Market Signals May 14th, 2024: Is AI Token Making a Comeback?

Overall, the crypto market has been stagnant for the past seven days. BTC is still in a sideways consolidation phase, with the price holding in the $60,000-$63,000 range. Currently, $60,000 is a critical support level for BTC’s price movement.

Meanwhile, the performance of the majority of altcoins has also been in the red zone in the past week. The total market cap of altcoins has dropped from $1.07 trillion to $975 billion as of this writing.

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions!

AI Sector Token ➡️ Bullish 🚀

Tokens that are exposed to Artificial Intelligence have the potential to receive a positive catalyst this week. The catalyst comes from OpenAI’s new product announcement plan, which will be held on Monday (5/13) at 10:00 Pacific Time (PT). If converted to Western Indonesian Time, the event will take place on Tuesday (5/14) at midnight.

https://x.com/OpenAI/status/1788987793613725786

Many assume that OpenAI’s new product is a ChatGPT-based search engine or a new open-source language model for ChatGPT services. If the new OpenAI product is significant, AI-based tokens could potentially witness a price surge. It is common knowledge that when the AI sector has a significant update, AI-based tokens will gain positive sentiment.

Tokens that potentially have bullish signals: WLD, ARKM, RNDR, NEAR

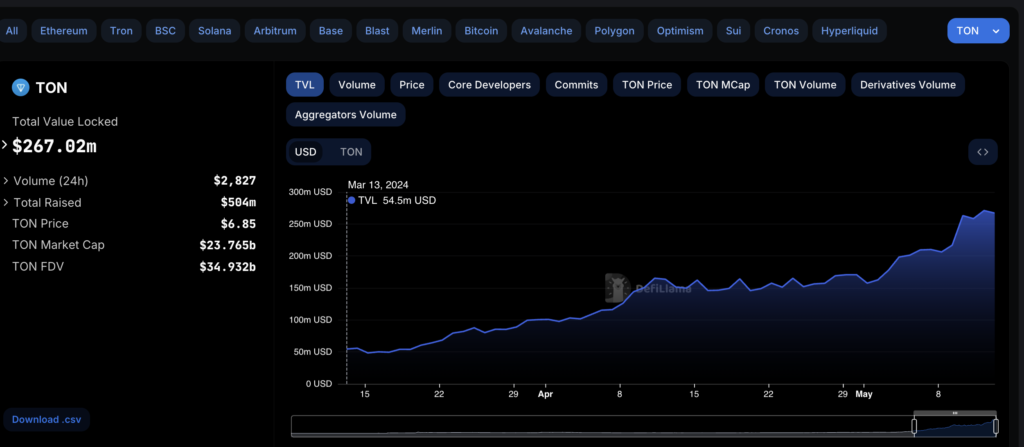

Toncoin (TON) ➡️ Bullish 🚀

Toncoin (TON) has recently gained popularity and attracted attention from crypto spaces. As a result, the Total Value Locked (TVL) has increased more than fivefold in the last month.

A wave of big-name partnerships fuels TON’s TVL surge. From industry giants like Arkham Intelligence, CryptoQuant, and Pantera Capital, which announced to be Toncoin investors. The launch campaign of Notcoin, which began trading on major exchanges on May 16, 2024, also contributed to the increased demand for Toncoin.

With these factors in play, TON prices might continue a short-term rally.

Bitcoin (BTC) ➡️ Uncertain ⚖️

As mentioned at the beginning of the article, BTC is in a prolonged sideways phase. Consumer Price Index (CPI) data will be announced on May 15, 2024, giving an uncertain signal for BTC’s price movement this week.

It is estimated that the CPI data for April will be 3.4% year-on-year (yoy), slightly lower than March’s 3.5% yoy. However, the figure is still above the Fed’s inflation target of 2%. Previously, the Fed had said that it would not cut interest rates before the inflation rate was below 2%.

The price of BTC could either increase or decrease, depending on the results of the CPI data announcement and the reaction of market participants. However, BTC’s condition could worsen if the price breaks the critical support at $59,000. The decline in BTC prices could continue to the $56,000 area.

Aevo (AEVO) ➡️ Bearish 📉

AEVO is under bearish pressure this week due to the scheduled token unlock on May 15, 2024. AEVO plans to release 827.6 million AEVO or approximately 752.36% of the total outstanding supply.

The unlock tokens are allocated to early private sale investors, the AEVO development team, and the DAO treasury. It should be noted that this is Aevo’s first token unlock after the Token Generation Event (TGE) on March 13, 2024.

Using the current AEVO price of $1.12, the unlock value is equivalent to $926 million. An unlock token with such a large amount of value could potentially be a negative catalyst as the supply of AEVO grows. Moreover, if there is no demand to absorb the token

Starknet (STRK) ➡️ Bearish 📉

Similar to Aevo, Starknet (STRK) will also have a token unlock agenda on May 15, 2024. However, STRK’s bearish potential may not be as significant as AEVO’s. This is because STRK’s token unlocks only 64 million STRK or 8.7% of the total circulation.

With the current STRK price of $1.16, the value of the unlock tokens this time is equivalent to $78.08. The additional supply of STRK will cause volatility in the price of STRK in the short term. If there are no buyers to absorb the supply, the price of STRK has the potential to correct.

Crypto Performance on Pintu Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- Uma : 🔼49,90% (Rp 69.957)

- Tellor Tributes : 🔼49,85% (Rp 2.230.541)

- Toncoin (TON): 🔼24,11% (Rp 118.516)

Cryptocurrencies With the Worst Performance

- Tenet (TENET): 🔽34,40% (Rp 664)

- Inspect : 🔽32,85% (Rp 1.163)

- Neon : 🔽31,10% (Rp 11.263)

References

- Diccon Hyatt, What You Need to Know Ahead of Wednesday’s Much Anticipated CPI Inflation Report, Investopedia, accessed on 13 May 2024.

- Yashu Gola, Telegram-linked Toncoin soars 50% in May for these 3 reasons, CoinTelegraph, accessed on 13 May 2024.

Share

Related Article

See Assets in This Article

INSP Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-