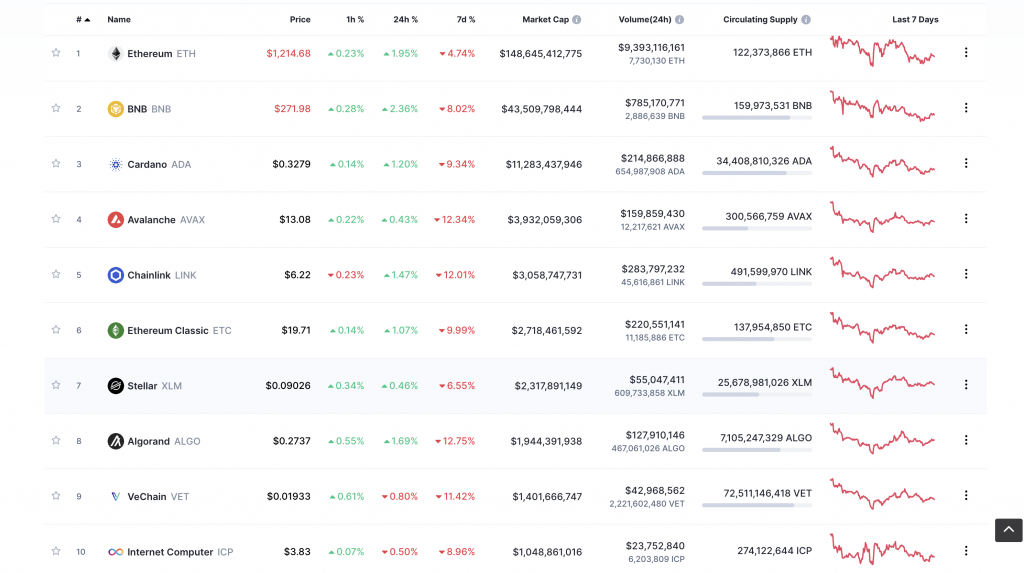

However, Ethereum itself has limitations, such as expensive gas fees and problems related to transaction scalability. Inevitably, the third generation of blockchains was born to solve the issues that Ethereum has.

This third generation of blockchain has many advantages. Such as a different consensus mechanism, lower transaction fees and higher processing speed. Solana, Avalanche, Polkadot, Cardano, and Polygon are part of the third generation of blockchain.

These blockchains are also called the Ethereum killers. It is because they are developing technologies to address Ethereum's scalability issues. Yet, the question arises whether this so-called Ethereum killers can survive and defeat Ethereum. Especially now that Ethereum has completed The Merge, and will continue its full upgrade to Ethereum 2.0 in 2023.

The Emergence of Smart Contracts on the Third Generation of Blockchain

Due to Ethereum’s limitations, the emergence of the aforementioned third generation of blockchain has attracted developers. They now have various blockchain choices for writing smart contracts and developing DApps. Here are some of the advantages offered by this new generation of blockchains:

- Solana

The Solana blockchain is relatively similar to Ethereum. Because it has smart contract technologies to support the creation of DApps, NFTs, and staking. But, one of the differences is that Solana comes with a verification algorithm that combines a proof-of-history (PoH) system with a proof-of-stake (PoS). It gives Solana a maximum transaction speed of up to 50,000 per second. Aside from that, Solana offers substantially lower transaction fees than Ethereum.

Even so, Solana still has some drawbacks. Several of them involve the server shutting down due to bot activity on its network. In addition, many people still doubt the decentralization of the Solana network.

You can learn more about Solana technology and how it works through the following article

- Avalanche

Another third generation of blockchain dubbed as Ethereum killer is Avalanche. One of the reasons is that Avalance can process up to 4,500 transactions per second. Much higher than Ethereum, which currently only processes 15 transactions per second.

Apart from that, Avalanche is also compatible with Ethereum Virtual Machine (EVM). This allows the use of Ethereum-based smart contracts without requiring code changes. One of the smart contract technologies implementations on the Avalanche blockchain is decentralized exchanges (DEX), such as Sushiswap and Pangolin.

Find out complete information about Avalanche through the following article.

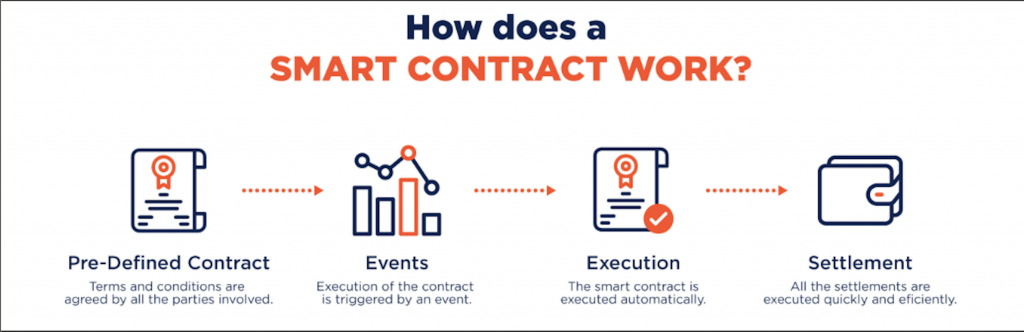

How Smart Contracts Work

The way smart contracts work is very logical. Because they follow a structured formula of ‘if, when, and then.’ That formula is written in code on the blockchain. Thus, the contract will be executed automatically if every condition is met. On the other hand, the contract cannot be executed if any of the conditions are not met.

The use of the blockchain system makes all transaction data automatically updated. Also, every data is immediately sent and stored to each node. This, at the same time, makes transactions irreversible and cant be hacked.

A vending machine serves as a straightforward example of how a smart contract operates. Let’s say a vending machine sells drinks for 10,000 rupiah. If you put in 10,000 rupiah, then choose the type of drink, the machine will process and give you the drink you choose. But your money will be returned when the chosen drink is unavailable. All these processes take place automatically and without the intervention of people.

Basically, the smart contract has the same concept as the vending machine earlier. The programmers will determine what terms and conditions must be met. All the possibilities that can occur must also be studied and explored. Then the smart contract will run automatically according to the formula and term that has been made.

In the following article, you can dig deeper into Ethereum, the home of thousands of smart contracts.

The Benefit of Smart Contract

- Security. By being on a decentralized blockchain, smart contracts do not have a single point of attack. In addition, no third parties can manipulate the contract mechanism.

- Trustless. With smart contracts, users don’t have to worry that the other party doesn’t carry out the agreement. Smart contracts ensure the deal will be executed when all conditions are met.

- Efficiency. The use of smart contracts makes the entire execution process run automatically. It does not need the intervention of a third party.

- Accuracy. The execution of the smart contract will follow the code and formula that have been written. This eliminates the possibility of multiple interpretations that can occur in traditional contracts.

- Public Records. Smart contracts are created on a public blockchain network. So that every transaction can be tracked while protecting user privacy.

- Transparency. With everyone being able to see the contents of the smart contract, everyone can examine and criticize the contents if a detrimental agreement is found.

The Implementation of Smart Contract

Rights Management (Tokens)

Blockchains with smart contract technologies, such as Ethereum, allow developers to create new crypto tokens on their network. These tokens are usually designed with specific uses within a dApps platform. Tokens with a special and particular role are also known as utility tokens. For example, the CAKE token has a role in the PancakeSwap application scheme.

In addition, developers can use smart contracts to create tokens to regulate the voting mechanism in a protocol. These tokens are referred as governance tokens. By having a governance token, the owner can determine every decision the platform will make. For example, COMP tokens can make their owners take part in the voting for decision-making regarding Compound development

If you are interested in token governance, you can also learn more about DAO through the following article.

Financial Product

The use of smart contract technologies is most widely applied in making DApps. There are various types of DApps, but the most common is decentralized finance . The use of smart contracts in DeFi apps aims to change traditional finance, such as savings, loans, and insurance, to be completely decentralized.

Compound, a DeFi protocol for lending and borrowing, is one of the popular DeFi applications. Through Compound, users can deposit a crypto asset to earn interest or borrow a crypto asset. The use of smart contracts allows this to be done without the need for a third party and is fully automated.

You can explore DeFi in more detail through the following article.

NFT

Smart contract technologies are also essential in the Non-Fungible Token (NFT) ecosystem. In the context of NFTs, the role of smart contracts is to store unique information of an NFT. So, when the minting process is complete, the smart contract will automatically determine the creator as the owner. A smart contract can also transfer proof of ownership to a new owner when the NFT is sold.

The implementation of smart contracts in NFT DApps is also very broad. Because they can include gaming platforms such as Decentraland, streaming music such as Audius, to NFT-based works of art.

If you are interested in knowing the ins and outs of the NFT world, find the complete information in the following article.

The Future of Smart Contracts

According to DappRadar, the number of smart contracts has reached 226,665, and the number of DApps has reached 12,779. Meanwhile, DApps daily users have reached 1.77 million.

As we know, the smart contract and DApps industry are currently in their early phase. This means there is still great potential for expanding the implementation of smart contract technologies in the future. But, at the same time, this industry still has significant challenges.

As reported by DappRadar, the DApps industry is still growing. The Total Value Locked (TVL) of the DeFi industry in the third quarter of 2022 increased by 2.9% quarterly to US$69 billion. Ethereum is still the most dominating, holding 69.6% of the total or around US$ 48 billion stored in smart contracts.

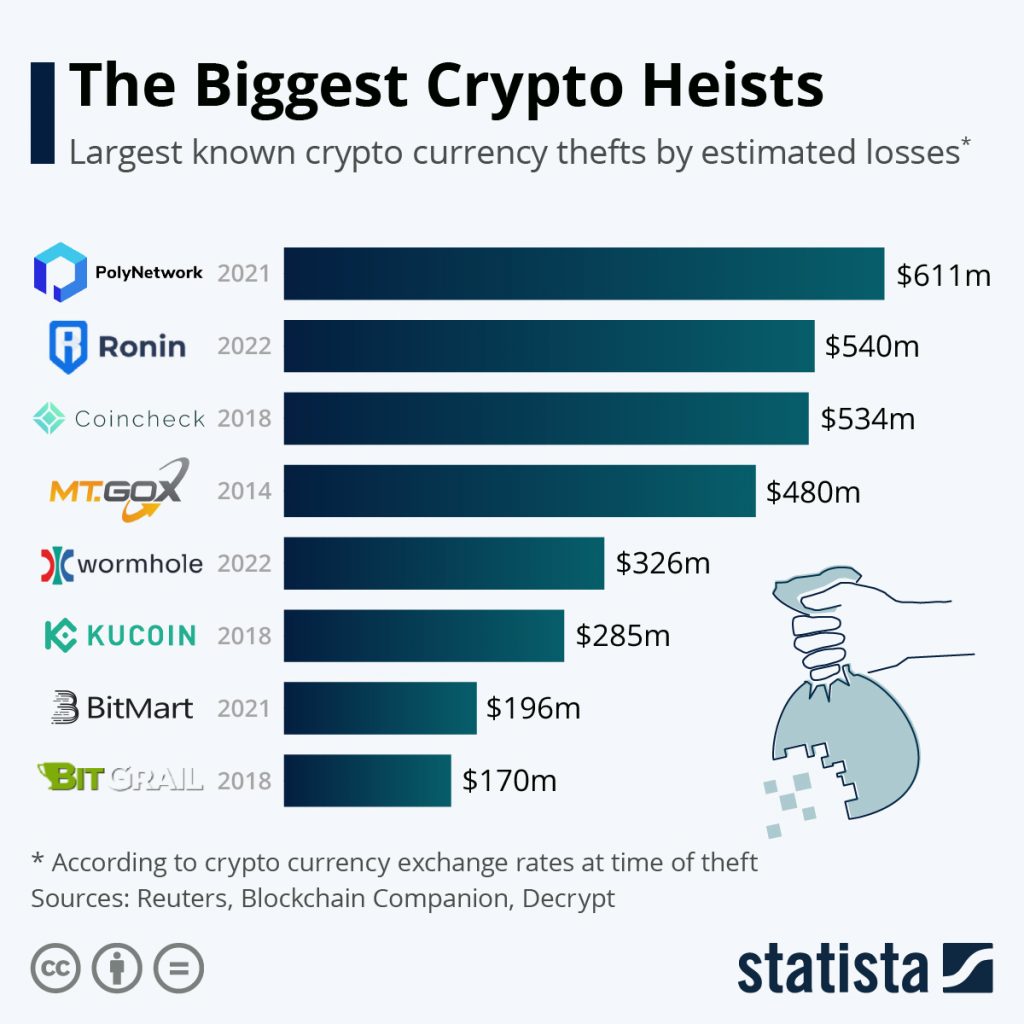

💡 But, on the one hand, during the third quarter of 2022, a total of US$ 461 million worth of crypto assets were stolen. Currently, blockchain bridges are still the main target of hackers.

Therefore, the widespread adoption of smart contracts and DApps still has a long, winding road. In addition to hacking problems, scalability, and UI/UX are other major hurdles for DApps’ mainstream adoption. However, if all of these issues are fixed, widespread adoption of smart contracts and dApps is only a matter of time.

Start Investing at Pintu

You can start investing in DApps tokens such as, UNI, COMP, AAVE, and others through Pintu App. Through Pintu, you can invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Besides making transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for knowledge and educational purposes, not as a financial advice.

Reference

- Coin Base Learn, What is Smart Contract? Coinbase, accessed on 16 November 2022.

- Chainlink, Smart Contracts Introduction, Chainlink, accessed on 16 November 2022.

- IBM, What are smart contracts on blockchain? IBM, accessed on 16 November 2022.

- Coin Telegraph, What is a Smart contract and how does it work? accessed on 16 November 2022.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-