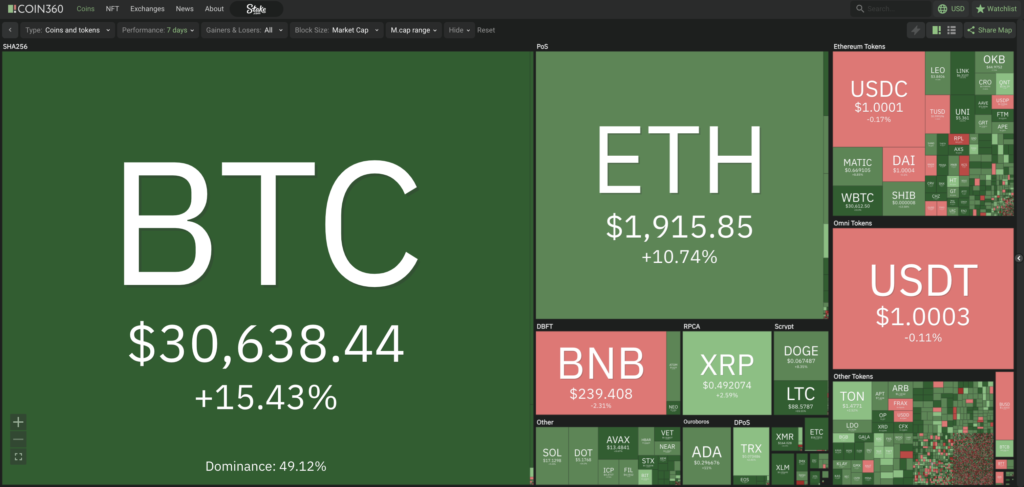

Market Analysis Jun 26th 2023: Blackrock and Fidelity’s Spot ETFs Spur Sharp Bitcoin Rise by 18%

The crypto market rallied over the past week, driven by investor enthusiasm for spot Bitcoin ETFs from Blackrock and Fidelity. BTC prices rose 18% and caused BTC Dominance to creep up to 51.5%. Is the crypto market back in a bullish position? Check out the full analysis below.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 📈 US Housing Starts significantly rose by 21.7% in May compared to the previous month, and initial unemployment claims remained stable at 264,000 in the week ending June 17, staying at the highest level since October 2021.

- 🏠 Home sales (single-family, townhomes, condominiums, and co-ops) slightly increased by 0.2% in May. However, on a yearly basis, sales were down by 20.4% compared to the previous year.

- 📉 The rate of mortgage interest showed volatility, with average rates ranging from 6.09% to 6.79%.

- 🔝 BTC surged by 18% driven by Blackrock and Fidelity Investment’s announcement about a spot Bitcoin Exchange-Traded Fund (ETF). BTC indicators are showing overbought and met resistance at the US$32,000 price point.

Macroeconomic Analysis

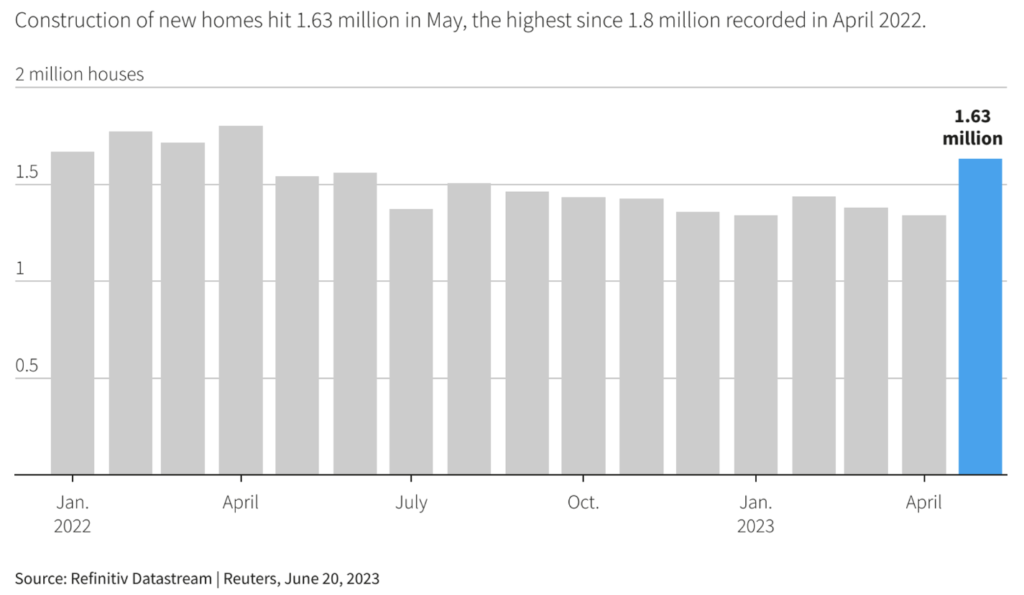

The latest monthly report released by the US Census Bureau, showed a significant increase in Housing Starts in May compared to the previous month by 21.7%. The significant jump in May surpassed market expectations, which had anticipated a more moderate decline of 0.8%. This increase was a rebound from the revised decline of 2.9% which was previously reported as an increase of only 2.2%.

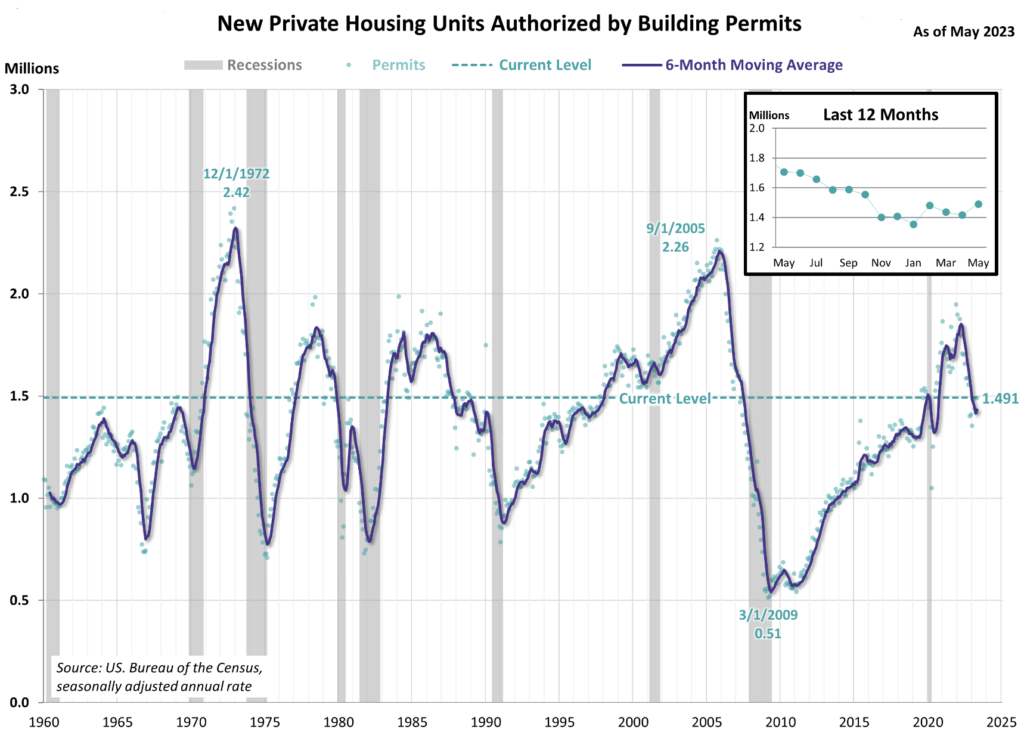

Improvement was also seen in the building permit data released by the US Census Bureau and the Department of Housing and Urban Development, which increased by 1.491 million, or 5.2%, beating the forecast of 1.425 million. However, compared to the same period last year, building permits actually fell by 12.7%. Nonetheless, the housing market is an important economic driver, although credit conditions have yet to improve. This remains a challenge for the construction sector, which relies heavily on construction and development loans to sustain the momentum gained in May.

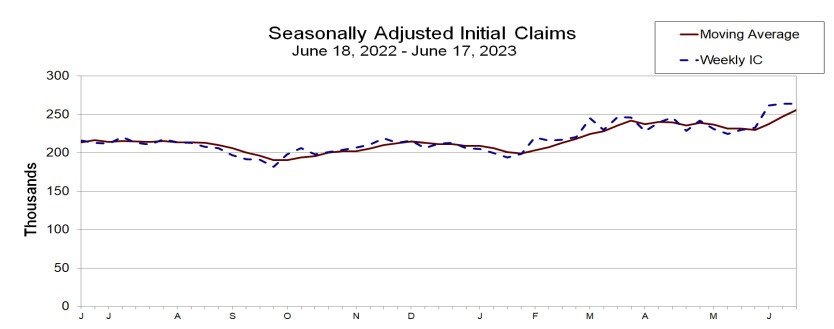

A report from the Labor Department released on Thursday, showed initial jobless claims remained steady at 264,000 in the week ending June 17. US unemployment benefits also remained at their highest level since October 2021, indicating that the labor market is facing signs of declining intensity to some degree.

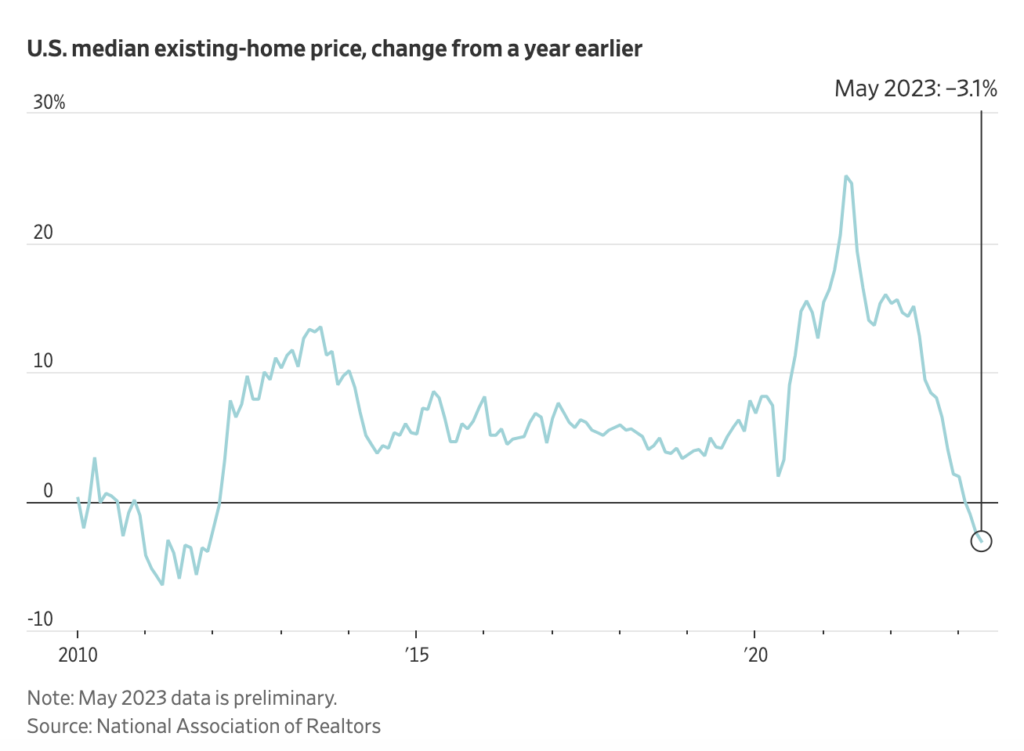

From a housing price perspective over the past decade, a report released by the National Association of Realtors revealed that U.S. home prices experienced their largest annual decline, or a 3.1% drop compared to the previous year. This is the largest year-over-year decline in home prices since December 2011.

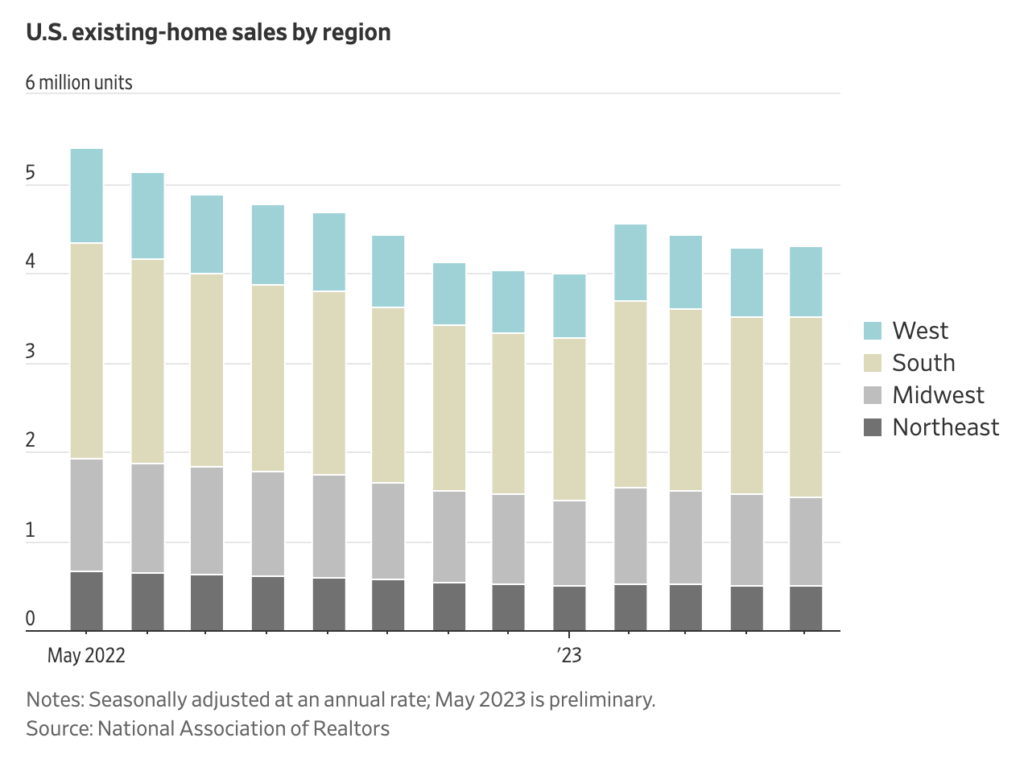

Home sales, including single-family homes, townhomes, condominiums and co-ops, increased slightly by 0.2% in May. On an annual basis, home sales are down 20.4% from a year ago. In addition, the seasonally adjusted annual sales rate fell from 5.4 million units a year ago to 4.3 million units in May.

Mortgage rates have shown volatility throughout 2023, with average rates ranging from 6.09% to 6.79%. However, mortgage rates remained relatively stable in April, when some of the homes closed in May were likely still under contract.

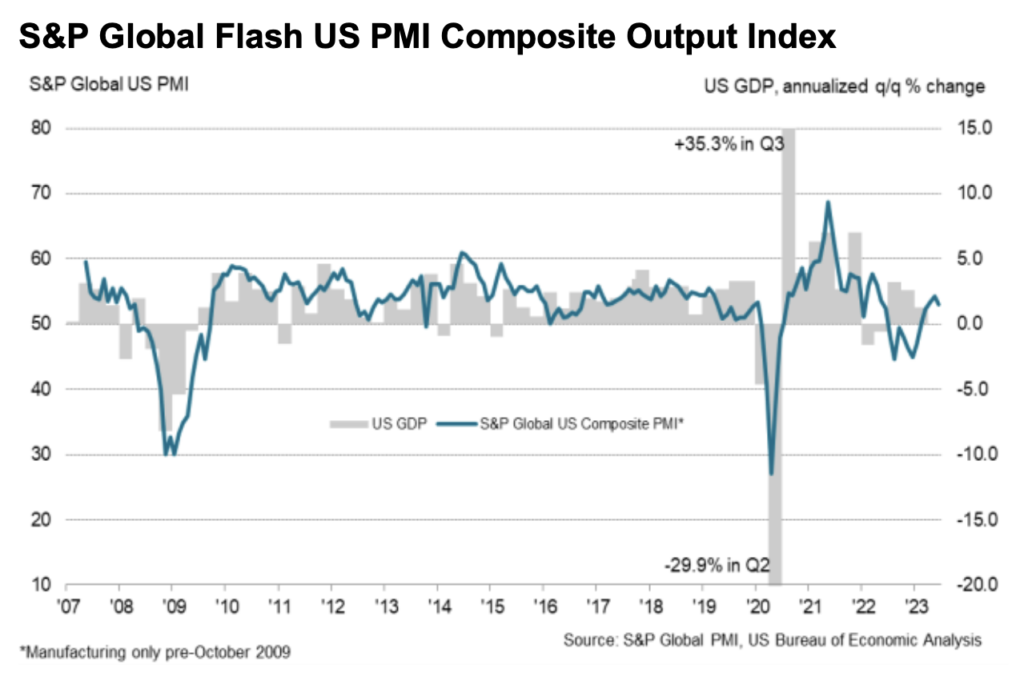

U.S. private sector activity expanded at a slower pace in early June, as indicated by the S&P Global Composite PMI, which fell to 53 from 54.3 in May. This was below market expectations for a reading of 54.4.

The S&P Global Manufacturing PMI also fell from 48.3 to 46.3 over the same period. Similarly, the services PMI declined slightly to 54.1.

Despite this slowdown, the overall rate of expansion of business activity in the United States remained relatively strong in June. This suggests that GDP is likely to have risen by around 1.7%, putting second-quarter growth at around 2%.

BTC Price Analysis

Last week, the crypto market strengthened, driven by investor enthusiasm for Blackrock and Fidelity Investment’s Spot Bitcoin Exchange Traded Fund (ETF). This news triggered positive sentiment in the bullish market, pushing the BTC price up 18% and the overall crypto market up 12%, with market capitalization increasing by $150 million in one week. Currently, all indicators for BTC show an overbought situation with resistance at US$32 thousand.

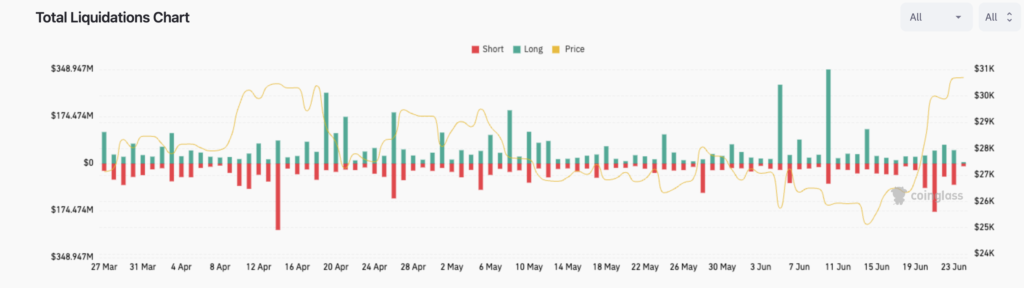

The announcement of BlackRock’s ETF filing in mid-June has affected the fortunes of short sellers, resulting in the liquidation of more than $220 million worth of short positions since that date. In the last 24 hours alone, approximately $36 million of short bitcoin positions have been liquidated, bringing the total amount of short positions liquidated in the last 24 hours to $78 million.

Due to the rise in BTC over the past week, the BTC dominance has continued to creep up to 51.5%, the highest level since April 2021. It is currently encountering a strong resistance point at 52%.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in an anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Ethereum staking soared, reaching 20 million coins. According to data from Token.Unlocks as of June 22, the amount of Ethereum staked exceeded 20 million coins, or approximately $38.25 billion, with a staking rate of 16.43%. Since the Shanghai upgrade, the net increase in stakes has reached over 3.66 million ETH. As of the end of June 2023, the annualized staking return rate has reached 5.98%.

- Optimism Rebrands as OP Mainnet to Facilitate ‘Superchain’ Development. The official Optimism Twitter account has changed its name to OP Mainnet, reflecting its vision to form a “superchain” of various L2 networks. With a total locked value of over $1.3 billion, OP Mainnet aims to be the base layer of this “superchain”. In addition, OP Labs developers have created the OP Stack, a software stack that facilitates the development of L2 blockchains. Crypto exchange Coinbase has used the OP Stack to develop its own L2 network, Base.

- Polygon has launched Copilot, an AI-powered guide to help users navigate its ecosystem and Web3. Copilot acts as an integrated assistant, providing users with valuable insights, assistance, and proactive suggestions to improve their interaction with blockchain technology. The AI-powered tool can understand and respond to natural language, making it user-friendly for both new and experienced users in the blockchain space. The move aligns with Polygon’s mission to simplify the complexities of blockchain and make it more accessible to a broader audience.

News from the Crypto World in the Past Week

- Following in the Footsteps of Blackrock and Fidelity, Valkyrie Funds Files for Bitcoin ETF. Valkyrie Funds has filed an application with the Securities and Exchange Commission (SEC) to launch a physically backed bitcoin ETF. This filing adds to Valkyrie’s lineup of products, which already includes a Bitcoin Strategy ETF and a Bitcoin Miner ETF. If approved, the new ETF, to be called the Valkyrie Bitcoin Fund, will be listed on the Nasdaq under the ticker symbol BRRR.

- Federal Reserve Chairman Jerome Powell acknowledges the resilience of bitcoin and other cryptocurrencies. Powell noted that cryptocurrencies have been integrated into the financial system because of their potential as investments and stores of value. He also highlighted the significant market share of stablecoins in the crypto market and emphasized the need for a regulatory framework to ensure their safe and reliable operation. While Powell didn’t take a definitive stance on future regulations, his comments underscore the importance of cryptocurrencies as an asset class.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Aave +25,98%

- Synthetix +15,58%

- Uniswap +10,67%

- PancakeSwap +6,17%

Cryptocurrencies With the Worst Performance

- Rocket Pool (RPL) -3,79%

- Render (RNDR) -3,04%

- Litecoin -2,94%

- Stacks (STX) -2,52%

References

- Wu Blockchain, Ethereum Staking Surpasses 20 Million Tokens, Wublock.Substack, accessed on 25 June 2023.

- OptimismFND, It’s official: the chain formerly known as Optimism is now OP Mainnet!, Twitter, ********accessed on 25 June 2023.

- Derek Anderson, Valkyrie joins rush with BTC spot ETF application to go with its futures, miners ETFs, Cointelegraph, accessed on 25 June 2023.

- André Beganski, Fed Chair Powell Says Bitcoin Has ‘Staying Power’ as an Asset Class, Decrypt, accessed on 25 June 2023.

- Polygon Labs, Introducing Polygon Copilot, Your AI-Powered Guide to Polygon and Web3, Polygon.technology, accessed on 25 June 2023.

Share

Related Article

See Assets in This Article

SNX Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-