What is Radiant Capital (RDNT)?

Lending protocols are by far the most attractive sector in the DeFi space. However, they are separated by blockchains, which fragments liquidity. Radiant Capital, with its omnichain concept, tries to solve this problem. So, what is Radiant Capital? What is the technology, and how does it work? Find out the full explanation in the following article.

Article Summary

- ⛓️ Radiant Capital is an omnichain cross-chain lending protocol built using LayerZero technology.

- 💸 Radiant Capital allows users to deposit and borrow various crypto assets across multiple chains.

- 👀 Some of Radiant Capital’s key features include Dynamic Liquidity Provisioning (dLP) for dynamic liquidity allocation, ZAP dLP for easier liquidity provisioning, and RDNT vesting mechanism that can increase yields.

- 🪙 Radiant Capital has a native RDNT token, an omnichain fungible token (OFT-20). It acts as a utility token in the Radiant Capital ecosystem.

What is Radiant Capital (RDNT)?

Lending protocols are still the most dominating sector in DeFi. Unfortunately, many money markets had their own liquidity. This results in capital fragmentation spread across various chains. From the user’s perspective, this liquidity segregation creates a suboptimal borrowing and lending experience.

For borrowers, they must first determine the chain to make a loan. In addition, the assets to be borrowed must also be in the same chain. If the chains differ, the user must bridge the asset first.

Radiant Capital brings the first omnichain money market in an attempt to fix all that. So, what is Radiant Capital? Radiant Capital is a cross-chain lending protocol built using LayerZero technology. With LayerZero, Radiant Capital users can save and borrow crypto assets on various chains.

This means that users no longer need to select and adjust the chains that support the crypto assets. In other words, Radiant Capital seeks to combine liquidity from various money markets on Web3 into one efficient and user-friendly lending protocol.

Based on Defi Llama, Radiant Capital’s total value locked (TVL) is currently at US$ 437.41 million. It’s spread across the Arbitrum, BSC, and Ethereum chains. With US$ 237.12 million, it is the lending protocol with the largest TVL on the Arbitrum network. Furthermore, it ranks third in overall TVL on the Arbitrum network.

How Does Radiant Capital Work?

Radiant Capital uses LayerZero’s technology to enable cross-chain transactions. This allows users to deposit various assets on different chains. Furthermore, users can also borrow supported assets across different chains.

LayerZero is a cross-chain messaging protocol designed to facilitate interaction between smart contracts across different blockchain networks. It aims to address interoperability issues in the crypto industry. Learn more about LayerZero technology here.

In addition to using LayerZero technology, Radiant Capital utilizes Stargate Finance’s stable interface router. A bridge built using LayerZero’s delta algorithm allows Radiant to transfer assets through a unified liquidity pool while achieving instant-guaranteed finality. This will enable users (borrowers) to reclaim their collateral and determine the withdrawal chain and percentage.

Currently, it only supports deposits on the Arbitrum network and Binance Smart Chain (BNB Chain). Meanwhile, loans can be made on all EVM chains supported by Stargate Finance. Radiant continues to develop its protocols to ensure deposits and loans can be made on a fully omnichain basis.

Radiant Capital Features

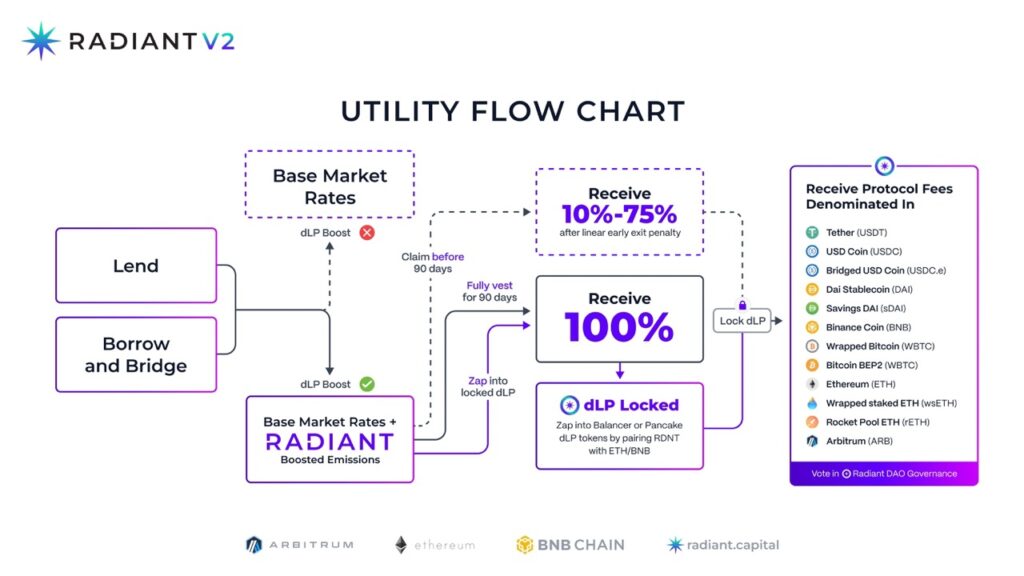

1. Dynamic Liquidity Provisioning (dLP) Mechanism

Radiant Capital’s dLP mechanism ensures the availability of liquidity to borrowers efficiently and sustainably. It uses an algorithm that adjusts the liquidity pool based on market demand and asset utilization. By dynamically reallocating liquidity, Radiant can optimize fund efficiency while minimizing the risk of liquidity shortage or excess.

The dLP mechanism also incentivizes liquidity providers. The yields can be denominated in BTC, ETH, BNB, stablecoins, and $RDNT emission. To earn the $RDNT emission incentive, users, whether borrowers or liquidity providers, must vest their RDNT. It must equal 5% of their deposit value in USD into the dLP token.

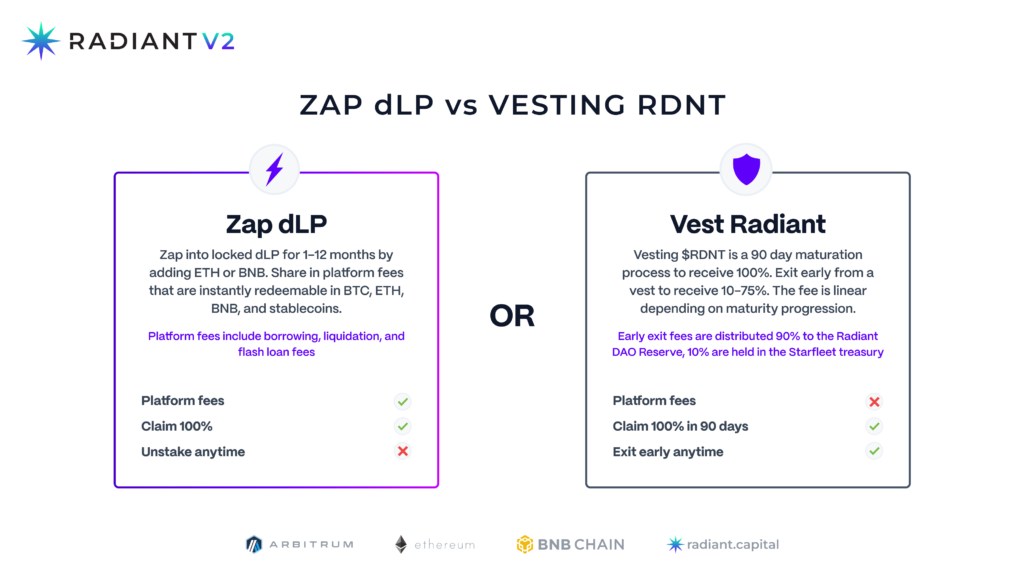

2. ZAP dLP

In addition to the dLP mechanism, Radiant Capital also features Zapping dLP or ZAP dLP. Zap dLP is a mechanism created to improve liquidity provision within the protocol. It allows users to allocate their assets seamlessly and efficiently across liquidity pools. As a result, users no longer need to allocate assets manually.

Moreover, with ZAP dLP, users can easily convert their assets into dLP tokens. Then, they can participate in various liquidity pools across the chain. As it becomes easier for users to manage their liquidity positions, they can increase their potential returns.

Pintu Academy has prepared a guide article on using DeFi safely here.

3. Vesting RDNT

The vesting feature of RDNT is the dLP token locking mechanism. This mechanism was created to encourage long-term commitment, sustainable incentives, maintain protocol health, and prevent a sudden influx of tokens into the market.

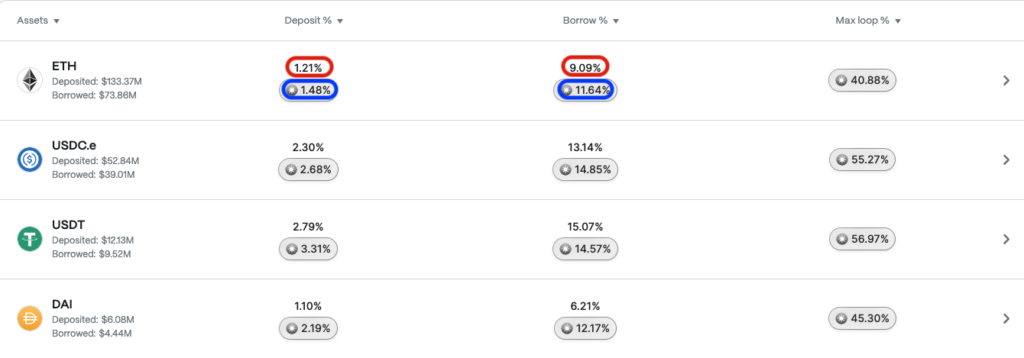

As mentioned, the RDNT vesting value is 5% of the amount deposited in USD into the dLP token. As shown in the chart below, if users deposit US$1,000 without vesting 5% of their deposit, they will only get market rewards (red box). But, if they lock 5% or $50 in dLP tokens, they can get $RDNT emissions (blue box).

The vesting period of dLP tokens lasts for 90 days. If you lock in for 90 days, you will get a 100% reward. However, if the user claims it before the vesting period ends, they will get 10-75% of the due amount. The amount received will be adjusted for any penalties incurred.

Advantages of Radiant Capital

- 🌐 Interoperability. LayerZero technology allows Radiant Capital users to deposit or borrow from multiple chains. Users can utilize this to participate in yield farming, access liquidity, and other investment opportunities.

- 💰 Capital Efficiency. By consolidating liquidity from multiple blockchain networks, Radiant Capital creates a deep pool of assets. As a result, users can enjoy saving/borrowing at more competitive rates. As for Radiant Capital, capital efficiency contributes to the overall health and stability of the DeFi ecosystem.

- ⚡ Seamless. Cross-chain technology combined with ZAP dLP makes the saving/borrowing process more accessible and more practical. Users no longer need to match the chains and compatible assets. The intuitive design of Radiant Capital’s interface ensures a smooth and hassle-free user experience.

- 🔐 Security. In the ever-evolving DeFi landscape, security remains paramount. Radiant Capital has implemented strong security measures by ensuring all its features and technology have passed audits. The agencies that audit Radian’s security include Blocksec, PeckShield, and Zokyo.

RDNT Token

RDNT is an omnichain fungible token (OFT-20) and the native token of the Radiant Capital ecosystem. As an OFT, RDNT supports cross-chain token transfers; in this case, all EVM chains are supported by Stargate Finance.

The primary function of RDNT is as a utility token in dLP. So, users can get RDNT emission on their deposits or loans by stacking dLP.

RDNT is also a currency for transaction fees in Radiant Capital. In addition, RDNT token holders can participate in the protocol’s governance by voting on proposals that determine the future of Radiant Capital.

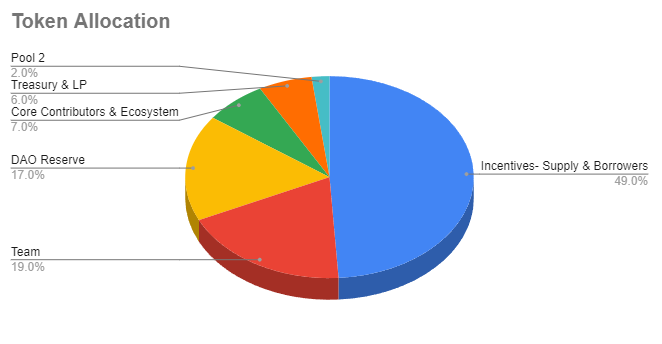

RDNT has an overall supply of 1 billion tokens. Of this total, 49% of the tokens are allocated to incentivize liquidity providers and borrowers. Then, as much as 19% is given to the Radian Capital core team and 17% to the Radiant DAO Reserve.

Since its launch on July 26, 2022, RDNT reached its highest level in the masses on April 16, 2023. At that time, the price reached the level of US$ 0.47. Meanwhile, as of November 29, 2023, the RDNT price was US$ 0.24.

In the DeFi space, the easiest way to profit is by staking or yield farming. Find out the difference between the two here.

Conclusion

Lending protocols are currently fragmented, causing an unpleasant user experience. To address this, Radiant Capital utilizes cross-chain technology to offer a more effortless and seamless lending protocol.

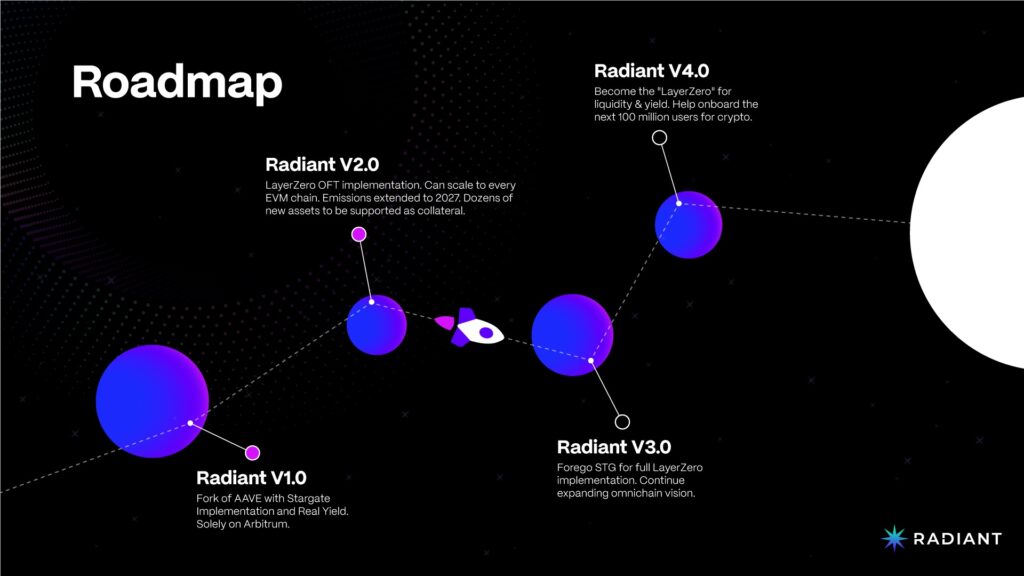

However, the current version (V2) is only available on three chains – Ethereum, BSC, and Arbitrum. This means that Radiant Capital has a long way to go before it can become an omnichain lending protocol.

The good news is that Radiant Capital plans to implement LayerZero technology in the upcoming V3 update. This will allow Radiant Capital to realize its omnichain vision and improve its interoperability.

How to Buy RDNT Token on Pintu

You can start investing in RDNT by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for RDNT.

- Click buy and fill in the amount you want.

- Now you have RDNT!

In addition to RDNT, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- Radiant Capital, Welcome to Radiant Capital, Docs, accessed on 29 November 2023.

- Radiant Capital, Announcing Radiant v2: A New Era in Decentralized Finance, Medium, accessed on 29 November 2023.

- Antony Biance, Radiant Capital Explained, Data Wallet, accessed on 29 November 2023.

- Chase Devens, Inside the Arbitrum Ecosystem Boom, Messari, accessed on 29 November 2023.

Share