Yield Farming vs Staking: What’s the Difference?

Passive income is one of the favorite ways for crypto investors to generate additional profits. With the development of the decentralized applications (dApps) ecosystem, there are now more diverse ways for decentralized finance applications to offer returns to their users. The yield farming and staking methods are still the favorite choices of crypto investors. So what differentiates the two? Which one is more profitable? Read more in the following article.

Article Summary

- 👁️ Yield farming is the practice of lending crypto assets to DeFi platforms to generate high returns or rewards in the form of additional cryptocurrencies. Meanwhile, staking is the practice to lock tokens into the network that uses a proof of stakes (PoS) to ensure all transactions are verified and secured.

- 🚧 In terms of mechanism, yield farming is much more complex than staking. Investors must choose which tokens to lend and on which platform, with the possibility of continuously switching platforms or tokens. Meanwhile, investors only need to select a platform in staking, and the yield is immediately received daily.

- ⚠️ Yield farming is also much riskier than staking because of the threat of impermanent loss, price volatility, smart contract hacking, and rug pulls. While staking risks are limited to price volatility and blockchain hacks.

- 💸 In terms of profit, yield farming offers a much greater potential return, which can reach 100%. Meanwhile, staking yields are only around 5-14%.

What is Yield Farming?

Yield farming is the practice of lending crypto assets to DeFi platforms to generate high returns or rewards in the form of additional cryptocurrencies. It has drawn analogies to farming because it’s an innovative way to “grow your own cryptocurrency.” The concept is similar to traditional banking practices. Banks will distribute the customer funds to borrowers. The borrowers will be charged interest, part of which will be used as a reward to the customers who lend their funds.

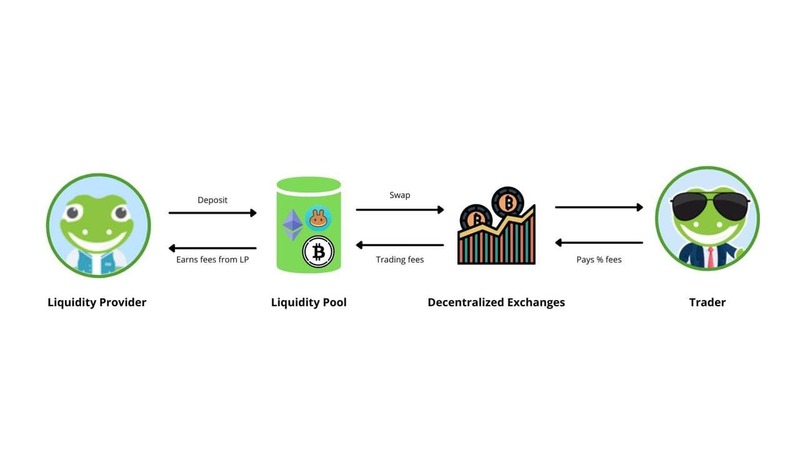

As a liquidity provider, investors must lock the assets into a liquidity pool. Later, the assets will be used for the platform’s purposes, such as lending to other users in the case of Compound. In return for being a liquidity provider, you will earn a percentage of transaction fees, token rewards, interest, and price appreciation. The larger the funds locked in the liquidity pool, the greater the rewards.

The yield farming method is related to Automated Market Makers (AMMs). Learn about AMMs in the following article.

What is Staking?

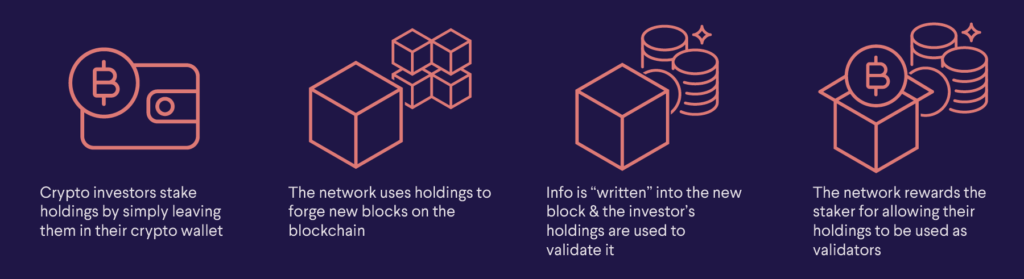

Staking is the practice to lock tokens into the network that uses a proof of stakes (PoS) such as Ethereum, Solana, and Cardano to ensure all transactions are verified and secured. In simple terms, the concept of staking is similar to time deposits, where the assets owned by the investor are locked for a certain period. However, some staking services allow users to withdraw their funds anytime.

With staking, you are essentially locking up crypto assets to participate in running the blockchain and ensuring its safety. In return for participating, later, investors will get interest from the locked assets every day. As for the amount of the return, it depends on each crypto asset.

Pintu Academy has prepared a complete and thorough article about staking here.

Yield Farming and Staking Platform

If you’re interested in trying to yield farming or staking, here are some platforms you can try.

Yield Farming Platform

- Compound. It is a DeFi protocol built on the Ethereum network that allows you to run yield farming by becoming a liquidity provider. In addition to getting rewarded with crypto assets that you store in the liquidity pool, you will also get COMP tokens that you can trade or become governance tokens.

- PancakeSwap. It is a decentralized exchange (DEX) on Binance Smart Chain (BSC) that allows users to do yield farming by providing liquidity. You can be rewarded with CAKE tokens based on the number of tokens you store in the liquidity pool and the APR of the yield farming.

Staking Platform

- Ethereum. After becoming PoS through The Merge, you can do staking on Ethereum. Thanks to the Shapella update, you can withdraw your ETH anytime. There are various ways to stake ETH; you can use a staking service, become a validator, or use the Liquid Staking Derivatives (LSD) platform.

- Solana. Similar to Ethereum, as a PoS network, Solana provides staking services for its users. By locking in SOL assets, you will be rewarded with an APY of around 6.3%. You only need to choose a wallet or site that provides Solana staking services.

Yield Farming vs Staking: What’s the Difference?

Actually, yield farming and staking have the main similarity in that both require holding a number of crypto assets to get a return. Some people even call staking part of yield farming. However, the two have differences. The following are some of the distinguishing factors:

The Mechanism

The following is a mechanism comparison between yield farming and staking:

⚙️ Yield Farming Mechanism. The yield farming mechanism is much more complex than staking. Investors must first determine what tokens and DeFi platforms to use. The tokens also vary, from niche altcoins to high-volume stablecoins.

Later, the returns obtained will depend on the number of tokens deposited in the liquidity pool. In general, investors are required to actively switch platforms or tokens to obtain more optimal returns in yield farming. However, such active management may lead to additional gas fees.

⚙️ Staking Mechanism. The staking mechanism is much simpler than yield farming. Investors only need to select a destination staking pool and lock their assets for a certain period. Later, the relevant network will borrow the locked assets for network needs. In return, investors will immediately get rewards sent to their respective wallets.

The Risks

The following are the respective risks of yield farming and staking:

🔴 Yield Farming Risk. Impermanent loss is one of the risks of yield farming. This happens when the value of the locked crypto asset decreases. Remember, yield farming works by maintaining a balanced proportion between paired assets. Another risk is the potential for rug pulls or hacks on smart contracts used to lock assets in yield farming.

🔴 Staking Risk. Unlike yield farming, staking does not have the risk of impermanent loss. The main risk of staking is the hacking of the blockchain network. The subsequent risk is crypto asset price volatility. When the price of the staked asset drops deeply, the value of the yield of similar tokens also drops with market fluctuations. On the one hand, locking the asset for a certain period prevents investors from cutting losses when the price falls sharply.

Speaking of risk, this article can help you strategize to deal with the risks of investing in crypto assets.

The Advantages

The followings are the advantages and benefits of yield farming and staking:

🟢 Yield Farming Advantage. Along with a more complex mechanism and higher risk, the potential profitability of yield farming is much higher than staking. In some cases, returns from yield farming can be as high as 100%. However, to achieve these high returns, investors are required to manage actively. That is, investors actively change tokens following market trends or switching platforms. On the one hand, yield farming does not apply a lock-up mechanism so that investors can withdraw their funds anytime.

🟢 Staking Advantage. In line with its lower risk level and more straightforward mechanism, the Annual Percentage Yield (APY) of staking ranges from 5-14%. The APY is also fixed, so investors will know how much return they will get when the staking period ends. Another advantage of staking is its passive management. This means that investors only need to choose a network and stake their assets, then the returns will come.

The Time Horizon

⏳ Time Horizon Yield Farming. Regarding investment duration, yield farming is much more flexible than staking. As yield farming does not require a lock-up period, investors can withdraw their funds anytime. Therefore, it is possible that yield farming can generate higher returns in the short term than staking. Of course, this must be followed by the right momentum and strategy.

As for the long term, yield farming requires a few extra steps. To ensure maximum yield, investors must actively change tokens and dApps platforms to find the best yield.

⏳ Time Horizon Staking. Staking allows investors to get immediate returns daily. However, if it is for the short term, it will certainly not be maximized, especially since the APY of staking for an entire year is not high. While in the long run, staking returns can be much more maximized. Especially if you are committed to HODL the token. On the one hand, the long duration can be a cushion to deal with the risk of price fluctuations.

Conclusion

The question arises about the better option after knowing the comparison between yield farming and staking. Of course, it is difficult to say which one is better, as it will all depend on the needs and preferences of each investor. However, as a strategy to earn passive income, both yield farming and staking are good strategies.

Yield farming could be a better choice for those of you aiming for high returns and having a high-risk tolerance level. However, yield farming requires an active management strategy and additional costs for optimal returns. Meanwhile, staking is a better choice if you want a more straightforward method with lower risk.

Regardless of yield farming or staking, it is essential for investors always to do their research. Investors should always know and understand how both of them work and the risks behind them.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

Ryan Watkins, How to Yield Farm Like a Pro, Messari, accessed on 24 May 2023.

Coinbase Learn, What is Staking?, Coinbase, accessed on 24 May 2023.

Avinandan Banerjee, Staking Vs Yield Farming Vs Liquidity Mining, What’s The Difference? Blockchain Council, accessed on 24 May 2023.

Lulia Vasile, Yield Farming vs. Staking: Which One Is Better? BeIn Crypto, accessed on 24 May 2023.

Joel Agbo, Yield Farming vs Staking: Understanding the Key Differences for Crypto Investors, CoinGecko, accessed on 24 May 2023.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-