Market Analysis Nov 18th, 2024: Bitcoin Breaks Records, Eyes $100k

Bitcoin continues its historic bull run, surpassing $93,000 last week. Will it reach the coveted $100,000 mark? Our in-depth analysis examines the factors driving this bullish momentum.

Market Analysis Summary

- 🟢 Bitcoin’s surge towards the $100k milestone continues to gain momentum. While the current overbought conditions, indicated by an RSI in the mid-80s for BTC/USD, might suggest a potential short-term correction, the broader market sentiment remains bullish.

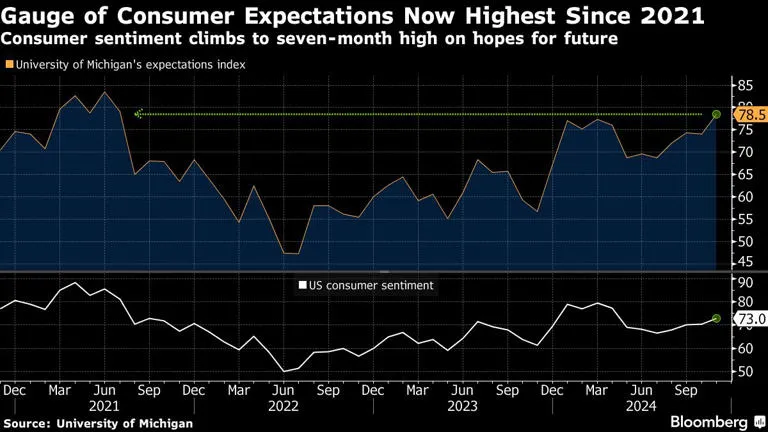

- 📈 Michigan consumer sentiment index increased to 73. The expectations index jumped to 78.5, its highest point since mid-2021.

- ⤴️ CPI rises 0.2% in October as forecast. Excluding the more volatile food and energy components, the CPI rose 0.3% for the month.

Macroeconomic Analysis

Michigan Consumer Sentiment

U.S. consumer sentiment rose to a seven-month high in early November, fueled by growing optimism about the economy and their personal finances.

The University of Michigan’s preliminary November sentiment index increased to 73. The expectations index jumped to 78.5, its highest point since mid-2021, according to data released on Friday.

The positive outlook also reflected expectations for slower inflation. Consumers anticipate prices will rise by 2.6% over the next year, the lowest rate since 2020. However, expectations for average price increases over the next five to 10 years ticked up to 3.1%.

The preliminary survey, conducted from October 22 to November 4, wrapped up just before Americans re-elected Donald Trump as president.

The university’s measure of expected personal finances reached its highest level since March, partly due to improved income prospects. Confidence in long-term business conditions also surged to nearly a four-year high.

Despite frustrations over high prices, consumers have grown increasingly optimistic about the economic outlook, with rising expectations for the labor market.

Meanwhile, the gauge of current conditions dipped to 64.4, as did the university’s measure of buying conditions for durable goods.

Other Economic Indicators

- CPI: The consumer price index (CPI) rose by 0.2% in October, marking its fourth consecutive monthly increase, and climbed 2.6% year-over-year, according to the Labor Department’s Bureau of Labor Statistics. Excluding the more volatile food and energy components, the CPI rose 0.3% for the month.

- PPI: Compared to the previous PPI reading of 0.1%, this new data shows a slight increase, implying that manufacturers are selling goods at marginally higher prices. This small uptick could lead to a modest rise in consumer price inflation, although the increase remains within expected limits, signaling that inflation is not accelerating rapidly. The PPI plays an important role in understanding inflation trends within the economy, as it makes up a large portion of overall inflation.

- Jobless Claim: Jobless claims data have been particularly volatile recently as Southeastern states recover from two hurricanes and Boeing Co. workers return following a weeks-long strike. Currently, new claims are below the two-year average. The four-week moving average of initial unemployment claims, which helps smooth out fluctuations, fell to 221,000—its lowest since May, according to Labor Department data released Thursday.

BTC Price Analysis

BTC prices have continued their remarkable rally today, surpassing the $90,000 mark for the first time. The world’s largest cryptocurrency has now risen approximately 30% since election day and is up 121% year-to-date.

The current excitement in the crypto markets is clear. There appears to be a generational shift in investment flows, as reflected in recent data. BlackRock’s Bitcoin ETF has now exceeded the holdings of its Gold ETF, potentially shedding light on the challenges faced by traditional gold as BTC’s popularity grows. It’s noteworthy that in 2024, BTC has shown less volatility than in previous years, with many attributing this to increasing institutional adoption.

BTC ETFs have experienced significant inflows over the past week, with nearly $2 billion flowing in over the last two days, primarily driven by the IBIT ETF. This steady stream of ETF inflows is reassuring for fund managers and institutions, as it suggests reduced volatility in line with increasing mainstream adoption.

BTC is trading approximately 5% higher today, having broken through the $90k level.

With limited historical price action at these levels, technical analysis becomes challenging. On the upside, key round numbers like $95k are worth monitoring, with the $100k milestone in sight as a real possibility.

On the downside, there are a few indicators to consider. BTC/USD is currently in overbought territory, with the RSI in the mid-80s

Support on the downside may be identified around 90,000, with additional levels at 88,800 and 86,300. Further below, the 85,000 and 81,500 levels also warrant attention.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a overbought condition where 83.00% of price movement in the last 2 weeks have been up and a trend reversal can occur. It indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Dogecoin Skyrockets After Elon Musk Is Appointed to Lead “DOGE Department” by Trump! Dogecoin surged after President-elect Donald Trump appointed Elon Musk to lead the Department of Government Efficiency alongside billionaire Vivek Ramaswamy. The department aims to cut billions of dollars in government spending by reforming bureaucracy and reducing regulations. Elon, a well-known Dogecoin supporter, helped drive the meme coin’s value up to 40 cents, with a market cap nearing $58 billion.

News from the Crypto World in the Past Week

- Solana Holders, Get Ready: Solana ETF Predicted to Launch in the US by 2025. The likelihood of a Solana ETF launching in the United States before the end of 2025 is considered “very high,” according to Matthew Sigel, Head of Digital Asset Research at VanEck. Donald Trump’s victory in the US presidential election is seen as a green light for the Securities and Exchange Commission (SEC) to approve more crypto products, including altcoin ETFs like Solana , XRP, and Litecoin . Pro-crypto regulations under Trump are expected to usher in an SEC chairman more open to innovation, in contrast to the aggressive regulatory stance during Joe Biden’s administration. Analysts believe this shift could be a major game-changer for the US crypto industry, paving the way for more diverse crypto ETFs and greater market accessibility.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Peanut the Squirrel (PNUT) +1349%

- MANTRA (OM) +191%

- Stellar +107%

- Bonk (BONK) +98%

Cryptocurrencies With the Worst Performance

- Neiro (First Neiro On Ethereum) -18,25%

- Helium (HNT) -13,01%

- Artificial Superintelligence Alliance (FET) -12,81%

- Aave -12,64%

References

- Rachel Barber, Dogecoin soars after Trump’s Elon Musk announcement: What to know about the cryptocurrency, usatoday, accessed on 16 November 2024.

- Alex O’Donnel, Odds favor Solana ETF in 2025: VanEck, cointelegraph, accessed on 16 November 2024.

Share

Related Article

See Assets in This Article

AAVE Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-